DeSantis Thinks the Federal Reserve, Elitists, and China, Should all Have Less Power in Our Financial Lives

Federal Reserve Chairman Jerome Powell, appointed by President Trump, then reappointed by President Biden recently got a lot of attention from Florida governor and presidential hopeful Ron DeSantis – and it wasn’t the kind of attention someone in Powell’s position would welcome. This week, in his first big speech on the economy, DeSantis separated himself from the top candidates from each political party by vowing to “rein in” the Fed.

The platform DeSantis unveiled this week helps establish his position and puts a face on his campaign that is decidedly above the culture wars of other political campaigns. It also creates a clear difference in economic issues between himself and his party’s frontrunner, also from Florida, Donald Trump.

In a campaign speech in New Hampshire, DeSantis blamed the US central bank for high inflation, and its dipping a toe into social policy. He was also very critical of the Fed considering a digital dollar that would compete with private crypto, which the candidate does not oppose.

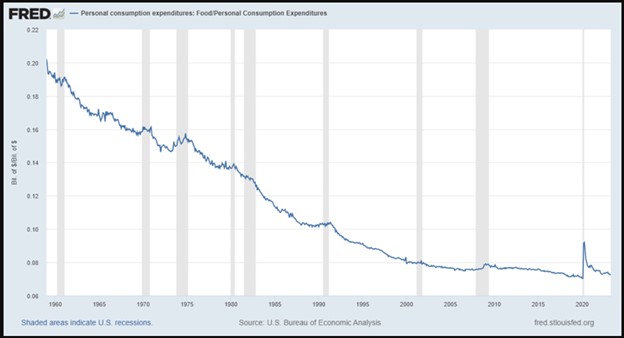

The overall tone as he began to lay out his economic agencda, was one of looking to curb the power of large corporations, limit ties to China, and stand against powerful elites. “We need to rein in the Federal Reserve. It is not designed or supposed to be an economic central planner. It is not supposed to be indulging in social justice or social engineering,” the governor said. He continued, “It’s got one job, maintaining stable prices, and it has departed from that with what it’s done over the past many years.”

As statements that could be taken as a shot at the current Fed chairman, DeSantis said he would not likely support another term for Powell. “I will appoint a Chair of the Federal Reserve who understands the limited role that it has and focuses on making sure that prices are stable for American businesses and consumers, said DeSantis.

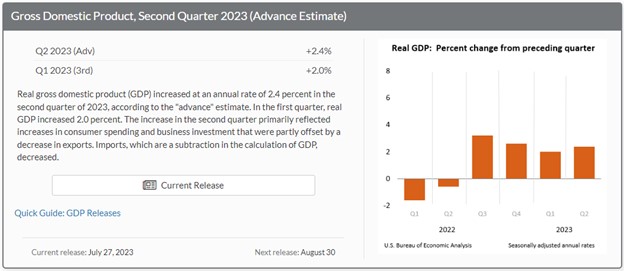

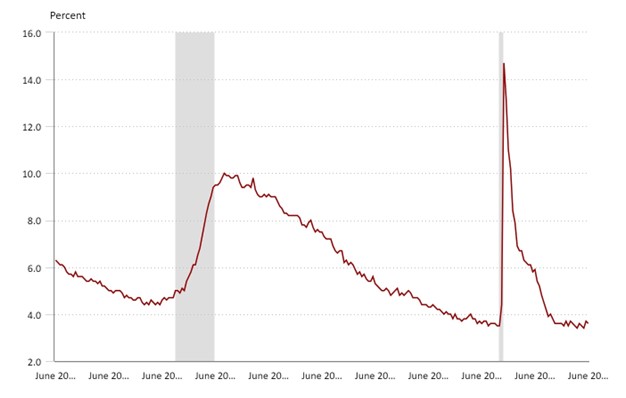

What seemed to be his biggest gripe with how the Federal Reserve has been run is with monetary policy. He believes that policy was kept too easy for too long after the financial crisis and pandemic. He believes this contributed to the high inflation, which forced a rapid tightening from policy makers.

The popular governor of the third most populace state, also railed against the Fed’s steps toward creating a central bank digital currency (CBDC), saying it was trying to crush financial liberty and seize more control over financial transactions.

“Why did they want this? They want to go to a cashless society. They want to eliminate cryptocurrency and they want all the transactions to go through this central bank digital currency,” DeSantis proclaimed.

The DeSantis economic vision, as described, was consistent with his reputation as Florida’s executive which is one that stands against the abuses of government power and big business. “We cannot have policy that kowtows to the largest corporations and Wall Street at the expense of small businesses and average Amerricans.” He continued, “There is a difference between a free-market economy, which we want, and corporatism in which the rules are jiggered to be able to help incumbent companies.”

He also expressed concern over loss of economic sovereignty sharply saying, “We have to restore the economic sovereignty of this country and take back control of our economy from China. This abusive relationship between two countries, must come to an end.”

Take Away

DeSantis is on the road, both showing he has an understanding of economics and unveiling a plan that is distinct from the top two candidates, both of which have already occupied the White House. DeSantis is being watched very closely by both political parties as he is a very popular governor with a lot of admiration and a large following. Florida remains a beneficiary of the large migration of businesses and families out of other states looking for a more innovative, fiscally responsible, less constricting place to live and do business.

Paul Hoffman

Managing Editor, Channelchek

Source

https://www.wmur.com/article/desantis-economic-plan-new-hampshire/44694804

https://www.ft.com/content/40cfecfb-e597-4bba-9ca6-a0fccb187184