Image Credit: NASA Kennedy (Flickr)

Journey to Investments in Space-Related Companies

Are space exploration, space recreation, and the military transformation in space opening investment opportunities? NASA has aggressive plans to collaborate with commercial partners to establish a presence on the moon – SpaceX, Blue Origin, and Virgin Galactic are successfully moving forward with their own services beyond the Earth’s atmosphere, and SpaceForce, which is approaching its third anniversary, is experiencing a growing budget allocation from Washington. If space is the final frontier, does it deserve consideration as part of your portfolio – could the timing be right to explore the possibilities?

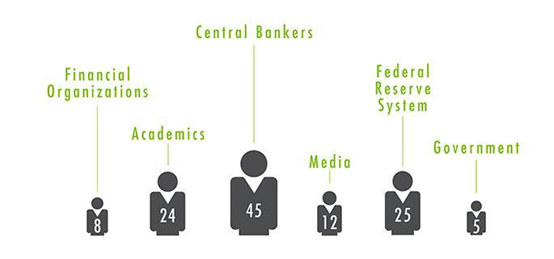

Last year (2021), there were several spaceflight-related records set. This includes the most successful orbital launches in a year, most humans sent to space, and most orbiting Earth all at the same time. Launching more equipment, with or without passengers, into orbit opens possibilities for many companies, large and small. The big companies, like Boeing (BA), which is developing the Starliner spacecraft for travel, and Northrop Grumman (NOC), which is developing the Cygnus spacecraft, are huge companies, so space missions and travel will be just a small fraction of their business. Meanwhile, smaller companies, even those with various related lines of business, stand to experience a greater impact from increased launches, travel, and military design and implementation.

Companies do not have to build the rocket or space vehicle itself to benefit. There are launch operations, communications, data, satellites, computer systems, design, etc., all critical to providing a successful mission.

Smaller companies in this investment space have been underperforming the S&P 500 so far this year. Whether this means they are on the launch pad and headed to the moon with the new pace of activity or that they will continue to sit idle for some time is never known with stocks in any industry, but this sector is expanding while so many others are shrinking.

Who are some of the smaller, more interesting companies to discover?

Maxar Technologies, Inc (NYSE: MAXR) is a space and geospatial data provider with a full range of space technology products and solutions for both commercial and government customers. Maxar’s solutions include satellites, Earth imagery, geospatial data, and analytics.

Current MAXR Price, $24.25/ Market Cap $1.79b.

Kratos Defense & Security Solutions, Inc. (KTOS) provides engineering, information technology, and warfighter solutions to the U. S. Department of Defense. Kratos is a U.S. government contractor that operates through two segments, Kratos Government Solutions and Unmanned Systems. The Kratos Government Solutions segment offers microwave electronic products, space and satellite communications, training and cybersecurity/warfare, modular systems, turbine technologies, and defense and rocket support services. The Unmanned Systems segment provides unmanned aerial systems (drones), and unmanned ground and seaborne systems.

Current KTOS Price $13.03/ Market Cap $1.63b.

Rocket Lab USA, Inc.(RKLB) serves commercial, aerospace contractors, and government customers. The company was founded in 2006 and went public via SPAC in August of 2021. It provides launch services, spacecraft design, manufacturing, and other spacecraft and non-orbit management products and services. Rocket Lab also designs, manufactures, and sells small orbital launch vehicles and satellite platforms. They are developing an 8-ton payload class launch vehicle.

Current Price $5.18 / Market Cap $2.4b.

Momentus, Inc. (MTS) serves satellite operators. It is a smaller company that focuses on providing in-space infrastructure services, and in-space transportation hosted payloads and in-orbit services. Current Price $1.85 / Market Cap $154.1m.

Take-Away

There has been increasing buzz around space travel, work being done on improved internet and communications from space, exploring Mars, and expanded military operations from the heavens. This increased business and increased attention is on an upward trajectory and could potentially take some small company prices with it.

Helping you discover and explore smaller companies is one of Channelchek’s main purposes. Login to your free Channelchek account, click on COMPANY Data, and start your journey.

Managing Editor, Channelchek

Suggested Content

Capitalizing on the New Space Race

|

Edge Computing Importance to AI Applications

|

The Most Effective Artificial Intelligence Will Never Exist in the Cloud

|

When Corporate Governance Gets Sticky

|

Sources

https://en.wikipedia.org/wiki/2021_in_spaceflight

https://www.space.com/rocket-lab-goes-public-spac-merger

https://channelchek.com/aux/(expanded:check-channels)

Stay up to date. Follow us:

|