Research News and Market Data on TWI

Feb 26, 2026, 06:00 ET

WEST CHICAGO, Ill., Feb. 26, 2026 /PRNewswire/ — Titan International, Inc. (NYSE: TWI) (“Titan” or the “Company”), a leading global manufacturer of off-highway wheels, tires, assemblies, and undercarriage products, today reported financial results for the fourth quarter and year ended December 31, 2025. The full earnings release including a reconciliation of GAAP to Non-GAAP figures can be found in the investor relations section of the Company’s website at https://ir.titan-intl.com/news-and-events/news-releases/default.aspx.

Q4 2025 Key Figures

- Revenues grew 7% to $410 million

- Gross margin improved to 10.9%

- Adjusted EBITDA increased 18% to $11 million

Paul Reitz, President and Chief Executive Officer, commented, “We wrapped-up 2025 with another positive quarter as our Q4 2025 results exceeded Q4 2024 in terms of revenue, gross margin and Adjusted EBITDA. Our EMC segment was a standout performer, with revenue growth of 21% and gross margin expansion of 3.4 percentage points. Importantly, we anticipate continued growth in this segment in 2026. Our Ag segment recorded a top-line increase of 2.6% in the fourth quarter, roughly flat excluding FX. Going into 2026 in Ag we expect demand for smaller equipment to outpace high-horsepower units as farmers continue to contend with elevated input costs and weaker commodity prices. In our Consumer segment, fourth quarter sales were up slightly within our Specialty division, while down modestly overall. Focusing on 2026, OEMs and their dealer networks look to have generally reached the end of their finished goods destocking and we expect to see some benefit from that as a result. A resumption in demand would therefore flow through to demand for tires, wheels and other components. It also bears repeating that our Consumer segment enjoys a high proportion of aftermarket sales and therefore is less susceptible to the OEM cycles.”

Mr. Reitz concluded, “Over the past couple years visibility across our end markets has been constrained — and that added complexity creates an advantage for Titan with our One Stop Shop strategy. Our diversified supply chain offers global manufacturing, strategic sourcing and JVs and this gives us flexibility to adapt quickly to the frequent changes we continue to see in trade policy and ultimately allows us to serve our customers better than anyone else. By keeping our customers at the forefront of everything we do, we continue to cement our market leadership position. We remain well positioned for an Ag market rebound and as always, we will continue to prioritize our customers and in doing so, we expect 2026 will be a good year for Titan.”

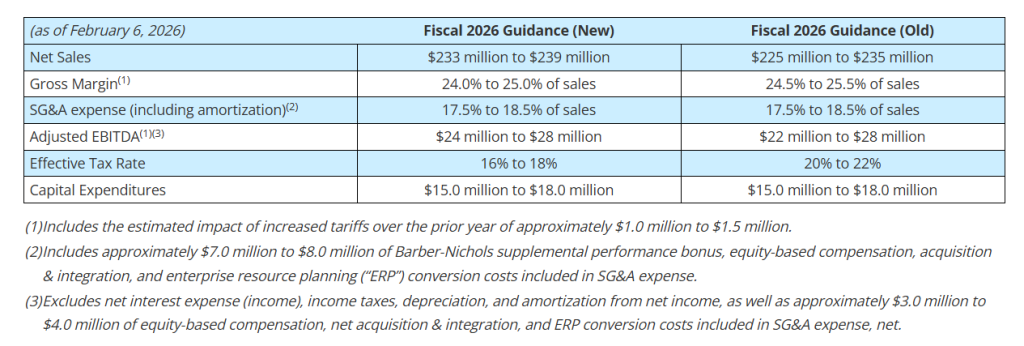

First Quarter and Fiscal Year 2026 Outlook

Tony Eheli, Chief Financial Officer, stated, “We ended the year with a strong balance sheet and maintained a disciplined expense profile that drove improvements in margin and profitability, while allowing us to continue to invest in our product, people, and processes. We expect to start 2026 with a seasonal uptick in activity with Q1 sales between $490 million and $510 million and Adjusted EBITDA between $28 million and $33 million. For the full year we are expecting revenue in the $1.85 to $1.95 billion range with Adjusted EBITDA between $105 million and $115 million.”

About Titan

Titan International, Inc. (NYSE: TWI) is a leading global manufacturer of off-highway wheels, tires, assemblies, and undercarriage products. Headquartered in West Chicago, Illinois, the Company globally produces a broad range of products to meet the specifications of original equipment manufacturers (OEMs) and aftermarket customers in the agricultural, earthmoving/construction, and consumer markets. For more information, visit www.titan-intl.com.

Safe Harbor Statement

This press release contains forward-looking statements. These forward-looking statements are covered by the safe harbor for “forward-looking statements” provided by the Private Securities Litigation Reform Act of 1995. The words “believe,” “expect,” “anticipate,” “plan,” “would,” “could,” “potential,” “may,” “will,” and other similar expressions are intended to identify forward-looking statements, which are generally not historical in nature. These forward-looking statements are based on our current expectations and beliefs concerning future developments and their potential effect on us. Although we believe the assumptions upon which these forward-looking statements are based are reasonable, these assumptions are subject to significant risks and uncertainties, and are subject to change based on various factors, some of which are beyond Titan International, Inc.’s control. As a result, any of these assumptions could prove to be inaccurate and the forward-looking statements based on these assumptions could be incorrect. The matters discussed in these forward-looking statements are subject to risks, uncertainties, and other factors that could cause actual results and trends to differ materially from those made, projected, or implied in or by the forward-looking statements depending on a variety of uncertainties or other factors including, but not limited to, the effect of geopolitical instability; the effect of a recession on the Company and its customers and suppliers; changes in the Company’s end-user markets into which the Company sells its products as a result of domestic and world economic or regulatory influences or otherwise; changes in the marketplace, including new products and pricing changes by the Company’s competitors; the Company’s ability to maintain satisfactory labor relations; unfavorable outcomes of legal proceedings; the Company’s ability to comply with current or future regulations applicable to the Company’s business and the industry in which it competes or any actions taken or orders issued by regulatory authorities; availability and price of raw materials; levels of operating efficiencies; the effects of the Company’s indebtedness and its compliance with the terms thereof; changes in the interest rate environment and their effects on the Company’s outstanding indebtedness; unfavorable product liability and warranty claims; actions of domestic and foreign governments, including the imposition of additional tariffs; geopolitical and economic uncertainties relating to the countries in which the Company operates or does business; risks associated with acquisitions, including difficulty in integrating operations and personnel, disruption of ongoing business, and increased expenses; results of investments; the realization of projected synergies; the effects of potential processes to explore various strategic transactions, including potential dispositions; fluctuations in currency translations; risks associated with environmental laws and regulations; risks relating to our manufacturing facilities, including that any of our material facilities may become inoperable; risks relating to financial reporting, internal controls, tax accounting, and information systems; and the other risks and factors detailed in the Company’s periodic reports filed with the Securities and Exchange Commission, including the disclosures under “Risk Factors” in those reports. These forward-looking statements are made only as of the date hereof. The Company cautions that any forward-looking statements included in this press release are subject to a number of risks and uncertainties, and the Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, changed circumstances or future events, or for any other reason, except as required by law.

SOURCE Titan International, Inc.