Investors Already Wary of Big Tech’s Dizzying Heights May Deviate Away From Swelling Large Cap Weightings

What’s different about this year’s Russell Index Reconstitution?

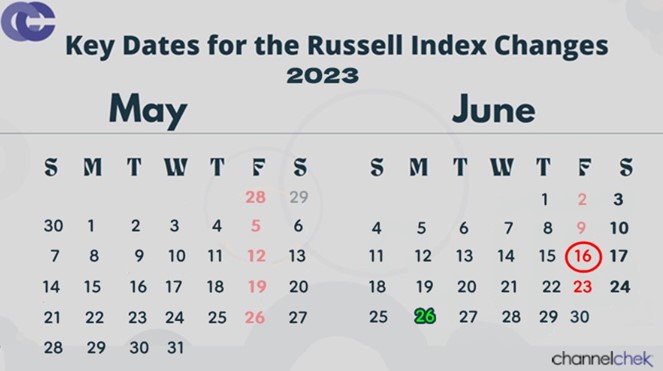

When the market closes on Friday, June 23rd , the overall FTSE Russell 3000 index and the other indexes that it impacts, including the Russell 1000 Large-cap and Russell 2000 Small-cap index, will be rebalanced to reflect current market-cap size. When the bell rings on Monday June 26th, the indexes will have different members and adjusted weighting of those constituents. Some market watchers and analysts expect this year to be a “headache” for active portfolio managers. Here’s why.

The new FTSE Russell makeup is already known. There is only a small chance a change in that might occur between now and Friday, it is largely assured that the reconstitution will increase the concentration of the top ten biggest companies in the large-cap Russell 1000 Index to a historical high of 29%. Active managers that are already underweighted mega-caps and big tech represented in the large-cap indexes will have to decide if they are going to increase holdings or be even more underweighted in comparison to an index that investors are likely to compare them to.

Additionally, while active fund managers are freer to weight their portfolios (within the boundaries of the fund’s prospectus), investors tend to compare the returns of index funds to the performance of managed funds when investing. This would increase the size of the bet in terms of fund percentage for managed funds, some already underweighted in tech. They’ll have a decision to make.

Further confusing things on the large-cap side is that the wisdom of diversification is being tested. If ten of the largest company’s make up 29% of an index, one that financial advisors and mom-and-pop investors are comparing them to, then roughly mimicking its concentrations would reduce diversification. Investing in a fund with a more even balance of stocks had once been the primary driver of mutual funds’ growth in popularity.

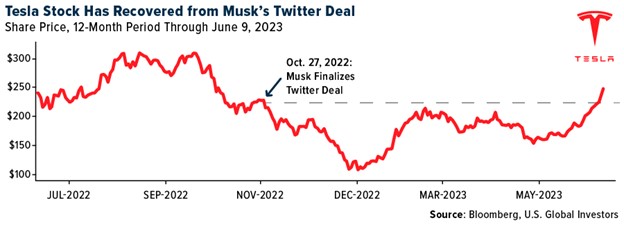

The rebalancing will heap a higher weighting to mega-cap names, including those referred to as FAANG stocks. This group of companies have already had tremendous gains this year, a pace that history would indicate is not sustainable.

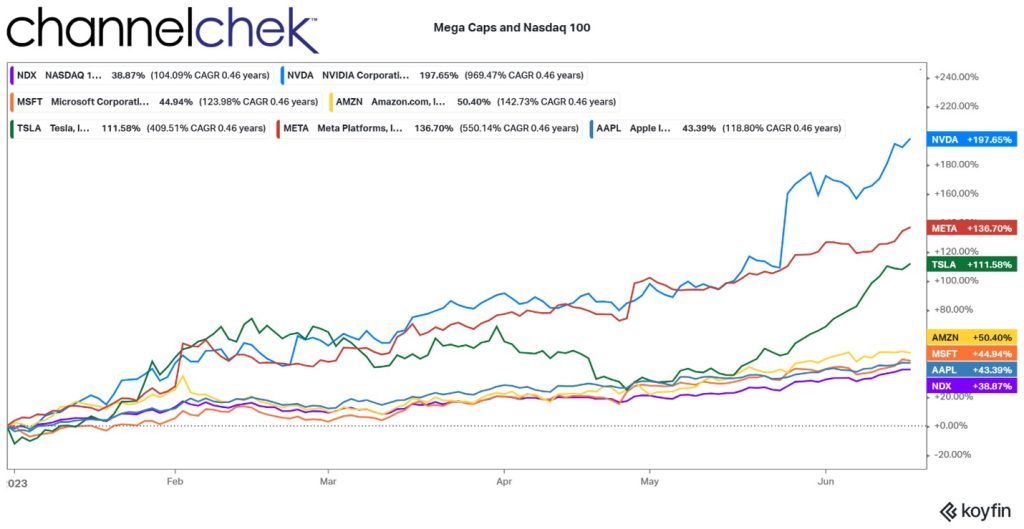

Just look at the numbers, as we near the mid-year mark in 2023.

To date the top 100 stocks in the Nasdaq, heavily weighted with mega-caps and large-cap tech, has increased 38.87%. Using historical returns, most would forecast that these topstocks have much more downside for the next six months than upside. Yet, to stay on the same playing field with index funds, managed money would have to bet against stock market history.

The largest of stocks, as demonstrated below, are pulling a lot of weight. Nvidia (NVDA) is up nearly 200%, Meta (META) returned 137%, Tesla (TSLA) is also up over 100%. A fund manager with flexibility could be torn; on the one hand, afraid to bet against such momentum, on the other, historical probabilities suggest they should.

There’s recent evidence that portfolio managers are looking for value away from the mega-cap stocks that have had the kind of run that in some cases made them twice as expensive. The Russell Small-cap Index, which is part of the June rebalancing is made up of the lowest 2,000 companies in terms of market cap of the broader Russell 3000. June has been a great month for the index so far. The index month-to-date is up 7.75% compared to the Nasdaq 100’s 6.56%. This beats June’s returns for Microsoft (MSFT), Apple (AAPL), and Amazon, among others. The performance, which includes an increase of 3.6% and a 2.8% jump on June 6th indicates investors are rotating away from large-cap stocks that have become historically expensive and into smaller companies that are cheap by historical standards.

The reconstitution also provides investors in the weeks and hours leading up to the rebalance to speculate on how the rebalance will impact individual stocks. Since the preliminary list of changes was announced last month, companies expected to be added to the Russell 1000 Index have gained 4.9%, while the those that moved to a smaller-cap index have grown 11.3%, according to data compiled by Wells Fargo (6/14/23).

Take Away

The Russell Reconstitution elevates the percentage weighting of mega-cap tech stocks that usually trade in rough tandem. Mutual fund managers, and other managed money will have to rethink their weighting of a sector that has already skyrocketed on speculation of future growth.

There has already been signs of a slowdown of interest in mega-tech, compared to a significant increase in attention to small-caps that are cheap by most measures. If the rotation continues, money managers that adhere to tried and true wisdom related to diversification, and metrics like P/E ratios, may wind up the year outperforming the indexed funds they tend to be compared to.

Managing Editor, Channelchek

Sources

https://www.ft.com/content/01ad3636-f15c-42c2-ab2c-81418f8160be