Peninsula Energy (PENMF) Corporate Presentation from NobleCon18News and Market Data on Peninsula EnergyNobleCon 18 Complete Rebroadcast

|

Category: Energy

Permex Petroleum (OILCF) NobleCon18 Presentation Replay

Vivakor (VIVK) NobleCon18 Presentation Replay

Can Energy Stocks Continue Their High Octane Performance?

Image Credit: Burak Kebapki

Many Reasons to Remain Bullish on the Energy Sector

Do you recall how big tech stocks started to climb dramatically in 2020? Then when many thought they were overdone, they rose even higher in 2021? Well, energy stocks, despite their staggering climb, seem to be having their turn, and there are reasons to believe the sector’s momentum will continue. Just as with the tech sector, they can’t keep rocketing upwards forever, but there are many factors that suggest the run is not yet over.

JP Morgan is quite bullish on the energy sector. In a recent report, they stated, “Energy is the only sector that is seeing its quality, growth, and momentum scores improve simultaneously.” The bank believes that energy stocks remain the best equity investment as commodity prices continue to rise. They point to continued rapid earnings growth. Despite the massive gains in 2021 and year-to-date, they wrote in a research note on Thursday (April 28), there is still room for more upside in energy stocks.

| “Energy is the only sector that is seeing quality, growth, and momentum scores improve simultaneously while maintaining an attractive value and income profile,” – Dubravko Lakos-Bujas, Chief U.S. Equity Strategist and Global Head of Quantitative Research, JPMorgan |

Energy remains the bank’s highest conviction investment. Commodity prices continue to rise and the underlying fundamentals of companies are improving. Accordingly, the expectation is that a combination of rapid earnings growth and renewed ratings for key multiples will continue to drive the sector.

And while demand remains elevated for commodities, supply could stay constrained due to a rising cost of capital and pressure from ESG policies. “The supply-demand balance continues to be tilted in favor of improving demand with higher commodity prices,” Lakos-Bujas said.

The highly regarded strategist estimates that energy demand will exceed supply by 20% and would require $1.3 trillion in incremental capital to close the gap by 2030. “While investor interest and sentiment has clearly inflected from record lows over the past year, energy stocks are far from pricing in strong and sustainable outlooks for fundamentals and shareholder returns,” the Chief Equity Strategists said.

JPMorgan’s note highlighted that energy remains the “cheapest sector” based on forward-looking earnings and book value. This is despite the sector rising 53% in 2021, and another 38% year-to-date. The energy sector trades at 9.5x forward earnings, which is well below its long-term average multiple of 16.5x.

Noble Capital Markets analysts, in their newsletter, Energy: First Quarter 2022 Review and

Outlook wrote, “Energy industry fundamentals remain strong. Energy prices are high and show no sign of decreasing. High oil prices, combined with improved operating efficiencies, mean that production companies are facing very favorable returns on their investment. We look for companies to continue reporting strong positive cash flow and to use cash flow to increase drilling and improve balance sheets.”

Take-Away

All rallies eventually come to an end. But analysts seem to be in agreement, the fundamentals, global events, and current valuation make a compelling case for the energy sector. Channelchek is a great resource to review, explore and discover small and microcap energy stocks from green energy, to fossil fuels, and even natural resources used in energy storage or transmission.

Sign up here for Channelchek notifications.

Paul Hoffman

Managing Editor, Channelchek

Suggested Reading

Energy and Global Fundamentals Make a Good Case for Owning Western Uranium Stocks

|

Exploration and Production Review and Outlook – Noble Capital Markets Energy Sector Review – Q1 2022

|

Energy Fuels (UUUU) NobleCon18 Presentation Replay

|

Alvopetro Energy (ALVOF) NobleCon18 Presentation Replay

|

Sources

https://am.jpmorgan.com/sg/en/asset-management/per/funds/global-growth/

Stay up to date. Follow us:

|

Release – CanAlaska Deals Three Uranium Properties for AUD$15M

CanAlaska Deals Three Uranium Properties for AUD$15M

Research, News, and Market Data on CanAlaska Uranium

Basin Energy to Spend AUD$5M for 60% of Two Uranium Properties and 100% in One Uranium Property

Staged Option to Earn up to 80% Interest in Geikie and North Millennium Projects, Subject to Additional AUD$10M in Spend

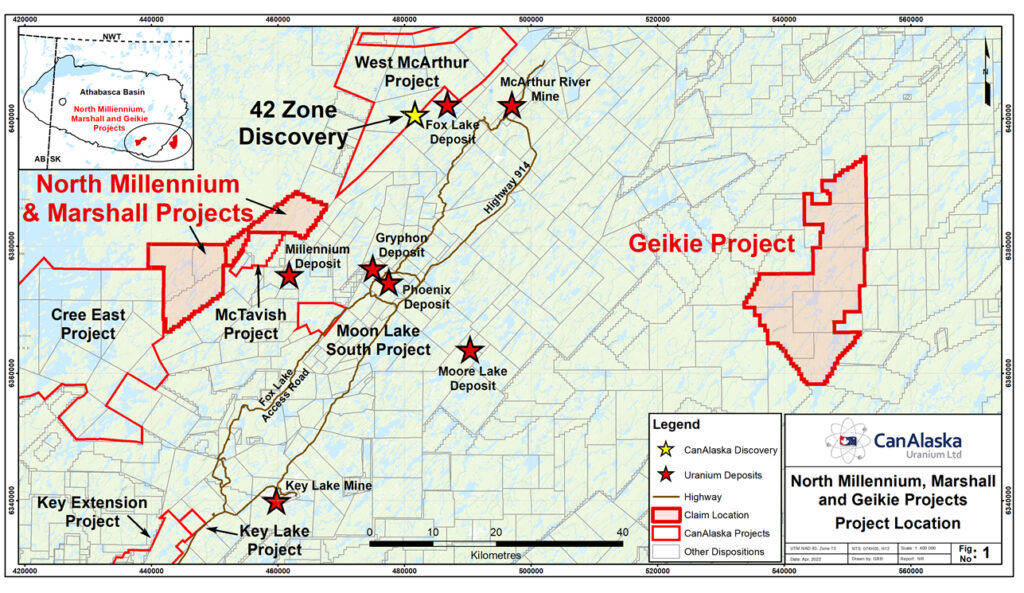

Vancouver, Canada, April 27, 2022 – CanAlaska Uranium Ltd. (TSX-V: CVV; OTCQB: CVVUF; Frankfurt: DH7N) (“CanAlaska” or the “Company”) is pleased to announce it has entered into Purchase Option Agreements (“POA”) with Basin Energy Limited (“Basin Energy”), an Australian public limited corporation, to allow Basin Energy to earn up to an 80% interest in CanAlaska’s 100%-owned North Millennium and Geikie projects, and a 100% interest in CanAlaska’s 100%-owned Marshall project. These projects total 50,994.56 hectares in the Eastern Athabasca Basin in Saskatchewan, Canada (the “Projects”) (Figure 1).

Figure 1: North Millennium, Marshall and Geikie Project Location Map

North Millennium and Geikie Projects

Basin Energy may earn up to an 80% interest in each of the North Millennium and Geikie projects by undertaking work and milestone payments in three defined earn-in stages on each project.

- Basin Energy may earn an initial 40% interest (“40% Option”) in each of the projects by paying the Company AUD$33,333.33 cash per project and issuing 6.66% worth of ordinary shares in Basin Energy’s capital structure as at listing on the Australian Securities Exchange (“ASX”) per project within 180 days following execution of a definitive Property Option Agreement (“POA”). Basin Energy will have the right to extend the 40% Option on a month-by-month basis for up to three (3) consecutive months upon payment of an option extension fee of AUD$8,333 per month per project.

- Basin Energy may earn an additional 20% interest (“60% Option”) in each of the projects by incurring AUD$2,500,000 in exploration expenditures per project within 24 months of the ASX listing date.

- Basin Energy may earn an additional 20% interest (“80% Option”) in each of the projects by issuing a further 2,250,000 ordinary shares in Basin Energy per project and incurring an additional AUD$5,000,000 (total: AUD$7,500,000) in exploration expenditures per project within 48 months of the ASX listing date and granting the Company a 2.75% net smelter returns (“NSR”) royalty on all products derived from the claims with a repurchase right of 0.50% NSR for AUD$500,000 at any time commencing from the grant of the 2.75% NSR per project.

- CanAlaska will be operator of the projects through the 60% Option threshold and charge an operator fee.

- Basin Energy will be obligated to keep and maintain the North Millennium and Geikie claims in good standing for a minimum period of one year at all times during the term of the POA.

After successful completion of either of the 40% Option or 60% Option stages of the agreement, and if Basin Energy elects to not enter the final stage, a joint venture will be formed and the parties will co-contribute on a simple pro-rata basis or dilute on a pre-defined straight-line dilution formula. If either party dilutes to a 10% interest, the diluting party will automatically forfeit its interest in the respective project and in lieu thereof will be granted a 2.75% net smelter returns (NSR) royalty on the respective property on all products derived from the claims with a repurchase right of 0.50% NSR for AUD$500,000 at any time commencing from the grant of the 2.75% NSR, except that, this provision will not apply to CanAlaska if CanAlaska has already been granted the 2.75% NSR prior to diluting to a 10% interest.

Marshall Project

Basin Energy may acquire a 100% interest in the Marshall project by:

- Paying the Company AUD$33,333.33 cash and issuing 6.66% worth of ordinary shares in Basin Energy’s capital structure as at listing on the ASX within 180 days following execution of a definitive POA. Basin Energy will have the right to extend the payment period on a month-by-month basis for up to three (3) consecutive months upon payment of an option extension fee of AUD$8,333 per month.

- Granting to the Company a 2.75% net smelter returns (“NSR”) royalty on all products derived from the claims with a repurchase right of 0.50% NSR for AUD$500,000 at any time commencing from the grant of the 2.75% NSR.

- CanAlaska and Basin Energy will enter into an agreement (the “Marshall Project Operator Agreement”), on terms acceptable to both parties, pursuant to which Basin Energy will engage the Company to be the operator of the initial AUD$1,500,000 work program on the property after closing of the transaction. CanAlaska will be entitled to charge Basin Energy an operator fee.

An area of mutual interest will be established that extends two kilometres from the boundary of the North Millennium, Geikie and Marshall claims.

First Programs

The parties will establish a Joint Technical Operating Committee (“JTOC”) under the terms of the Marshall Project Operator Agreement and the POAs relating to the North Millennium and Geikie projects to discuss exploration and development strategies, review and comment on programs and budgets submitted by CanAlaska, as the Operator under the agreements, review the progress and results of activities conducted under the current programs and to discuss other issues in respect to the properties. The final binding decision with respect to establishing programs to be carried out by the Operator (including any changes or amendments to programs) shall be made by Basin Energy. The preliminary work programs and budgets for each project will be laid out for the next 2 years. Once the 40% Option threshold has been met with respect to the North Millennium and Geikie projects, and the 100% Option has been fully exercised with respect to the Marshall project, it is anticipated the first exploration programs under the respective property agreements will be conducted in the last half of 2022.

About Basin Energy Limited

Basin Energy Limited (ACN 655 515 110) is an Australian unlisted uranium exploration and development company incorporated for the purpose of pursuing highly prospective uranium opportunities globally. Basin Energy is backed by a high-quality board and management team with extensive uranium project experience across multiple jurisdictions and a proven track record of value creation. The completion of this transaction is conditional upon Basin Energy listing on the ASX which is indicatively planned for early Q3-CY2022.

CanAlaska CEO, Cory Belyk, comments, “Completion of these definitive agreements with Basin Energy represents a very significant investment into CanAlaska’s uranium portfolio providing multiple discovery opportunities for CanAlaska shareholders on several of our new and highly prospective Eastern Athabasca projects. It has been a real delight to work with the Basin Energy team to bring these projects across another critical threshold. I look forward to the first Basin Energy funded exploration programs.”

Other News

The prior announced Purchase Option Agreements for the Waterbury East and McTavish projects have expired.

About CanAlaska Uranium

CanAlaska Uranium Ltd. (TSX-V: CVV; OTCQB: CVVUF; Frankfurt: DH7N) holds interests in approximately 300,000 hectares (750,000 acres), in Canada’s Athabasca Basin – the “Saudi Arabia of Uranium.” CanAlaska’s strategic holdings have attracted major international mining companies. CanAlaska is currently working with Cameco and Denison at two of the Company’s properties in the Eastern Athabasca Basin. CanAlaska is a project generator positioned for discovery success in the world’s richest uranium district. The Company also holds properties prospective for nickel, copper, gold and diamonds.

The qualified technical person for this news release is Nathan Bridge, MSc., P.Geo., CanAlaska’s Vice President, Exploration.

For further information visit www.canalaska.com.

On behalf of the Board of Directors

“Peter Dasler”

Peter Dasler, M.Sc., P.Geo.

President

CanAlaska Uranium Ltd.

Contacts:

Peter Dasler, President

Tel: +1.604.688.3211 x 138

Email: info@canalaska.com

Cory Belyk, CEO and Executive Vice President

Tel: +1.604.688.3211 x 138

Email: cbelyk@canalaska.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-looking information

All statements included in this press release that address activities, events or developments that the Company expects, believes or anticipates will or may occur in the future are forward-looking statements. These forward-looking statements involve numerous assumptions made by the Company based on its experience, perception of historical trends, current conditions, expected future developments and other factors it believes are appropriate in the circumstances. In addition, these statements involve substantial known and unknown risks and uncertainties that contribute to the possibility that the predictions, forecasts, projections and other forward-looking statements will prove inaccurate, certain of which are beyond the Company’s control. Readers should not place undue reliance on forward-looking statements. Except as required by law, the Company does not intend to revise or update these forward-looking statements after the date hereof or revise them to reflect the occurrence of future unanticipated events.

Exploration and Production Review and Outlook – Noble Capital Markets Energy Sector Review – Q1 2022

Energy: First Quarter 2022 Review and Outlook

Noble Capital Markets Energy Sector Newsletter

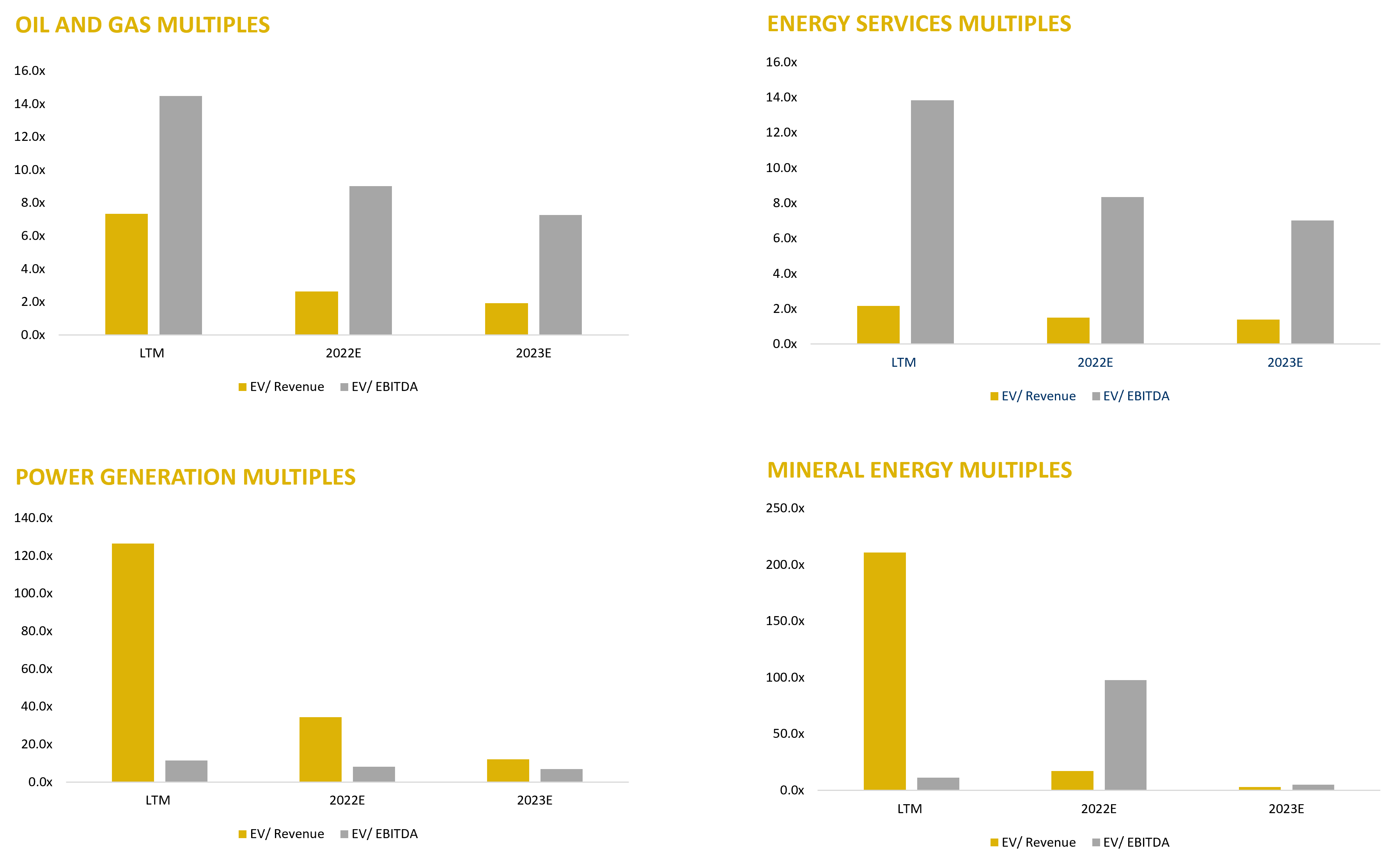

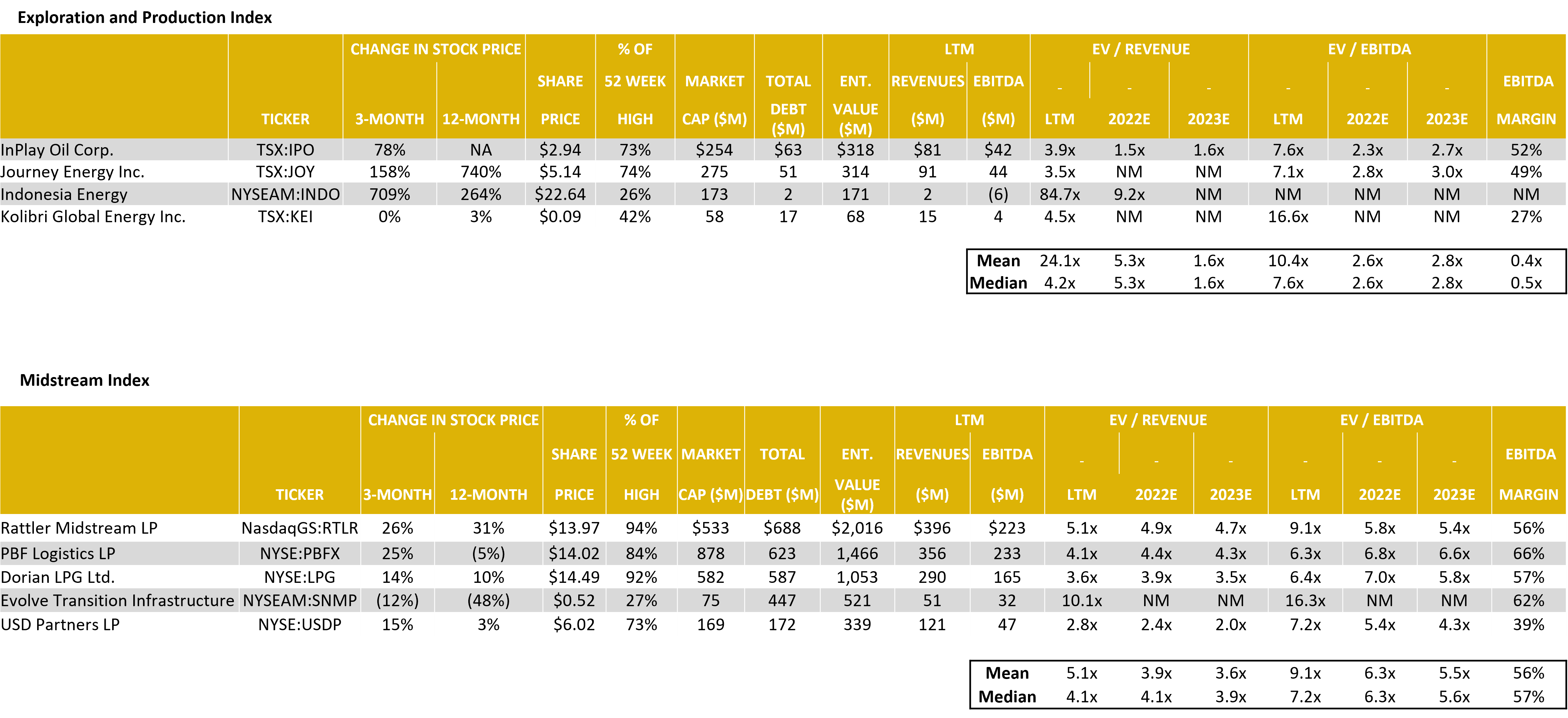

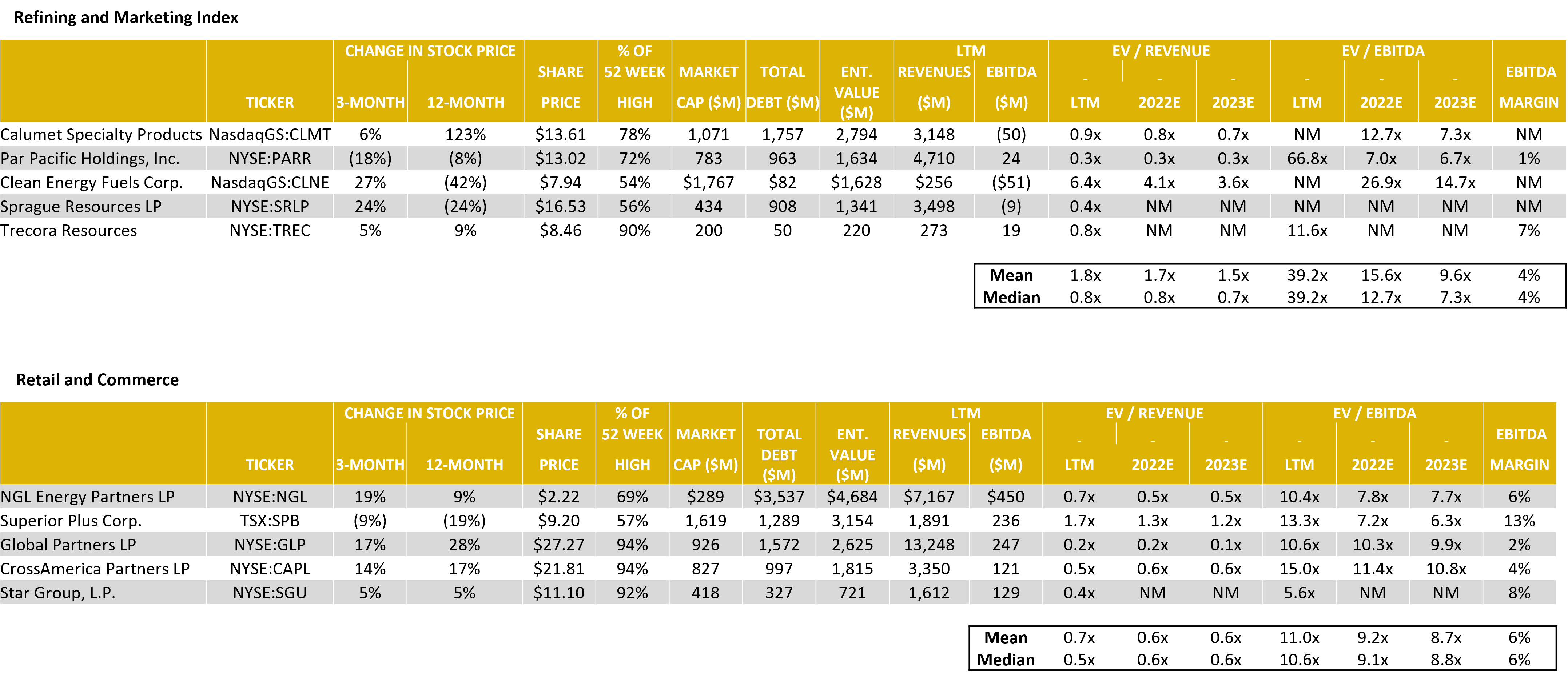

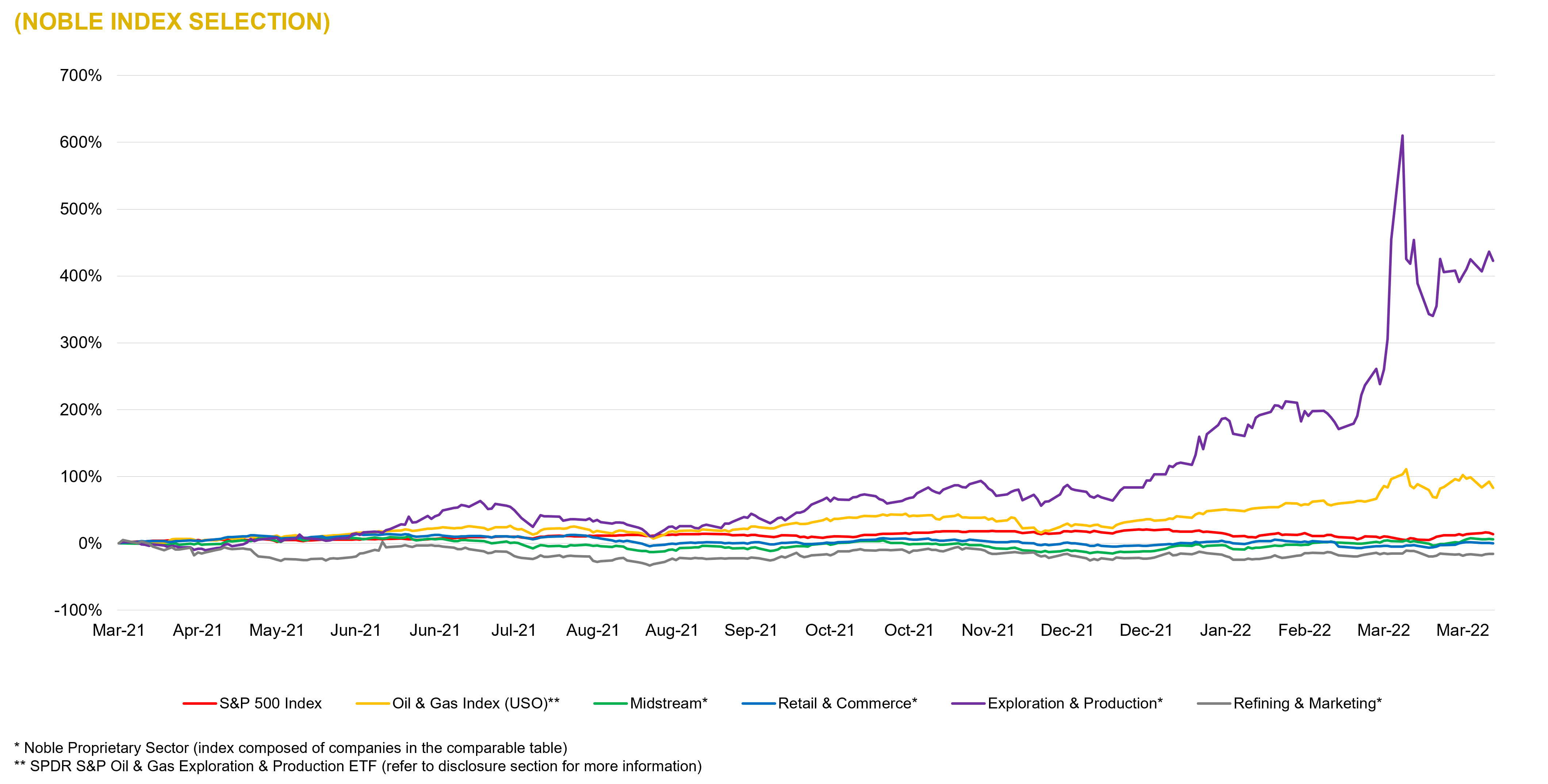

Source: Capital IQ as of 03/31/2022

Energy Fundamental Data

Source: Energy Information Administration as of 12/31/2021

ENERGY INDUSTRY OUTLOOK

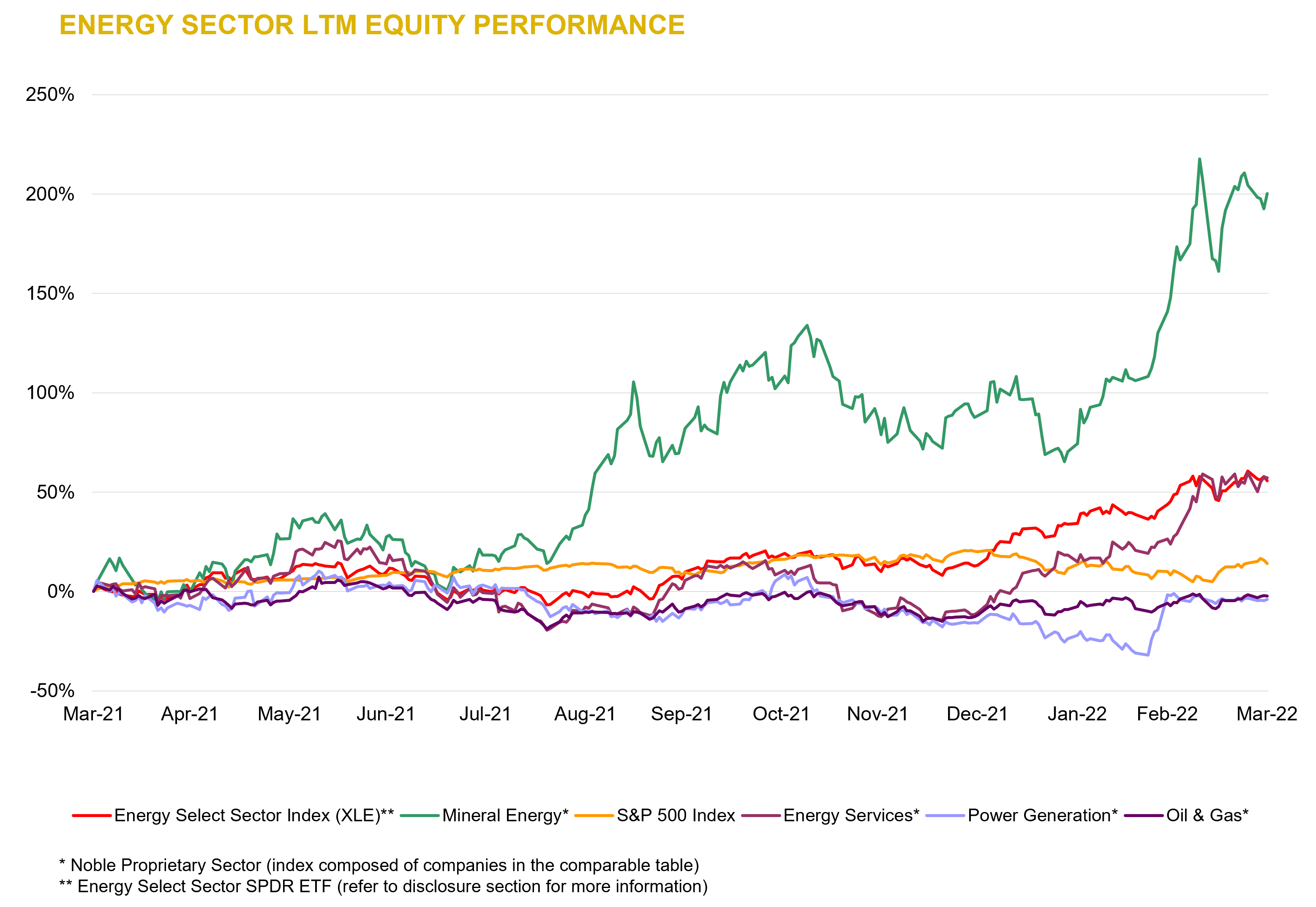

Energy Stocks Remain On A Tear

Energy Stocks Performance

Energy stocks, as measured by the XLE Energy Index, continued their torrid pace rising 41% in the quarter and far outpacing the overall market. The increase reflects higher oil and gas prices during the quarter, much of which can be attributed to the conflict between Russia and Ukraine. That said, investors are growingly accepting the fact that higher prices are not merely related to temporary factors such as Ukraine, supply chain issues, a post-covid economic rebound, or OPEC supply tightening. Instead, there is growing belief that higher prices reflect a fundamental disconnect between the energy demand and supply. Investors no longer talk about domestic supply costs as the factors setting prices instead concentrating on how rising demand will be met until renewable energy is able to have a significant impact on energy demand.

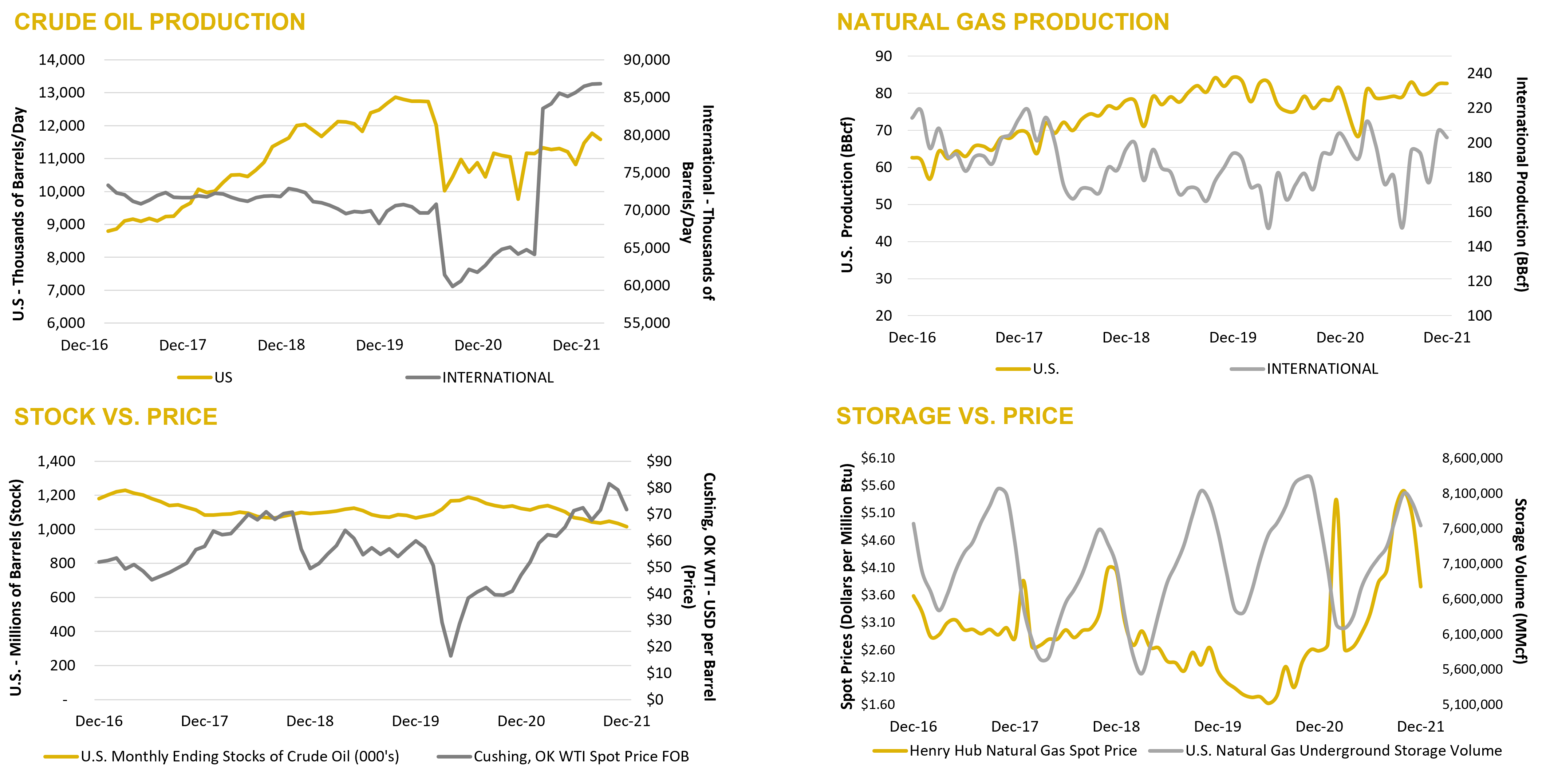

Oil Prices

The run-up in oil prices has been extraordinary virtually doubling in price over the last twelve months. Prices have backed off of highs hit at the beginning of the Ukraine conflict but remain at levels well above that needed for energy companies to make large profits. Brent prices remain approximately $5/bbl. above WTI prices ending the quarter near $108/bbl. Futures prices remain relatively flat declining about a $1 each month going forward. We do not believe $100 oil prices are sustainable and expect increased drilling to eventually lower prices. Nevertheless, we have raised our long-term oil price assumption used in our valuation models to $60 from $50.

Drillers are beginning to react to higher oil prices, but the response has been slow. Active rigs have doubled in the last twelve months but remain below pre-pandemic levels and are only one-third of peak levels in 2015. As the chart below shows, there has been a disconnect between the oil rig count and oil prices in recent years that has become only more exaggerated in recent months with oil prices rising above $100. As indicated previously, we expect drilling activity to continue to increase as long as oil prices remain at current inflated levels. How quickly drilling will increase remains to be seen.

Natural Gas Prices

Natural gas prices have also been exceptionally strong early in the quarter climbing approaching $6/mcf. Much attention has been given to the role domestic gas producers might have in supplying natural gas to Europe to replace gas being received from Russia. The trend towards building liquified natural gas (LNG) export terminals (or reversing import terminals) began years ago. Still, the United States is several years away from increasing its LNG export capacity to a level that could offset Russian imports. That said, the trend will most likely continue creating a favorable outlook for domestic natural gas producers. Interestingly, natural gas prices are higher at the Henry Hub pricing point than most of the country reflecting regional temperature disparities and perhaps a growing trend towards LNG exports.

Storage levels, which entered the winter heating season at high levels, exit the season near historically low levels. Temperatures in the lower 48 states have been colder than normal with the last two weeks in March being significantly colder than normal. As we enter the summer months, there is little to move storage levels back in line. We would expect to enter the next heating season at average to below average storage levels.

Outlook

Energy industry fundamentals remain strong. Energy prices are high and show no sign of decreasing. High oil prices, combined with improved operating efficiencies, mean that production companies are facing very favorable returns on their investment. We look for companies to continue reporting strong positive cash flow and to use cash flow to increase drilling and improve balance sheets. We do not expect companies to raise dividend payments given the cyclical nature of recent oil price trends but would not rule out share repurchases if stock prices do not rebound further. Concerns of industry-wide reductions in lifting costs or a fundamental shift away from carbon-based fuels have gone to the wayside due to a lack of supply response to higher prices. The drilling that is being done is very profitable and that should lead to higher company profits and improved company financials. We believe small energy companies that can expand without drawing attention may be at an advantage.

Source: Michael Heim 01/04/2022; Energy Information Agency (EIA)

Source: Capital IQ as of 03/31/2022

Oil & Gas – Comparable Tables

Source: Capital IQ as of 03/31/2022

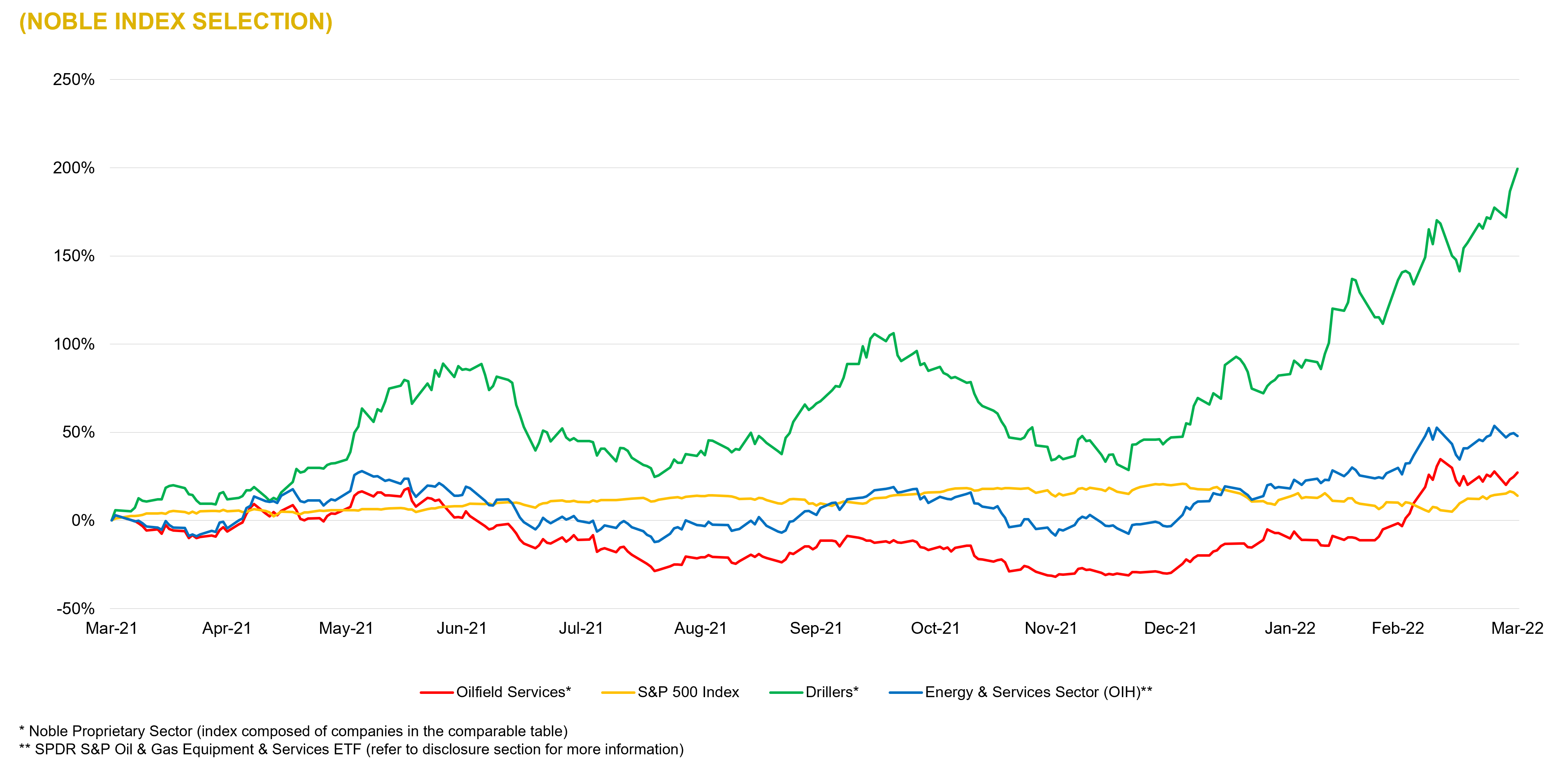

Oil & Gas – LTM Equity Performance

Source: Capital IQ as of 03/31/2022

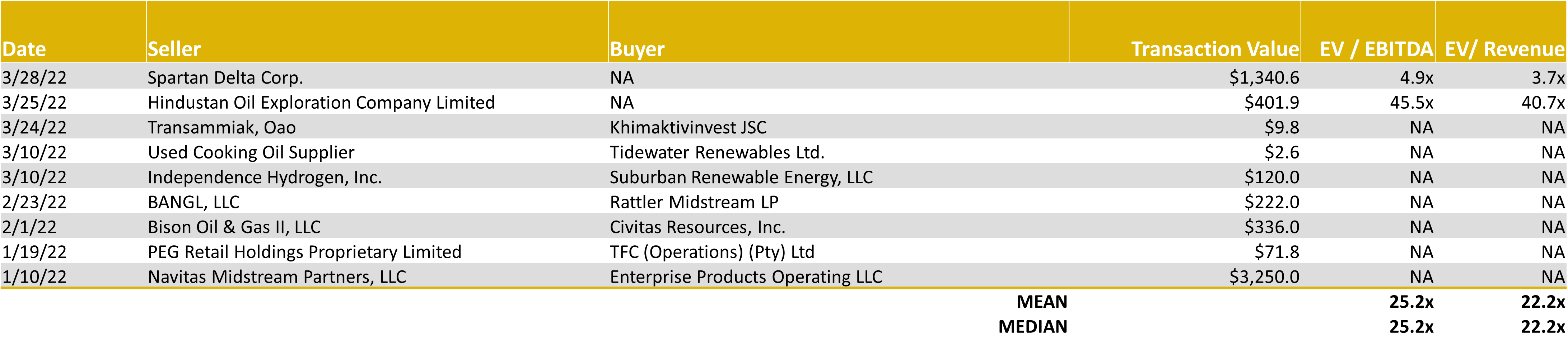

Oil & Gas – 2021-4Q Global M&A Activity

Source: Capital IQ as of 03/31/2022

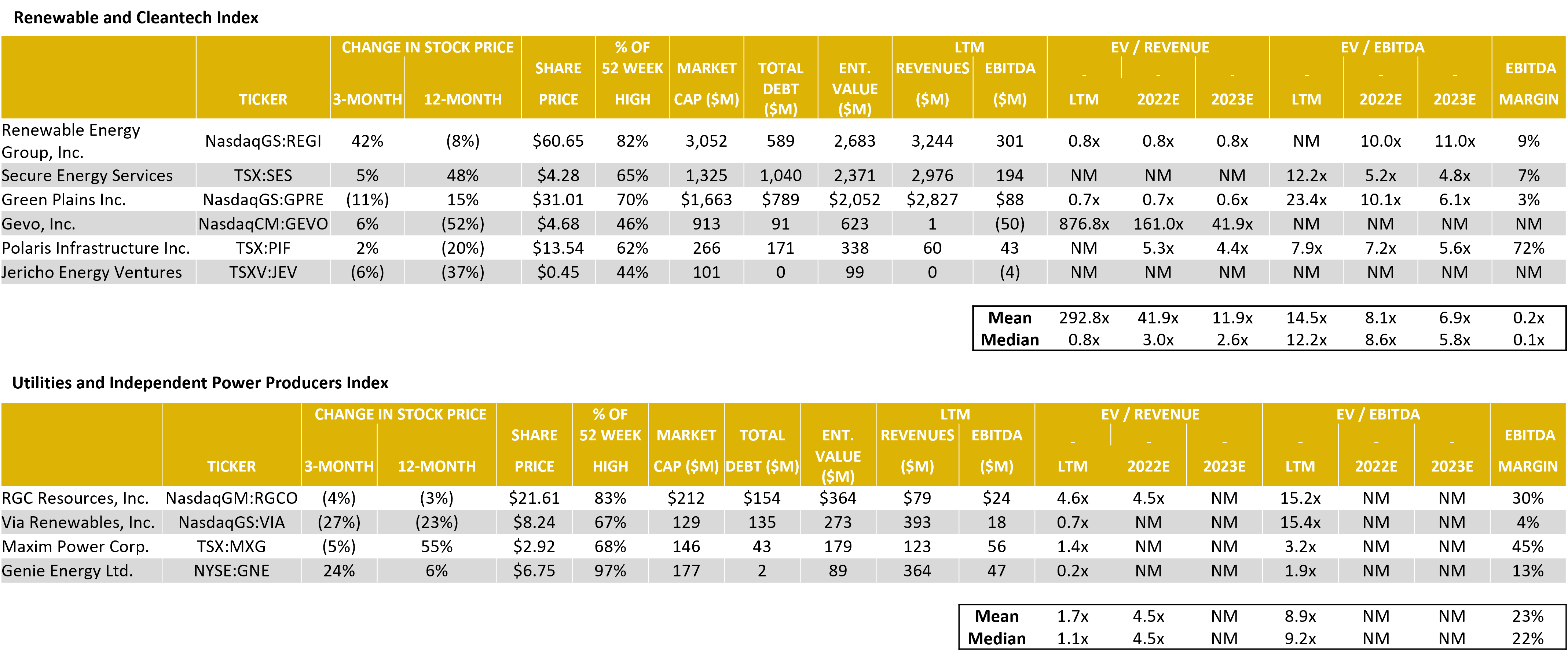

Power Generation – Comparable Tables

Source: Capital IQ as of 03/31/2022

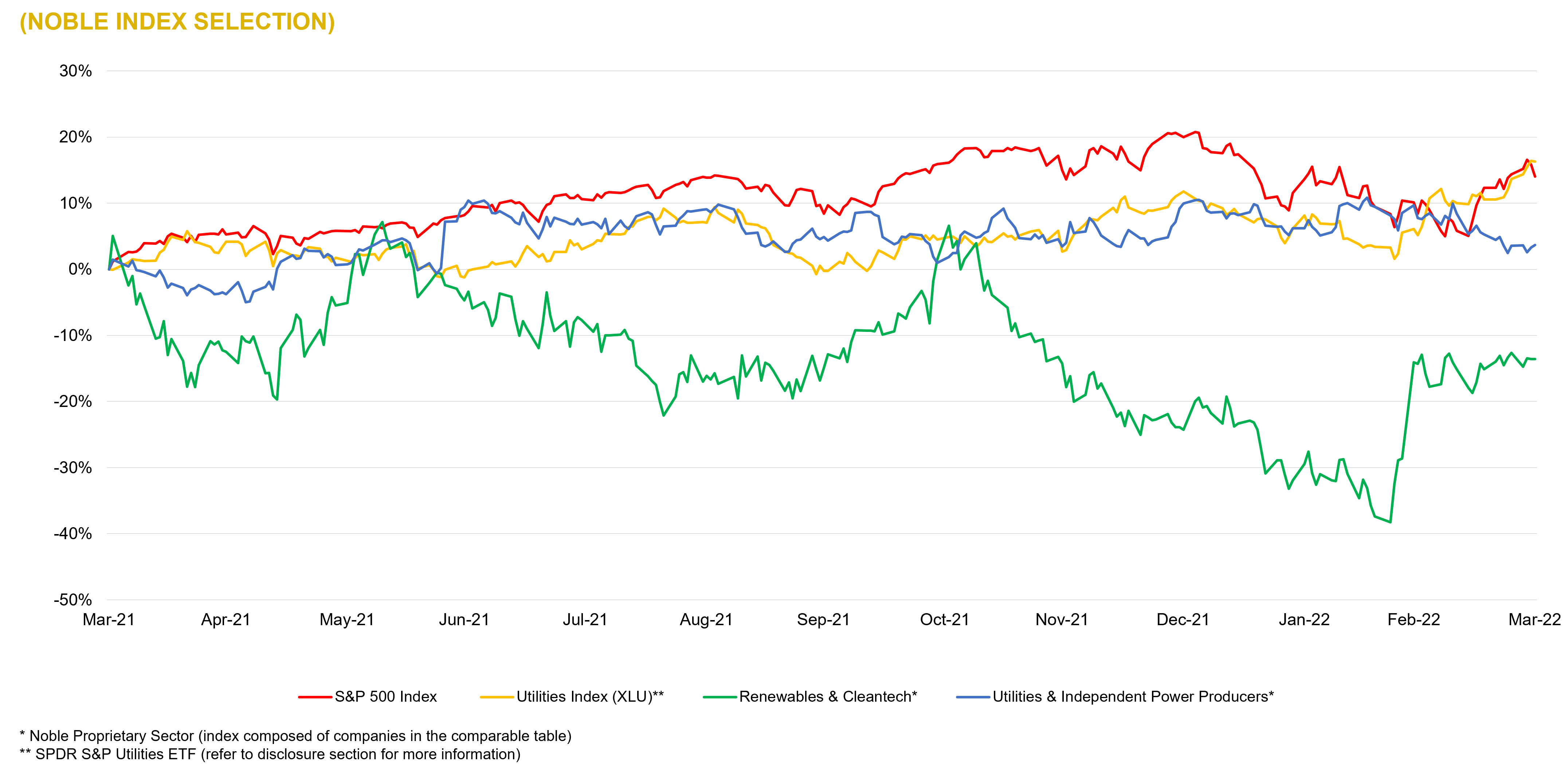

Power Generation – LTM Equity Performance

Source: Capital IQ as of 03/31/2022

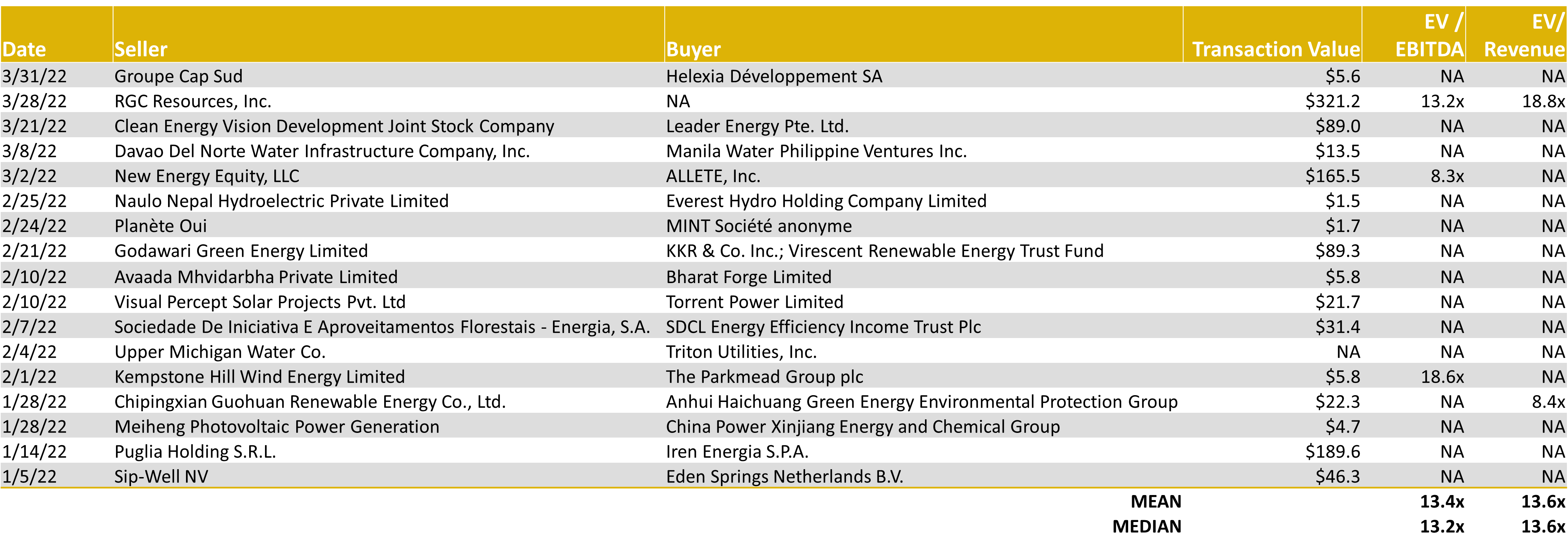

Power Generation – 2021-4Q Global M&A Activity

Source: Capital IQ as of 03/31/2022

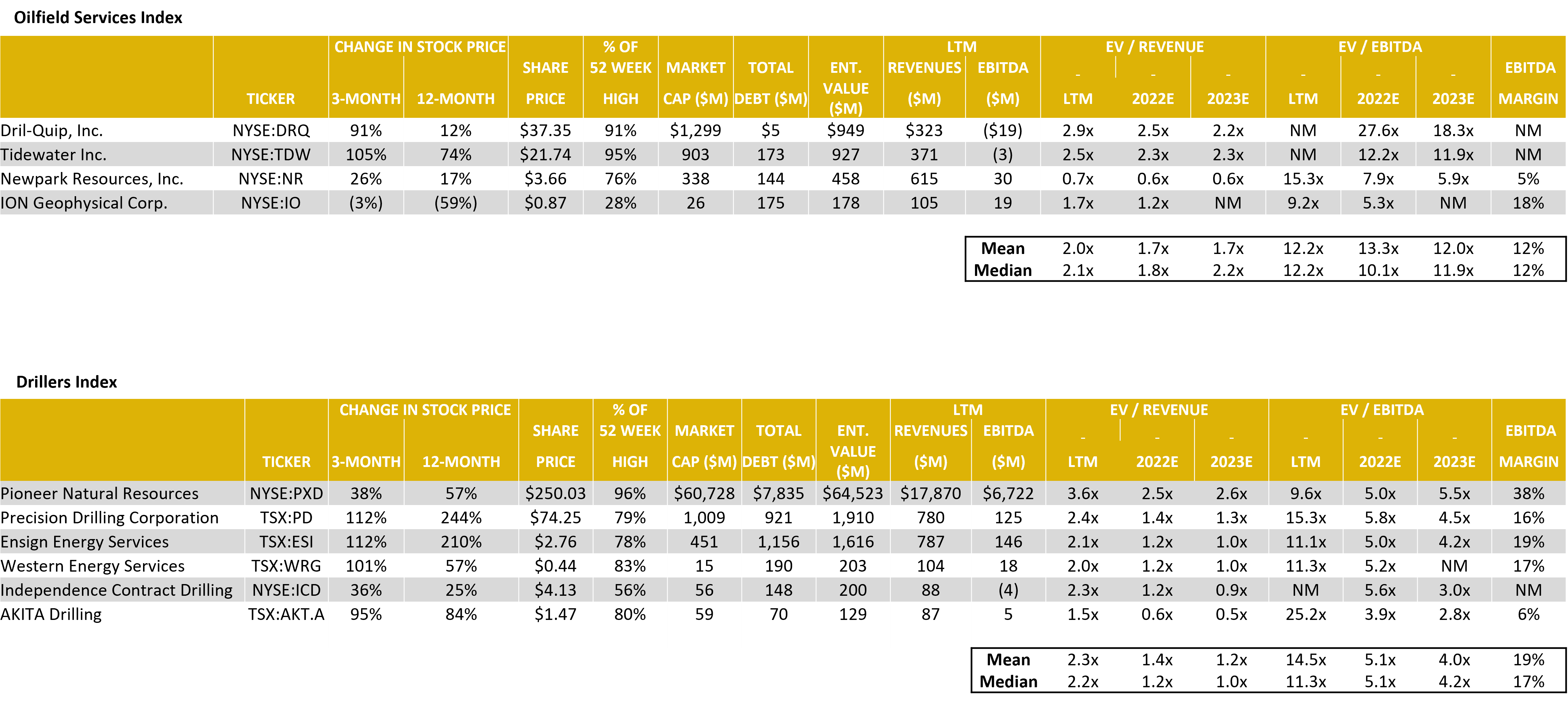

Energy Services – Comparable Tables

Source: Capital IQ as of 03/31/2022

Energy Services – LTM Equity Performance

Source: Capital IQ as of 03/31/2022

Energy Services – 2021-4Q M&A Activity

Source: Capital IQ as of 03/31/2022

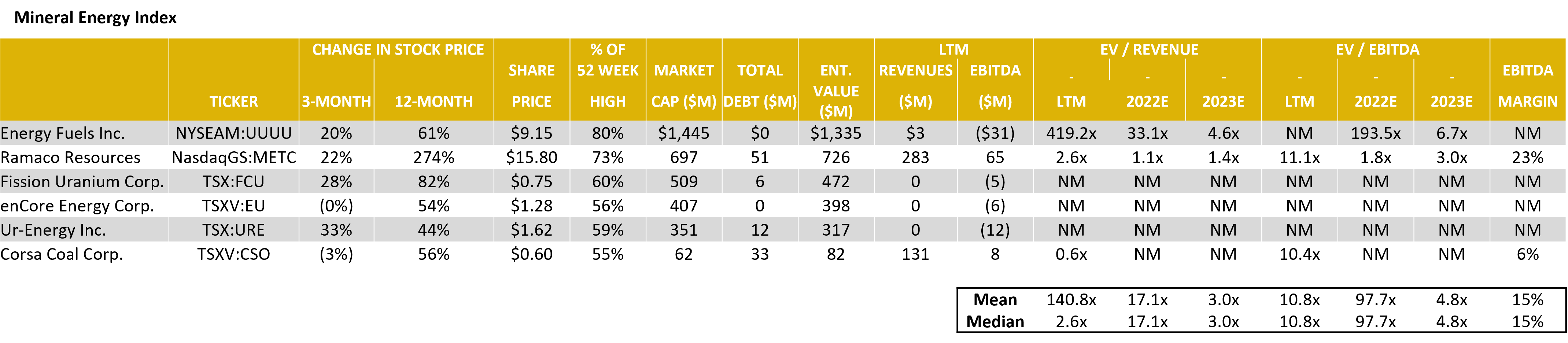

Mineral Energy – Comparable Tables

Source: Capital IQ as of 03/31/2022

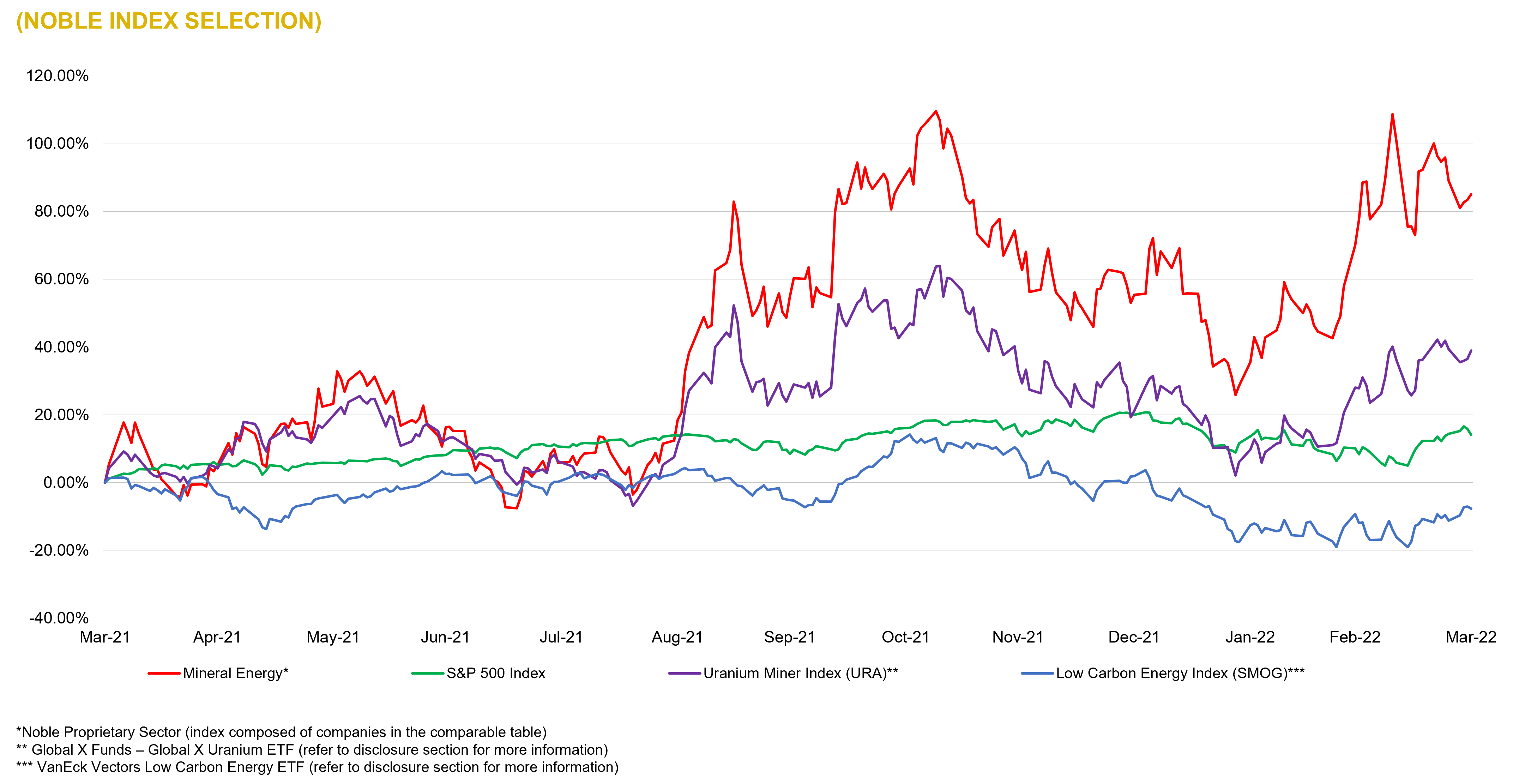

Mineral Energy – LTM Equity Performance

Source: Capital IQ as of 03/31/2022

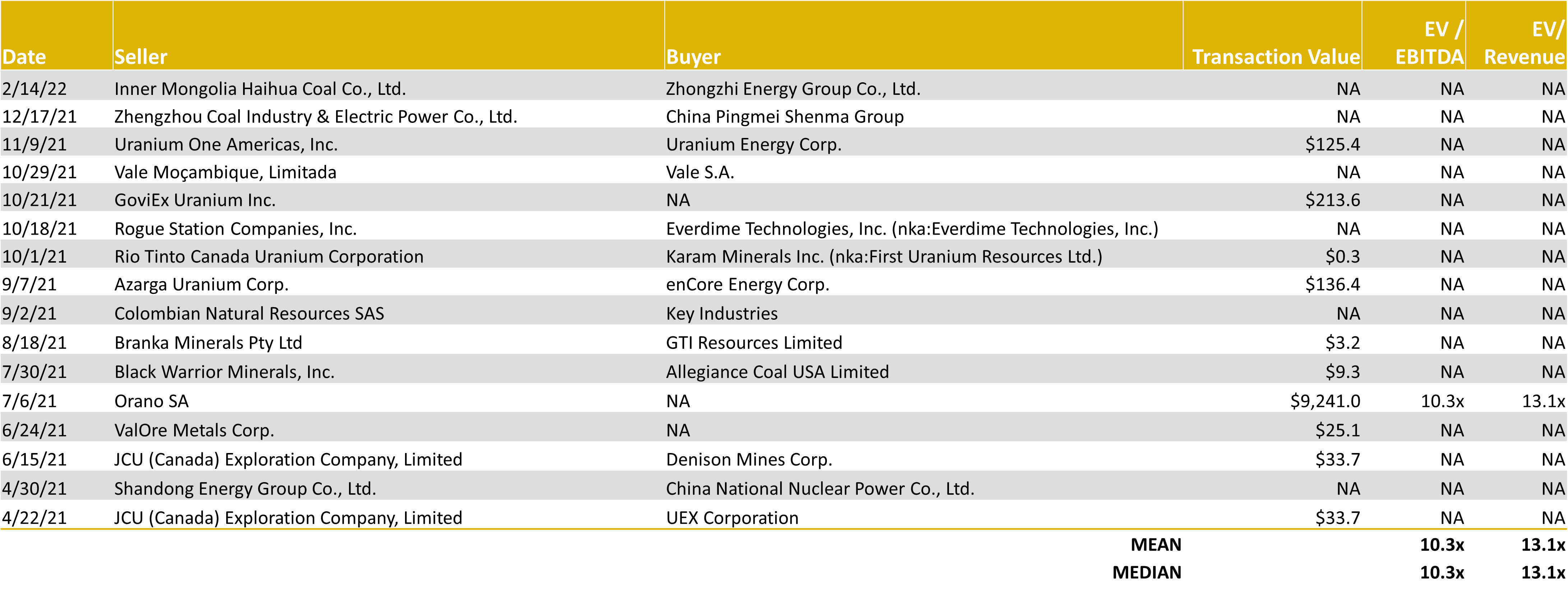

Mineral Energy – 2021 Global M&A Activity

Source: Capital IQ as of 03/31/2022

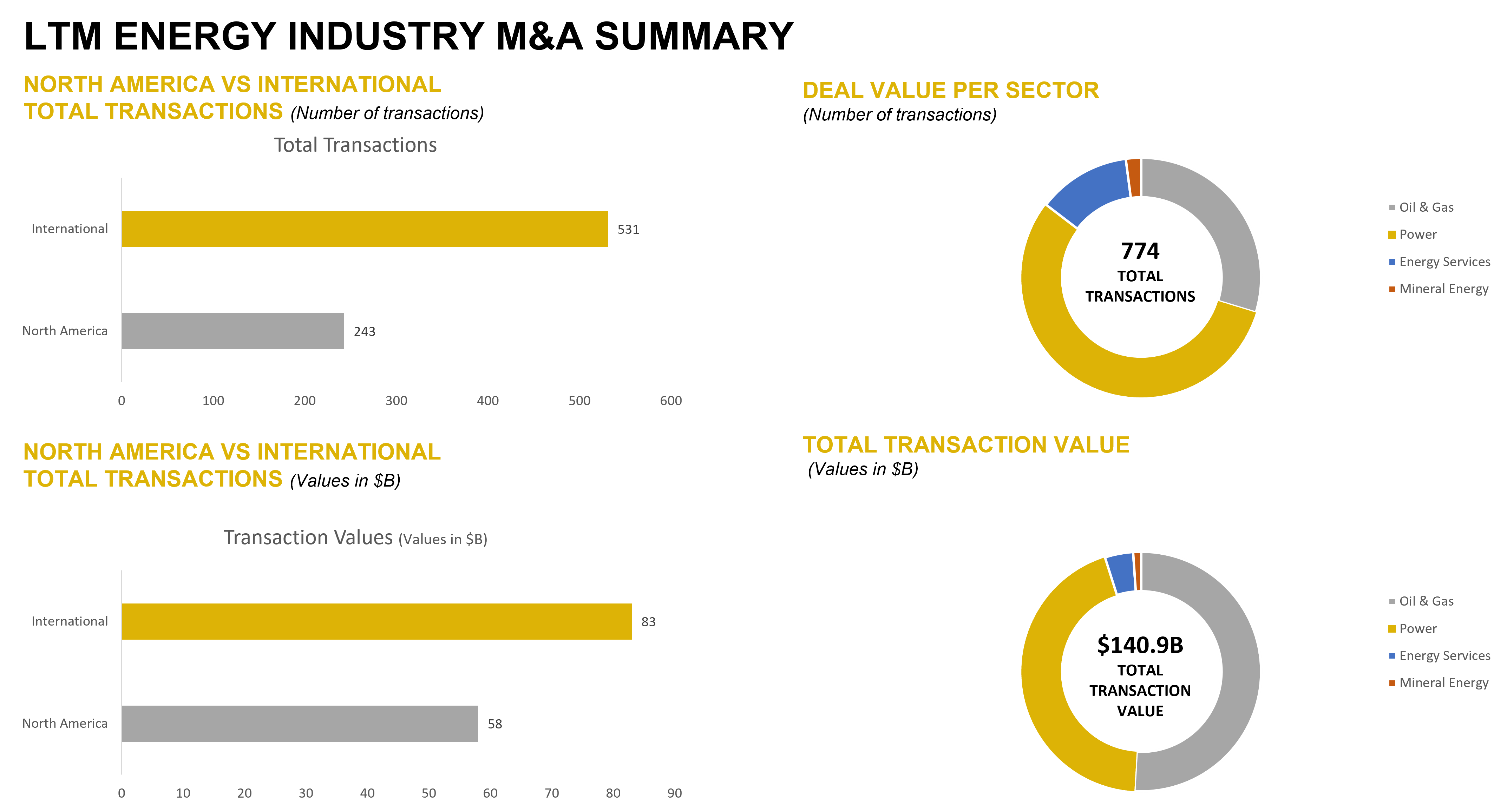

LTM Energy – Energy Industry M&A Summary

Source: Capital IQ as of 03/31/2022

NOBLE QUARTERLY HIGHLIGHTS

Permex Petroleum Corp. (OTCQB:OILCF)

Industry: Energy – Oil and Gas Exploration and Production

Permex Petroleum is a uniquely positioned junior oil & gas company with assets and operations across the Permian Basin of West Texas and the Delaware Sub-Basin of New Mexico. The company focuses on combining its low-cost development of Held by Production assets for sustainable growth with its current and future Blue-Sky projects for scale growth.

1st Quarter News Highlights:

March 28, 2022: The Company announced the closing of a brokered private placement, which resulted in gross proceeds of approximately USD $7.5 million before deducting the placement agent’s fees and other estimated fees and expenses related to the Offering. Each Unit consists of one common share and one common share purchase warrant. Each Warrant will be exercisable into one Share for a period of five years at an exercise price of USD $0.21 per share.

Peninsula Energy Ltd. (OTCQB:PENMF)

Industry:Mineral Energy; Exploration and production

Peninsula Energy Limited (PEN) is an ASX listed uranium mining company which commenced in-situ recovery operations in 2015 at its 100% owned Lance Projects in Wyoming, USA. Peninsula is embarking on a project transformation initiative at the Lance Projects to change from an alkaline ISR operation to a low-pH ISR operation with the aim of aligning the operating performance and cost profile of the project with industry leading global uranium production projects.

1st Quarter News Highlights:

March 28, 2022: Peninsula Energy announced the initiation of an update to the 2018 Low-pH Feasibility Study on its flagship, 100% owned Lance Project (“Lance”) located in Wyoming, USA. The Company is also pleased to announce the selection of Western Water Consultants, Inc. d/b/a WWC Engineering, a leading US-based consulting and engineering firm with significant Uranium In-Situ Recovery (“ISR”) expertise, to author the Study.

Alvopetro Energy Ltd. (OTCQX:ALVOF)

Industry: Energy – Oil & Gas; Exploration and production

Alvopetro Energy Ltd.’s vision is to become a leading independent upstream and midstream operator in Brazil. The company’s strategy is to unlock the on-shore natural gas potential in the state of Bahia in Brazil, building off the development of their Caburé and Gomo natural gas projects and the construction of strategic infrastructure assets.

1st Quarter News Highlights:

March 17, 2022: The company announced a 33% increase in quarterly dividend to US$0.08/share, payable in cash on April 14, 2022, to shareholders of record at the close of business on March 31, 2022. This dividend is designated as an “eligible dividend” for Canadian income tax purposes. Alvopetro’s cash flows are linked to US dollars and as such, dividends are being paid in US dollars.

Source: Company Press Releases

DOWNLOAD THE FULL REPORT (PDF)

Noble Capital Markets Energy Newsletter Q1 2022

This newsletter was prepared and provided by Noble Capital Markets, Inc. For any questions and/or requests regarding this newsletter, please contact >Francisco Penafiel

DISCLAIMER

All statements or opinions contained herein that include the words “ we”,“ or “ are solely the responsibility of NOBLE Capital Markets, Inc and do not necessarily reflect statements or opinions expressed by any person or party affiliated with companies mentioned in this report Any opinions expressed herein are subject to change without notice All information provided herein is based on public and non public information believed to be accurate and reliable, but is not necessarily complete and cannot be guaranteed No judgment is hereby expressed or should be implied as to the suitability of any security described herein for any specific investor or any specific investment portfolio The decision to undertake any investment regarding the security mentioned herein should be made by each reader of this publication based on their own appraisal of the implications and risks of such decision This publication is intended for information purposes only and shall not constitute an offer to buy/ sell or the solicitation of an offer to buy/sell any security mentioned in this report, nor shall there be any sale of the security herein in any state or domicile in which said offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or domicile This publication and all information, comments, statements or opinions contained or expressed herein are applicable only as of the date of this publication and subject to change without prior notice Past performance is not indicative of future results.

Please refer to the above PDF for a complete list of disclaimers pertaining to this newsletter

Energy and Global Fundamentals Make a Good Case for Owning Western Uranium Stocks

Global Events Seem to have created a Separate Uranium Market for the East and West – Is this an Opportunity?

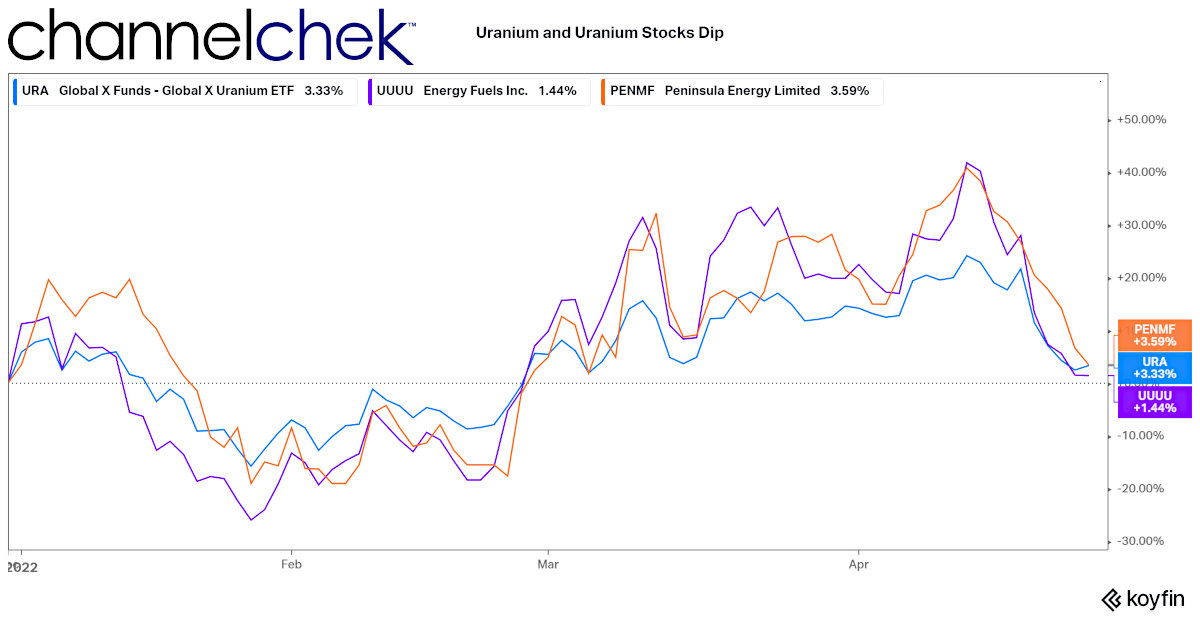

Should investors buy the uranium dip? After reaching a recent high on April 13, spot uranium has come under significant selling pressure. This may be a temporary reaction to lockdowns and restrictions in China related to the country’s zero Covid policy and recent outbreaks. Public companies related to uranium production had reached their highest level since November in April; they have fallen with the price per tonne of the yellow metal.

Market Fundamentals

The price for anything goes up and down on two factors, supply and demand – part of demand is speculation. This component of demand is particularly relevant in commodities. Uranium, of course, is a commodity.

Prior to the late April dip, uranium and related companies were experiencing a substantial run-up. The reasons for this were many; in fact, let’s word this are many, because they still exist.

A list worth sharing of reasons to be bullish on uranium was provided on April 20 at NobleCon18 by Peninsula Energy (PENMF). Peninsula is an advanced stage uranium developer, “ready to put pounds in the can, and out to market.” Wayne Heili, who has 30 years of experience in the business, discussed the unfolding trends that explain the enthusiasm for uranium.

Corporations involved in uranium production to serve the West followed the price of uranium. The question investors are asking is, does the cheaper entry price create a buying opportunity.

The Case for Uranium

Mr. Heili said nuclear is part of the green energy mix that the world is requiring. This mix, the Peninsula CEO pointed out, is splitting into an Eastern and Western-oriented market in terms of who is served. It was explained to the investors present that whether by law or by choice, the utilities that are serving the West are going to stop relying on nuclear fuel from Russia. Western markets are currently characterized as having a supply deficit. There is little or no production, conversion, or enrichment and perhaps not enough fuel fabrication capacity. This, of course, translates into the West needing to create or add capacity to fill the void of not accepting supplies from the East.

We’re now in the part of the nuclear fuel cycle where production will have to be ramped up. Adding to the need is the European Union now recognizes and characterizes uranium as green.

Another catalyst for increased demand and prices is the Sprott Uranium Fund. The investment company’s physical uranium trust is inventorying U308. Material that may never make it to a plant.

The industry has been receiving bi-partisan support from Washington, and national self-reliance has shown its importance when it comes to the supply of energy and other essentials.

Separately at NobleCon18, Mark Chalmers of Energy Fuels (UUUU) spoke about the uranium market and his company. He shared that 20% of electricity produced in the US is from nuclear. The focus on reducing carbon and maintaining or increasing baseload energy has brought about a nuclear renaissance.

Take-Away

While the overall stock market has been trending down this year, energy stocks, including uranium, have been marching much higher. Two weeks ago, Covid fears overseas brought uranium and uranium stocks down to just above their opening at the start of 2022. Is this substantial dip just a blip before they head back up? The energy industry and the uranium sector of that industry are faced with increasing demand. Supplying that demand should increase revenues.

Suggested Content

The Good News and Bad News Surrounding US Uranium Self-Reliance

|

There Seems to be a Perfect Storm in Favor of Uranium Investors

|

This Firm Facilitates Direct Investment in Physical Uranium

|

NobleCon18 Peninsula Energy Ltd. Presentation

|

Stay up to date. Follow us:

|

Release – Encore Energy Provides Rosita Uranium Plant Update Releases Corporate Video

Encore Energy Provides Rosita Uranium Plant Update; Releases Corporate Video

Research, News, and Market Data on enCore Energy

CORPUS CHRISTI, Texas, April 18, 2022 /PRNewswire/ – enCore Energy Corp. (“enCore” or the “Company“) (TSXV: EU) (OTCQB: ENCUF) announced today that the refurbishment of its 100% owned Rosita In-Situ Recovery (ISR) Uranium Processing Plant (Rosita Plant) is presently 90% complete with an expected completion date in May 2022. The Plant modernization and refurbishment is essential to the Company goal of becoming the next producer of American uranium. enCore is also pleased to launch its first corporate video which can be viewed at: https://www.youtube.com/watch?v=b8ncNg-rq-Q

Once the modernization and refurbishment project is complete, enCore will commence commissioning work, expected to take approximately 30 days. Following commissioning work the Plant will be ready to start receiving loaded resin. Concurrently, monitor well installation, baseline water quality analysis, and hydrological testing will be completed as part of the Production Area Authorization (PAA) process with the Texas Commission on Environmental Quality. (TCEQ). Wellfield installation will begin immediately following the submittal of the PAA data package to the TCEQ. All activities are on track and on budget for a projected 2023 production start.

Simultaneously, enCore is commencing a cost benefit analysis to consider options for expansion of the current 800,000 pounds U3O8 production capacity at its Rosita Plant. The capacity of the Rosita Plant has the potential to be increased to 2,000,000 pounds U3O8 with the primary expense being acquisition and installation of a larger second dryer that could range between $1.25 and $2.0 million. No additional permits are required to upsize capacity at the Rosita Plant.

enCore congratulates the team at the licensed Rosita Plant and Kingsville Dome Plant, both located in South Texas, for operating with phenomenal safety records. The Rosita Plant has operated for 1,290 days without a Lost Time Accident and the Kingsville Dome Plant has operated for 2,662 days without any Lost Time Accidents.

enCore’s Rosita Plant, located approximately 60 miles from Corpus Christi, Texas, is a licensed, past-producing in-situ recovery (ISR) uranium plant currently under modernization and refurbishment. With a completion deadline at the end of Q2/2022, the plant is on schedule and on budget to meet a 2023 production target. The Rosita Plant is designed to process uranium feed from multiple satellite operations, all located in the South Texas area and is 1 of 11 licensed uranium processing plants in the United States, 2 of which are owned by enCore Energy.

enCore Energy is rapidly advancing towards becoming the next producer of American uranium. With approximately 90 million pounds of U3O8 estimated in the measured and indicated categories and 9 million pounds of U3O8 estimated in the inferred category1, enCore is the most diversified in-situ recovery uranium development company in the United States. enCore is focused on becoming the next uranium producer from its licensed and past-producing South Texas Rosita Processing Plant by 2023. The South Dakota-based Dewey Burdock and Wyoming Gas Hills projects offer mid-term production opportunities with significant New Mexico uranium resource endowments providing long-term opportunities. The enCore team is led by industry experts with extensive knowledge and experience in all aspects of ISR uranium operations and the nuclear fuel cycle.

|

1 Mineral resource estimates are based on technical reports prepared in accordance with NI43-101 and available on SEDAR as well as company websites at www.encoreuranium.com. |

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS: Certain information in this news release constitutes forward-looking statements under applicable securities laws. Any statements that are contained in this news release that are not statements of historical fact may be deemed to be forward-looking statements. Forward-looking statements are often identified by terms such as “may”, “should”, “anticipate”, “expect”, “potential”, “believe”, “intend” or the negative of these terms and similar expressions. Forward-looking statements in this news release include, but are not limited to, statements relating to the intended use of the net proceeds of ?the Offering and the completion of any capital project or property acquisitions. Forward-looking statements necessarily involve known and unknown risks, including, without limitation, risks associated with general economic conditions; adverse industry events; future legislative and regulatory developments; inability to access additional capital; the ability of enCore to implement its business strategies; and other risks. Readers are cautioned not to place undue reliance on forward-looking statements as there can be no assurance that the plans, intentions or expectations upon which they are placed will occur. Such information, although considered reasonable by management at the time of preparation, may prove to be incorrect and actual results may differ materially from those anticipated. Forward-looking statements contained in this news release are expressly qualified by this cautionary statement.

SOURCE enCore Energy Corp.

Energy Fuels (UUUU)(EFR:CA) – Production Timeline May Be Moving Up. Price Target Raised

Thursday, April 14, 2022

Energy Fuels (UUUU)(EFR:CA)

Production Timeline May Be Moving Up. Price Target Raised

As of April 24, 2020, Noble Capital Markets research on Energy Fuels is published under ticker symbols (UUUU and EFR:CA). The price target is in USD and based on ticker symbol UUUU. Research reports dated prior to April 24, 2020 may not follow these guidelines and could account for a variance in the price target.

Energy Fuels is the largest uranium producer in the U.S. and holds more production capacity and uranium resources than any other U.S. producer. The Company also produces vanadium. Headquartered in Colorado, Energy Fuels holds three of America’s key uranium production centers: the White Mesa Mill in Utah, the Nichols Ranch ISR Facility in Wyoming, and the Alta Mesa ISR Facility in Texas. The producing White Mesa Mill is the only conventional uranium mill in the U.S. and has a licensed capacity of 8 million pounds of U3O8 per year. Nichols Ranch is in production and has a licensed capacity of 2 million pounds of U3O8 per year. Alta Mesa is currently on standby. Energy Fuels also owns several licensed and developed uranium and vanadium mines on standby and other projects in development.

Michael Heim, Senior Research Analyst, Noble Capital Markets, Inc.

Refer to the full report for the price target, fundamental analysis, and rating.

Energy Fuels ships Uranium, Vanadium and Rare Earth Element (REE) Carbonate in the same week. The shipment of Vanadium is not unusual nor is the shipment of REE Concentrate although it is worth noting that shipments of both elements can be erratic. The shipment of Uranium to an enrichment center in Illinois does not represent sales, per se, but can be viewed as a sign that the company is getting closer to sales. While not significant by itself, the shipment all three elements in the same week represents a milestone for the company.

Energy Fuels REE production is advancing. The company has begun producing a “more advanced” form of REE Carbonate. Importantly, it was achieved with existing operations and will set the stage for the company as it takes the next step of considering complete separation of Rare Earth Elements. Energy Fuels has already begun a pilot to evaluate the separation of heavy elements and has engaged a firm …

This Company Sponsored Research is provided by Noble Capital Markets, Inc., a FINRA and S.E.C. registered broker-dealer (B/D).

*Analyst certification and important disclosures included in the full report. NOTE: investment decisions should not be based upon the content of this research summary. Proper due diligence is required before making any investment decision.

Release – Energy Fuels Hits Critical Mineral Trifecta in Rare Earths Uranium Vanadium

Energy Fuels Hits Critical Mineral ‘Trifecta’ in Rare Earths, Uranium & Vanadium; Now Performing Commercial-Scale Partial Rare Earth Separation

Research, News, and Market Data on Energy Fuels

Energy Fuels recently made commercial shipments of uranium, vanadium & advanced rare earth materials – all in a single week

LAKEWOOD, Colo., April 13, 2022 /CNW/ – Energy Fuels Inc. (NYSE: UUUU) (TSX: EFR) (“Energy Fuels” or the “Company”) is pleased to announce that during the week of April 4, the Company’s White Mesa Mill located near Blanding, Utah (the “Mill“) made three (3) commercial shipments of three (3) critical mineral products. During that week, Energy Fuels shipped:

- Natural uranium concentrates (“U3O8“) to the Metropolis Works uranium conversion facility in Metropolis, Illinois for conversion into uranium hexafluoride which will be enriched and used as fuel for the production of clean, carbon-free nuclear energy;

- Vanadium pentoxide (“V2O5“) to the Bear Metallurgical Company in Butler, Pennsylvania for conversion to ferrovanadium (“FeV“) which will be sold into the steel and specialty alloys industries; and

- High-purity mixed rare earth element (“REE“) carbonate (“REE Carbonate“) to Neo Performance Materials’ (“Neo’s“) Silmet facility in Estonia for separation into advanced REE products. The REE Carbonate had undergone partial separation at the Mill using existing Mill facilities prior to its delivery to Silmet, which is the first commercial-scale REE separation to occur in the U.S. since at least the early-2000’s (to the Company’s knowledge).

This is the first time Energy Fuels, the Mill – and perhaps any facility in history – has accomplished such a feat. The Company believes it is clearly establishing itself as a “Clean Energy and Critical Mineral Hub” for the United States.

The Company is pleased to announce that it has begun partial commercial-scale REE separations at its White Mesa Mill, located near Blanding, Utah (the “Mill“) utilizing existing Mill facilities. As a result, the Company is now producing a more advanced REE Carbonate than it did in 2021. The Company utilized an existing solvent extraction (“SX“) circuit at the Mill to remove most of the lanthanum (“La“) and produce an advanced cerium (“Ce“)-plus REE Carbonate. This product is roughly 32% – 34% neodymium-praseodymium (“NdPr“) and 1.8% terbium (“Tb“) and dysprosium (“Dy“) on a % TREO basis.

This is the first commercial-scale REE separation conducted by the Company, and to the Company’s knowledge, the first to occur in the U.S. since at least the early-2000’s. The successful integration of partial separations with existing Mill equipment and processes represents a significant advancement in Energy Fuels’ long-term plans of becoming a vertically integrated producer of advanced REE products. These separation processes also allow the Company to refine operating costs and optimize metallurgical and engineering designs for installation of a more advanced SX separation circuit at the Mill in the future. This most recent production campaign also further validates Energy Fuels’ monazite crack and leach process.

Energy Fuels continues to make rapid progress on restoring commercial REE capabilities to the United States. The Company is currently completing its latest campaign of REE Carbonate production (with partial La separation) from natural monazite sand concentrates. In July 2021, Energy Fuels began successfully extracting REEs from natural monazite utilizing a crack and leach process. The REE Carbonate that the Company has produced since July 2021 meets Neo’s commercial specifications, thereby allowing it to be fed directly into the separation process. Energy Fuels’ REE Carbonate is the most advanced REE material being produced at commercial quantities in the U.S. today, as it has been chemically altered, impurities have been removed, and it is ready for REE separation without further processing. The Company’s new REE Carbonate is even further advanced, as it has been partially separated. The Company is continuing to seek additional supplies of natural monazite sand to expand production.

The Company is also pleased to announce that it is making progress on its lab-scale REE separation pilot program. Lab-scale piloting began in 2021 and is ongoing. The Company has achieved production of a high-purity mixed NdPr oxide from its lab-scale pilot. A sample of NdPr oxide will be sent to Neo for further evaluation with the intent to sell this product as well as other separated oxides to Neo or others in the future. Through the operation of this pilot program, specific design criteria, as well as reagent costs, are being evaluated, which to date, are within initial expectations. REE separation piloting is expected to continue throughout the rest of 2022, which will also allow the Company to evaluate separation of the heavy REEs (samarium (“Sm“)-plus).

Energy Fuels has also formally engaged the French consulting firm, Carester SAS (“Carester“), to perform more detailed scoping, cost estimation, permitting support, technical support, and design for commercial “light” REE separation infrastructure at the Mill. The Company is currently preparing an application to the State of Utah, which it expects to submit in late 2022 or in early 2023. The Company plans to be in a position to initially produce up to 10,000 tonnes of total REE oxides (“TREO“) by 2025 or 2026. The preliminary, high-level scoping work Carester performed for Energy Fuels in 2021 estimated capital and operating costs to install and operate a “light” separation infrastructure at the Mill capable of producing 10,000 tonnes TREO per year, which are in line with the Company’s initial expectations. The Company’s expanded collaboration with Carester will include validation of these numbers. If confirmed, Energy Fuels expects to be among the lowest cost REE producers in the world, while also recovering uranium and possibly thorium. Energy Fuels is also evaluating the production of “heavy” REE oxides, including Dy and Tb, which could occur by 2027 or 2028.

The price of uranium has risen dramatically since Russia’s invasion of Ukraine. The spot price of natural uranium concentrates (“U3O8“) currently sits at $63.25 per pound, an increase of over 50% since December 31, 2021. Energy Fuels has been the largest producer of uranium in the United States for the past several years and has over 11.5 million pounds of annual uranium production capacity, more than any other U.S. company. As of December 31, 2021, the Company had roughly 700,000 pounds of U.S.-origin U3O8, produced by the Company in finished inventory and expects to produce an additional 100,000 to 120,000 pounds in 2022. All the Company’s current finished U.S. produced uranium inventory is at the two North American uranium conversion facilities. The Company also has additional significant stockpiled mineralized material at the Mill that can be processed relatively quickly for uranium recovery as required.

The Company has also observed a marked uptick in interest from nuclear utilities seeking long-term uranium supply, and is now actively engaged in pursuing selective long-term uranium sales contracts.

Vanadium prices have also risen substantially this year. The mid-point spot price of vanadium oxide (“V2O5“) in Europe is currently $12.00 per pound, an increase of nearly 40% since the end of 2021. Energy Fuels has begun selectively selling some of its vanadium inventory in 2022 at increasing prices per pound of V2O5. The Company is continuing to ship V2O5 to the Bear Metallurgical facility in Pennsylvania (“Bear Met“) for conversion to ferrovanadium (“FeV“) for sale into the steel and specialty alloy industries.

Mark S. Chalmers, President and CEO of Energy Fuels stated: “I believe the week of April 4, 2022 will go down as one of the most important weeks in Company history. This week, our vision of Energy Fuels as ‘America’s Critical Mineral and Clean Energy Hub’ tangibly advanced, as our White Mesa Mill in Utah sent three shipments of advanced materials containing a total of fifteen critical elements, including the rare earth elements cerium, praseodymium, neodymium, samarium, europium, gadolinium, dysprosium, terbium, holmium, yttrium, erbium, thulium, ytterbium, and lutetium, along with uranium and vanadium, to downstream processing facilities. We sent a shipment of high-purity rare earth carbonate containing 32% – 34% NdPr to Silmet in Estonia, where it will be refined and processed into various advanced materials for use in permanent magnets used in electric vehicle (EV) motors and wind generation, batteries, electronics, defense applications, and other technologies. We sent a shipment of uranium concentrates to ConverDyn in Illinois for sale to U.S. nuclear utilities for the production of carbon-free nuclear energy, and further adding to Energy Fuels’ industry-leading finished U.S.-origin uranium inventory. And, we sent another truckload of vanadium to Bear Met in Pennsylvania for conversion into ferrovanadium for use in high-strength steel and other advanced and specialty alloys.

“I could not be more proud of what our team is doing at the White Mesa Mill on rare earths. It is hard to believe, but we are currently producing commercial-scale quantities of a rare earth material that is more advanced than any other company in the U.S. We even recently began commercial-scale rare earth separation in March using existing Mill facilities, the first time the United States has produced a separated rare earth product in a couple of decades. Keep in mind that we only announced our entry into the rare earth space in April 2020. Yet barely two years later, Energy Fuels is producing commercial quantities of advanced rare earth materials. We have been able to move at ‘lightning speed,’ because we have existing licenses, expertise, and infrastructure, along with dedication and hard work. We believe we are moving faster than any other company in the U.S. on restoring low-cost, domestic critical material supply chains. At Energy Fuels, we don’t just talk about restoring critical domestic supply chains. We innovate, invest, and work hard to actually do it, all to the highest environmental, human health, and human rights standards in the world.”

Energy Fuels is a leading U.S.-based uranium mining company, supplying U3O8 to major nuclear utilities. Energy Fuels also produces vanadium from certain of its projects, as market conditions warrant, and is ramping up commercial-scale production of REE carbonate. Its corporate offices are in Lakewood, Colorado, near Denver, and all its assets and employees are in the United States. Energy Fuels holds three of America’s key uranium production centers: the White Mesa Mill in Utah, the Nichols Ranch in-situ recovery (“ISR“) Project in Wyoming, and the Alta Mesa ISR Project in Texas. The White Mesa Mill is the only conventional uranium mill operating in the U.S. today, has a licensed capacity of over 8 million pounds of U3O8 per year, has the ability to produce vanadium when market conditions warrant, as well as REE carbonate from various uranium-bearing ores. The Nichols Ranch ISR Project is on standby and has a licensed capacity of 2 million pounds of U3O8 per year. The Alta Mesa ISR Project is also on standby and has a licensed capacity of 1.5 million pounds of U3O8 per year. In addition to the above production facilities, Energy Fuels also has one of the largest NI 43-101 compliant uranium resource portfolios in the U.S. and several uranium and uranium/vanadium mining projects on standby and in various stages of permitting and development. The primary trading market for Energy Fuels’ common shares is the NYSE American under the trading symbol “UUUU,” and the Company’s common shares are also listed on the Toronto Stock Exchange under the trading symbol “EFR.” Energy Fuels’ website is www.energyfuels.com.

This news release contains “forward-looking information” within the meaning of applicable securities laws in the United States and Canada. Forward-looking information may relate to future events or future performance of Energy Fuels. All statements in this release, other than statements of historical facts, with respect to Energy Fuels’ objectives and goals, as well as statements with respect to its beliefs, plans, objectives, expectations, anticipations, estimates, and intentions, are forward-looking information. Specific forward-looking statements in this discussion include, but are not limited to, the following: any expectation that the Company may establish itself as a Clean Energy and Critical Mineral Hub in the U.S; any expectation that the Company may be successful in becoming a vertically integrated producer of advanced REE products; any expectation that the Company may be successful in helping to restore commercial REE capabilities and critical supply chains in the U.S.; any expectation that the Company may be successful in securing additional supplies of natural monazite sand to expand production; any expectation that the Company may successfully permit and install a more advanced commercial separation circuit at the Mill in the future for the separation of light and/or heavy REEs and the timing of any such permitting and installation; any expectation as to future production levels of REE oxides; any expectation that the Company may be among the lowest-cost REE producers in the world; any expectation as to the amount of uranium the Company may produce in 2022; any expectation as to stockpiled mineralized material at the Mill that may be processed for the recovery of uranium and the timing of any such processing; any expectation that the Company may secure long-term uranium sales contracts at suitable uranium prices; any expectation as to future vanadium sales and the prices of such sales; and any expectation that the Company will be able to operate at the highest environmental, human health, and human rights standards in the world. Often, but not always, forward-looking information can be identified by the use of words such as “plans”, “expects”, “is expected”, “budget”, “scheduled”, “estimates”, “continues”, “forecasts”, “projects”, “predicts”, “intends”, “anticipates” or “believes”, or variations of, or the negatives of, such words and phrases, or state that certain actions, events or results “may”, “could”, “would”, “should”, “might” or “will” be taken, occur or be achieved. This information involves known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking information. Factors that could cause actual results to differ materially from those anticipated in these forward-looking statements include risks associated with: technical difficulties; processing difficulties and upsets; licensing, permitting and regulatory delays; litigation risks; competition from others; and market factors, including future demand for and prices realized from the sale of uranium, vanadium and REEs. Forward-looking statements contained herein are made as of the date of this news release, and Energy Fuels disclaims, other than as required by law, any obligation to update any forward-looking statements whether as a result of new information, results, future events, circumstances, or if management’s estimates or opinions should change, or otherwise. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, the reader is cautioned not to place undue reliance on forward-looking statements. Energy Fuels assumes no obligation to update the information in this communication, except as otherwise required by law.

SOURCE Energy Fuels Inc.

Green Jet Fuels Succeed in a Couple of More Huge Milestones

Image Credit: Pavel Vanka (Flickr)

Jumbo Aircraft Using 100% Plant-Based Fuel on Long-Range Flight is Now Reality

The environmental future and aviation future are on the same flight path. Airbus just completed another historic milestone that puts commercial flights using only renewables closer to their destination. For the first time, an Airbus 380 “superjumbo” conducted a three-hour flight propelled by 100 % recycled cooking oil as fuel in its engines. The flight was then repeated using a mix of plant-based products. The length of the flights and duration make this a significant achievement.

The superjumbo is a double-decker plane and has room for 545 people. A version used for testing was used for this historic experiment. The “green” fuel flight began at Airbus’s hometown of Toulouse, France, and was completed on the East coast in the city of Nice.

Four days later, Airbus repeated the test when the aircraft’s Rolls Royce Trent 900 engine was fed again with a mixture of non-fossil fuels, including recycled cooking oil and agricultural residues.

Over the past year, Airbus has flown three different types of test aircraft, each having landed without incident using sustainable aircraft fuel. The huge A380, now joins the company’s A319 and A350 planes, that have flown on similar fuels.

Reduces Carbon Dioxide by 80 Percent

Commercial airlines like Air France, Lufthansa and Singapore Airlines use the 309 ton plane for long flights. With an Airbus 380’s range of 9300 miles, the eco-minded jet fuel would reduce carbon dioxide emissions by as much as 80 % on passenger flights to distant destinations.

In addition to environmental savings, Airbus, and presumably, other manufacturers can be enthusiastic that the eco-fuel is up to three percent more efficient than traditional jet fuel. With a consumption of 8.75 gallons of cooking oil per mile, over many miles, the range increases somewhat. However, the fuel that is not yet manufactured in scale costs as much as five times more than regular aviation fuels.

This means either more costly commercial airline tickets in the very first years or state subsidies funded by taxes until producing the fuel commercially gets fully off the ground. This has been done for other eco-energy sectors, including wind, solar, and EVs.

Other Green Aviation News

Eco-friendly jet fuels are being manufactured by companies like Gevo ($GEVO). The aircraft fuel manufacturer is building a huge green plant in South Dakota to make fuels from non-carbon sources. The plant won’t be producing cash flow until 2024. However, Gevo, Inc. has a strategic alliance with Axens North America, Inc. for ethanol-to-jet technology and sustainable aviation fuel commercial project development.

On March 25 Delta Air Lines signed a contract with Gevo which is a “take-or-pay” agreement with Delta to supply 75 million gallons of sustainable aviation fuel (SAF) per year for seven years.

Earlier in the fall of 2021, Chevron signed a deal to jointly invest in building and operating one or more facilities that would process corn to produce sustainable aviation fuel with GEVO.

Current research from Noble Capital Markets for the green fuel company GEVO is available on Channelchek at no cost.

Take-Away

The Air Transport Association (IATA) is the industry’s leading business trade association. The IATA has a stated aim to fly carbon neutral by 2050. Tests being undertaken by plane manufacturers like Airbus moves the world closer to accomplishing this goal. Plant-based fuel manufacturers like GEVO are working to ramp up production, which could help lower the costs to become more practical.

Managing Editor, Channelchek

Suggested Reading

Lithium Inflation and Availability Concerns Elon Musk

|

Hydrogen Powered Transportation May Include Planes by 2025

|

History Being Made in Net-Zero Passenger Flights

|

How does the Gates Buffett Natrium Reactor Work?

|

Sources

https://investors.gevo.com/news/delta-air-lines-signs-75-million-gallon-per-year-agreement-with-gevo

Stay up to date. Follow us:

|

Alvopetro Energy (ALVOF) Scheduled to Present at NobleCon18 Investor Conference

|

|

||

|

Alvopetro Energy provides a preview of their upcoming presentation at NobleCon18 NobleCon18 – Noble Capital Markets 18th Annual Small and Microcap Investor Conference – April 19-21, 2022 – Hard Rock, Hollywood, FL 100+ Public Company Presentations | Scheduled Breakouts | Panel Presentations | High-Profile Keynotes | Educational Sessions | Receptions & Networking Events Free Registration Available – More InfoResearch News and Advanced Market Data on ALVOFNobleCon18 Presenting Companies Alvopetro Energy Ltd.’s vision is to become a leading independent upstream and midstream operator in Brazil. Our strategy is to unlock the on-shore natural gas potential in the state of Bahia in Brazil, building off the development of our Caburé natural gas field and our strategic midstream infrastructure. |

|

boepd |

= |

barrels of oil equivalent (“boe”) per day |

|

bopd |

= |

barrels of oil and/or natural gas liquids (condensate) per day |

|

mmcf |

= |

million cubic feet |

|

mmcfpd |

= |

million cubic feet per day |

BOE Disclosure. The term barrels of oil equivalent (“boe”) may be misleading, particularly if used in isolation. A boe conversion ratio of six thousand cubic feet per barrel (6Mcf/bbl) of natural gas to barrels of oil equivalence is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead. All boe conversions in this news release are derived from converting gas to oil in the ratio mix of six thousand cubic feet of gas to one barrel of oil.

Forward-Looking Statements and Cautionary Language. This news release contains “forward-looking information” within the meaning of applicable securities laws. The use of any of the words “will”, “expect”, “intend” and other similar words or expressions are intended to identify forward-looking information. Forward?looking statements involve significant risks and uncertainties, should not be read as guarantees of future performance or results, and will not necessarily be accurate indications of whether or not such results will be achieved. A number of factors could cause actual results to vary significantly from the expectations discussed in the forward-looking statements. These forward-looking statements reflect current assumptions and expectations regarding future events. Accordingly, when relying on forward-looking statements to make decisions, Alvopetro cautions readers not to place undue reliance on these statements, as forward-looking statements involve significant risks and uncertainties. More particularly and without limitation, this news release contains forward-looking information concerning the plans and timing relating to the Company’s operational activities and expected gas sales and gas deliveries under Alvopetro’s long-term gas sales agreement. The forward?looking statements are based on certain key expectations and assumptions made by Alvopetro, including but not limited to equipment availability, the timing of regulatory licenses and approvals, the success of future drilling, completion, testing, recompletion and development activities, the outlook for commodity markets and ability to access capital markets, the impact of the COVID-19 pandemic, the performance of producing wells and reservoirs, well development and operating performance, foreign exchange rates, general economic and business conditions, weather and access to drilling locations, the availability and cost of labour and services, environmental regulation, including regulation relating to hydraulic fracturing and stimulation, the ability to monetize hydrocarbons discovered, the regulatory and legal environment and other risks associated with oil and gas operations. The reader is cautioned that assumptions used in the preparation of such information, although considered reasonable at the time of preparation, may prove to be incorrect. Actual results achieved during the forecast period will vary from the information provided herein as a result of numerous known and unknown risks and uncertainties and other factors. Although Alvopetro believes that the expectations and assumptions on which such forward-looking information is based are reasonable, undue reliance should not be placed on the forward-looking information because Alvopetro can give no assurance that it will prove to be correct. Readers are cautioned that the foregoing list of factors is not exhaustive. Additional information on factors that could affect the operations or financial results of Alvopetro are included in our annual information form which may be accessed on Alvopetro’s SEDAR profile at www.sedar.com. The forward-looking information contained in this news release is made as of the date hereof and Alvopetro undertakes no obligation to update publicly or revise any forward-looking information, whether as a result of new information, future events or otherwise, unless so required by applicable securities laws.

SOURCE Alvopetro Energy Ltd.