Research News and Market Data on VVX

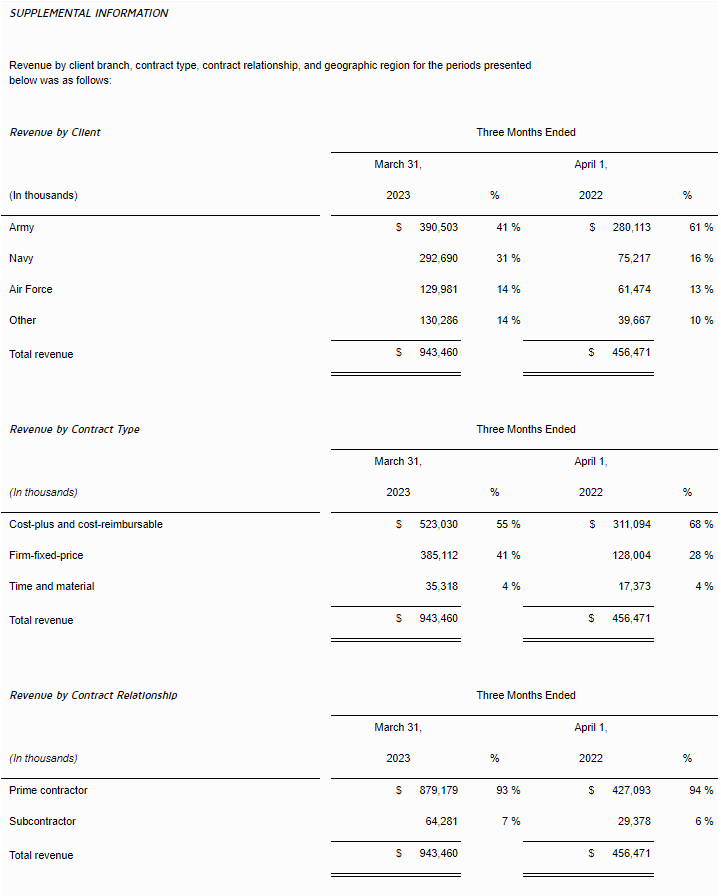

Company Release – 5/9/2023

First Quarter 2023 Highlights:

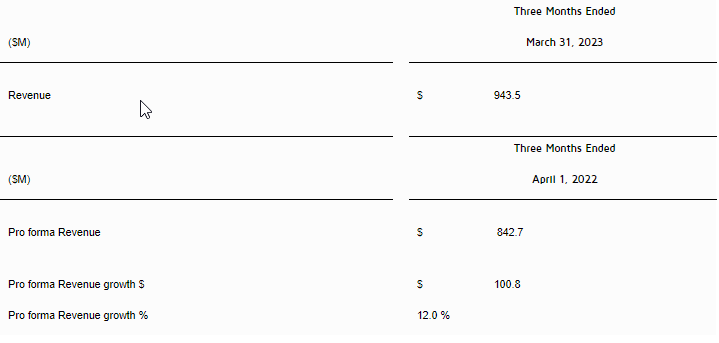

- Revenue of $943.5 million, up 12.0% y/y on a pro forma basis

- Continued expansion in the Pacific driving strong revenue growth of ~300% y/y

- Awarded new contracts valued at ~$600 million and secured ~$250 million in recompetes

- Reported operating income of $30.6 million; adjusted operating income1 of $62.6 million

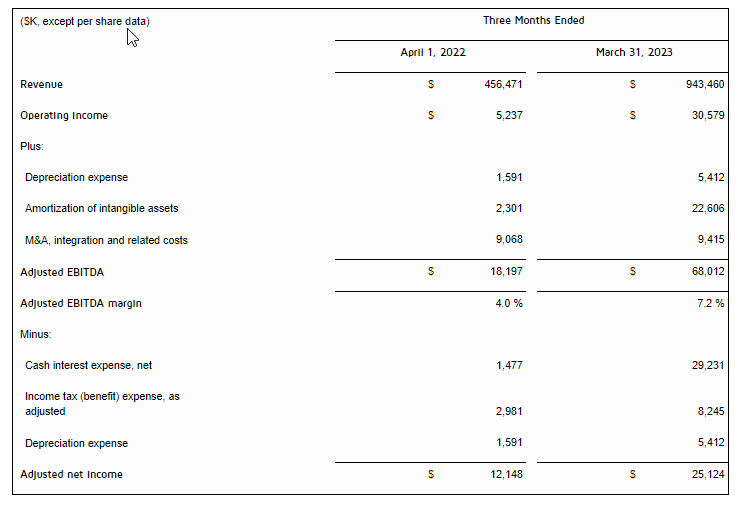

- Adjusted EBITDA1 of $68.0 million with a margin1 of 7.2%

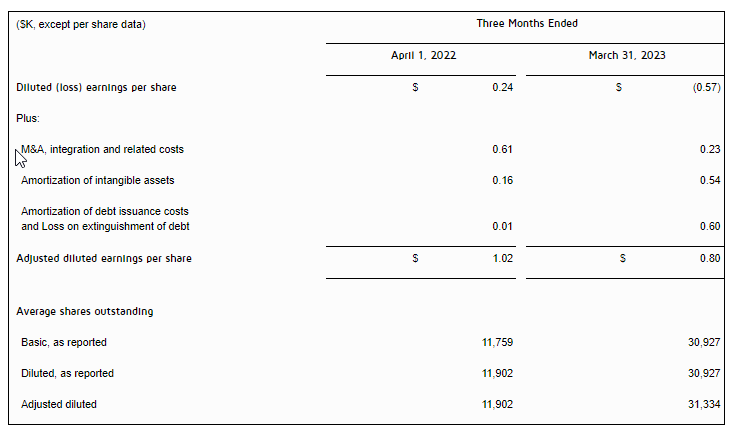

- Diluted EPS of ($0.57); adjusted diluted EPS1 of $0.80

2023 Guidance:

- Reiterating full-year 2023 guidance

MCLEAN, Va., May 9, 2023 /PRNewswire/ — V2X, Inc. (NYSE:VVX) announced first quarter 2023 financial results.

“V2X reported an excellent start to the year with revenue increasing 12.0% year-over-year, on a pro forma basis during the first quarter,” said Chuck Prow, President and Chief Executive Officer of V2X. “Adjusted EBITDA for the quarter was $68.0 million or a 7.2% margin and reflects a benefit from strong revenue volume and program productivity. The pace of award activity is improving and was exemplified by approximately $600 million in new business awarded to V2X. With over $4 billion in bids under evaluation and a robust backlog of ~$12 billion, the outlook for V2X remains solid.”

“Revenue growth in the quarter was generated by continued expansion on existing programs, contribution from new awards, as well as success in securing recompete wins late last year and in early 2023,” said Mr. Prow. “Our teams continued to drive momentum with several notable wins in the quarter. This has been achieved while successfully expanding on our core programs. Importantly, we continue to experience significant growth in the Pacific or INDOPACOM, with our presence and footprint in the region proving to be a key channel to support increasing mission requirements.”

Mr. Prow continued, “Our growth activities during the quarter were robust. In March, we were awarded two strategically important new business contracts. Firstly, we were the successful bidder on the Naval Test Wing Pacific contract valued at $440 million over seven years, which further builds on the services V2X is providing under the $880 million Naval Test Wing Atlantic program. This effort to support the critical test and evaluation activities performed by the Naval Test Wing Pacific leveraged V2X’s proprietary and innovative technology-based solution, AMMO®, and demonstrates our commitment to maintaining high levels of mission readiness. We are honored to be selected to support the Navy’s preeminent organization for flight testing and flight test support of the latest systems. Secondly, V2X was also awarded a three-year, approximately $100 million contract to provide critical cybersecurity support services to a government client. This is a key win for V2X in the cyber and IT support domain and leverages our core mission of intersecting our technology and operations capabilities.”

“In addition, during the first quarter, we were awarded over $250 million in recompetes,” said Mr. Prow. “This includes a five-year, $142 million contract with Naval Air Systems Command (NAVAIR) PMA 281 in support of mission planning systems. PMA-281 is responsible for the acquisition and life cycle management of a range of mission planning, control system and execution tools that are developed and integrated in partnership with other services, and foreign nation partners. This recompete win with the Navy represents successful execution on this deliberate client engagement campaign. We also secured a five-year recompete contract valued at over $90 million with a National Security client. Transition to the new contract is complete and I’d like to thank our team for their exceptional performance and dedication to this important client.”

Mr. Prow concluded, “The significant momentum in harnessing combined V2X solutions offers an opportunity to deliver growth with access to pursuits that would not have been achievable in the past. We remain focused on delivering on our strategy to drive growth by creating more value in our core markets with converged solutions, increasing market share where our operational knowledge sets us apart, and expanding mission capabilities into adjacent markets.”

First Quarter 2023 Results

On July 5, 2022 (“Closing Date”), Vectrus, Inc. (“Vectrus”) completed its merger (“the Merger”) with Vertex Aerospace Services Holding Corp. (“Vertex”), thereby forming V2X, Inc. First quarter 2022 “reported results” reflect the contributions of Vectrus from January 1, 2022, through March 31, 2022, unless otherwise noted. Comparisons to historical periods are relative to legacy Vectrus results, unless otherwise noted.

- Revenue of $943.5 million, up 12.0% y/y on a pro forma basis

- Operating income of $30.6 million, including merger and integration related costs of $9.4 million, and amortization of acquired intangible assets of $22.6 million

- Adjusted operating income1 of $62.6 million

- Adjusted EBITDA1 of $68.0 million with a 7.2% adjusted EBITDA margin1

- Diluted EPS of ($0.57)

- Adjusted diluted EPS1 of $0.80

- Net debt as of March 31, 2023 of $1,288.6 million

- Total backlog as of March 31, 2023 of $11.8 billion

“Our first quarter financial results were a strong start to the year,” said Susan Lynch, Senior Vice President and Chief Financial Officer. “Pro forma revenue increased 12.0% year-over-year to $943.5 million. Revenue growth was driven by momentum in the Pacific, expansion on existing programs, and the contribution from new business wins awarded in 2022 and 2023. Notably, revenue from the Pacific increased approximately 300% year-over-year and 18% sequentially, reflecting our agile readiness position to support the increased operational tempo of mission exercises in the region.”

For the quarter, the Company reported operating income of $30.6 million and adjusted operating income1 of $62.6 million. Adjusted EBITDA1 was $68.0 million with a margin of 7.2%. First quarter diluted EPS was ($0.57), due primarily to merger and integration related costs, loss on extinguishment of debt, amortization of acquired intangible assets, and interest expense. Adjusted diluted EPS1 for the quarter was $0.80 cents.

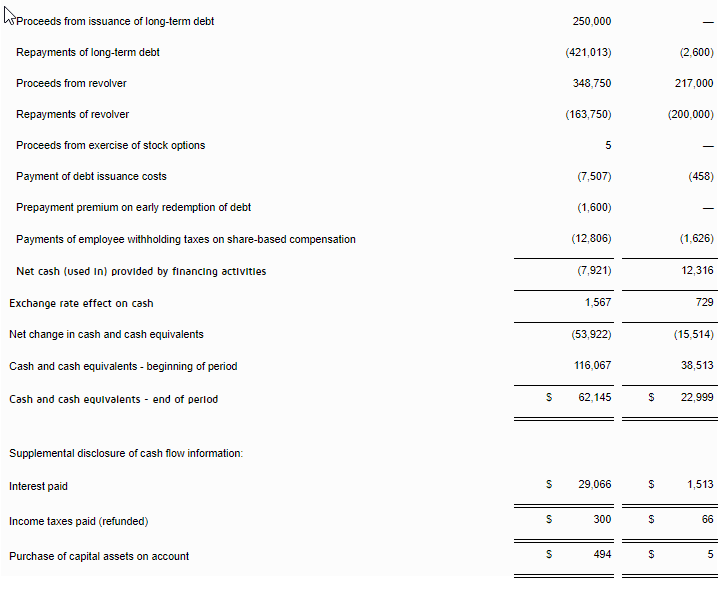

Ms. Lynch continued, “In the first quarter, V2X successfully enhanced its capital structure through a lower cost credit facility with greater liquidity. The new $750 million credit facility eliminated the second lien term loan B, the incremental portion of the first lien term loan B, and the asset-based loan revolver and was replaced with a lower cost $500 million revolver and a $250 million term loan A. In order to manage interest rate risk and uncertainty, the Company also entered into interest rate swaps, converting 30% of its variable-rate term loan debt into fixed rate-debt. I would like to thank our banking partners for their support and trust in our business. At the end of the quarter, our net consolidated indebtedness to EBITDA1 (net leverage ratio) was 3.8x. We are focused on reducing debt and expect that our leverage ratio will show further improvement in 2023.”

“Net cash used in operating activities for the quarter was $38.5 million. Adjusted net cash used in operating activities1 was $23.4 million, which adds back $13.4 million of CARES Act related payments and $1.7 million of M&A and integration costs,” said Ms. Lynch. “Cash flow followed our normal seasonal pattern and we expect operating cash flow to ramp to our previously communicated guidance.”

Total backlog as of March 31, 2023, was $11.8 billion and funded backlog was $2.6 billion. The trailing twelve-month book-to-bill was 1.4x.

Reiterating 2023 Guidance

Ms. Lynch concluded, “I am pleased with our strong start to the year. Our teams continue to work together seamlessly, making notable progress on integration milestones while driving results across the board. We have made great strides in harmonizing our processes, technology, and applications, which is allowing us to deliver on our commitments. As such, the Company is reiterating its guidance for 2023.” Guidance for 2023 remains as follows:

| $ millions, except for per share amounts | 2023 Guidance | 2023 Mid-Point | ||

| Revenue | $3,800 | To | $3,900 | $3,850 |

| Adjusted EBITDA1 | $290 | To | $310 | $300 |

| Adjusted Diluted Earnings Per Share1 | $3.80 | To | $4.30 | $4.05 |

| Adjusted Net Cash Provided by Operating Activities 1 | $115.0 | To | $135.0 | $125.0 |

Forward-looking statements are based upon current expectations and are subject to factors that could cause actual results to differ materially from those suggested here, including those factors set forth in the Safe Harbor Statement below.

First Quarter 2023 Conference Call

Management will conduct a conference call with analysts and investors at 4:30 p.m. ET on Tuesday, May 9, 2023. U.S.-based participants may dial in to the conference call at 888-886-7786, while international participants may dial 416-764-8658. A live webcast of the conference call as well as an accompanying slide presentation will be available here: https://app.webinar.net/4AayJaN5XPr

A replay of the conference call will be posted on the V2X website shortly after completion of the call and will be available for one year. A telephonic replay will also be available through May 23, 2023, at 844-512-2921 (domestic) or 412-317-6671 (international) with passcode 30124902.

Presentation slides that will be used in conjunction with the conference call will also be made available online in advance at https://investors.vectrus.com/. V2X recognizes its website as a key channel of distribution to reach public investors and as a means of disclosing material non-public information to comply with its obligations under the U.S. Securities and Exchange Commission (“SEC”) Regulation FD.

Footnotes:

1 See “Key Performance Indicators and Non-GAAP Financial Measures” for descriptions and reconciliations.

About V2X

V2X is a leading provider of critical mission solutions and support to defense clients globally, formed by the 2022 Merger of Vectrus and Vertex to build on more than 120 combined years of successful mission support. The Company delivers a comprehensive suite of integrated solutions across the operations and logistics, aerospace, training and technology markets to national security, defense, civilian and international clients. Our global team of approximately 15,000 employees brings innovation to every point in the mission lifecycle, from preparation, to operations, to sustainment, as it tackles the most complex challenges with agility, grit, and dedication.

Safe Harbor Statement

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995 (the “Act”): Certain material presented herein includes forward-looking statements intended to qualify for the safe harbor from liability established by the Act. These forward-looking statements include, but are not limited to, all the statements and items listed under “Reiterating 2023 Guidance” above and other assumptions contained therein for purposes of such guidance, other statements about our 2023 performance outlook, revenue, contract opportunities, and any discussion of future operating or financial performance.

Forward-looking statements generally can be identified by the use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “believe,” “could,” “potential,” “continue” or similar terminology. These statements are based on the beliefs and assumptions of the management of the Company based on information currently available to management.

These forward-looking statements are not guarantees of future performance, conditions, or results, and involve a number of known and unknown risks, uncertainties, assumptions, and other important factors, many of which are outside our management’s control, that could cause actual results to differ materially from the results discussed in the forward-looking statements. In addition, forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from the Company’s historical experience and our present expectations or projections. For a discussion of some of the risks and uncertainties that could cause actual results to differ from such forward-looking statements, see the risks and other factors detailed from time to time our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and other filings with the SEC.

We undertake no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Key Performance Indicators and Non-GAAP Measures

The primary financial performance measures we use to manage our business and monitor results of operations are revenue trends and operating income trends. Management believes that these financial performance measures are the primary drivers for our earnings and net cash from operating activities. Management evaluates its contracts and business performance by focusing on revenue, operating income, and operating margin. Operating income represents revenue less both cost of revenue and selling, general and administrative (SG&A) expenses. Cost of revenue consists of labor, subcontracting costs, materials, and an allocation of indirect costs, which includes service center transaction costs. SG&A expenses consist of indirect labor costs (including wages and salaries for executives and administrative personnel), bid and proposal expenses and other general and administrative expenses not allocated to cost of revenue. We define operating margin as operating income divided by revenue.

We manage the nature and amount of costs at the program level, which forms the basis for estimating our total costs and profitability. This is consistent with our approach for managing our business, which begins with management’s assessing the bidding opportunity for each contract and then managing contract profitability throughout the performance period.

In addition to the key performance measures discussed above, we consider adjusted net income, adjusted diluted earnings per share, adjusted operating income, adjusted EBITDA, adjusted EBITDA margin, adjusted operating cash flow, and pro forma revenue to be useful to management and investors in evaluating our operating performance, and to provide a tool for evaluating our ongoing operations. This information can assist investors in assessing our financial performance and measures our ability to generate capital for deployment among competing strategic alternatives and initiatives. We provide this information to our investors in our earnings releases, presentations, and other disclosures.

Adjusted net income, adjusted diluted earnings per share, adjusted operating income, adjusted EBITDA, adjusted EBITDA margin, adjusted operating cash flow, and pro forma revenue, however, are not measures of financial performance under GAAP and should not be considered a substitute for financial measures determined in accordance with GAAP. Definitions and reconciliations of these items are provided below.

- Pro forma revenue is defined as the combined results of our operations for the three months ended March 31, 2023 and April 1, 2022 as if the Merger had occurred on January 1, 2021.

- Adjusted operating income is defined as operating income, adjusted to exclude items that may include, but are not limited to, significant charges or credits, and unusual and infrequent non-operating items that impact current results but are not related to our ongoing operations, such as M&A, integration, and related costs.

- Adjusted EBITDA is defined as operating income, adjusted to exclude depreciation and amortization of intangible assets, and items that may include, but are not limited to, significant charges or credits, and unusual and infrequent non-operating items that impact current results but are not related to our ongoing operations, such as M&A, integration, and related costs.

- Adjusted EBITDA margin is defined as adjusted EBITDA divided by revenue.

- Adjusted net income is defined as net income, adjusted to exclude items that may include, but are not limited to, significant charges or credits, and unusual and infrequent non-operating items that impact current results but are not related to our ongoing operations, such as M&A, integration and related costs, amortization of acquired intangible assets, amortization of debt issuance costs, and loss on extinguishment of debt.

- Adjusted diluted earnings per share is defined as adjusted net income divided by the weighted average diluted common shares outstanding.

- Cash interest, net is defined as interest expense, net adjusted to exclude amortization of debt issuance costs.

- Adjusted operating cash flow is defined as net cash provided by (or used in) operating activities adjusted to exclude infrequent non-operating items, such as M&A payments and related costs.

In this document, the Company presents certain forward-looking non-GAAP metrics. The Company does not provide outlook on a GAAP basis because the items that the Company excludes from GAAP to calculate the comparable non-GAAP measure can be dependent on future events that are less capable of being controlled or reliably predicted by management and are not part of the Company’s routine operating activities. Additionally, management does not forecast many of the excluded items for internal use and therefore cannot create or rely on outlook done on a GAAP basis. The occurrence, timing and amount of any of the items excluded from GAAP to calculate non-GAAP could significantly impact the Company’s fiscal 2023 GAAP results.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/v2x-announces-strong-first-quarter-2023-results-301819919.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/v2x-announces-strong-first-quarter-2023-results-301819919.html

SOURCE V2X, Inc.