InPlay Oil Corp. Announces BDC Term Facility and Provides Second Quarter 2020 Financial and Operating Results

August 14, 2020 – Calgary Alberta – InPlay Oil Corp. (TSX: IPO) (OTCQX: IPOOF) (“InPlay” or the “Company”) is pleased to announce that it has entered into a non-binding term sheet (the “BDC Term Sheet”) with the Business Development Bank of Canada (“BDC”), in partnership with our syndicate of lenders, for a non-revolving term facility of up to $25 million with a four year term. The Company is also announcing its financial and operating results for the second quarter. InPlay’s condensed unaudited interim financial statements and notes, as well as management’s discussion and analysis (“MD&A”) for the three and six months ended June 30, 2020 will be available at www.sedar.com and our website at www.inplayoil.com.

Subsequent to the end of the second quarter, on July 15, 2020 the Company announced the completion of its Credit Facility redetermination at $65 million, maturing on May 31, 2021. On July 30, 2020 the Company entered into the BDC Term Sheet with the BDC under their Business Credit Availability Program (“BCAP”) which, subject to the entering into of definitive agreements, will provide the Company with a non-revolving $25 million, second lien, four year term facility (the “BDC Term Facility”). The Export Development Canada (“EDC”) and BDC programs were initially announced to provide pre-COVID-19 financially viable companies with additional liquidity to continue operations and development activity through the pandemic and allow them to return to preCOVID-19 operating levels in a time frame that can be managed with improved crude oil and commodity pricing.

The BDC Term Facility will provide InPlay with significant additional long term liquidity at reasonable interest rates to withstand the impacts of the COVID-19 pandemic and allow the Company to pursue development opportunities that generate long-term, sustainable net asset value per share growth for our shareholders into the recovery phase. InPlay quickly assessed the program when first announced and were early in initiating discussions with both BDC and Export Development Bank of Canada (“EDC”) regarding their programs. InPlay is pleased to become one of the first companies to be approved for a term sheet through the program, validating our financial strength while also confirming the comments made in our April and May 2020 press releases stating we believed based on the criteria put forward that InPlay was a financially viable Company prior to the COVID19 pandemic. The Company appreciates the support of the BDC and our syndicate of lenders to make this partnership possible.

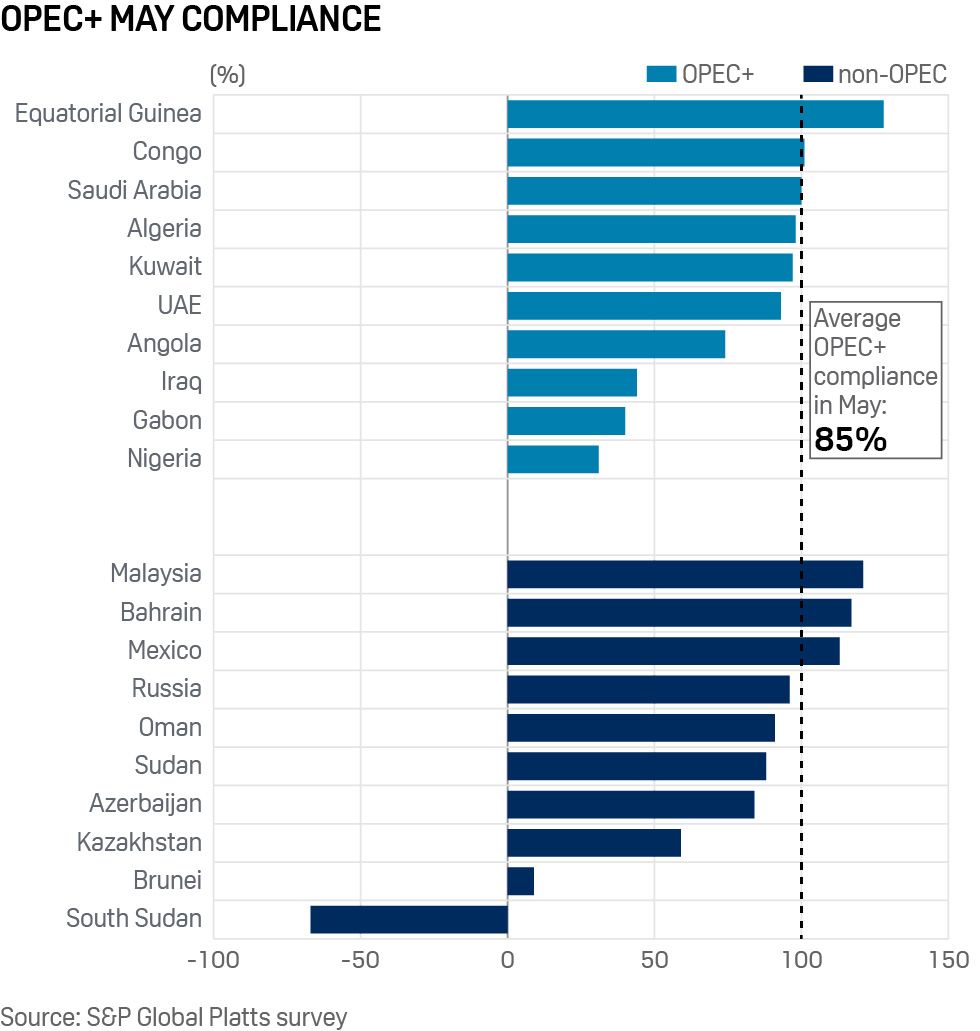

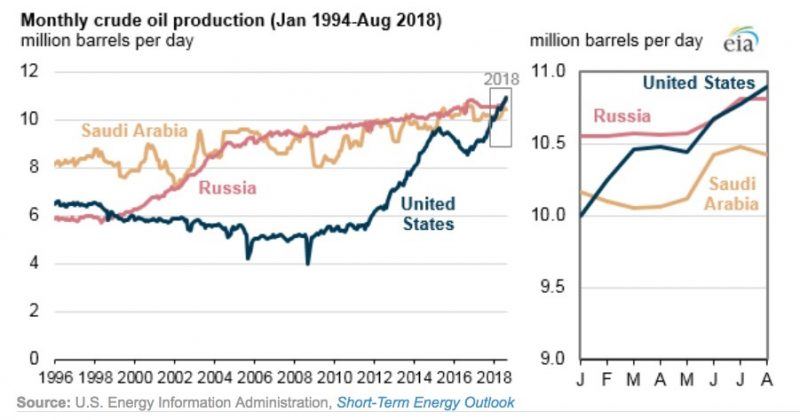

As a result of crude oil demand improving from the lows seen in April, combined with the reductions in production from OPEC+ and production curtailments by producers, commodity prices have improved earlier than initially expected. Since the end of the second quarter the Company has begun the process of bringing back on our operated shut-in and curtailed production as well as starting to service wells that have been down as long as they have payouts of approximately six months. We anticipate production returning to close to our production capacity levels in late August with average September production forecasted to approximate pre-COVID production rates, including oil inventory of approximately 28,000 to 30,000 barrels which will opportunistically be sold into the spot market prior to year-end.

InPlay has been extremely successful in obtaining approved applications under the Alberta government’s Site Rehabilitation Program (“SRP”). The Company’s diligence in submitting these applications quickly as well as our detailed grant requests has resulted in greater than $1.0 million being received from the program to date. InPlay was allocated a significantly higher portion of the total amount of this program in comparison to our percentage of Alberta oil and gas production. The Company also expects to receive additional grants in subsequent phases of the SRP. As these programs are completed, these amounts will be reflected as a reduction in our decommissioning obligation liability. We thank our operations team and key service providers in their diligence and attentiveness to this program which resulted in well received applications and significant benefit from the program.

Second Quarter 2020 Financial & Operations Results

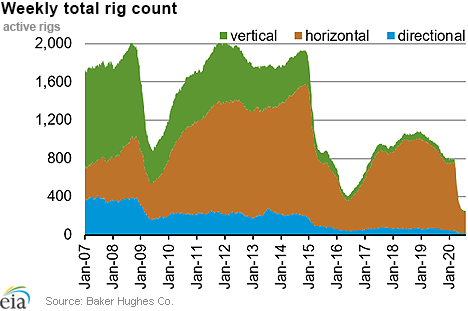

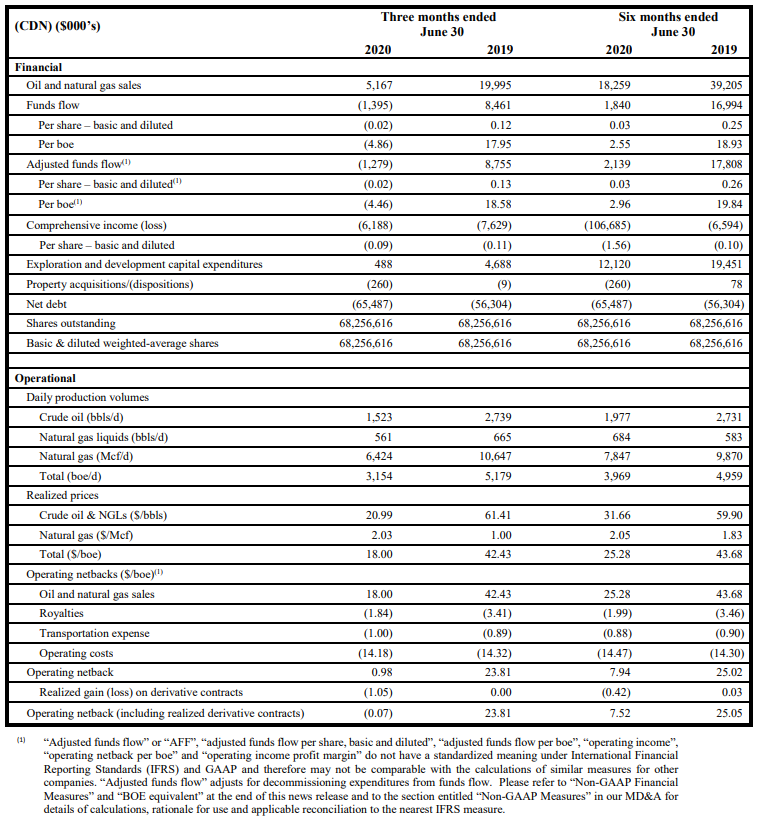

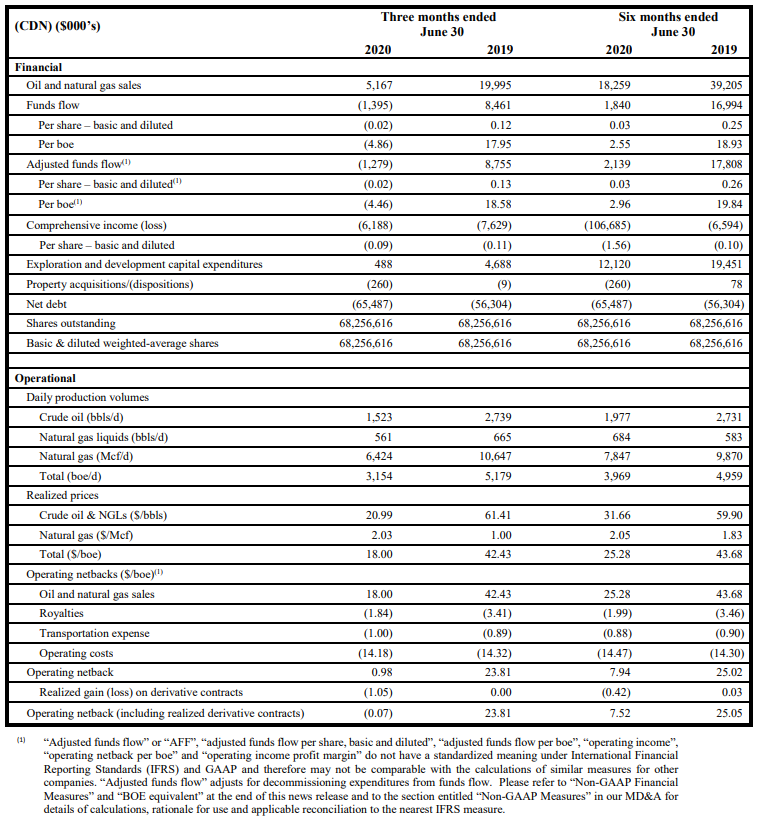

InPlay was proactive and promptly reacted to the dramatic and unprecedented drop in crude oil pricing in March by immediately suspending its 2020 development capital program, quickly implementing cost cutting initiatives in the field and office and initiating temporary production curtailments and shut-ins resulting in production declines to approximately 65% of estimated capacity. This resulted in average production of 3,154 boe/d in the second quarter of 2020 compared to 5,179 boe/d in the second quarter of 2019.

The Company’s operations are well positioned to make adjustments when facing these extreme volatile commodity price environments. The Company looked at all wells in detail taking into account fixed and variable costs, safety concerns, as well as shut-in and startup costs to determine which wells could be temporarily shut in or curtailed and fully restarted with minimal incremental costs. Further initiatives were also undertaken to reduce costs and scale back discretionary expenditures which allowed the Company to achieve lower operating and G&A costs during the quarter of $4.1 and $0.8 million ($14.18 per boe and $2.73 per boe) respectively compared to $6.7 and $1.8 million ($14.32 per boe and $3.81 per boe) in the second quarter of 2019. This is a significant achievement given the presence of fixed costs being incurred over a significantly lower production base. Improved commodity prices began to materialize in June and allowed us to start bringing on curtailed production easily meeting our sales nominations while continuing to fill inventory storage levels. As of June 30, 2020 approximately 24,000 barrels of oil were in storage allowing the Company to sell this production in the future at advantageous pricing levels.

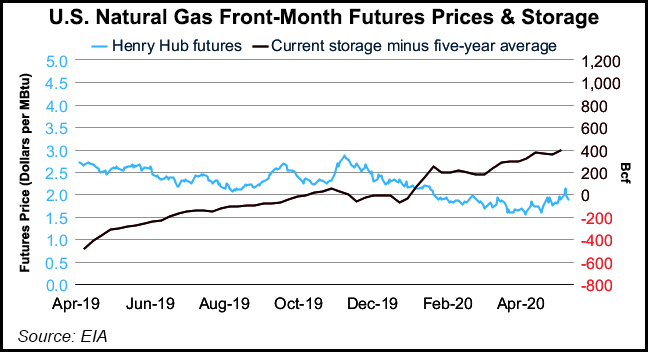

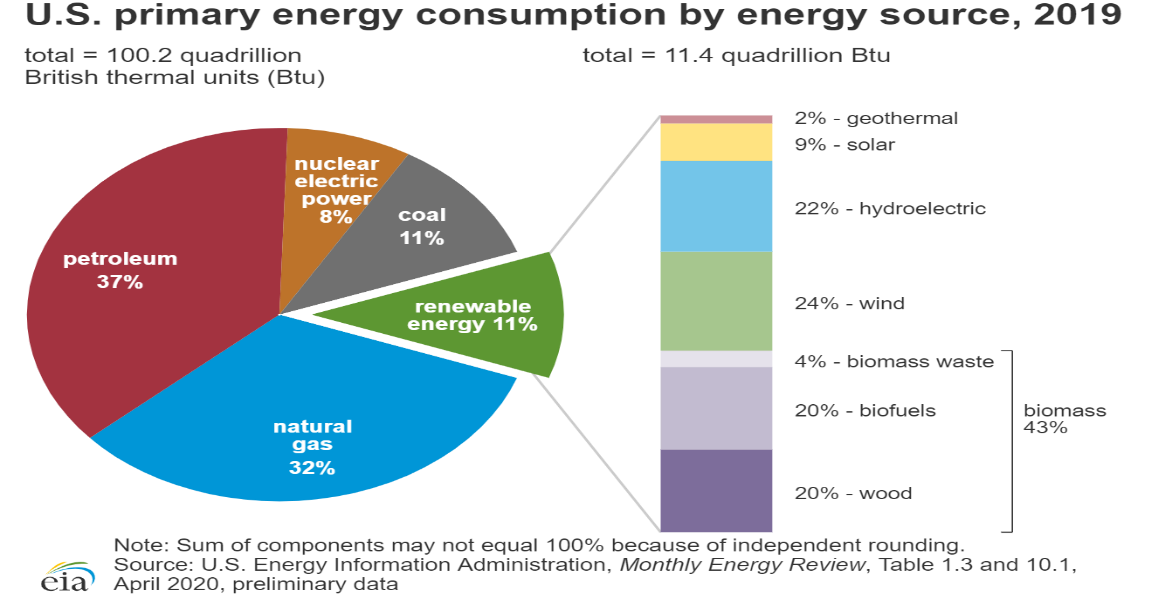

The commodity price collapse due to demand destruction as a result of the COVID-19 crisis heavily impacted financial results for the second quarter of 2020. Oil prices were significantly lower over the second quarter with WTI prices averaging $27.85 USD/bbl, compared to $59.84 USD/bbl for the second quarter of 2019. Revenue was most affected in April at the apex of the crisis when we had to meet sales volumes that were previously nominated at the beginning of March prior to the crisis. This resulted in a net realized price of only $17.06 CDN/bbl for our crude during the month of April. Reacting to the distressed crude oil pricing environment, InPlay began reducing sales nominations in May and June. NGL prices also continued to remain at multi-year lows over the quarter as the Company’s realized NGL prices averaged $11.66 CDN/bbl in the second quarter of 2020 compared to $19.67 CDN/bbl over the same period in 2019, largely due to the benchmarking of these prices on low WTI pricing during the quarter and continued weakness in propane and butane pricing. With these dramatic reductions in commodity prices during the second quarter of 2020, InPlay incurred an adjusted funds flow (“AFF”) deficit of $1.3 million over the quarter.

The Company’s COVID-19 response also included multiple cost cutting measures highlighted by a 20 percent reduction in field and office salaries as wells as cost reductions in all areas of our operations. InPlay has also taken advantage of certain provincial and federal government programs in response to the COVID-19 crisis. The Company received approximately $0.3 million under the Canada Emergency Wage Subsidy (“CEWS”) during the second quarter of 2020. These cost cutting measures and our curtailed operations resulted in savings of approximately $3.4 million in the second quarter of 2020 compared to our original January 2020 budget.

Financial and Operating Results:

Outlook

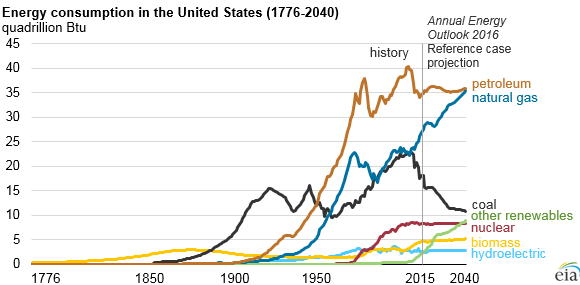

The Company is cautiously optimistic for the remainder of 2020 and expects that commodity pricing will start gaining momentum in 2021 and beyond as the lack of capital spending on oil and gas projects on a worldwide scale will lead to declining production and ultimately result in demand exceeding supply. Commodity prices have improved quicker than originally anticipated and all cost structures have decreased as a result of internal cost cutting measures and external market conditions. Success in obtaining additional long term financing with the BDC Term Facility is expected to provide us with ample liquidity to get through this difficult period and the potential to resume our development capital program prior to the end of 2020. At current commodity prices and with lower cost structures, the Company has the ability to commence a capital program on projects that are budgeted to payout in 1 to 1.5 years, based on comparable well performance. Subject to the anticipated closing of the BDC Term Facility, we are currently working on plans to resume our 2020 capital program, depending on pricing, in the fourth quarter of 2020. The Company expects to provide capital guidance for the remainder of 2020 in the near future.

InPlay remains steadfast on managing the current crisis, daily monitoring of our rapidly changing environment and prudently reacting to changing circumstances. Management will continue to take action with the objective of diligently managing costs, preserving liquidity and will make capital spending decisions considering commodity prices and liquidity levels.

We thank our employees and all of our service providers for their commitments and efforts in this unprecedented time as well as our directors for their ongoing commitment and dedication. Finally, we thank all of our shareholders and lending partners for their continued interest and support.

For further information please contact:

Doug Bartole

President and Chief Executive Officer

InPlay Oil Corp.

Telephone: (587) 955-0632

Darren Dittmer

Chief Financial Officer

InPlay Oil Corp.

Telephone: (587) 955-0634

Reader Advisories

Non-GAAP Financial Measures

Included in this press release are references to the terms “adjusted funds flow”, “adjusted funds flow per share, basic and diluted”, “adjusted funds flow per boe”, “operating income”, “operating netback per boe” and “operating income profit margin”. Management believes these measures are helpful supplementary measures of financial and operating performance and provide users with similar, but potentially not comparable, information that is commonly used by other oil and natural gas companies. These terms do not have any standardized meaning prescribed by GAAP and should not be considered an alternative to, or more meaningful than, “funds flow”, “profit (loss) before taxes”, “profit (loss) and comprehensive income (loss)” or assets and liabilities as determined in accordance with GAAP as a measure of the Company’s performance and financial position.

InPlay uses “adjusted funds flow”, “adjusted funds flow per share, basic and diluted” and “adjusted funds flow per boe” as key performance indicators. Adjusted funds flow should not be considered as an alternative to or more meaningful than funds flow as determined in accordance with GAAP as an indicator of the Company’s performance. InPlay’s determination of adjusted funds flow may not be comparable to that reported by other companies. Adjusted funds flow is calculated by adjusting for decommissioning expenditures from funds flow. This item is adjusted from funds flow as decommissioning expenditures are incurred on a discretionary and irregular basis and are primarily incurred on previous operating assets, making the exclusion of this item relevant in Management’s view to the reader in the evaluation of InPlay’s operating performance. Adjusted funds flow per share, basic and diluted is calculated by the Company as adjusted funds flow divided by the weighted average number of common shares outstanding for the respective period. Management considers adjusted funds flow per share, basic and diluted an important measure to evaluate its operational performance as it demonstrates its recurring operating cash flow generated attributable to each share. Adjusted funds flow per boe is calculated by the Company as adjusted funds flow divided by production for the respective period. Management considers adjusted funds flow per boe an important measure to evaluate its operational performance as it demonstrates its recurring operating cash flow generated per unit of production. For a detailed description of InPlay’s method of calculating adjusted funds flow, adjusted funds flow per share, basic and diluted and adjusted funds flow per boe and their reconciliation to the nearest GAAP term, refer to the section “Non-GAAP Measures” in the Company’s MD&A filed on SEDAR.

InPlay also uses “operating income”, “operating netback per boe” and “operating income profit margin” as key performance indicators. Operating income should not be considered as an alternative to or more meaningful than net income as determined in accordance with GAAP as an indicator of the Company’s performance. Operating income is calculated by the Company as oil and natural gas sales less royalties, operating expenses and transportation expenses and is a measure of the profitability of operations before administrative, share-based compensation, financing and other noncash items. Management considers operating income an important measure to evaluate its operational performance as it demonstrates its field level profitability. Operating netback per boe is calculated by the Company as operating income divided by average production for the respective period. Management considers operating netback per boe an important measure to evaluate its operational performance as it demonstrates its field level profitability per unit of production. Operating income profit margin is calculated by the Company as operating income as a percentage of oil and natural gas sales. Management considers operating income profit margin an important measure to evaluate its operational performance as it demonstrates how efficiently the Company generates field level profits from its sales revenue. For a detailed description of InPlay’s method of the calculation of operating income, operating netback per boe and operating income profit margin and their reconciliation to the nearest GAAP term, refer to the section “Non-GAAP Measures” in the Company’s MD&A filed on SEDAR.

Forward-Looking Information and Statements

This news release contains certain forward–looking information and statements within the meaning of applicable securities laws. The use of any of the words “expect”, “anticipate”, “continue”, “estimate”, “may”, “will”, “project”, “should”, “believe”, “plans”, “intends” “forecast” and similar expressions are intended to identify forward-looking information or statements. In particular, but without limiting the foregoing, this news release contains forward-looking information and statements pertaining to the following: the anticipated entering into of definitive documents and closing of the BDC Term Facility; production estimates including timing of production restart plants and the impact thereof; the estimated time to payout of wells; the potential for and extent of planned curtailments or shut-ins and the potential timing and impact thereof; expectations regarding future commodity prices; future liquidity and financial capacity; the potential resumption of our development capital program prior to the end of 2020; future results from operations and operating metrics and capital guidance; future costs (including retention of cost reductions post COVID-19), expenses and royalty rates; future interest costs; the exchange rate between the $US and $Cdn; expectations to receive additional grants under the SRP; and methods of funding our capital program.

Forward-looking statements in this news release also include statements regarding the expected terms and availability of the proposed BDC Term Facility, as well as the use of proceeds therefrom. Pursuant to the terms of the BDC Term Sheet, closing of the BDC Term Facility remains subject to a number of conditions, including final BDC credit approval and the entering into of definitive documentation among BDC, InPlay and InPlay’s current lenders. If the BDC Term Facility is not entered into, there may be an adverse impact on InPlay’s ability to continue to fund its operations and development activities. While approvals of InPlay’s syndicate of lenders have been obtained and definitive documentation is expected to be entered into in short order, there can be no assurances that the BDC Term Facility will be completed on the terms currently contemplated in the BDC Term Sheet or at all and, accordingly, investors should not unduly rely on the same.

Forward-looking statements or information are based on a number of material factors, expectations or assumptions of InPlay which have been used to develop such statements and information but which may prove to be incorrect. Although InPlay believes that the expectations reflected in such forward-looking statements or information are reasonable, undue reliance should not be placed on forward-looking statements because InPlay can give no assurance that such expectations will prove to be correct. In addition to other factors and assumptions which may be identified herein, assumptions have been made regarding, among other things: the impact of increasing competition; the general stability of the economic and political environment in which InPlay operates; the timely receipt of any required regulatory approvals; the ability of InPlay to obtain qualified staff, equipment and services in a timely and cost efficient manner; drilling results; the ability of the operator of the projects in which InPlay has an interest in to operate the field in a safe, efficient and effective manner; the ability of InPlay to obtain financing on acceptable terms including the completion of the BDC Term Facility; field production rates and decline rates; the ability to replace and expand oil and natural gas reserves through acquisition, development and exploration; the timing and cost of pipeline, storage and facility construction and the ability of InPlay to secure adequate product transportation; future commodity prices; currency, exchange and interest rates; regulatory framework regarding royalties, taxes and environmental matters in the jurisdictions in which InPlay operates; and the ability of InPlay to successfully market its oil and natural gas products.

The forward-looking information and statements included herein are not guarantees of future performance and should not be unduly relied upon. Such information and statements, including the assumptions made in respect thereof, involve known and unknown risks, uncertainties and other factors that may cause actual results or events to defer materially from those anticipated in such forward-looking information or statements including, without limitation: the duration and impact of COVID-19; changes in commodity prices; the potential for variation in the quality of the reservoirs in which we operate; changes in the demand for or supply of our products; unanticipated operating results or production declines; changes in tax or environmental laws, royalty rates or other regulatory matters; changes in development plans of InPlay or by third party operators of our properties; increased debt levels or debt service requirements; inaccurate estimation of our oil and gas reserve and resource volumes; limited, unfavorable or a lack of access to capital markets; increased costs; a lack of adequate insurance coverage; the impact of competitors; and certain other risks detailed from time-to-time in InPlay’s disclosure documents.

The forward-looking information and statements contained in this news release speak only as of the date hereof and InPlay does not assume any obligation to publicly update or revise any of the included forward-looking statements or information, whether as a result of new information, future events or otherwise, except as may be required by applicable securities laws.

Test Results and Initial Production Rates

Test results and initial production rates disclosed herein, particularly those short in duration, may not necessarily be indicative of long term performance or of ultimate recovery. A pressure transient analysis or well-test interpretation has not been carried out and thus certain of the test results provided herein should be considered to be preliminary until such analysis or interpretation has been completed.

BOE equivalent

Barrel of oil equivalents or BOEs may be misleading, particularly if used in isolation. A BOE conversion ratio of 6 mcf: 1 bbl is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead. Given that the value ratio based on the current price of crude oil as compared to natural gas is significantly different than the energy equivalency of 6:1, utilizing a 6:1 conversion basis may be misleading as an indication of value.