Nuclear Power Plant Start Will be Delayed as Reliable US Fuel Production Needs to Improve

The energy and fuel shortages stemming from the Russia/Ukraine war extend beyond oil and gas. A sharp impact is also being felt in the nuclear energy world as uranium is less available for new and existing plants. In the US, TerraPower’s natrium reactor completion date is now estimated at least two years beyond the original plan. This is because of problems securing the proper fuel. TerraPower is a start-up co-founded by Bill Gates with support from Warren Buffett to revolutionize nuclear reactor design and methods. The natrium reactor being built as a test of the technology is being built in Kemmerer, Wyoming, which is considered a coal town. The original completion date was 2028.

What is Now Expected

The company expects the natrium demonstration reactor operation to be delayed by at least two years because there will not be sufficient commercial capacity to produce high-assay low-enriched uranium fuel to test come the original 2028 in-service date.

TerraPower’s CEO and President Chris Levesque said Russia’s invasion of Ukraine earlier this year caused “the only commercial source of HALEU fuel” to no longer be a viable part of the supply chain. The company is now working with the US Department of Energy (DOE), Congress, and project stakeholders to explore potential alternative sources. Levesque said, “while we are working now with Congress to urge the inclusion of $2.1 billion to support HALEU in the end-of-year government funding package, it has become clear that domestic and allied HALEU manufacturing options will not reach commercial capacity in time to meet the proposed 2028 in-service date for the Natrium demonstration plant.”

The company has not provided a new schedule but expects to in 2023, when there may be more clarity of what will be available and when. “But given the lack of fuel availability now and that there has been no construction started on new fuel enrichment facilities, TerraPower is anticipating a minimum of a two-year delay to being able to bring the Natrium reactor into operation,” Levesque warned.

About the Plant and its Fuel

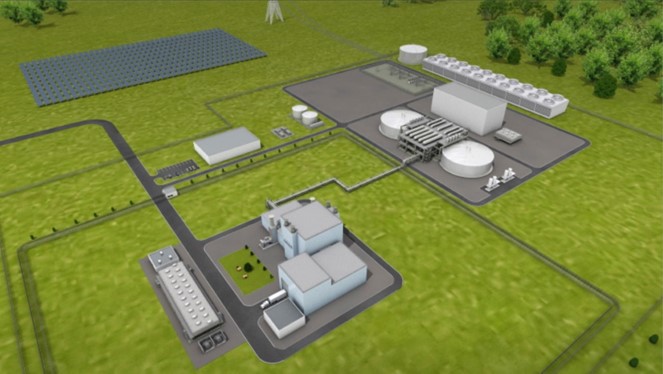

Kemmerer in Wyoming was selected in 2021 as the preferred site for the Natrium demonstration project, featuring a 345 MWe sodium-cooled fast reactor with a molten salt-based energy storage system. TerraPower remains fully committed to the project and is “moving full steam ahead” on the construction of the plant, licensing applications and engineering and design work, Levesque added. Work scheduled to begin in Spring 2023 on the large sodium facility will continue as planned, and TerraPower expects “minimal disruption” to the current projected start-of-construction date.

HALEU fuel is enriched to between 5% and 20% uranium-235, and is the fuel type which will fuel most of the next-generation reactor designs. The DOE has projected a national need for more than 40 tonnes of HALEU before the end of the decade to support the current administration’s goal of 100% clean electricity by 2035.

Funding the Construction

Gates helped found TerraPower in 2006 and has been the company’s chairman. TerraPower’s goal is to provide more affordable, secure, and environmentally friendly nuclear energy globally. The plant is expected to cost $4 billion. To date, $1.6 billion has been appropriated by Congress, and private funding of $830 has been raised by TerraPower.

Wyoming US Senator John Barrasso responded to the announcement saying the US ” must reestablish itself as the global leader in nuclear energy. Instead of relying on our adversaries like Russia for uranium, the United States must produce its own supply of advanced nuclear fuel.” He said he has sent a letter to Energy and Natural Resources Chairman Joe Manchin requesting an oversight hearing early next year to ensure that DOE is “working aggressively” to make HALEU available for the USA’s first advanced reactors. He also said he has written to Secretary of Energy Jennifer Granholm today “blasting DOE for not moving fast enough to ensure a domestic supply of HALEU”.

Take Away

The Natrium project by Bill Gate’s company, with support from US tax dollars and Warren Buffett, is being constructed as a test. One thing the test bore out is that securing a reliable fuel supply needs a good deal more work.

Natrium plants are smaller and use current technology. These plants are expected to be built faster and cheaper than a traditional large-scale nuclear power plant. When first announced last year, Gates and Buffett said that once successfully demonstrated, the plant could be quickly expanded or replicated elsewhere.

Managing Editor, Channelchek

Sources

https://www.world-nuclear-news.org/Articles/HALEU-fuel-availability-delays-Natrium-reactor-pro