Image Credit: Jevgenijs Slihto

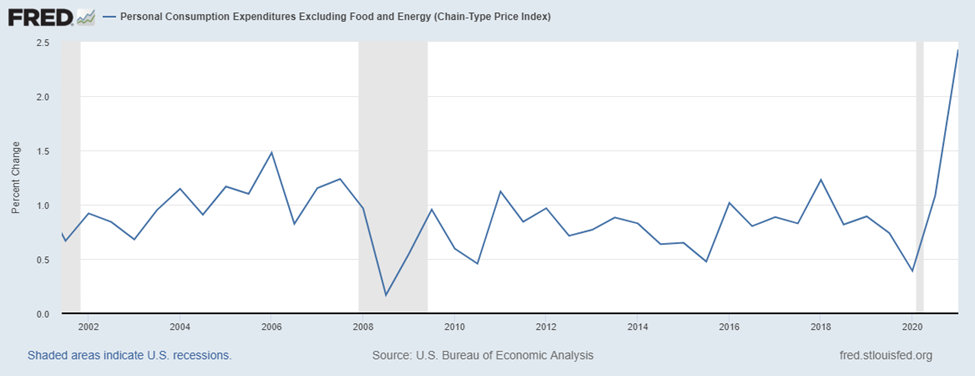

“Core PCE” Inflation Spike – Highest 3-Month Rate since 1982

Fed Chairman Powell doubled down on inflation being temporary and transitory during the post FOMC meeting press conference. Despite his official position, the Fed head admitted that the recent rate of inflation was “not moderately above” the Fed’s 2% target but “way above target.” The inflation measure that the Fed says it uses for its target is the annual “core PCE,” this spiked even higher on Friday (after the Powell’s Wednesday Press conference).

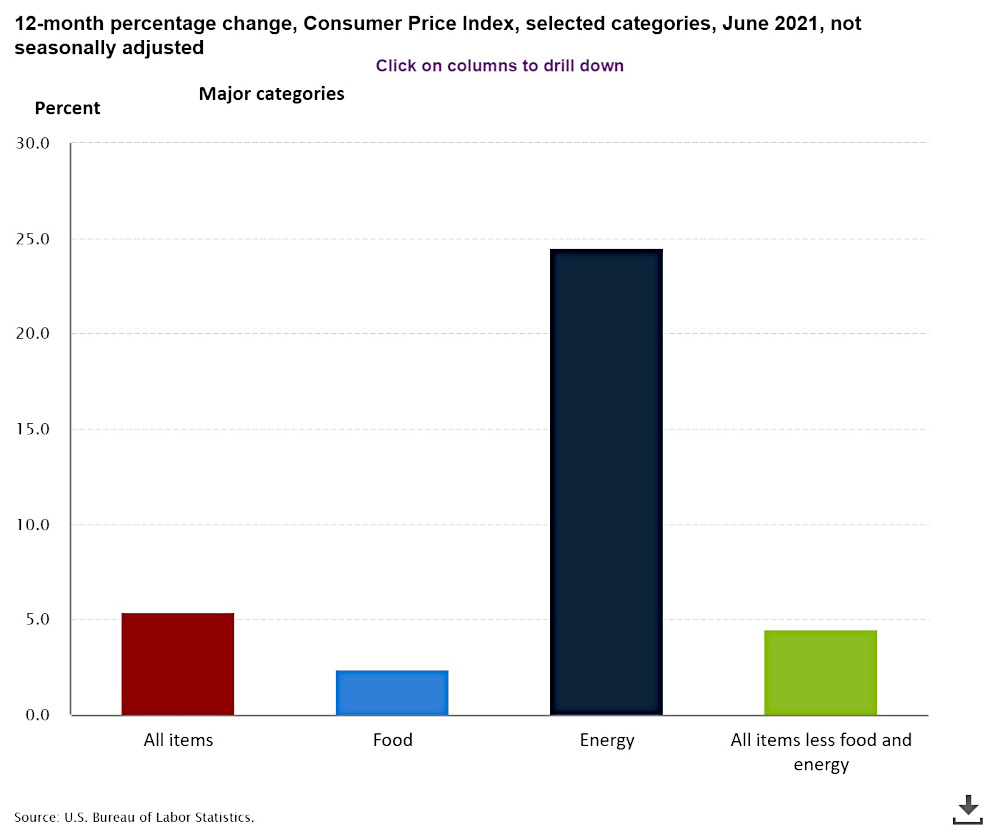

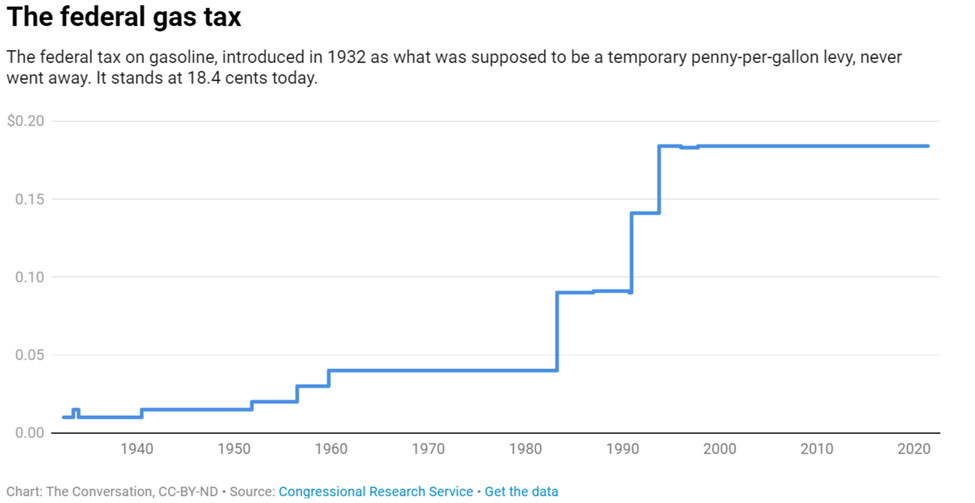

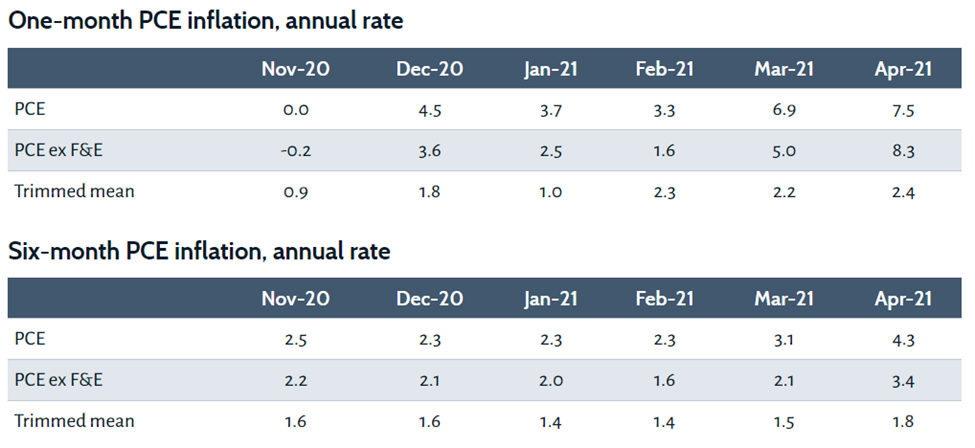

In 2012, the PCE Price Index became the inflation index used by the U.S. Federal Reserve for making monetary policy decisions. Personal consumption expenditures are among the three main parts of the Personal Income and Outlays report, the most recent was released on Friday (July 30). According to the BEA, this Personal Consumption Expenditures price index, without food and energy, jumped by 0.45% in June, from May, after having jumped by 0.5% in May, 0.7% in April, and 0.4% in March. What’s noteworthy is the Fed’s 2% target compared to the gauge they use which is up 3.5% from June last year, it is the highest year-over-year rise since May 1991.

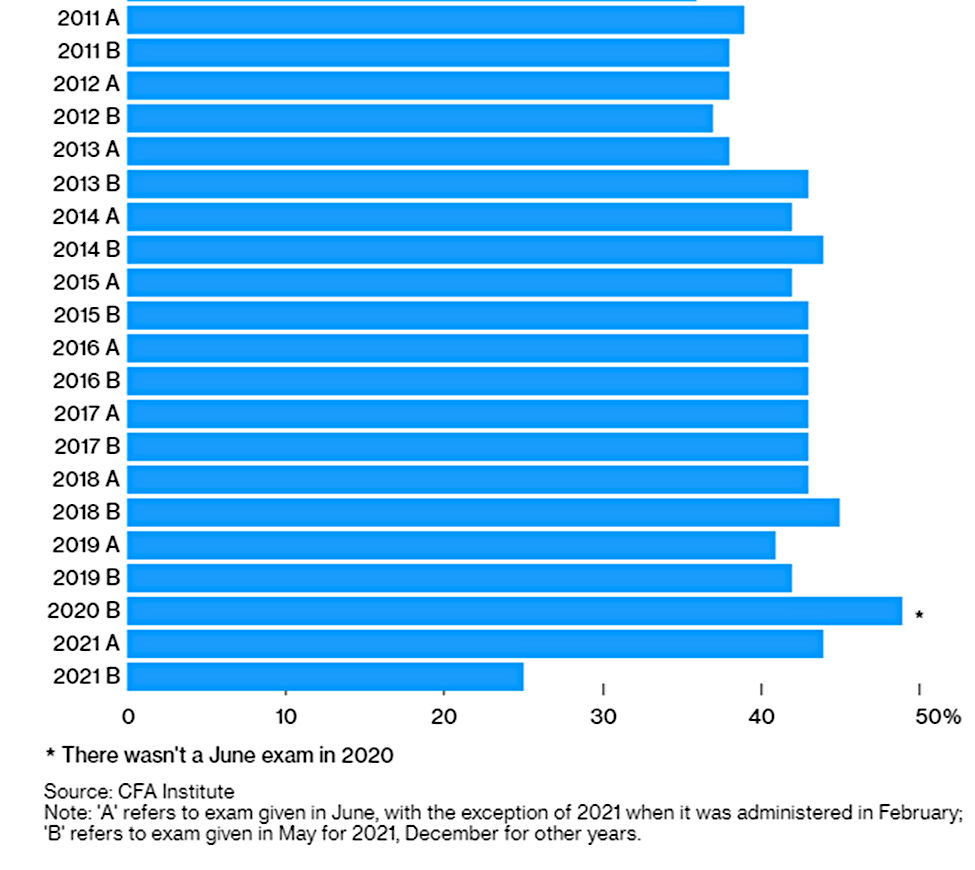

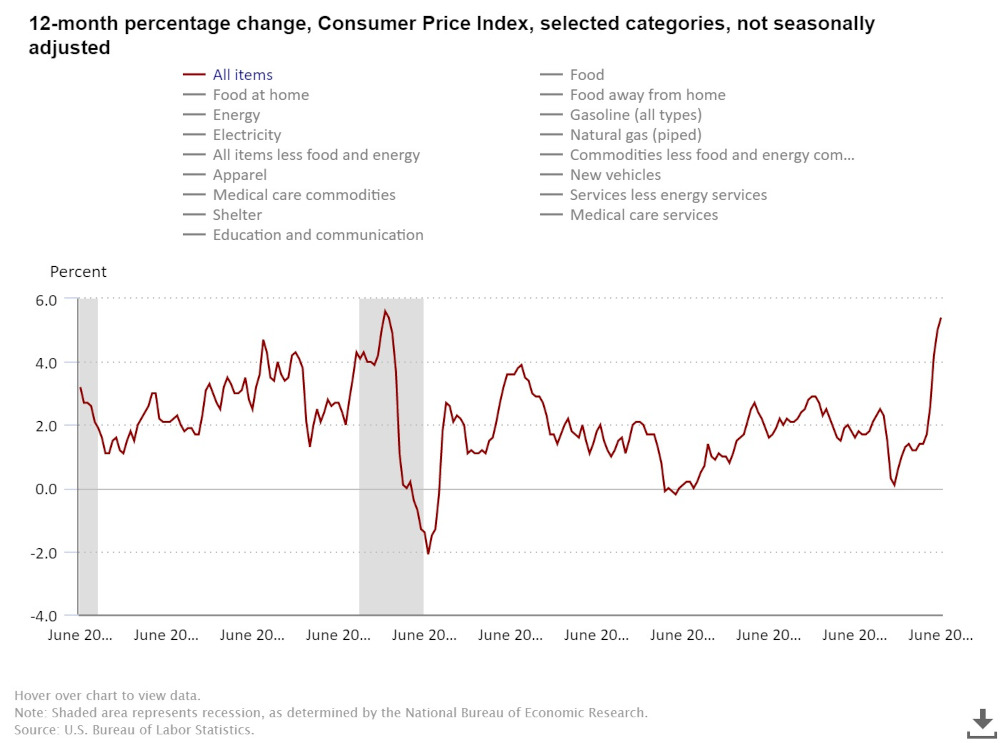

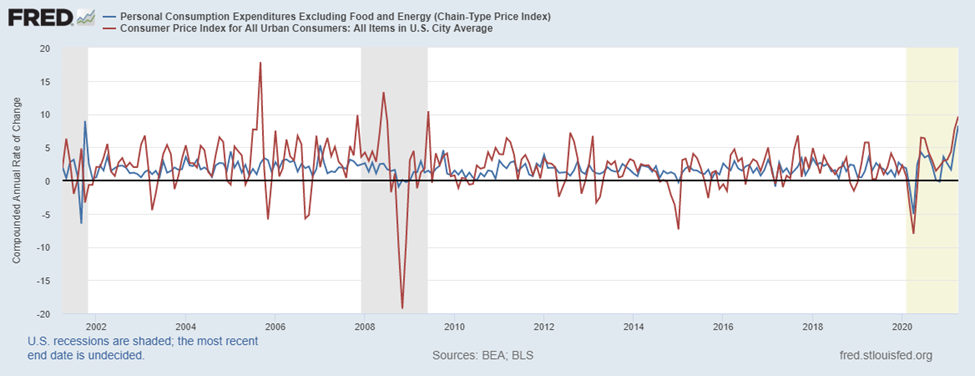

The graph below from the St. Louis Federal Reserve website is a percent change in PCE inflation measures on a semiannual basis over 20 years. The visual makes it clear that this inflation measure is currently behaving well outside of normal parameters.

The annualized rate of core PCE over April, May, and June was 6.7%, this is the highest run-rate since July 1982. Inflation has suddenly throttled up this spring and into summer. Although we’ve experienced higher inflation data historically, those price increases were always met with the Fed and the interest rate markets reacting strongly. What we have now is government officials broadcasting that inflation is not going to be long lasting, to many this temporary talk sounds reminiscent of Washington’s “only a 14-day lockdown,” and then we’ll have business as usual. It’s understandable that professionals and economic hobbyists are at home looking at the data and feeling uncertain that it is temporary. The bond market to date, often viewed as the more informed money (over stock and real estate speculation), has accepted the idea that these increases are only temporary.

So far in 2021, Fed officials have not had a perfect record. The PCE price index, which includes food and energy, also released Friday, jumped 4.0%. Every three months (roughly, as the FED only meets eight times per year), the meeting is followed by the release of “Projection Materials,” which memorializes where FOMC members think the economy and inflation are headed. The median projection for core PCE inflation is now way behind expectations. For example, in December, core PCE projection for 2021: 1.8% the actual was only actual =1.5%. In March, the core PCE projection for 2021 was 2.0% the forecast of the surge to 2.0% was perfect. By June the core PCE projection was 2.1% the actual was 3.5% when the monthly surges are added in. A miss by an additional 1.4% over the 2.1% expectation is significant and could demonstrate a lack of grasp on what’s possible.

Fed Chair Powell was asked to explain and define at Wednesday’s press conference both why monetary policy should remain easy with inflation surging, and to clear up what exactly “temporary” and “transitory” mean to him. He admitted that there was nothing temporary or transitory in the current inflation. The loss in dollar purchasing power is permanent; prices are not expected to go back to where they were.

What is expected to be transitory is the current pace of price increases. The starting point down the road could be 6% higher, but prices aren’t expected to continue increasing at the highest speed we’ve seen in 40 years. In that sense, each rate increase stands alone, so the pace is “transitory” or “temporary.” The use of semantics by Fed officials is an art form all to itself.

Paul Hoffman

Managing Editor, Channelchek

Suggested Reading:

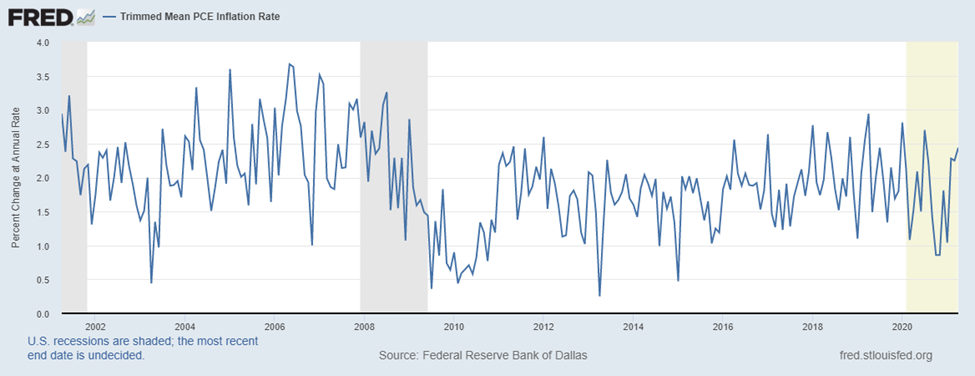

Trimmed PCE Inflation vs. the PCE Deflator

|

Is Inflation Going to Hurt Stocks?

|

A Look at Real Estate Risk to the Stock Market

|

Is the Bubble Michael Burry Warned About Still Looming?

|

Sources:

https://www.bea.gov/news/2021/personal-income-and-outlays-june-2021-and-annual-update

https://www.investopedia.com/terms/p/pce.asp

https://www.bea.gov/news/2021/personal-income-and-outlays-june-2021-and-annual-update

https://fred.stlouisfed.org/graph/?id=PCEPILFE,#0

Stay up to date. Follow us:

|