As we progress through earnings season, a concerning trend is becoming more apparent – the widening valuation gap between small and large cap companies. Across sectors like biotech, construction, media and more, large cap stocks are trading at significantly higher valuation multiples compared to their small and mid cap peers. For long-term investors, this divergence could signal an opportunity to start positioning in overlooked parts of the market.

Valuation refers to the process of determining the current worth of an asset or company. The most common valuation metric used by investors is the price-to-earnings (P/E) ratio. This compares a company’s current stock price to its earnings per share, giving a sense of how much investors are willing to pay for each dollar of earnings.

Typically, investors are willing to pay higher multiples for larger companies perceived as higher quality investments. However, the gap in P/E ratios between large caps and small caps has expanded dramatically over the past year. The sizable disparity between the two classes is the largest it has been in over 20 years.

For example, Pfizer trades around 13x forward earnings expectations. But the average forward P/E for biotech stocks with market caps under $500 million is only 5x. This means investors are valuing each dollar of Pfizer’s earnings twice as highly as the average small cap biotech peer.

We see similar trends in other sectors. In construction & engineering, Jacobs Engineering trades at 25x forward earnings versus under 10x for small cap marine construction firms like Orion Group Holdings and Great Lakes Dredge & Dock. Media giants like Disney (14x) and Fox Corp (11x) also command far higher valuations than small cap peers like Direct Digital Media (DRCT), Entravision (EVC), or Townsquare Media (TSQ).

What explains this growing divergence in how the market is pricing future earnings potential?

For one, large cap companies often have broader business diversification that allows them to navigate volatile economic conditions. Pfizer’s COVID vaccine gave revenues a shot in the arm during the pandemic. Meanwhile, smaller biotechs with narrower clinical pipelines carry more binary risk around drug development outcomes.

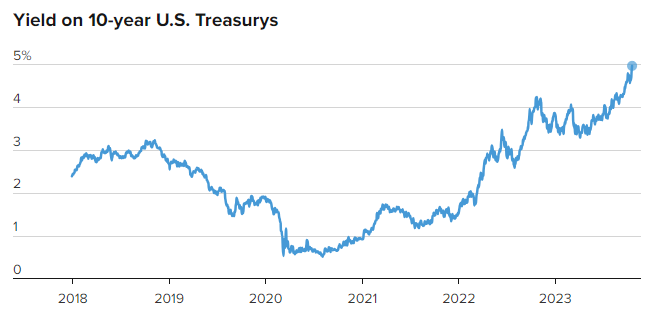

Bigger balance sheets also provide an advantage. Large caps can leverage financial strength to pursue acquisitions, ramp up buybacks and maintain dividends during downturns. With higher cash reserves and access to capital, they are better equipped to weather tightening financial conditions.

Many large caps also benefit from durable competitive advantages like strong branding, pricing power, high barriers to entry and economies of scale. This allows them to consistently deliver high returns on invested capital and cash flows sought by investors.

Smaller companies tend to deliver more volatile financial results. They lack established competitive positions and have less excess cash. Weaker balance sheets increase vulnerability to supply chain disruptions, rising input costs and tight financing conditions.

While these factors help explain higher valuations for large caps, the magnitude of the gap suggests investors may be overlooking the long-term potential of small and micro cap stocks.

Though more volatile, smaller companies offer greater growth potential. They can deliver exponential returns if new innovations gain traction or they carve out niche industry positions. With valuations already compressed, their risk/reward profiles appear skewed to the upside.

Noble Capital Markets’ Director of Research, Michael Kupinski states in his Q3 2023 Media Sector Review, “We believe that there is higher risk in the small cap stocks, especially given that some companies may not be cash flow positive, have capital needs, or have limited share float. But investors seem to have thrown the baby out with the bathwater. While those small cap stocks are on the more speculative end of the scale, many small cap stocks are growing revenues and cash flow, have capable balance sheets, and/or are cash flow positive. For attractive emerging growth companies, the trading activity will resolve itself over time. Some market strategists suggest that small cap stocks trade at the most undervalued in the market, as much as a 30% to 40% discount to fair value.”

Astute investors know that future unicorns often hide among today’s small and micro caps. Many current large cap leaders like Apple, Amazon and Tesla began as small companies trading at single digit earnings multiples. Yet these stocks generated huge returns for early investors.

Just because a company is small does not necessarily mean it is distressed. Many smaller firms boast solid fundamentals and growth drivers that are simply not apparent to short-term traders. Their lower valuations present a compelling entry point for long-term investors.

While large caps will remain a core portfolio holding for many, today’s environment presents a unique opportunity. The extreme valuation divergence has created asymmetric upside potential in overlooked small cap names. As legendary investor Warren Buffett said, “Be fearful when others are greedy and greedy when others are fearful.”

Digging Deeper into Valuation Metrics

When assessing valuation gaps between small and large caps, it helps to look beyond simple price-to-earnings ratios. Other useful metrics can provide additional context on relative value.

For example, the price-to-sales (P/S) ratio compares a company’s market capitalization to total revenue. High growth companies with minimal earnings often trade at elevated P/S multiples. However, small caps today trade at an average P/S ratio of just 0.7x versus 2.3x for large caps. Again, a sizable gap that favors small companies.

Enterprise value to EBITDA (EV/EBITDA) is another meaningful valuation yardstick. By incorporating debt levels and focusing on cash profits, EV/EBITDA provides a more holistic view of a company’s valuation. Currently, small caps trade at an average forward EV/EBITDA of 6x – roughly half that of large cap peers.

Across an array of valuation metrics, small and mid caps trade at substantial discounts relative to large caps. This suggests underlying fundamentals and growth prospects may not be fully reflected in their beaten-down share prices.

Small Cap Opportunities Across Industries

While small caps appear broadly undervalued, some industries stand out as particularly compelling hunting grounds.

For example, junior mining stocks have been ravaged during the recent crypto/tech selloff. But with inflation soaring and geopolitical tensions rising, demand for precious metals should strengthen. Many miners are generating robust cash flows at today’s elevated commodity prices. Yet their shares trade at deep discounts to book value.

Biotech is another area laden with small cap opportunities. Developing novel drugs carries substantial risk, so setbacks in clinical trials can decimate share prices. However, the sector remains ripe for M&A. Larger pharmas need to replenish pipelines, providing takeout potential. Investors can balance risks via diversification across promising development stage companies.

Oil and gas producers offer further value among small energy firms. Strong demand and restricted supply has sent oil prices surging. Many smaller E&Ps focused on prolific shale basins sport attractive cash flows and reserves value. Yet their shares lag larger counterparts, despite superior growth outlooks.

The bottom line is that while risks are higher with small caps, their depressed valuations provide a margin of safety. Reward far exceeds risk for selective investors focused on fundamentals.

Mitigating Volatility

Small caps carry well-known risks, including elevated volatility. Information flow and analyst coverage is more sparse for smaller companies. Major drawdowns can rattle investor nerves and sink long-term performance if not adequately prepared for. Resources like Channelchek is a great tool to help provide data to investors in the small cap space.

Based on your age, time horizon, and risk tolerance, here are some tips to mitigate volatility while still capturing small cap upside:

- Maintain reasonable portfolio allocation – small and microcaps should represent a smaller portion of your equity holdings

- Diversify across sectors, industries and market caps to smooth volatility

- Maintain a long-term mindset – don’t panic sell on temporary declines

With prudent risk controls, small caps can boost portfolio returns while diversifying away from large cap shares. Their more attractive valuations provide a compelling opportunity during these volatile times.

“In the equity markets history tends to repeat itself. At some point the smart money will start allocating more portfolio weight into these undervalued equities, which will narrow this historic valuation gap, offering potential for above average returns for small and microcaps,” said Nico Pronk, CEO of Noble Capital Markets.