Selling at a Loss Near Year-End Could be Financially Worthwhile

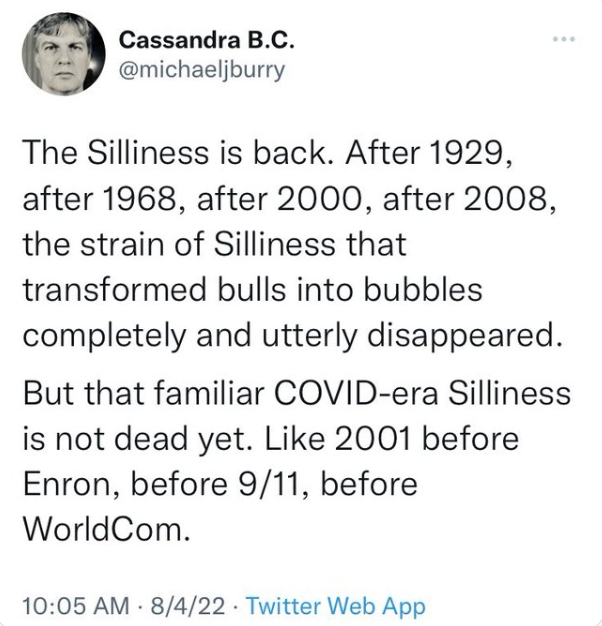

Calling someone “paper hands” is common in online trading communities such as r/wallstreetbets. It borders on a bullying tactic to encourage others on the platform to remain in stocks that have weakened. The main reason is that many in the community own and have taken a “diamond hands” position. Investors should consider that the tax code may reward those investors that are looking out for themselves first and the chat board community second.

The first three-quarters of overall market performance in 2022 can only be described as ugly. Each portfolio is likely to have its share of losses. Many investors can make a little lemonade out of the abundance of lemons that may be in their portfolios. But first, they need to take steps to harvest these lemons.

Tax Loss Harvesting

While there are many reasons that taking a loss is uncomfortable, the reason one invests in the first place is for financial gain. Playing the cards you’re handed at all times is considered prudent investing. Taking and using them to help reduce one’s tax bill can make financial sense. The tax consequence decision to sell below-cost investments and use the losses to offset gains from other investments or ordinary income is referred to as tax loss harvesting.

An example of how tax loss harvesting could help an investor financially is this. An investor will sell one or more of their negative on-the-year investments and recognize a loss. The investor then uses these capital losses to offset capital gains and/or W2 or 1099 income. If losses exceed gains by $3,000 or the losses taken up to $3,000, can be used to offset ordinary income in the current year. Amounts above $3,000 can be carried forward and used in future tax years.

There is one more step, investing in something else. The investor can either maintain their sector allocation or invest in something completely different. Buying back the same issuer name is an IRS no-no. The investors’ exposure to the overall market remains intact, but there is a $3,000 reduction in earned income or capital gains.

Wash Sale Rule

There is a link below this article to the IRS website; before executing a tax strategy, it is recommended you visit the site, and if not clear, consult your tax advisor.

One way investors have gotten themselves in trouble with the IRS is by selling a security at a loss and then reacquiring the same or substantially similar investment. If you sell a security and claim a tax loss on that sale, the Internal Revenue Service’s guidelines, commonly referred to as the “wash sale,” rule will require you don’t reinvest in the same issuer.

The wash sale rule outlines that investors cannot buy a “substantially identical” security 30 days before or after the sale of the funds chosen when conducting tax loss harvesting. This doesn’t mean the investor has to buy an investment in a completely different industry. For example, if an investor sold a silver mining company stock to harvest a tax loss — but still wants mining exposure — they could potentially buy a new or different stock within the industry.

Take Away

Taking an investment loss means a hard dollar recognition of the loss and recognition that you judged wrong. But, investing is always about maximizing financial gain. Investors that are correct 25% of the time often beat those that are correct 60% of the time. So needing to be correct could actually hurt performance. Understanding the other financial moves investors can make to maximize their overall finances can incrementally benefit their personal balance sheet.

While belonging to a consortium of investors that are stronger when sticking together is comforting, one must recognize that when it comes to investing, most will do what is best for themselves first. There is no guilt in protecting or maximizing your own finances legally.

Channelchek is a niche community of small and microcap investors. We believe in leveling the playing field by providing the exact same research and analysis to individuals at no cost that the most revered hedge funds in the country download from expensive services they subscribe to. Sign-up to receive this equity research each morning.

Managing Editor, Channelchek

Sources

https://www.irs.gov/taxtopics/tc409

https://www.nasdaq.com/articles/the-advisors-guide-to-tax-loss-harvesting