Gevo Reports Third Quarter 2020 Financial Results

Gevo to Host Conference Call Today at 4:30 p.m. EST/2:30 p.m. MST

ENGLEWOOD, Colo. – November 10, 2020 – Gevo, Inc. (NASDAQ: GEVO) today announced financial results for the third quarter of 2020 and recent corporate highlights.

Recent Corporate Highlights

- In August 2020, Gevo entered into a Renewable Hydrocarbons Purchase and Sale Agreement (the “Agreement”) with Trafigura Trading LLC (“Trafigura”), whereby Gevo agreed to supply renewable hydrocarbons to Trafigura. The initial term of the agreement is 10 years, and Trafigura has the option to extend the initial term. With the Trafigura agreement, Gevo now has approximately 48MGPY of offtake agreements in place, collectively representing about $1.5 billion of revenue across the life of the contracts.

- On August 2020, Gevo and Praj Industries Ltd entered into a Master Framework Agreement to collaborate on providing renewable jet fuel and premium gasoline in India and neighboring countries, which agreement replaces the construction licenses agreement entered into in April 2019.

- In August 2020, Gevo completed a registered direct offering of 38.5 million shares of common stock (or common stock equivalents) at $1.30 per share. Total proceeds were $45.9 million, net of closing costs.

- In July 2020, $2 million in aggregate principal amount of Gevo’s 12.0% Convertible Senior Secured Notes due 2020/2021 (the “2020/21 Notes”) were converted into 4,169,428 shares of common stock, including $0.3 million of make-whole interest.

- In July 2020, Gevo completed a public offering of 30 million units, with each unit consisting of one share of common stock (or common stock equivalent) and a Series 2020-A warrants to buy one share of common stock at an exercise price $0.60 per share. Total proceeds were $16.1 million, net of closing costs. During the third quarter, 27.3 million Series 2020-A warrants were exercised, resulting in an additional total net proceeds to Gevo of $16.4 million.

- Due to its strong balance sheet and available cash, Gevo expects that on December 31, 2020 it will pay off the entire outstanding balance of $12.7 million of the 2020/21 Notes. Upon repayment of the outstanding debt represented by the 2020/21 Notes, Gevo will have no outstanding debt secured by all of its assets.

- In late October, Gevo began production of approximately 50,000 gallons of renewable isobutanol at its production facility in Luverne, MN (the “Luverne Facility”). Once the renewable isobutanol has been produced, Gevo will ship the isobutanol to the South Hampton Facility for use in the production of renewable hydrocarbons during the first quarter of 2021. Gevo plans to produce an additional 50,000 gallons of renewable isobutanol during the second quarter of 2021 for use at the South Hampton Facility. Gevo expects to periodically produce renewable isobutanol in this manner until a new, larger hydrocarbon production facility is financed and constructed.

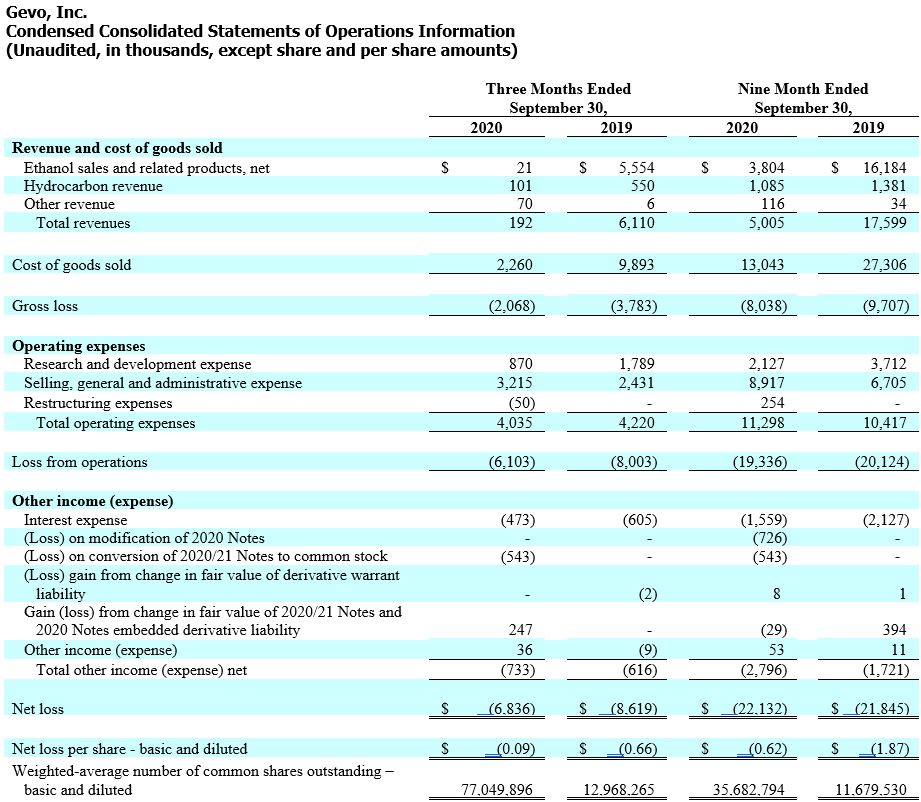

2020 Third Quarter Financial Highlights

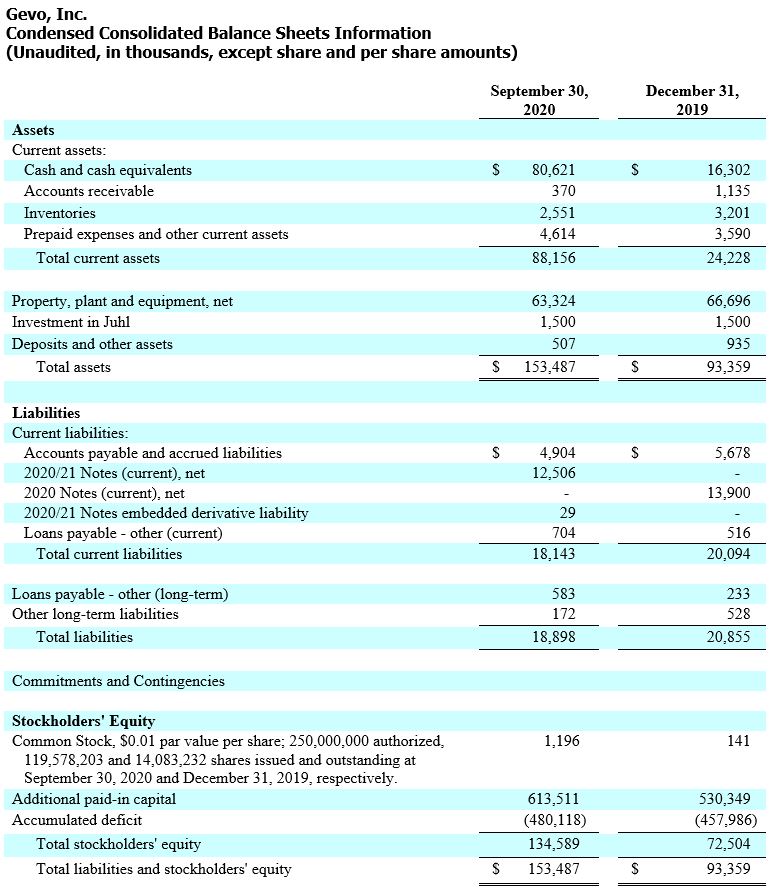

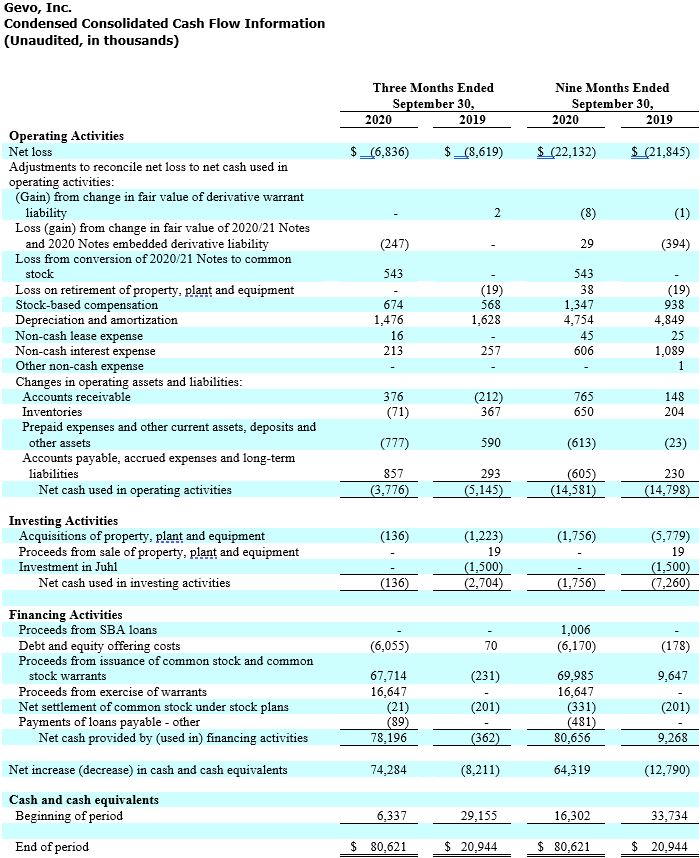

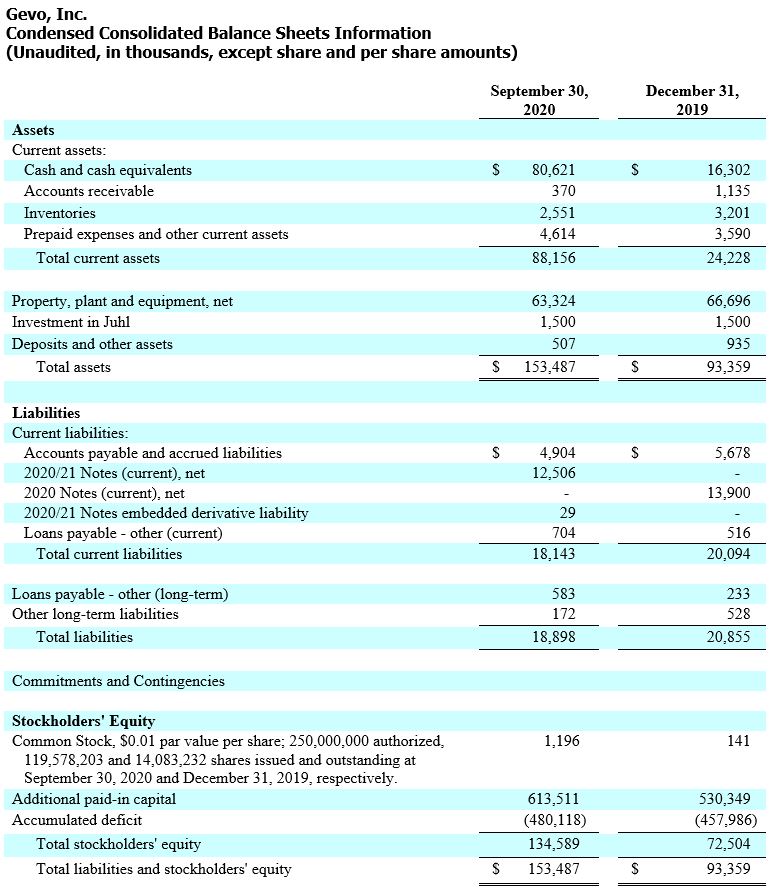

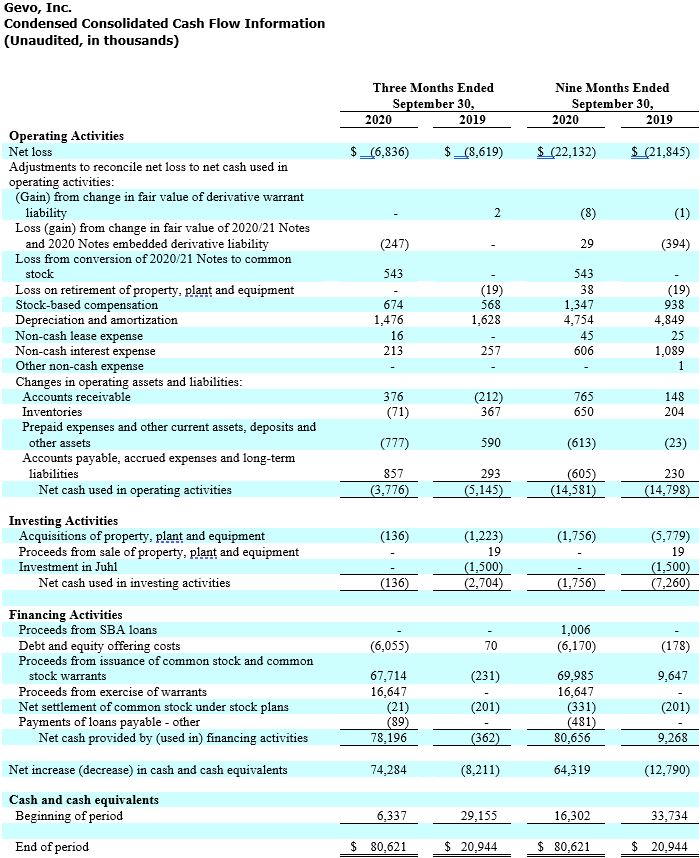

- Ended the quarter with cash and cash equivalents of $80.6 million compared to $6.3 as of the end of Q2 2020

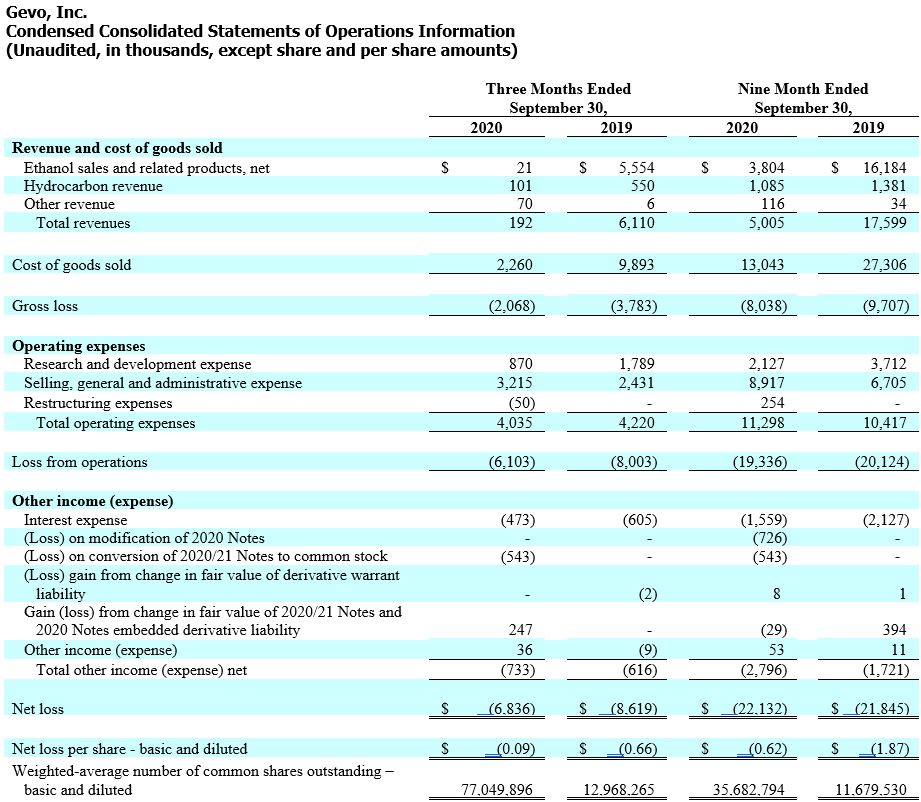

- Revenue totaled $0.2 million for the quarter compared to $6.1 million in Q3 2019

- Hydrocarbon revenue decreased to $0.1 million for the quarter compared to $0.6 million in Q3 2019

- Loss from operations of ($6.1) million for the quarter compared to ($8.0) million in Q3 2019

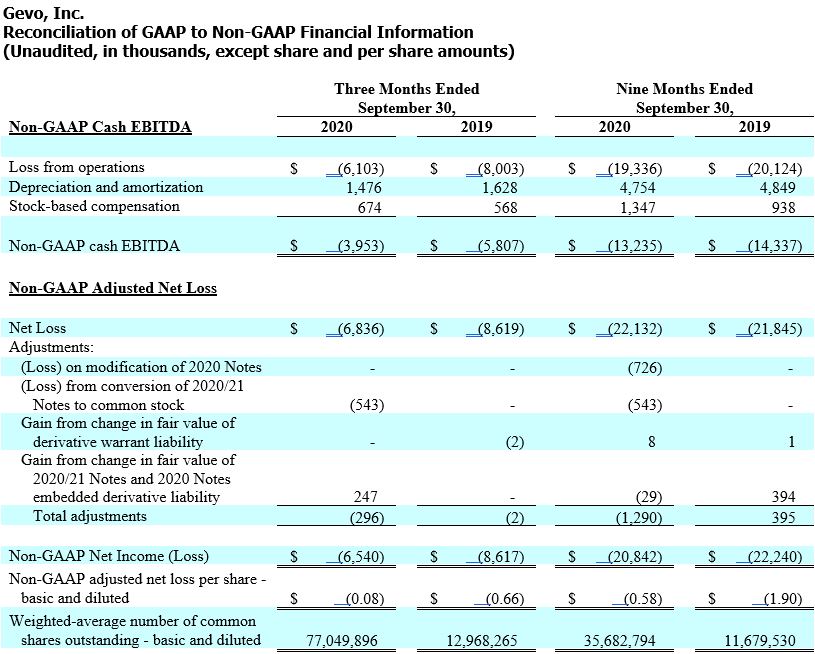

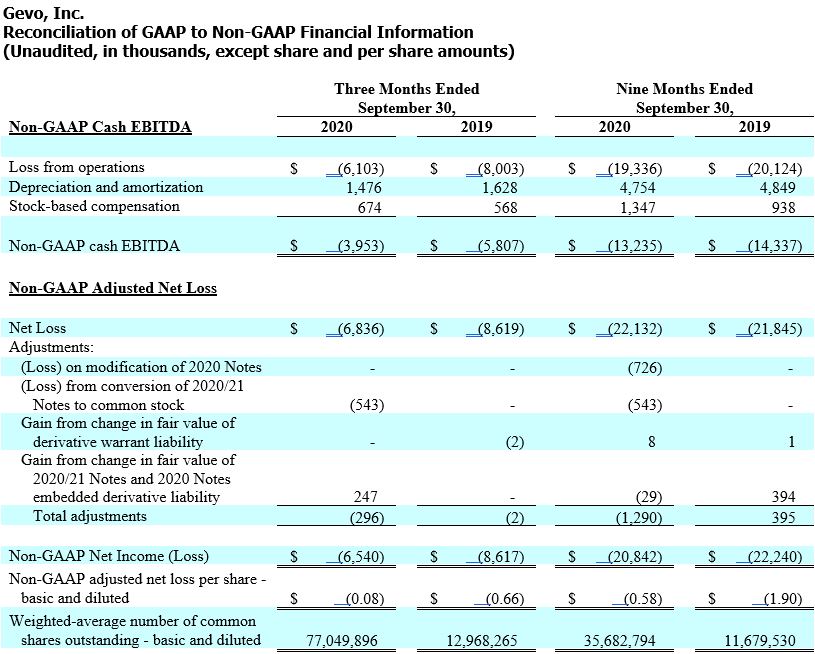

- Non-GAAP cash EBITDA loss of ($4.0) million for the quarter compared to ($5.8) million in Q3 2019

- Net loss per share of ($0.09) based on 77,049,896 weighted average shares outstanding for the quarter compared to ($0.66) based on 12,968,265 weighted average shares outstanding for the quarter in Q3 2019

- Non-GAAP adjusted net loss per share of ($0.08) based on 77,049,896 weighted average shares outstanding for the quarter compared to ($0.66) based on 12,968,265 weighted average shares outstanding for the quarter in Q3 2019

Commenting on the third quarter of 2020 and recent corporate events, Dr. Patrick R. Gruber, Gevo’s Chief Executive Officer, said “This past quarter marked a turning point for Gevo. We secured the blockbuster deal with Trafigura, a major energy player. This offtake agreement brought our total off-take tally to about 48MGPY, collectively representing about $1.5 billion of revenue across the life of the contracts. With customers pinned down and enough money in the bank to complete the engineering and project development work needed to bring projects to financial close next year, and because we have several interested project equity investors engaged in detailed due diligence, I believe that our project financing activity with Citigroup is going well, so far. We continue to work on securing more customer agreements and expect to announce one or more in the coming months. Overall, we are progressing well. We need to continue to make progress and keep on track”.

Third Quarter 2020 Financial Results

Revenue for the three months ended September 30, 2020 was $0.2 million compared with $6.1 million in the same period in 2019.

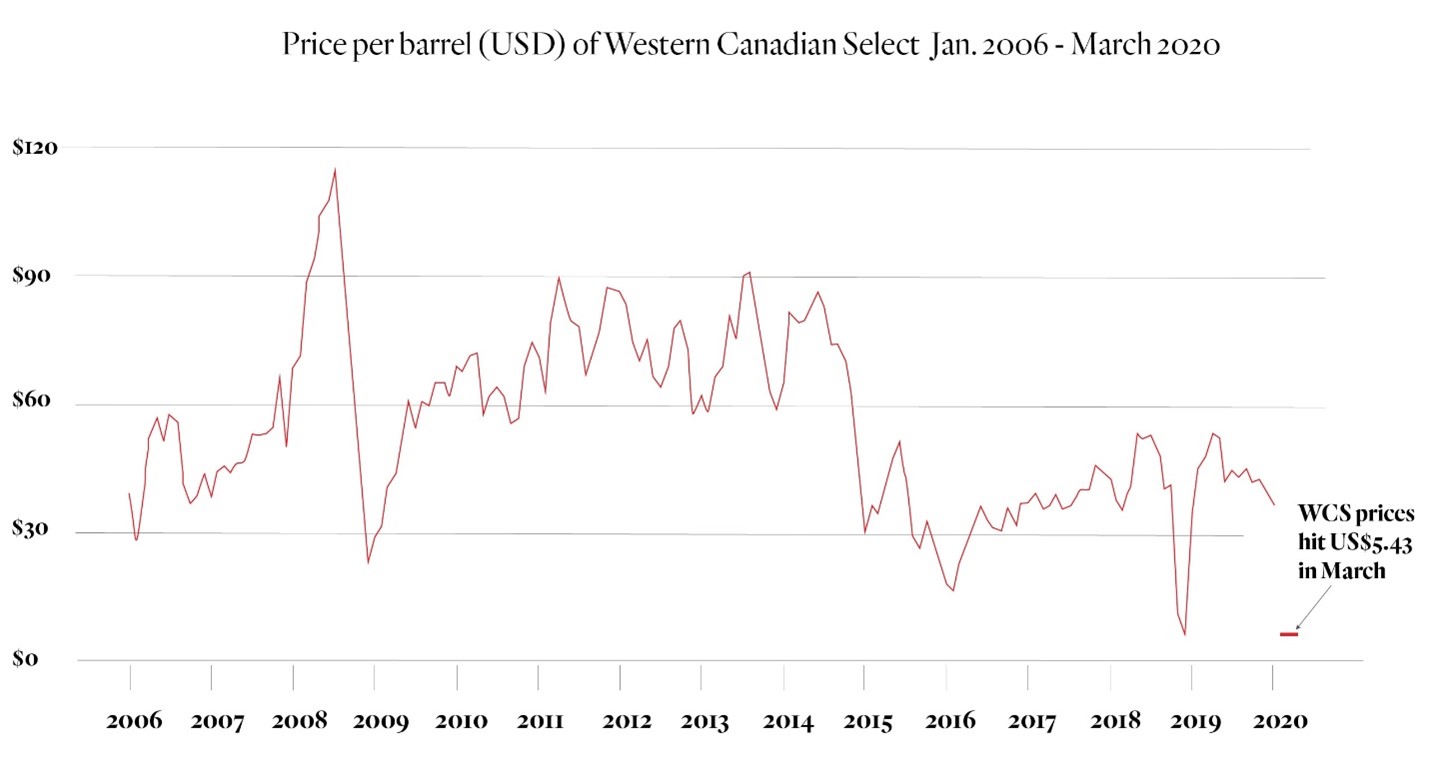

Revenue derived at our production facility located in Luverne, Minnesota (the “Luverne Facility”) related to ethanol sales and related products was $0.02 million for the third quarter of 2020, a decrease of approximately $5.5 million from the same period in 2019. As a result of COVID-19 and in response to an unfavorable commodity environment, Gevo terminated its production of ethanol and distiller grains in March 2020, which resulted in lower sales for the period. We do not expect to earn revenue from the sale of ethanol, isobutanol and related products while the Luverne Facility’s operations are suspended.

During the three months ended September 30, 2020, hydrocarbon revenue was $0.1 million compared with $0.6 million in the same period in 2019 as a result of decreased shipments of finished products from our demonstration plant at the South Hampton Resources, Inc. facility in Silsbee, Texas. Gevo’s hydrocarbon revenue is comprised of sales of alcohol-to-jet fuel, isooctane and isooctene.

Cost of goods sold was $2.3 million for the three months ended September 30, 2020, compared with $9.9 million in the same period in 2019, primarily as a result of terminating ethanol production as a result of COVID-19 and in response to an unfavorable commodity environment. Cost of goods sold included approximately $0.9 million associated with the production of isobutanol and related products and maintenance of the Luverne Facility and approximately $1.4 million in depreciation expense for the three months ended September 30, 2020.

Gross loss was $2.1 million for the three months ended September 30, 2020, versus a $3.8 million gross loss in the same period in 2019.

Research and development expense decreased by $0.9 million during the three months ended September 30, 2020 compared with the same period in 2019, due primarily to a decrease in personnel and consultant expenses.

Selling, general and administrative expense increased by $0.8 million during the three months ended September 30, 2020, compared with the same period in 2019, due primarily to an increase in personnel, consulting and insurance expenses and professional fees offset by a decrease in investor relations expenses.

Loss from operations in the three months ended September 30, 2020 was $(6.1) million, compared with a ($8.0) million loss from operations in the same period in 2019.

Non-GAAP cash EBITDA loss in the three months ended September 30, 2020 was ($4.0) million, compared with a ($5.8) million non-GAAP cash EBITDA loss in the same period in 2019.

Interest expense in the three months ended September 30, 2020 was $0.5 million, a decrease of $0.1 million as compared to the same period in 2019, primarily due to a decline in amortization of original issue discounts and debt issuance costs compared to the same period last year and the conversion of $2.0 million of 2020/21 Notes in July 2020.

In the three months ended September 30, 2020, Gevo recognized net non-cash gain totaling $0.2 million due to changes in the fair value of certain of our financial instruments, such as warrants and embedded derivatives.

In the three months ended September 30, 2020, Gevo recognized net non-cash loss totaling $0.5 million due to the conversion of $2.0 million of 2020/21 Notes in July 2020.

Gevo incurred a net loss for the three months ended September 30, 2020 of ($6.8) million, compared with a net loss of ($8.6) million during the same period in 2019. Non-GAAP adjusted net loss for the three months ended September 30, 2020 was ($6.5) million, compared with a non-GAAP adjusted net loss of ($8.6) million during the same period in 2019.

Cash at September 30, 2020 was $80.6 million, and the total principal face value of outstanding secured debt was $12.7 million.

Webcast and Conference Call Information

Hosting today’s conference call at 4:30 p.m. EST (2:30 p.m. MST) will be Dr. Patrick R. Gruber, Chief Executive Officer, Lynn Smull, Chief Financial Officer, Carolyn M. Romero, Vice President-Controller, and Geoffrey T. Williams, Jr., Vice President-General Counsel & Secretary. They will review Gevo’s financial results and provide an update on recent corporate highlights.

To participate in the conference call, please dial (833) 729-4776 (inside the U.S.) or (830) 213-7701 and reference the access code 4631139#, or through the event weblink https://edge.media-server.com/mmc/p/oxzaapnc.

A replay of the call and webcast will be available two hours after the conference call ends on November 10, 2020. To access the replay, please visit https://edge.media-server.com/mmc/p/oxzaapnc. The archived webcast will be available in the Investor Relations section of Gevo’s website at www.gevo.com.

About Gevo

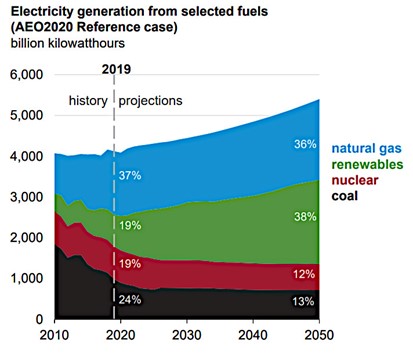

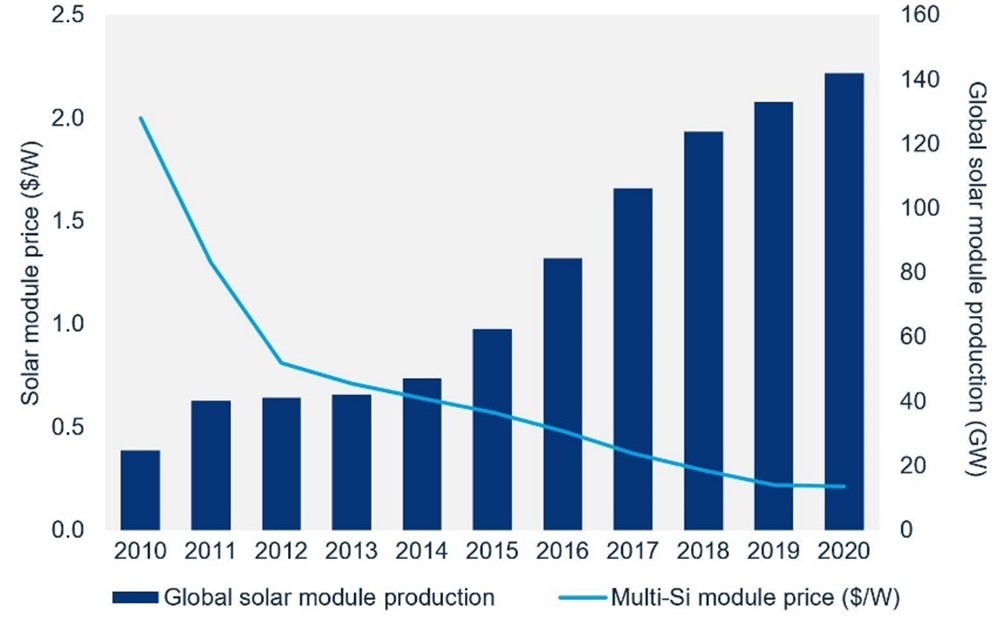

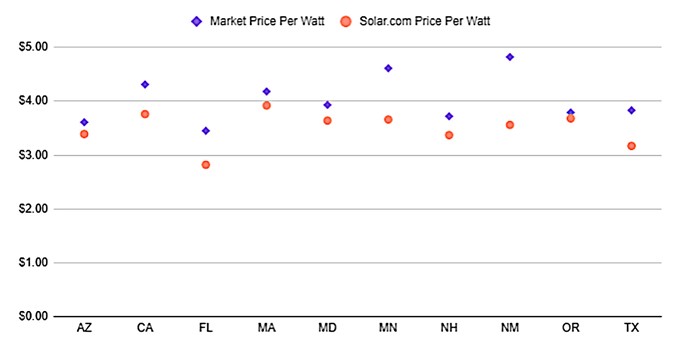

Gevo is commercializing the next generation of renewable premium gasoline, jet fuel and diesel fuel with the potential to achieve zero carbon emissions, addressing the market need of reducing greenhouse gas emissions with sustainable alternatives. Gevo uses low-carbon renewable resource-based carbohydrates as raw materials, and is in an advanced state of developing renewable electricity and renewable natural gas for use in production processes, resulting in low-carbon fuels with substantially reduced carbon intensity (the level of greenhouse gas emissions compared to standard petroleum fossil-based fuels across their lifecycle). Gevo’s products perform as well or better than traditional fossil-based fuels in infrastructure and engines, but with substantially reduced greenhouse gas emissions. In addition to addressing the problems of fuels, Gevo’s technology also enables certain plastics, such as polyester, to be made with more sustainable ingredients. Gevo’s ability to penetrate the growing low-carbon fuels market depends on the price of oil and the value of abating carbon emissions that would otherwise increase greenhouse gas emissions. Gevo believes that its proven, patented, technology enabling the use of a variety of low-carbon sustainable feedstocks to produce price-competitive low carbon products such as gasoline components, jet fuel, and diesel fuel yields the potential to generate project and corporate returns that justify the build-out of a multi-billion dollar business. Learn more at our website: www.gevo.com

Forward-Looking Statements

Certain statements in this press release may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements relate to a variety of matters, including, without limitation, Gevo’s agreement with Trafigura, Gevo’s ability to finance and construct the production facilities necessary to produce the products it has under contract, Gevo’s business development activities, the financing process with Citigroup, Gevo’s plans to develop its business, Gevo’s ability to successfully finance its operations and growth projects, Gevo’s ability to achieve cash flow from its planned projects, the ability of Gevo’s products to contribute to lower greenhouse gas emissions, particulate and sulfur pollution and other statements that are not purely statements of historical fact. These forward-looking statements are made based on the current beliefs, expectations and assumptions of the management of Gevo and are subject to significant risks and uncertainty. Investors are cautioned not to place undue reliance on any such forward-looking statements. All such forward-looking statements speak only as of the date they are made, and Gevo undertakes no obligation to update or revise these statements, whether as a result of new information, future events or otherwise. Although Gevo believes that the expectations reflected in these forward-looking statements are reasonable, these statements involve many risks and uncertainties that may cause actual results to differ materially from what may be expressed or implied in these forward-looking statements. For a further discussion of risks and uncertainties that could cause actual results to differ from those expressed in these forward-looking statements, as well as risks relating to the business of Gevo in general, see the risk disclosures in the Annual Report on Form 10-K of Gevo for the year ended December 31, 2019 and in subsequent reports on Forms 10-Q and 8-K and other filings made with the U.S. Securities and Exchange Commission by Gevo.

Non-GAAP Financial Information

This press release contains financial measures that do not comply with U.S. generally accepted accounting principles (GAAP), including non-GAAP cash EBITDA loss, non-GAAP adjusted net loss and non-GAAP adjusted net loss per share. Non-GAAP cash EBITDA excludes depreciation and non-cash stock-based compensation. Non-GAAP adjusted net loss and adjusted net loss per share excludes non-cash gains and/or losses recognized in the quarter due to the changes in the fair value of certain of Gevo’s financial instruments, such as warrants, convertible debt and embedded derivatives. Management believes these measures are useful to supplement its GAAP financial statements with this non-GAAP information because management uses such information internally for its operating, budgeting and financial planning purposes. These non-GAAP financial measures also facilitate management’s internal comparisons to Gevo’s historical performance as well as comparisons to the operating results of other companies. In addition, Gevo believes these non-GAAP financial measures are useful to investors because they allow for greater transparency into the indicators used by management as a basis for its financial and operational decision making. Non-GAAP information is not prepared under a comprehensive set of accounting rules and therefore, should only be read in conjunction with financial information reported under U.S. GAAP when understanding Gevo’s operating performance. A reconciliation between GAAP and non-GAAP financial information is provided in the financial statement tables below.

1 Cash EBITDA loss is a non-GAAP measure calculated by adding back depreciation and non-cash stock compensation to GAAP loss from operations. A reconciliation of cash EBITDA loss to GAAP loss from operations is provided in the financial statement tables following this release.

2 Adjusted net loss per share is a non-GAAP measure calculated by adding back non-cash gains and/or losses recognized in the quarter due to the changes in the fair value of certain of our financial instruments, such as warrants, convertible debt and embedded derivatives, to GAAP net loss per share. A reconciliation of adjusted net loss per share to GAAP net loss per share is provided in the financial statement tables following this release.

3 Cash EBITDA loss is a non-GAAP measure calculated by adding back depreciation and non-cash stock compensation to GAAP loss from operations. A reconciliation of cash EBITDA loss to GAAP loss from operations is provided in the financial statement tables following this release.

4 Adjusted net loss is a non-GAAP measure calculated by adding back non-cash gains and/or losses recognized in the quarter due to the changes in the fair value of certain of our financial instruments, such as warrants, convertible debt and embedded derivatives, to GAAP net loss. A reconciliation of adjusted net loss to GAAP net loss is provided in the financial statement tables following this release.

Investor and Media Contact

+1 720-647-9605

IR@gevo.com

Source: Gevo

Each event in our popular Virtual Road Shows Series has a maximum capacity of 100 investors online. To take part, listen to and perhaps get your questions answered, see which virtual investor meeting intrigues you

Each event in our popular Virtual Road Shows Series has a maximum capacity of 100 investors online. To take part, listen to and perhaps get your questions answered, see which virtual investor meeting intrigues you