Salem Media Group, Inc. Announces First Quarter 2021 Total Revenue of $59.4 Million

IRVING, Texas–(BUSINESS WIRE)– Salem Media Group, Inc. (Nasdaq: SALM) released its results for the three months ended March 31, 2021.

First Quarter 2021 Results

For the quarter ended March 31, 2021 compared to the quarter ended March 31, 2020:

Consolidated

- Total revenue increased 1.9% to $59.4 million from $58.3 million;

- Total operating expenses decreased 27.9% to $55.0 million from $76.3 million;

- Operating expenses, excluding gains or losses on the disposition of assets, stock-based compensation expense, changes in the estimated fair value of contingent earn-out consideration, impairments, depreciation expense and amortization expense (1) decreased 6.2% to $51.4 million from $54.8 million;

- Operating income was $4.4 million compared to an operating loss of $18.0 million;

- Net income was $0.3 million, or $0.01 net income per diluted share compared to a net loss of $55.2 million, or $2.07 net loss per share;

- EBITDA (1) was $7.5 million compared to a loss of $14.3 million;

- Adjusted EBITDA (1) increased 131.1% to $7.9 million from $3.4 million; and

- Net cash used by operating activities increased 18.9% to $9.2 million from $7.7 million.

Broadcast

- Net broadcast revenue decreased 2.5% to $44.0 million from $45.2 million;

- Station Operating Income (“SOI”) (1) increased 36.3% to $10.7 million from $7.9 million;

- Same Station (1) net broadcast revenue decreased 1.9% to $43.9 million from $44.8 million; and

- Same Station SOI (1) increased 32.1% to $10.9 million from $8.2 million.

Digital Media

- Digital media revenue increased 5.7% to $9.6 million from $9.1 million; and

- Digital Media Operating Income (1) increased 21.6% to $0.9 million from $0.8 million.

Publishing

- Publishing revenue increased 43.4% to $5.7 million from $4.0 million; and

- Publishing Operating Income (1) was $0.5 million compared to a loss of $1.1 million.

Included in the results for the quarter ended March 31, 2021 are:

- A $0.3 million ($0.2 million, net of tax, or $0.01 per share) net loss on the disposition of assets relates to the additional loss recorded at closing on the sale of radio station WKAT-AM and FM translator in Miami, Florida; and

- A $0.1 million non-cash compensation charge ($0.1 million, net of tax) related to the expensing of stock options.

Included in the results for the quarter ended March 31, 2020 are:

- A $17.3 million impairment charge ($12.8 million, net of tax, or $0.48 per share), of which $0.3 million related to impairment of mastheads, and the remainder to broadcast licenses due to the financial impact of the COVID-19 pandemic;

- A $0.3 million impairment charge ($0.2 million, net of tax, or $0.01 per share) related to the company’s goodwill.; and

- A $0.1 million non-cash compensation charge ($0.1 million, net of tax) related to the expensing of stock options.

Per share numbers are calculated based on 27,138,773 diluted weighted average shares for the quarter ended March 31, 2021, and 26,683,363 diluted weighted average shares for the quarter ended March 31, 2020.

Balance Sheet

As of March 31, 2021, the company had $216.3 million outstanding on the 6.75% senior secured notes due 2024 (the “Notes”) and no balance outstanding on the Asset Based Revolving Credit Facility (“ABL Facility”). The company received $11.2 million in aggregate principal amount of Paycheck Protection Plan (“PPP”) loans through the Small Business Administration that were available to our radio stations and networks under the Consolidated Appropriations Act.

Shelf Registration Statement and At-the-Market Facility

In April 2021, the company filed a prospectus supplement to our shelf registration statement on Form S-3 with the SEC covering the offering, issuance and sale of up to $15.0 million of the Company’s Class A Common Stock pursuant to an at-the-market facility, with B. Riley Securities, Inc. acting as sales agent.

Acquisitions and Divestitures

The following transactions were completed since January 1, 2021:

- On April 28, 2021, the company closed on the acquisition of the Centerline New Media domain and digital assets for $1.3 million of cash. The digital content library will be operated within Salem Web Network’s church products division.

- On March 18, 2021, the company sold radio station WKAT-AM and an FM translator in Miami, Florida for $3.5 million in cash. The company collected $3.2 million in cash upon closing and entered a promissory note for $0.3 million in cash due one year from the closing date.

- On March 8, 2021, the company acquired the Triple Threat Trader newsletter. The company paid no cash at the time of closing and assumed deferred subscription liabilities of $0.1 million. As part of the purchase agreement, the company may pay up to an additional $11,000 in contingent earn-out consideration over the next two years based on the achievement of certain revenue benchmarks.

Pending transactions:

- On April 20, 2021, the company entered into an Asset Purchase Agreement (“APA”) to sell Singing News Magazine and Singing News Radio (formerly Solid Gospel Network) for $0.1 million in cash. The buyer will assume the deferred subscription liability of $0.4 million. The sale is expected to close in the second quarter of 2021.

- On April 10, 2021, the company entered into an agreement to sell approximately 34 acres of land in Lewisville, Texas, currently being used as the transmitter site for Company owned radio station KSKY-AM, for $12.1 million in cash. The company will retain enough of the property in the southwest corner of the site to operate the station. Following a due diligence period and satisfaction of several contingencies, the company expects to close on this transaction in the third quarter of 2021.

- On February 4, 2021, the company entered into an APA to acquire KDIA-AM and KDYA-AM in San Francisco, California for $0.6 million in cash. The company paid $0.1 million in cash to an escrow account with $0.5 million of cash due upon closing. The purchase is subject to the approval of the FCC and is expected to close in the first half of 2021.

- On February 5, 2020, the company entered into an APA with Word Broadcasting to sell radio stations WFIA-AM, WFIA-FM and WGTK-AM in Louisville, Kentucky for $4.0 million with a $250,000 credit applied to the sale price if closing occurs before March 31, 2020. Additionally, Word Broadcasting would receive a credit toward the purchase price of a sum equal to the monthly fees paid under the TBA that began in January 2017 for months 4-29 of the TBA and a sum equal to $2,000 per month for each monthly fee payment for months 30 and thereafter of the TBA; and a credit of the $450,000 option payment. The company estimated the loss on sale to be approximately $0.5 million net of tax if the sale closed by March 31, 2020 and $0.3 million net of tax if the sale closes later. Due to changes in debt markets, the transaction was not funded and it is uncertain when or if the transaction will close.

Conference Call Information

Salem will host a teleconference to discuss its results on May 6, 2021 at 4:00 p.m. Central Time. To access the teleconference, please dial (877) 524-8416, and then ask to be joined into the Salem Media Group First Quarter 2021 call or listen via the investor relations portion of the company’s website, located at investor.salemmedia.com. A replay of the teleconference will be available through May 20, 2021 and can be heard by dialing (877) 660-6853, passcode 13717857 or on the investor relations portion of the company’s website, located at investor.salemmedia.com.

Follow us on Twitter @SalemMediaGrp.

Second Quarter 2021 Outlook

For the second quarter of 2021, the company is projecting total revenue to increase between 13% and 15% from second quarter 2020 total revenue of $52.9 million. The company is also projecting operating expenses before gains or losses on the sale or disposal of assets, stock-based compensation expense, changes in the estimated fair value of contingent earn-out consideration, impairments, depreciation expense and amortization expense to increase between 6% and 9% compared to the second quarter of 2020 non-GAAP operating expenses of $50.1 million.

A reconciliation of non-GAAP operating expenses, excluding gains or losses on the disposition of assets, stock-based compensation expense, changes in the estimated fair value of contingent earn-out consideration, impairments, depreciation expense and amortization expense to the most directly comparable GAAP measure is not available without unreasonable efforts on a forward-looking basis due to the potential high variability, complexity and low visibility with respect to the charges excluded from this non-GAAP financial measure, in particular, the change in the estimated fair value of earn-out consideration, impairments and gains or losses from the disposition of fixed assets. The company expects the variability of the above charges may have a significant, and potentially unpredictable, impact on its future GAAP financial results.

About Salem Media Group, Inc.

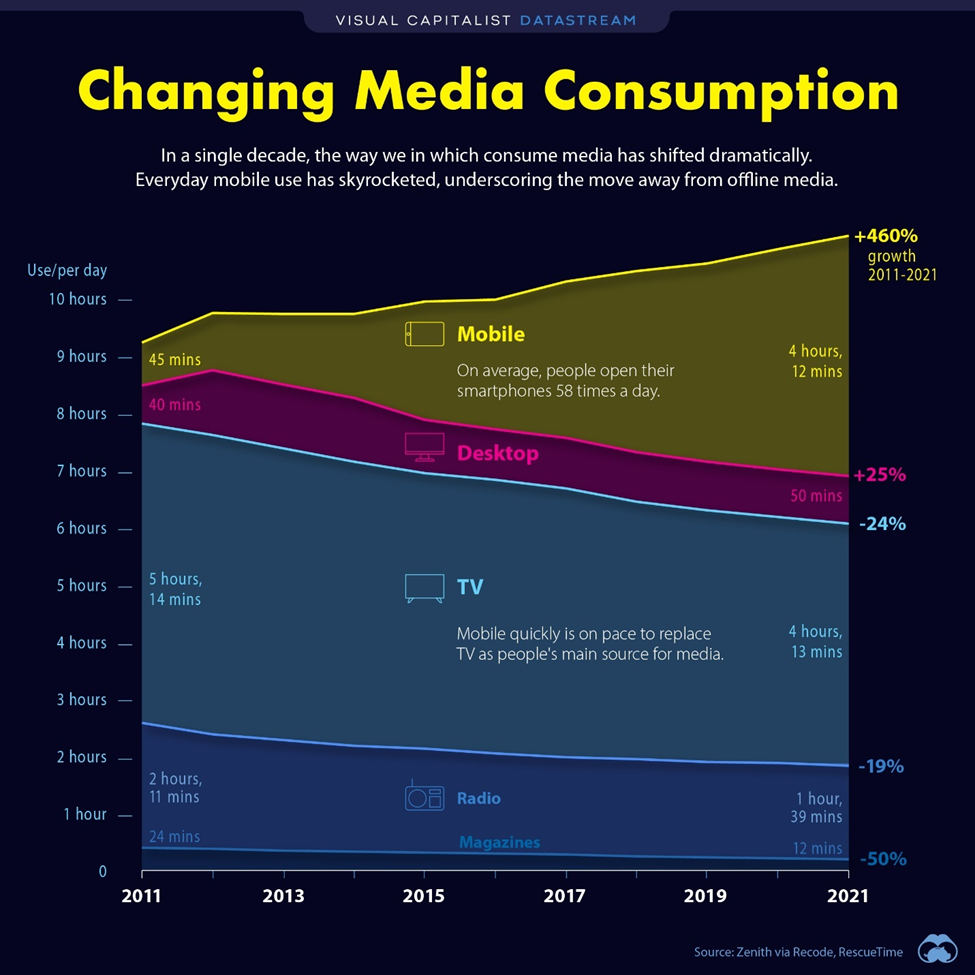

Salem Media Group is America’s leading multimedia company specializing in Christian and conservative content, with media properties comprising radio, digital media and book and newsletter publishing. Each day Salem serves a loyal and dedicated audience of listeners and readers numbering in the millions nationally. With its unique programming focus, Salem provides compelling content, fresh commentary and relevant information from some of the most respected figures across the Christian and conservative media landscape. Learn more about Salem Media Group, Inc., at www.salemmedia.com, Facebook and Twitter (@SalemMediaGrp).

Forward-Looking Statements

Statements used in this press release that relate to future plans, events, financial results, prospects or performance are forward-looking statements as defined under the Private Securities Litigation Reform Act of 1995. Actual results may differ materially from those anticipated as a result of certain risks and uncertainties, including but not limited to the ability of Salem to close and integrate announced transactions, market acceptance of Salem’s radio station formats, competition from new technologies, adverse economic conditions, and other risks and uncertainties detailed from time to time in Salem’s reports on Forms 10-K, 10-Q, 8-K and other filings filed with or furnished to the Securities and Exchange Commission. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. Salem undertakes no obligation to update or revise any forward-looking statements to reflect new information, changed circumstances or unanticipated events.

(1) Regulation G

Management uses certain non-GAAP financial measures defined below in communications with investors, analysts, rating agencies, banks and others to assist such parties in understanding the impact of various items on its financial statements. The company uses these non-GAAP financial measures to evaluate financial results, develop budgets, manage expenditures and as a measure of performance under compensation programs.

The company’s presentation of these non-GAAP financial measures should not be considered as a substitute for or superior to the most directly comparable financial measures as reported in accordance with GAAP.

Regulation G defines and prescribes the conditions under which certain non-GAAP financial information may be presented in this earnings release. The company closely monitors EBITDA, Adjusted EBITDA, Station Operating Income (“SOI”), Same Station net broadcast revenue, Same Station broadcast operating expenses, Same Station Operating Income, Digital Media Operating Income, Publishing Operating Income (Loss), and operating expenses excluding gains or losses on the disposition of assets, stock-based compensation, changes in the estimated fair value of contingent earn-out consideration, impairments, depreciation and amortization, all of which are non-GAAP financial measures. The company believes that these non-GAAP financial measures provide useful information about its core operating results, and thus, are appropriate to enhance the overall understanding of its financial performance. These non-GAAP financial measures are intended to provide management and investors a more complete understanding of its underlying operational results, trends and performance.

The company defines Station Operating Income (“SOI”) as net broadcast revenue minus broadcast operating expenses. The company defines Digital Media Operating Income as net Digital Media Revenue minus Digital Media Operating Expenses. The company defines Publishing Operating Income (Loss) as net Publishing Revenue minus Publishing Operating Expenses. The company defines EBITDA as net income before interest, taxes, depreciation, and amortization. The company defines Adjusted EBITDA as EBITDA before gains or losses on the disposition of assets, before changes in the estimated fair value of contingent earn-out consideration, before impairments, before net miscellaneous income and expenses, before gain on bargain purchase, before (gain) loss on early retirement of long-term debt and before non-cash compensation expense. SOI, Digital Media Operating Income, Publishing Operating Income (Loss), EBITDA and Adjusted EBITDA are commonly used by the broadcast and media industry as important measures of performance and are used by investors and analysts who report on the industry to provide meaningful comparisons between broadcasters. SOI, Digital Media Operating Income, Publishing Operating Income (Loss), EBITDA and Adjusted EBITDA are not measures of liquidity or of performance in accordance with GAAP and should be viewed as a supplement to and not a substitute for or superior to its results of operations and financial condition presented in accordance with GAAP. The company’s definitions of SOI, Digital Media Operating Income, Publishing Operating Income (Loss), EBITDA and Adjusted EBITDA are not necessarily comparable to similarly titled measures reported by other companies.

The company defines Adjusted Free Cash Flow as Adjusted EBITDA less cash paid for capital expenditures, less cash paid for income taxes, and less cash paid for interest. The company considers Adjusted Free Cash Flow to be a liquidity measure that provides useful information to management and investors about the amount of cash generated by its operations after cash paid for capital expenditures, cash paid for income taxes and cash paid for interest. A limitation of Adjusted Free Cash Flow as a measure of liquidity is that it does not represent the total increase or decrease in its cash balance for the period. The company uses Adjusted Free Cash Flow, a non-GAAP liquidity measure, both in presenting its results to stockholders and the investment community, and in its internal evaluation and management of the business. The company’s presentation of Adjusted Free Cash Flow is not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance with GAAP. The company’s definition of Adjusted Free Cash Flow is not necessarily comparable to similarly titled measures reported by other companies.

The company defines Same Station net broadcast revenue as broadcast revenue from its radio stations and networks that the company owns or operates in the same format on the first and last day of each quarter, as well as the corresponding quarter of the prior year. The company defines Same Station broadcast operating expenses as broadcast operating expenses from its radio stations and networks that the company owns or operates in the same format on the first and last day of each quarter, as well as the corresponding quarter of the prior year. The company defines Same Station SOI as Same Station net broadcast revenue less Same Station broadcast operating expenses. Same Station operating results include those stations that the company owns or operates in the same format on the first and last day of each quarter, as well as the corresponding quarter of the prior year. Same Station operating results for a full calendar year are calculated as the sum of the Same Station-results for each of the four quarters of that year. The company uses Same Station operating results, a non-GAAP financial measure, both in presenting its results to stockholders and the investment community, and in its internal evaluations and management of the business. The company believes that Same Station operating results provide a meaningful comparison of period over period performance of its core broadcast operations as this measure excludes the impact of new stations, the impact of stations the company no longer owns or operates, and the impact of stations operating under a new programming format. The company’s presentation of Same Station operating results are not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance with GAAP. The company’s definition of Same Station operating results is not necessarily comparable to similarly titled measures reported by other companies.

For all non-GAAP financial measures, investors should consider the limitations associated with these metrics, including the potential lack of comparability of these measures from one company to another.

The Supplemental Information tables that follow the condensed consolidated financial statements provide reconciliations of the non-GAAP financial measures that the company uses in this earnings release to the most directly comparable measures calculated in accordance with GAAP. The company uses non-GAAP financial measures to evaluate financial performance, develop budgets, manage expenditures, and determine employee compensation. The company’s presentation of this additional information is not to be considered as a substitute for or superior to the directly comparable measures as reported in accordance with GAAP.

|

Salem Media Group, Inc. |

|||||||||

|

Condensed Consolidated Statements of Operations |

|||||||||

|

(in thousands, except share and per share data) |

|||||||||

|

|

|

|

|

||||||

|

|

|

|

Three Months Ended |

||||||

|

|

|

|

March 31, |

||||||

|

|

|

|

2020 |

|

|

2021 |

|

||

|

|

|

|

(Unaudited) |

||||||

|

Net broadcast revenue |

|

$ |

45,180 |

|

|

$ |

44,048 |

|

|

|

Net digital media revenue |

|

|

9,104 |

|

|

|

9,619 |

|

|

|

Net publishing revenue |

|

|

3,966 |

|

|

|

5,686 |

|

|

|

Total revenue |

|

|

58,250 |

|

|

|

59,353 |

|

|

|

Operating expenses: |

|

|

|

|

|

|

|||

|

|

Broadcast operating expenses |

|

|

37,327 |

|

|

|

33,343 |

|

|

|

Digital media operating expenses |

|

|

8,326 |

|

|

|

8,673 |

|

|

|

Publishing operating expenses |

|

|

5,062 |

|

|

|

5,205 |

|

|

|

Unallocated corporate expenses |

|

|

4,210 |

|

|

|

4,288 |

|

|

|

Change in the estimated fair value of contingent earn-out consideration |

|

|

(5 |

) |

|

|

— |

|

|

|

Impairment of indefinite-lived long-term assets other than goodwill |

|

|

17,254 |

|

|

|

— |

|

|

|

Impairment of goodwill |

|

|

307 |

|

|

|

— |

|

|

|

Depreciation and amortization |

|

|

3,700 |

|

|

|

3,170 |

|

|

|

Net (gain) loss on the disposition of assets |

|

|

79 |

|

|

|

318 |

|

|

Total operating expenses |

|

|

76,260 |

|

|

|

54,997 |

|

|

|

Operating income (loss) |

|

|

(18,010 |

) |

|

|

4,356 |

|

|

|

Other income (expense): |

|

|

|

|

|

|

|||

|

|

Interest income |

|

|

— |

|

|

|

1 |

|

|

|

Interest expense |

|

|

(4,032 |

) |

|

|

(3,926 |

) |

|

|

Gain on early retirement of long-term debt |

|

|

49 |

|

|

|

— |

|

|

|

Net miscellaneous income and (expenses) |

|

|

(52 |

) |

|

|

22 |

|

|

Net income (loss) before income taxes |

|

|

(22,045 |

) |

|

|

453 |

|

|

|

Provision for income taxes |

|

|

33,159 |

|

|

|

130 |

|

|

|

Net income (loss) |

|

$ |

(55,204 |

) |

|

$ |

323 |

|

|

|

|

|

|

|

|

|

|

|

||

|

Basic earnings (loss) per share Class A and Class B common stock |

|

$ |

(2.07 |

) |

|

$ |

0.01 |

|

|

|

Diluted earnings (loss) per share Class A and Class B common stock |

|

$ |

(2.07 |

) |

|

$ |

0.01 |

|

|

|

|

|

|

|

|

|

|

|||

|

Basic weighted average Class A and Class B common stock shares outstanding |

|

|

26,683,363 |

|

|

|

26,736,639 |

|

|

|

Diluted weighted average Class A and Class B common stock shares outstanding |

|

|

26,683,363 |

|

|

|

27,138,773 |

|

|

|

Salem Media Group, Inc. |

|||||||

|

Condensed Consolidated Balance Sheets |

|||||||

|

(in thousands) |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2020 |

|

|

March 31, 2021 |

|

|

|

|

|

|

|

|

(Unaudited) |

|

|

Assets |

|

|

|

|

|

|

|

|

Cash |

|

$ |

6,325 |

|

$ |

23,394 |

|

|

Trade accounts receivable, net |

|

|

24,469 |

|

|

22,974 |

|

|

Other current assets |

|

|

15,002 |

|

|

11,739 |

|

|

Property and equipment, net |

|

|

79,122 |

|

|

78,598 |

|

|

Operating and financing lease right-of-use assets |

|

|

48,355 |

|

|

46,646 |

|

|

Intangible assets, net |

|

|

347,547 |

|

|

347,093 |

|

|

Deferred financing costs |

|

|

213 |

|

|

187 |

|

|

Other assets |

|

|

3,538 |

|

|

3,323 |

|

|

Total assets |

|

$ |

524,571 |

|

$ |

533,954 |

|

|

|

|

|

|

|

|

|

|

|

Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

|

|

Current liabilities |

|

$ |

50,860 |

|

$ |

49,280 |

|

|

Long-term debt |

|

|

213,764 |

|

|

225,143 |

|

|

Operating and financing lease liabilities, less current portion |

|

|

47,847 |

|

|

46,152 |

|

|

Deferred income taxes |

|

|

68,883 |

|

|

69,071 |

|

|

Other liabilities |

|

|

7,938 |

|

|

8,236 |

|

|

Stockholders’ Equity |

|

|

135,279 |

|

|

136,072 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

524,571 |

|

$ |

533,954 |

|

|

SALEM MEDIA GROUP, INC. |

||||||||||||||||||||||||||

|

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY |

||||||||||||||||||||||||||

|

(Dollars in thousands, except share and per share data) |

||||||||||||||||||||||||||

|

|

Class A |

|

Class B |

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

Common Stock |

|

Common Stock |

|

Additional |

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

Paid-In |

|

Accumulated |

|

Treasury |

|

|

|||||||||||

|

|

Shares |

|

Amount |

|

Shares |

|

Amount |

|

Capital |

|

Earnings (Deficit) |

|

Stock |

|

Total |

|||||||||||

|

Stockholders’ equity, December 31, 2019 |

|

23,447,317 |

|

$ |

227 |

|

|

5,553,696 |

|

$ |

56 |

|

$ |

246,680 |

|

$ |

(23,294 |

) |

|

$ |

(34,006 |

) |

|

$ |

189,663 |

|

|

Stock-based compensation |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

103 |

|

|

— |

|

|

|

— |

|

|

|

103 |

|

|

Cash distributions |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(667 |

) |

|

|

— |

|

|

|

(667 |

) |

|

Net loss |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(55,204 |

) |

|

|

— |

|

|

|

(55,204 |

) |

|

Stockholders’ equity, March 31, 2020 |

|

23,447,317 |

|

$ |

227 |

|

|

5,553,696 |

|

$ |

56 |

|

$ |

246,783 |

|

$ |

(79,165 |

) |

|

$ |

(34,006 |

) |

|

$ |

133,895 |

|

|

Distributions per share |

$ |

0.025 |

|

|

|

$ |

0.025 |

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

Class A |

|

Class B |

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

Common Stock |

|

Common Stock |

|

Additional |

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

Paid-In |

|

Accumulated |

|

Treasury |

|

|

|||||||||||

|

|

Shares |

|

Amount |

|

Shares |

|

Amount |

|

Capital |

|

Earnings (Deficit) |

|

Stock |

|

Total |

|||||||||||

|

Stockholders’ equity, December 31, 2020 |

|

23,447,317 |

|

$ |

227 |

|

|

5,553,696 |

|

$ |

56 |

|

$ |

247,025 |

|

$ |

(78,023 |

) |

|

$ |

(34,006 |

) |

|

$ |

135,279 |

|

|

Stock-based compensation |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

78 |

|

|

— |

|

|

|

— |

|

|

|

78 |

|

|

Options exercised |

|

185,782 |

|

|

2 |

|

|

— |

|

|

— |

|

|

390 |

|

|

— |

|

|

|

— |

|

|

|

392 |

|

|

Net income |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

323 |

|

|

|

— |

|

|

|

323 |

|

|

Stockholders’ equity, March 31, 2021 |

|

23,633,099 |

|

$ |

229 |

|

|

5,553,696 |

|

$ |

56 |

|

$ |

247,493 |

|

$ |

(77,700 |

) |

|

$ |

(34,006 |

) |

|

$ |

136,072 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

SALEM MEDIA GROUP, INC. CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

|||||||

|

(Dollars in thousands) |

|||||||

|

(Unaudited) |

|||||||

|

|

Three Months Ended |

||||||

|

|

2020 |

|

|

2021 |

|

||

|

OPERATING ACTIVITIES |

|

|

|

||||

|

Net income (loss) |

$ |

(55,204 |

) |

|

$ |

323 |

|

|

Adjustments to reconcile net income (loss) to net cash provided by operating activities: |

|

|

|

|

|

||

|

Non-cash stock-based compensation |

|

103 |

|

|

|

78 |

|

|

Depreciation and amortization |

|

3,700 |

|

|

|

3,170 |

|

|

Amortization of deferred financing costs |

|

227 |

|

|

|

213 |

|

|

Non-cash lease expense |

|

2,252 |

|

|

|

2,161 |

|

|

Provision for bad debts |

|

1,900 |

|

|

|

(295 |

) |

|

Deferred income taxes |

|

33,084 |

|

|

|

188 |

|

|

Change in the estimated fair value of contingent earn-out consideration |

|

(5 |

) |

|

|

— |

|

|

Impairment of indefinite-lived long-term assets other than goodwill |

|

17,254 |

|

|

|

— |

|

|

Impairment of goodwill |

|

307 |

|

|

|

— |

|

|

Gain on early retirement of long-term debt |

|

(49 |

) |

|

|

— |

|

|

Net (gain) loss on the disposition of assets |

|

79 |

|

|

|

318 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

||

|

Accounts receivable and unbilled revenue |

|

2,419 |

|

|

|

2,549 |

|

|

Inventories |

|

70 |

|

|

|

(93 |

) |

|

Prepaid expenses and other current assets |

|

(587 |

) |

|

|

(750 |

) |

|

Accounts payable and accrued expenses |

|

4,478 |

|

|

|

2,490 |

|

|

Operating lease liabilities |

|

(2,407 |

) |

|

|

(2,497 |

) |

|

Contract liabilities |

|

133 |

|

|

|

1,122 |

|

|

Deferred rent income |

|

(84 |

) |

|

|

170 |

|

|

Other liabilities |

|

6 |

|

|

|

29 |

|

|

Income taxes payable |

|

57 |

|

|

|

21 |

|

|

Net cash provided by operating activities |

|

7,733 |

|

|

|

9,197 |

|

|

INVESTING ACTIVITIES |

|

|

|

|

|

||

|

Cash paid for capital expenditures net of tenant improvement allowances |

|

(1,587 |

) |

|

|

(1,859 |

) |

|

Capital expenditures reimbursable under tenant improvement allowances and trade agreements |

|

(84 |

) |

|

|

— |

|

|

Deposit on broadcast assets and radio station acquisitions |

|

— |

|

|

|

(100 |

) |

|

Proceeds from sale of assets |

|

2 |

|

|

|

3,501 |

|

|

Other |

|

(428 |

) |

|

|

(238 |

) |

|

Net cash provided by (used in) investing activities |

|

(2,097 |

) |

|

|

1,304 |

|

|

FINANCING ACTIVITIES |

|

|

|

|

|

||

|

Payments to repurchase 6.75% Senior Secured Notes |

|

(3,392 |

) |

|

|

— |

|

|

Proceeds from borrowings under ABL Facility |

|

33,319 |

|

|

|

16 |

|

|

Payments on ABL Facility |

|

(31,745 |

) |

|

|

(5,016 |

) |

|

Proceeds from borrowings under PPP Loans |

|

— |

|

|

|

11,195 |

|

|

Payments of debt issuance costs |

|

(1 |

) |

|

|

(3 |

) |

|

Proceeds from the exercise of stock options |

|

— |

|

|

|

392 |

|

|

Payments on financing lease liabilities |

|

(18 |

) |

|

|

(16 |

) |

|

Payment of cash distribution on common stock |

|

(667 |

) |

|

|

— |

|

|

Book overdraft |

|

(1,885 |

) |

|

|

— |

|

|

Net cash provided by (used in) financing activities |

|

(4,389 |

) |

|

|

6,568 |

|

|

Net increase in cash and cash equivalents |

|

1,247 |

|

|

|

17,069 |

|

|

Cash and cash equivalents at beginning of year |

|

6 |

|

|

|

6,325 |

|

|

Cash and cash equivalents at end of period |

$ |

1,253 |

|

|

$ |

23,394 |

|

|

Salem Media Group, Inc. |

|||||||||||||

|

Supplemental Information |

|||||||||||||

|

(in thousands) |

|||||||||||||

|

|

|

|

|

||||||||||

|

|

|

|

Three Months Ended |

||||||||||

|

|

|

|

March 31, |

||||||||||

|

|

|

|

2020 |

|

2021 |

||||||||

|

|

|

|

(Unaudited) |

||||||||||

|

|

Reconciliation of Total Operating Expenses to Operating Expenses excluding Gains or Losses on the disposition of assets, Stock-based Compensation Expense, Changes in the Estimated Fair Value of Contingent Earn-out Consideration, Impairments and Depreciation and Amortization Expense (Recurring Operating Expenses) |

||||||||||||

|

|

Operating Expenses |

|

$ |

76,260 |

|

$ |

54,997 |

||||||

|

|

Less depreciation and amortization expense |

|

|

(3,700) |

|

|

(3,170) |

||||||

|

|

Less change in estimated fair value of contingent earn-out consideration |

|

|

5 |

|

|

— |

||||||

|

|

Less impairment of indefinite-lived long-term assets other than goodwill |

|

|

(17,254) |

|

|

— |

||||||

|

|

Less impairment of goodwill |

|

|

(307) |

|

|

— |

||||||

|

|

Less net (gain) loss on the disposition of assets |

|

|

(79) |

|

|

(318) |

||||||

|

|

Less stock-based compensation expense |

|

|

(103) |

|

|

(78) |

||||||

|

|

Total Recurring Operating Expenses |

|

$ |

54,822 |

|

$ |

51,431 |

||||||

|

|

|

|

|

|

|

|

|

||||||

|

|

Reconciliation of Net Broadcast Revenue to Same Station Net Broadcast Revenue |

||||||||||||

|

|

Net broadcast revenue |

|

$ |

45,180 |

|

$ |

44,048 |

||||||

|

|

Net broadcast revenue – acquisitions |

|

|

— |

|

|

— |

||||||

|

|

Net broadcast revenue – dispositions |

|

|

(223) |

|

|

4 |

||||||

|

|

Net broadcast revenue – format change |

|

|

(176) |

|

|

(140) |

||||||

|

|

Same Station net broadcast revenue |

|

$ |

44,781 |

|

$ |

43,912 |

||||||

|

|

|

|

|

|

|

|

|

||||||

|

|

Broadcast operating expenses |

|

$ |

37,327 |

|

$ |

33,343 |

||||||

|

|

Broadcast operating expenses – acquisitions |

|

|

— |

|

|

— |

||||||

|

|

Broadcast operating expenses – dispositions |

|

|

(502) |

|

|

(106) |

||||||

|

|

Broadcast operating expenses – format change |

|

|

(260) |

|

|

(178) |

||||||

|

|

Same Station broadcast operating expenses |

|

$ |

36,565 |

|

$ |

33,059 |

||||||

|

|

|

|

|

|

|

|

|

||||||

|

|

Reconciliation of SOI to Same Station SOI |

|

|

|

|

|

|

||||||

|

|

Station Operating Income |

|

$ |

7,853 |

|

$ |

10,705 |

||||||

|

|

Station operating loss – acquisitions |

|

|

— |

|

|

— |

||||||

|

|

Station operating loss – dispositions |

|

|

279 |

|

|

110 |

||||||

|

|

Station operating loss – format change |

|

|

84 |

|

|

38 |

||||||

|

|

Same Station – Station Operating Income |

|

$ |

8,216 |

|

$ |

10,853 |

||||||

|

|

|||||||||||||

|

Salem Media Group, Inc. |

|||||||||||||

|

Supplemental Information |

|||||||||||||

|

(in thousands) |

|||||||||||||

|

|

|

|

Three Months Ended |

||||||||||

|

|

|

|

March 31, |

||||||||||

|

|

|

|

2020 |

|

2021 |

||||||||

|

|

|

|

(Unaudited) |

||||||||||

|

|

Calculation of Station Operating Income, Digital Media Operating Income and Publishing Operating Income (Loss) |

||||||||||||

|

|

Net broadcast revenue |

|

$ |

45,180 |

$ |

44,048 |

|||||||

|

|

Less broadcast operating expenses |

|

|

(37,327) |

|

(33,343) |

|||||||

|

|

Station Operating Income |

|

$ |

7,853 |

$ |

10,705 |

|||||||

|

|

|

|

|

|

|||||||||

|

|

Net digital media revenue |

|

$ |

9,104 |

$ |

9,619 |

|||||||

|

|

Less digital media operating expenses |

|

|

(8,326) |

|

(8,673) |

|||||||

|

|

Digital Media Operating Income |

|

$ |

778 |

$ |

946 |

|||||||

|

|

|

|

|

||||||||||

|

|

Net publishing revenue |

$ |

3,966 |

$ |

5,686 |

||||||||

|

|

Less publishing operating expenses |

|

(5,062) |

|

(5,205) |

||||||||

|

|

Publishing Operating Income (Loss) |

$ |

(1,096) |

$ |

481 |

||||||||

The company defines EBITDA (1) as net income before interest, taxes, depreciation, and amortization. The table below presents a reconciliation of EBITDA (1) to Net Income (Loss), the most directly comparable GAAP measure. EBITDA (1) is a non-GAAP financial performance measure that is not to be considered a substitute for or superior to the directly comparable measures reported in accordance with GAAP. The company defines Adjusted EBITDA (1) as EBITDA (1) before gains or losses on the disposition of assets, before changes in the estimated fair value of contingent earn-out consideration, before impairments, before net miscellaneous income and expenses, before (gain) loss on early retirement of long-term debt and before non-cash compensation expense. The table below presents a reconciliation of Adjusted EBITDA (1) to Net Income (Loss), the most directly comparable GAAP measure. Adjusted EBITDA (1) is a non-GAAP financial performance measure that is not to be considered a substitute for or superior to the directly comparable measures reported in accordance with GAAP.

|

Salem Media Group, Inc. |

||||||||

|

Supplemental Information |

||||||||

|

(in thousands) |

||||||||

|

Three Months Ended |

||||||||

|

March 31, |

||||||||

|

2020 |

|

2021 |

|

|||||

|

(Unaudited) |

||||||||

|

Net income (loss) |

$ |

(55,204 |

) |

$ |

323 |

|

||

|

Plus interest expense, net of capitalized interest |

4,032 |

|

3,926 |

|

||||

|

Plus provision for income taxes |

33,159 |

|

130 |

|

||||

|

Plus depreciation and amortization |

3,700 |

|

3,170 |

|

||||

|

Less interest income |

|

— |

|

|

(1 |

) |

||

|

EBITDA |

$ |

(14,313 |

) |

$ |

7,548 |

|

||

|

Less net (gain) loss on the disposition of assets |

79 |

|

318 |

|

||||

|

Less change in the estimated fair value of contingent earn-out consideration |

|

|

(5 |

) |

|

|

— |

|

|

Plus impairment of indefinite-lived long-term assets other than goodwill |

|

|

17,254 |

|

|

|

— |

|

|

Plus impairment of goodwill |

|

|

307 |

|

|

|

— |

|

|

Plus gain on early retirement of long-term debt |

(49 |

) |

— |

|

||||

|

Plus net miscellaneous income and expenses |

|

|

52 |

|

|

|

(22 |

) |

|

Plus non-cash stock-based compensation |

|

103 |

|

|

78 |

|

||

|

Adjusted EBITDA |

$ |

3,428 |

|

$ |

7,922 |

|

||

The company defines Adjusted Free Cash Flow (1) as Adjusted EBITDA (1) less cash paid for capital expenditures, less cash paid for income taxes, and less cash paid for interest. The company considers Adjusted Free Cash Flow to be a liquidity measure that provides useful information to management and investors about the amount of cash generated by its operations after cash paid for capital expenditures, cash paid for income taxes and cash paid for interest. A limitation of Adjusted Free Cash Flow as a measure of liquidity is that it does not represent the total increase or decrease in its cash balance for the period. The company uses Adjusted Free Cash Flow, a non-GAAP liquidity measure, both in presenting its results to stockholders and the investment community, and in its internal evaluation and management of the business. The company’s presentation of Adjusted Free Cash Flow is not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance with GAAP. The company’s definition of Adjusted Free Cash Flow is not necessarily comparable to similarly titled measures reported by other companies.

The table below presents a reconciliation of Adjusted Free Cash Flow to net cash provided by operating activities, the most directly comparable GAAP measure. Adjusted Free Cash Flow is a non-GAAP liquidity measure that is not to be considered a substitute for or superior to the directly comparable measures reported in accordance with GAAP.

|

Salem Media Group, Inc. |

||||||

|

Supplemental Information |

||||||

|

(in thousands) |

||||||

|

Three Months Ended |

||||||

|

March 31, |

||||||

|

2020 |

2021 |

|||||

|

(Unaudited) |

||||||

|

Net cash provided by operating activities |

$ |

7,733 |

$ |

9,197 |

||

|

Non-cash stock-based compensation |

(103) |

(78) |

||||

|

Depreciation and amortization |

(3,700) |

(3,170) |

||||

|

Amortization of deferred financing costs |

(227) |

(213) |

||||

|

Non-cash lease expense |

|

|

(2,252) |

|

|

(2,161) |

|

Provision for bad debts |

(1,900) |

295 |

||||

|

Deferred income taxes |

(33,084) |

(188) |

||||

|

Change in the estimated fair value of contingent earn- out consideration |

|

|

5 |

|

|

— |

|

Impairment of indefinite-lived long-term assets other than goodwill |

|

|

(17,254) |

|

|

— |

|

Impairment of goodwill |

|

|

(307) |

|

|

— |

|

Net (gain) loss on the disposition of assets |

(79) |

(318) |

||||

|

Gain on early retirement of long-term debt |

49 |

— |

||||

|

Changes in operating assets and liabilities: |

|

|||||

|

Accounts receivable and unbilled revenue |

(2,419) |

(2,549) |

||||

|

Inventories |

(70) |

93 |

||||

|

Prepaid expenses and other current assets |

587 |

750 |

||||

|

Accounts payable and accrued expenses |

(4,478) |

(2,490) |

||||

|

Contract liabilities |

(133) |

(1,122) |

||||

|

Operating lease liabilities (deferred rent) |

2,407 |

2,497 |

||||

|

Deferred rent income |

|

|

84 |

|

|

(170) |

|

Other liabilities |

|

|

(6) |

|

|

(29) |

|

Income taxes payable |

|

|

(57) |

|

|

(21) |

|

Net income (loss) |

$ |

(55,204) |

$ |

323 |

||

|

Plus interest expense, net of capitalized interest |

4,032 |

3,926 |

||||

|

Plus provision for (benefit from) income taxes |

33,159 |

(79) |

||||

|

Plus depreciation and amortization |

3,700 |

3,170 |

||||

|

Less interest income |

|

— |

|

(1) |

||

|

EBITDA |

$ |

(14,313) |

$ |

7,548 |

||

|

Plus net (gain) loss on the disposition of assets |

79 |

318 |

||||

|

Plus change in the estimated fair value of contingent earn-out consideration |

|

|

(5) |

|

|

— |

|

Plus impairment of indefinite-lived long-term assets other than goodwill |

|

|

17,254 |

|

|

— |

|

Plus impairment of goodwill |

|

|

307 |

|

|

— |

|

Plus gain on early retirement of long-term debt |

(49) |

— |

||||

|

Plus net miscellaneous income and expenses |

|

|

52 |

|

|

(22) |

|

Plus non-cash stock-based compensation |

|

103 |

|

78 |

||

|

Adjusted EBITDA |

$ |

3,428 |

$ |

7,922 |

||

|

Less net cash paid for capital expenditures (1) |

(1,587) |

(1,859) |

||||

|

Plus cash received (paid for) taxes |

(18) |

79 |

||||

|

Less cash paid for interest, net of capitalized interest |

|

(165) |

|

(53) |

||

|

Adjusted Free Cash Flow |

$ |

1,658 |

$ |

6,089 |

||

| (1) |

Net cash paid for capital expenditures reflects actual cash payments net of cash reimbursements under tenant improvement allowances and net of property and equipment acquired in trade transactions. |

|

Selected Debt Data |

Outstanding at |

Applicable Interest Rate |

|||

|

March 31, 2021 |

|||||

|

Senior Secured Notes due 2024 (1) |

$ |

216,341,000 |

6.75% |

||

|

Asset-based revolving credit facility (2) |

$ |

— |

|

|

—% |

|

Small Business Administration Paycheck Protection Plan loans (3) |

$ |

11,194,895 |

|

|

1.00% |

|

(1) |

$216.3 million notes with semi-annual interest payments at an annual rate of 6.75%. |

||||||

|

(2) |

Outstanding borrowings under the ABL Facility, with interest spread ranging from Base Rate plus 0.50% to 1.00% for base rate borrowings and LIBOR plus 1.50% to 2.00% for LIBOR rate borrowings. |

||||||

|

(3) |

The PPP loans accrue interest at 1% annually and mature in five years for any amount that is not forgiven. |

||||||

Evan D. Masyr

Executive Vice President and Chief

Financial Officer

(805) 384-4512

evan@salemmedia.com

Source: Salem Media Group, Inc.