|

|

|

Heron Therapeutics CEO Barry Quart & President John Poyhonen deliver a formal corporate overview, followed by a Q & A session moderated by Noble Capital Markets Senior Healthcare Services & Medical Devices Analyst Gregory Aurand. Return to the Investor Forum Event Page

Heron Therapeutics, Inc. is a commercial-stage biotechnology company focused on improving the lives of patients by developing best-in-class treatments to address some of the most important unmet patient needs. Our advanced science, patented technologies, and innovative approach to drug discovery and development have allowed us to create and commercialize a portfolio of products that aim to advance the standard-of-care for acute care and oncology patients. For more information, visit www.herontx.com. |

Author: Admin

Does Net Profit Matter for Marijuana Stocks?

Image Credit: "thöR (Flickr)

Reconciling Marijuana Revenue with Marijuana Company Losses

What if the world’s largest cannabis producer by sales is also among the marijuana businesses with the largest losses? Should it concern investors in this newly sprouted sector that the company they are waiting on to grow is growing sales, but net profit is always red? Many investors are now scratching their heads and checking their patience with the largest company in this sector.

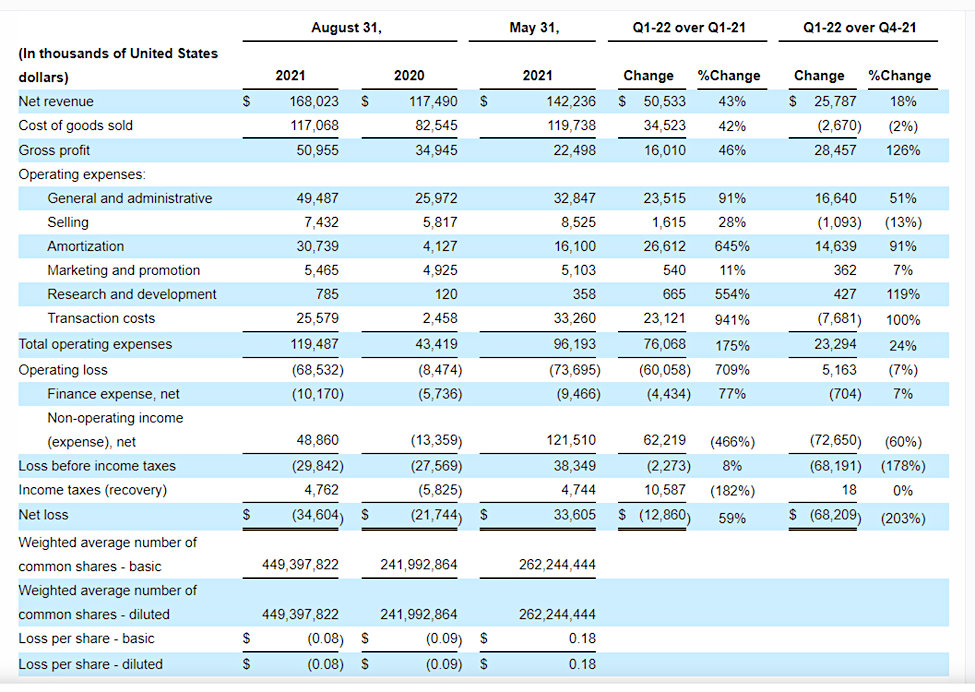

Tilray, the largest cannabis company by sales, reported revenue rose to $168 million for the quarter ended August 31, 2021. This is over $50 million higher than the year-earlier period. At the same time, the company reported its quarterly net loss widened to $34.6 million, approximately $13 million more compared to a year ago.

Income Statement Highs and Lows

If you look at a company’s Income Statement, the top line is Net Revenue, it’s sometimes labeled “Sales” or “Net Sales” As the entry title suggests this is all incoming money from goods sold, and it’s before all costs. How much of this is left after expenses determine “Net Profit” which is reported on the below example using Tilray’s Income Statement as Net Loss.

Tilray income Statement (as reported October 7, 2021)

Below the net revenue number is Cost of Goods Sold; these upfront raw material costs are immediately subtracted from revenue. Expenses include running the business, selling expenses, depreciation costs (amortization), marketing costs, product development, and in this case also include a high Transaction cost. After deducting all expenses, just before the double line, the statement provides the company’s “Net profit”, or in the above case Net Loss. For Tilray, this number is a negative $36,604,000.

What’s More Important,

Revenue or Profit?

The first step toward profit is revenue, so revenue is very important — if a company isn’t growing revenue while the market for its product is growing, they are falling behind in market share. In rapidly growing markets, it is not uncommon for there to be more investment in building the business infrastructure, which could include expensive transactions to buy assets in other markets or verticals.

As a longer-term investor, you want management to have a vision that takes advantage of expected realities. A recent example was this past Monday when Tesla reported. The market saw another industry that was non-existent before 2008 have its largest producer turn a profit. Tesla, since it was just a seed in Elon Musk’s mind, had not turned a profit selling cars until last quarter. In many ways, the EV industry is like the cannabis industry. The potential for the future looks extremely promising, but only for those that grow big enough, fast enough to survive the competition.

The lifecycle stage of an industry is a key consideration on whether investors should be concerned with negative bottom lines. It’s expected that fundamentals in terms of more open markets and easier transactions that the cannabis industry will experience growth well beyond its current pace. With this, companies in the sector are expected to have big improvements in revenue every year but operate at a loss. They are investing aggressively to lay the groundwork for the future.

As an investor, your main question is whether you have confidence in the industry, and do you have confidence in the way the company is investing in their future for the stockholders.

Understanding and agreeing with management’s vision for the company and whether or not they are delivering on that vision provides the best answer as to whether an investor should be concerned that a company hasn’t reported a positive net profit.

Source: Press release dated October 7, 2021

-Tilray CEO explains building momentum growing market base.

If investors understand the company’s strategy and vision and believe that it will eventually reach an inflection point to become sustainable, and increasingly profitable, then the stock will attract more attention and could outperform even if earnings are negative.

Take-Away

Losses for young companies in fledgling growth industries are common. Investors should have different expectations at the early part of any industry’s lifecycle. Negative earnings on their own can be deceiving. Realistic future potential is why most investors get involved. You want forward-looking, visionary management. Investors in companies at this stage often rely more on cash flow statements for corporations investing in themselves that show strong revenue growth. Weak cash flow may create difficulties for management, whereas one might be able to discern a positive economic reality if there is solid cash flow.

Investors not in tune with the fundamentals presented in a company’s quarterly report may look to see if there are well-qualified equity analysts covering the company they’re interested in. Channelchek is a no-cost resource for research and analysis from top-ranked equity analysts covering growth industries.

Future Research Analysts

Each year Noble Capital Markets, Channelchek, and generous sponsors hold the Channelchek College Equity Research Challenge.

We invite students to compete for high cash prizes awarded to the student and the student’s college – plus an offer for an internship at the largest company-sponsored research provider in the U.S.

Who can compete?

You don’t have to be a finance, accounting, or major in a related field to understand that up to $7500 for you, and an additional $5,000 to your school can be quite helpful. If you are fully matriculated and interested, you likely qualify.

Suggested Content:

Schwazze – C-Suite Interview with CEO, Justin Dye (video)

|

Driven by Stem – Virtual Road Show Replay (video)

|

Sources:

https://www.investingdaily.com/analyst/scott-chan/#archives

https://en.wikipedia.org/wiki/Tilray

https://www.newcannabisventures.com/cannabis-company-revenue-ranking/

Stay up to date. Follow us:

|

BioElectronics Corporation (BIEL) – New Developments in Pain Management – a NobleCon Online Investor Event

|

|

|

BioElectronics VP of Product Development Sree Koneru delivers a formal corporate overview, followed by a Q & A session moderated by Noble Capital Markets Senior Healthcare Services & Medical Devices Analyst Gregory Aurand. Return to the Investor Forum Event Page

Headquartered in Frederick, Maryland, and founded in 2000, BioElectronics Corporation is the leading company in the field on non-invasive electroceutical medical devices. BioElectronics is the maker of disposable, drug-free, pain therapy devices: ActiPatch® Therapy, over-the-counter treatment for back pain and other musculoskeletal complaints; RecoveryRx® Therapy for postoperative pain and chronic wound care. |

Release – ISG to Announce Third-Quarter Financial Results

ISG to Announce Third-Quarter Financial Results

STAMFORD, Conn.–(BUSINESS WIRE)– Information Services Group (ISG) (Nasdaq: III), a leading global technology research and advisory firm, said today it will release its third-quarter financial results on Thursday, November 4, 2021, at approximately 4:30 p.m., U.S. Eastern Time.

The firm will host a conference call with investors and industry analysts the following day, Friday, November 5, 2021, at 9 a.m., U.S. Eastern Time. Dial-in details are as follows:

- The dial-in number for U.S. participants is 1-877-502-9276;

- International participants should call 001-313-209-4906;

- The security code to access the call is 5609449.

Participants are requested to dial in at least five minutes before the scheduled start time.

A recording of the conference call will be accessible on ISG’s website (www.isg-one.com) for approximately four weeks following the call.

About ISG

ISG (Information Services Group) (Nasdaq: III) is a leading global technology research and advisory firm. A trusted business partner to more than 700 clients, including more than 75 of the world’s top 100 enterprises, ISG is committed to helping corporations, public sector organizations, and service and technology providers achieve operational excellence and faster growth. The firm specializes in digital transformation services, including automation, cloud and data analytics; sourcing advisory; managed governance and risk services; network carrier services; strategy and operations design; change management; market intelligence and technology research and analysis. Founded in 2006, and based in Stamford, Conn., ISG employs more than 1,300 digital-ready professionals operating in more than 20 countries—a global team known for its innovative thinking, market influence, deep industry and technology expertise, and world-class research and analytical capabilities based on the industry’s most comprehensive marketplace data. For more information, visit www.isg-one.com.

Source: Information Services Group, Inc.

Release – Comtech Telecommunications Corp. Announces $5.6 Million Contract Renewal to Provide Messaging Application Support

Comtech Telecommunications Corp. Announces $5.6 Million Contract Renewal to Provide Messaging Application Support

“We are pleased to continue providing support to ensure reliable text messaging services,” said

The contract was awarded to Comtech’s Trusted Location group, a leading provider of precise device location, mapping and messaging solutions for public safety, mobile network operators and enterprise solutions. Sold around the world to mobile network operators, government agencies, and Fortune 100 enterprises, its platforms locate, map, track and message. For more information, visit www.comtechlocation.com.

Certain information in this press release contains statements that are forward-looking in nature and involve certain significant risks and uncertainties. Actual results could differ materially from such forward-looking information. The Company’s

Comtech Investor Relations:

631-962-7005

investors@comtech.com

Source:

Release – Endeavour Silver Produces 1305399 Oz Silver And 10541 Oz Gold For 2.1 Million Oz Silver Equivalents In Q3, 2021

Endeavour Silver Produces 1,305,399 Oz Silver And 10,541 Oz Gold For 2.1 Million Oz Silver Equivalents In Q3, 2021; 2021 Consolidated Production Guidance Raised To 7.7 – 8.0 Million Oz Silver Equivalents

VANCOUVER, British Columbia, Oct. 07, 2021 (GLOBE NEWSWIRE) — Endeavour Silver Corp. (NYSE: EXK) (TSX: EDR) reports production of 1,305,399 silver ounces (oz) and 10,541 gold oz in Q3, 2021, for silver equivalent (“AgEq”) production of 2.1 million oz at an 80:1 silver:gold ratio, totaling 6.1 million AgEq oz for the 9 months ended September 30, 2021.

Management has increased 2021 consolidated production guidance to 7.7 – 8.0 million oz silver equivalents to reflect continued strong performance at Guanacevi due to higher than expected grades and tonnage milled. Full details are provided in the section, “Revision to Full Year 2021 Guidance” in this news release.

2021 Third Quarter Highlights

- Consolidated Production Ahead of Plan: Silver equivalent production at each mine is on track to meet or exceed 2021 production plans.

- Guanacevi Production Ahead of Plan: Higher throughput and higher silver and gold grades resulted in record production during the quarter, ahead of the annual plan. Based on continued strong performance, the operations team has significantly improved the production outlook for the full year, resulting in an estimated 20% increase in silver equivalent metal.

- Bolanitos Production on Plan: Processed tonnes were ahead of plan, offset by lower ore grades.

- El Compas Suspended: Final stockpiles were processed subsequent to the suspension of operations in early August. Most of the company personnel have been transferred to other sites or laid off, while the mine and plant have been placed on temporary care and maintenance. Management is evaluating several opportunities.

- Metal Sales and Inventories: Sold 699,540 oz silver and 9,925 oz gold, held 1,030,304 oz silver and 1,211 oz gold of bullion inventory and 37,100 oz silver and 2,028 oz gold in concentrate inventory. Management continued to withhold metal from sale during the price correction over the third quarter and plans to sell the withheld metal inventory in anticipation of a precious metal prices rebound.

- Robust Economics in the Terronera Feasibility Study: Favorable outcomes including improved confidence in the project cost, design and operability provide a strong position for securing project financing. The Terronera Project Technical Report, authored in accordance with National Instrument 43-101, will be filed on SEDAR and EDGAR by October 24, 2021.

- Acquired Bruner Gold Project in Nye County, Nevada: Completed the acquisition of an advanced stage gold exploration project in a favourable jurisdiction for US$10 million in cash.

Dan Dickson, CEO, commented, “We are well positioned to exceed our original full year consolidated production guidance, which has led to the decision to formally revise our annual targets. Our 2021 business plan shows strong performance, which has resulted in higher production than last year, despite suspending operations at the small El Compas mine. This reaffirms an important year of investment into our people and culture programs to ensure the long-term sustainability of our operations.”

“Entering the fourth quarter, we are also continuing with our exploration programs and anticipate releasing additional drill results at Terronera, building on the encouraging regional results we announced previously this year. We are advancing the Terronera development and continue to negotiate critical contracts, procure various long lead equipment items and general mine equipment, are increasing the work force and preparing for early earth works.”

Mine Operations

Consolidated silver production increased by 39% compared to Q3 2020, primarily driven by a 46% increase in silver production at the Guanacevi mine offset by the suspension of operations at the El Compas mine. Gold production increased by 3% with the Guanacevi mine seeing a 47% increase in silver equivalent ounces produced which was offset the suspension of operations at the El Compas mine. Silver and gold production at the Bolanitos mine increased moderately with a 11% increase in silver production and an 8% increase in gold production.

Guanacevi throughput exceeded plan and mining the new higher grade El Curso orebody has led to significantly improved grades and mine plan flexibility. Additionally, supplies of local third-party ores continued to supplement mine production, amounting to 10% of quarterly throughput, and contributing to the higher ore grades.

Bolanitos and El Compas processed tonnes were higher compared to plan and offset by lower grades, due to normal variations in the Bolanitos ore body and a lower grade of the final stockpile at El Compas.

As previously disclosed by the Company (see news release dated January 7, 2021), the existing reserve at El Compas was sufficient to continue mining until mid-2021. Management suspended operations in early August and is currently assessing opportunities.

Revision to Full Year 2021 Production Guidance

Updates to the full year 2021 consolidated production guidance are driven by strong performance at Guanacevi, while production at Bolanitos will remain the same as originally estimated for silver with a small increase in gold. Other operational components of the Company’s full year guidance remain unchanged from the targets released in the news release dated January 28, 2021, with the exception of the newly increased development budget at Terronera for an additional $13 million until year end.

The COVID-19 pandemic remains relevant in Mexico, and at the Company’s business locations, process and protocols remain in place to ensure staff and workers as well as our communities remain as safe as possible. Any unforeseen outbreaks could impact production.

| Guanacevi | Bolanitos | El Compas | Consolidated | |

| Tonnes per Day (TPD) | 1,000 – 1,200 | 1,000 – 1,200 | 200 – 250 | 2,400 – 2,650 |

| Silver Production (M oz) | 4.0 – 4.2 | 0.4 – 0.5 | 0.1 – 0.1 | 4.5 – 4.8 |

| Gold Production (K oz) | 12.0 – 13.0 | 24.0 – 25.0 | 4.1 – 4.1 | 40.1 – 42.1 |

| Silver Eq Production (M oz) | 5.0 – 5.2 | 2.3 – 2.5 | 0.4 – 0.4 | 7.7 – 8.0 |

| 2021 silver equivalent production is calculated using an 80:1 silver:gold ratio. | ||||

Production Highlights for Three Months and Nine Months Ended September 30, 2021

| Three Month Ended September | Nine Months Ended September | |||||

| 2021 | 2020 | % Change | 2021 | 2020 | % Change | |

| 222,461 | 206,324 | 8% | Throughput (tonnes) | 673,932 | 519,771 | 30% |

| 1,305,399 | 942,274 | 39% | Silver ounces produced | 3,427,223 | 2,396,478 | 43% |

| 10,541 | 10,260 | 3% | Gold ounces produced | 32,816 | 24,553 | 34% |

| 1,295,126 | 932,837 | 39% | Payable silver ounces produced | 3,394,103 | 2,373,246 | 43% |

| 10,328 | 10,041 | 3% | Payable gold ounces produced | 32,177 | 24,078 | 34% |

| 2,148,679 | 1,763,074 | 22% | Silver equivalent ounces produced (1) | 6,052,503 | 4,360,718 | 39% |

| 699,539 | 741,262 | (6%) | Silver ounces sold | 2,443,184 | 2,041,601 | 20% |

| 9,925 | 8,997 | 10% | Gold ounces sold | 30,398 | 21,669 | 40% |

| Silver equivalent ounces calculated using 80:1 ratio. | ||||||

Production Tables for Third Quarter, 2021 by Mine (1)

| Production | Tonnes | Tonnes | Grade | Grade | Recovery | Recovery | Silver | Gold |

| by mine | Produced | per day | Ag gpt(1) | Au gpt(1) | Ag % | Au % | Oz | Oz |

| Guanaceví | 105,496 | 1,147 | 387 | 1.13 | 89.5% | 94.1% | 1,174,168 | 3,605 |

| Bolañitos | 107,752 | 1,171 | 41 | 1.98 | 87.2% | 90.6% | 123,883 | 6,215 |

| El Compas | 9,213 | 192 | 24 | 1.81 | 103.4% | 134.5% | 7,348 | 721 |

| Consolidated | 222,461 | 2,445 | 204 | 1.57 | 89.3% | 93.9% | 1,305,399 | 10,541 |

| (1) gpt = grams per tonne | ||||||||

Production Tables for Nine Months Ended September 30, 2021 by Mine (1)

| Production | Tonnes | Tonnes | Grade | Grade | Recovery | Recovery | Silver | Gold |

| by mine | Produced | per day | Ag gpt(1) | Au gpt(1) | Ag % | Au % | Oz | Oz |

| Guanaceví | 306,021 | 1,117 | 353 | 1.05 | 87.3% | 91.3% | 3,031,626 | 9,432 |

| Bolañitos | 313,356 | 1,144 | 39 | 2.09 | 89.1% | 90.9% | 350,154 | 19,150 |

| El Compas | 54,555 | 199 | 36 | 3.05 | 72.0% | 79.1% | 45,443 | 4,234 |

| Consolidated | 673,932 | 2,460 | 181 | 1.70 | 87.2% | 89.3% | 3,427,223 | 32,816 |

| (1) gpt = grams per tonne | ||||||||

Release of Third Quarter, 2021 Financial Results and Conference Call

The 2021 Third Quarter Financial Results will be released before market on Tuesday, November 9, 2021 and a telephone conference call will be held the same day at 10:00am PT (1:00pm ET). To participate in the conference call, please dial the numbers below. No pass code is necessary.

Toll-free in Canada and the US: 1-800-319-4610

Local Vancouver: 604-638-5340

Outside of Canada and the US: +604-638-5340

A replay of the conference call will be available by dialing 1-800-319-6413 in Canada and the US (toll-free) or +604-638-9010 outside of Canada and the US. The required pass code is 7870#. The audio replay and a written transcript will be available on the Company’s website at www.edrsilver.com under the Investor Relations, Events section.

About Endeavour Silver – Endeavour Silver Corp. is a mid-tier precious metals mining company that owns and operates two high-grade, underground, silver-gold mines in Mexico. Endeavour is currently advancing the Terronera mine project towards a development decision and exploring its portfolio of exploration and development projects in Mexico and Chile to facilitate its goal to become a premier senior silver producer. Our philosophy of corporate social integrity creates value for all stakeholders.

SOURCE Endeavour Silver Corp.

Contact Information:

Galina Meleger, Vice President, Investor Relations

Toll free: (877) 685-9775

Tel: (604) 640-4804

Email: gmeleger@edrsilver.com

Website: www.edrsilver.com

Follow Endeavour Silver on Facebook, Twitter, Instagram and LinkedIn

Cautionary Note Regarding Forward-Looking Statements

This news release contains “forward-looking statements” within the meaning of the United States private securities litigation reform act of 1995 and “forward-looking information” within the meaning of applicable Canadian securities legislation. Such forward?looking statements and information herein include but are not limited to statements regarding the impact of suspension of mining operations, Endeavour’s anticipated performance in 2021, including production forecasts, cost estimates and metal price estimates, and the timing and results of mine expansion and development and receipt of various permits. The Company does not intend to and does not assume any obligation to update such forward-looking statements or information, other than as required by applicable law.

Forward-looking statements or information involve known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Endeavour and its operations to be materially different from those expressed or implied by such statements. Such factors include, among others, uncertainty of the ultimate impact of the COVID 19 pandemic on operations, changes in national and local governments, legislation, taxation, controls, regulations and political or economic developments in Canada and Mexico; operating or technical difficulties in mineral exploration, development and mining activities; risks and hazards of mineral exploration, development and mining; metal prices; the speculative nature of mineral exploration and development, risks in obtaining necessary licenses and permits, and challenges to the Company’s title to properties; as well as those factors described in the section “risk factors” contained in the Company’s most recent form 40F/Annual Information Form filed with the S.E.C. and Canadian securities regulatory authorities.

Forward-looking statements are based on assumptions management believes to be reasonable, including but not limited to: the continued operation of the Company’s mining operations ,the impact of the COVID 19 pandemic on mining operations in Mexico generally, and the Company’s operations specifically, no material adverse change in the market price of commodities, mining operations will operate and the mining products will be completed in accordance with management’s expectations and achieve their stated production outcomes, resource and reserve estimates, metal prices, and such other assumptions and factors as set out herein. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or information, there may be other factors that cause results to be materially different from those anticipated, described, estimated, assessed or intended. There can be no assurance that any forward-looking statements or information will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements or information. Accordingly, readers should not place undue reliance on forward-looking statements or information.

Source: Endeavour Silver Corporation

Baudax Bio (BXRX) – New Developments in Pain Management – a NobleCon Online Investor Event

|

|

|

Baudax Bio President and CEO Gerri Henwood delivers a formal corporate overview, followed by a Q & A session moderated by Noble Capital Markets Senior Healthcare Services & Medical Devices Analyst Gregory Aurand. Return to the Investor Forum Event Page

Baudax Bio is a pharmaceutical company focused on commercializing and developing innovative products for acute care settings. ANJESO is the first and only 24-hour, intravenous (IV) COX-2 preferential non-steroidal anti-inflammatory (NSAID) for the management of moderate to severe pain. In addition to ANJESO, Baudax Bio has a pipeline of other innovative pharmaceutical assets including two novel neuromuscular blocking agents (NMBAs) and a proprietary chemical reversal agent specific to these NMBAs. For more information, please visit www.baudaxbio.com. |

Release – ProMIS Neurosciences Announces Special Shareholder Meeting

ProMIS Neurosciences Announces Special Shareholder Meeting

TORONTO, Ontario and CAMBRIDGE, Mass. – October 7, 2021 – ProMIS Neurosciences Inc. (TSX: PMN) (OTCQB: ARFXF) (the “Company”), a biotechnology company focused on the discovery and development of antibody therapeutics targeting toxic oligomers implicated in the development of neurodegenerative diseases, is pleased to announce that it will hold a special general meeting of shareholders (the “Special Meeting”) on December 1, 2021. The Company has set October 18, 2021, as the record date for the Special Meeting.

The purpose of the Special Meeting is to ask shareholders to grant the Board of Directors (the “Board”) the authority, exercisable in the Board’s discretion, to consolidate (or reverse split) the Company’s issued and outstanding common shares in furtherance of a potential listing of the Company’s shares on a stock exchange in the United States. The full particulars of the special business will be set out in the management information circular for the Special Meeting, which will be mailed to shareholders and filed on SEDAR after the record date.

“With the recent closing of our successful financing, our lead program PMN310 is presently on track to complete all of the work necessary to file an IND in the second half of 2022 as well as initiate Phase 1 clinical trials soon thereafter,” stated Eugene Williams, the Company’s Executive Chairman. “We believe a listing on a stock exchange in the United States, which should provide greater liquidity for our shareholders, should also provide greater access to capital to help expedite the development of our potential therapies and the process of obtaining clinical validation of such potential therapies.”

At the Special Meeting, the shareholders will be specifically asked to consider, and if deemed advisable, pass a special resolution authorizing the Board to determine, at its discretion, to file articles of amendment to consolidate the common shares of the Company at a consolidation ratio within the range to be specified in the proxy materials. Subject to shareholder approval, the Board intends to proceed with a share consolidation in furtherance of a listing of the Company’s shares on a stock exchange in the United States but there can be no assurances that any such listing will occur following shareholder approval, a share consolidation or otherwise. Further, there is no assurance that the Company will meet the quantitative or qualitative requirements to list on a stock exchange in the United States. Finally, notwithstanding approval of the resolution by shareholders, the Board will retain the discretion to elect not to proceed with the share consolidation.

Any authority proposed to be granted to the Board to consolidate the shares is conditional upon the prior approval of the Toronto Stock Exchange.

About ProMIS Neurosciences

ProMIS Neurosciences, Inc. is a development stage biotechnology company focused on discovering and developing antibody therapeutics selectively targeting toxic oligomers implicated in the development and progression of neurodegenerative diseases, in particular Alzheimer’s disease (AD), amyotrophic lateral sclerosis (ALS) and Parkinson’s disease (PD). The Company’s proprietary target discovery engine is based on the use of two complementary techniques. The Company applies its thermodynamic, computational discovery platform—ProMI and Collective Coordinates—to predict novel targets, known as Disease Specific Epitopes, on the molecular surface of misfolded proteins. Using this unique approach, the Company is developing novel antibody therapeutics for AD, ALS and PD. ProMIS is headquartered in Toronto, Ontario, with offices in Cambridge, Massachusetts. ProMIS is listed on the Toronto Stock Exchange under the symbol PMN, and on the OTCQB Venture Market under the symbol ARFXF.

For further information about ProMIS Neurosciences, please consult the Company’s website at: www.promisneurosciences.com

For Investor Relations please contact:

Alpine Equity Advisors Nicholas Rigopulos, President nick@alpineequityadv.com Tel. 617 901-0785

The Toronto Stock Exchange has not reviewed and does not accept responsibility for the adequacy or accuracy of this news release.

This news release contains certain “forward-looking statements” within the meaning of such statements under applicable securities law. Forward-looking statements are frequently characterized by words such as “anticipates”, “plan”, “continue”, “expect”, “project”, “intend”, “believe”, “anticipate”, “estimate”, “may”, “will”, “potential”, “proposed”, “positioned” and other similar words, or statements that certain events or conditions “may” or “will” occur including, but not limited to, statements related to the intent of the Company to pursue a potential listing of its common shares on a stock exchange in the United States and the potential benefits to the Company and its shareholders related to such a listing, the Company conducting a share consolidation in furtherance of a potential listing of its common shares on a stock exchange in the United States and the potential timing for the filing of an IND and the commencement of clinical trials related to the Company’s lead program PMN310. Readers are cautioned that forward-looking statements are based on certain assumptions and are subject to known and unknown risks and uncertainties (both general and specific) that contribute to the possibility that the future events or circumstances contemplated by such forward-looking information will not occur. Such risks and uncertainties with respect to the forward-looking statements contained in this news release include, but are not limited to, the Company obtaining shareholder and Toronto Stock Exchange approval for a consolidation of its common shares, the Company’s ability to generally meet the quantitative and qualitative requirements to list its common shares on a stock exchange in the United States, the trading volumes in the Company’s common shares increasing as a result of a listing on a stock exchange in the United States, the Company’s ability to access capital improving as a result of a listing on a stock exchange in the United States, and the Company obtaining the necessary regulatory approvals and satisfying the other requirements to file an IND and commence its clinical trials related to its lead program PMN310 soon thereafter. Readers should also refer to the risk factors set forth in the Company’s continuous disclosure documents available at SEDAR (www.sedar.com). There can be no assurance that the plans, intentions or expectations upon which forward-looking statements are based will be realized. Actual results may differ, and the difference may be material and adverse to the Company and its shareholders. Therefore, readers should not place undue reliance upon such forward-looking statements. The Company does not intend, and does not assume any obligation, to update these forward-looking statements in order to reflect events or circumstances that may arise after the date of this news release except as required by applicable law or regulatory requirements.

Release -Sierra Metals Completes Strategic Review Process Initiates Annual Base Dividend of US$0.03 Per Share and Appoints Two New Directors to Its Board

Sierra Metals Completes Strategic Review Process, Initiates Annual Base Dividend of US$0.03 Per Share and Appoints Two New Directors to Its Board

TORONTO–(BUSINESS WIRE)– Sierra Metals Inc. (TSX: SMT) (BVL: SMT) (NYSE AMERICAN: SMTS) (“Sierra Metals” or “the Company”) announces today that its Board of Directors (the “Board”) has completed its previously announced review of strategic alternatives.

Based on an extensive review of various alternatives, the Board has determined, in consultation with its financial and legal advisors, that maximum value for shareholders will be delivered through the pursuit by the Company of various strategic value-enhancing opportunities.

Within its current assets and diversified extensive resource base, the Company will continue to focus its efforts on growing the production of the metals expected to feed into the anticipated global infrastructure supply demands. The increased focus will apply specifically to copper and steel-making products (zinc and iron ore), with the production of the precious metals as a valuable cost-credit byproduct.

Furthermore, the Company has completed an actionable review of its assets and will consider appropriate further action over the Company’s portfolio of assets. This action could take the form of divestments, joint ventures (“JVs”) or partnerships, and it could include assets such as the Cusi Silver Mine or exploration targets which lie outside the current operating areas.

Sierra Metals believes in the importance of Environmental, Social and Corporate Governance and will proceed with a heightened focus on these matters with a view to maintaining the best applicable practices in each of these areas. We strive for excellence in fulfilling our environmental and social duties and responsibilities, ultimately sharing increased wellbeing with our workforce and in the communities where we operate.

The Company will continue with a disciplined capital allocation approach and the use of funds on sustaining and growth projects, using a stringent stage-gate process with a close follow-up on implementation and delivery of projects which include:

- Delivery of current Prefeasibility Studies for mine expansion at our 3 operations, starting with Bolivar Mine, followed by Yauricocha and Cusi.

- Advancing with the inclusion into the Company’s mine plans of certain near-term underground and brownfield mine opportunities with the aim of increasing the return at the Yauricocha and Bolivar Mines.

Following COVID restrictions that limit the Company on its exploration activities, greenfield exploration on our extensive 110,000-hectare land packages will be reactivated in due course to develop new and expanded mineral resource opportunities. The Company will be open to JVs and partnerships for these opportunities.

Jose Vizquerra-Benavides, Chairman of the Board of Sierra Metals, said, “We have reached the end of the strategic review process announced early this year. This process, which has taken longer than usual due to COVID, has been instrumental in highlighting the value of our current operations and the value-enhancing opportunities that are available for development. The process has allowed us to develop a strategy that will guide our efforts for the coming years, including a renewed focus on green and steel-related metals, the inclusion of added value from our current extensive land holdings and shared wellbeing with our stakeholders.”

Luis Marchese, CEO of Sierra Metals, said: “The Company expects to have more robust EBITDA and free cash flow starting next year and carrying on into the coming years. This is a benefit of the recent throughput expansions, which are expected to increase production across our suite of metals, hand in hand with strengthened metal prices based on current consensus metal price projections. Our newly instituted dividend policy has been inaugurated on the back of these positive developments and speaks to our belief in Company and our ability to deliver on our growth initiatives. Over the past several years, we have made significant changes across the organization, streamlining our business, strengthening our team, optimizing our operations, and driving much-improved financial performance. Our operations have not only proven themselves to be quite resilient in these uncertain times, but we also expect to emerge from the pandemic and the strategic review process as a significantly stronger Company with a strong focus on growth and value creation for all shareholders as we execute our strategy.”

Annual Dividend

In addition, the Board has authorized the payment of an annual dividend to consist of a base dividend of US$5 million or US$0.03 per share plus an additional amount based on available cash flows generated each year after accounting for planned capital spending, distributions to non-controlling interests, greenfield exploration and mandatory debt service. The initial dividend is expected to be declared in November 2021 and paid to shareholders in December 2021. Additional details of this dividend will be provided in a subsequent press release.

Appointment of New Directors

The Board is also pleased to announce the appointment of Carlos E. Santa Cruz and Oscar M. Cabrera to the Board, effective immediately. Messrs. Cabrera and Santa Cruz have been appointed following the resignation of two directors earlier this year.

Mr. Santa Cruz is a Mining Engineer with over 40 years of experience of strong international managerial background in mining operations at a senior level. He held positions with major mining companies, including Senior Vice-President of Australian and New Zealand Operations and Senior Vice-President of South American Operations for Newmont. He currently sits as Chairman of the Board for BISA Ingenieria de Proyectos S.A.. and Director for JRC Ingeniería y Construcción S.A.C. Mr. Santa Cruz is an Independent Mining Consultant and Part-time Professor at Pontificia Universidad Católica and is a member of Industry Advisory Committees at Penn State and Piura University. Chairman of the Board for CIMADE, NGO oriented to promote sustainable mining and infrastructure megaprojects. Mr. Santa Cruz holds a Ph.D., Mining Engineering and M Eng., Industrial Engineering from Penn State University, as well as the Advanced Management Program from Harvard University. Mr. Santa Cruz is a Peruvian Citizen.

Mr. Cabrera is a Senior equity analyst with over 20 years of experience covering the metals and mining industry for bulge bracket investment banks and Canadian financial institutions, including Goldman Sachs, Merrill Lynch Canada and CIBC World Markets. He obtained recognition for industry thought leadership, fundamental commodity analysis and strong industry relationships, which has led to advisory roles for public mining companies, including Nexa Resources S.A. He also participated in the vetting of and advising on primary and secondary offerings in Canada, the U.S. and Europe. Mr. Cabrera holds a MBA from York University, a M Eng. in Structural Engineering from the University of Toronto and a B. Sc in Civil Engineering from the Instituto Tecnológico y de Estudios Superiores de Monterrey. Mr. Cabrera is a Canadian Citizen, originally from Mexico.

Jose Vizquerra-Benavides commented, “We are extremely pleased to have Carlos and Oscar join the Board of Sierra. Their extensive knowledge of mining operations and projects both in Peru and Mexico as well as commodity analysis and capital markets will benefit the Company as we progress on a plan of growth and value creation for all stakeholders.”

About Sierra Metals

Sierra Metals Inc. is a diversified Canadian mining company focused on the production and development of precious and base metals from its polymetallic Yauricocha Mine in Peru, and Bolivar and Cusi Mines in Mexico. The Company is focused on increasing production volume and growing mineral resources. Sierra Metals has recently had several new key discoveries and still has many more exciting brownfield exploration opportunities at all three Mines in Peru and Mexico that are within close proximity to the existing mines. Additionally, the Company also has large land packages at all three mines with several prospective regional targets providing longer-term exploration upside and mineral resource growth potential.

The Company’s Common Shares trade on the Bolsa de Valores de Lima and on the Toronto Stock Exchange under the symbol “SMT” and on the NYSE American Exchange under the symbol “SMTS”.

For further information regarding Sierra Metals, please visit www.sierrametals.com.

Continue to Follow, Like and Watch our progress:

Web: www.sierrametals.com | Twitter: sierrametals | Facebook: SierraMetalsInc | LinkedIn: Sierra Metals Inc

Forward-Looking Statements

This press release contains “forward-looking information” and “forward-looking statements” within the meaning of Canadian and U.S. securities laws (collectively, “forward-looking information“). Forward-looking information includes, but is not limited to, statements with respect to the date of the 2020 Shareholders’ Meeting and the anticipated filing of the Compensation Disclosure. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects”, “anticipates”, “plans”, “projects”, “estimates”, “assumes”, “intends”, “strategy”, “goals”, “objectives”, “potential” or variations thereof, or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative of any of these terms and similar expressions) are not statements of historical fact and may be forward-looking information.

Forward-looking information is subject to a variety of risks and uncertainties, which could cause actual events or results to differ from those reflected in the forward-looking information, including, without limitation, the risks described under the heading “Risk Factors” in the Company’s annual information form dated March 30, 2020 for its fiscal year ended December 31, 2019 and other risks identified in the Company’s filings with Canadian securities regulators and the United States Securities and Exchange Commission, which filings are available at www.sedar.com and www.sec.gov, respectively.

The risk factors referred to above are not an exhaustive list of the factors that may affect any of the Company’s forward-looking information. Forward-looking information includes statements about the future and is inherently uncertain, and the Company’s actual achievements or other future events or conditions may differ materially from those reflected in the forward-looking information due to a variety of risks, uncertainties and other factors. The Company’s statements containing forward-looking information are based on the beliefs, expectations and opinions of management on the date the statements are made, and the Company does not assume any obligation to update such forward-looking information if circumstances or management’s beliefs, expectations or opinions should change, other than as required by applicable law. For the reasons set forth above, one should not place undue reliance on forward-looking information.

Mike McAllister, CPIR

Vice President, Investor Relations

Sierra Metals Inc.

Tel: +1 (416) 366-7777

Email: info@sierrametals.com

Luis Marchese

CEO

Sierra Metals Inc.

Tel: +1 (416) 366-7777

Source: Sierra Metals Inc.

MedX Health (MDXHF)(MDX.V) – New Developments in Pain Management – a NobleCon Online Investor Event

|

|

|

MedX Health President of Dermatology Services Mike Druhan delivers a formal corporate overview, followed by a Q & A session moderated by Noble Capital Markets Senior Healthcare Services & Medical Devices Analyst Gregory Aurand. Return to the Investor Forum Event Page

MedX, headquartered in Ontario, Canada, is a leading medical device and software company focused on skin health with its SIAscopy® on DermSecure® telemedicine platform, utilizing its SIAscopy® technology. SIAscopy® is also imbedded in its products SIAMETRICS®, SIMSYS®, and MoleMate®, which MedX manufactures in its ISO 13485 certified facility. SIAMETRICS®, SIMSYS®, and MoleMate® include hand-held devices that use patented technology utilizing light and its remittance to view up to 2 mm beneath suspicious moles and lesions in a pain free, non-invasive manner, with its software then creating real-time images for physicians and dermatologists to evaluate all types of moles or lesions within seconds. These products are cleared by Health Canada, the U.S. Food and Drug Administration, the Therapeutic Goods Administration and Conformité Européenne for use in Canada, the US, Australia, New Zealand, the European Union, Brazil and Turkey. Visit https://medxhealth.com. |

Release – Gevo Partners with Engineering Procurement and Construction (EPC) Giant Kiewit on its Net-Zero 1 Project

Gevo Partners with Engineering, Procurement, and Construction (EPC) Giant, Kiewit, on its Net-Zero 1 Project

ENGLEWOOD, Colo., Oct. 07, 2021 (GLOBE NEWSWIRE) — Gevo, Inc. (NASDAQ: GEVO) is pleased to announce it has engaged Kiewit Energy Group Inc. to lead the Front End Engineering Design (FEED) effort for its Net-Zero 1 Project in Lake Preston, South Dakota. Kiewit Energy Group Inc. is part of Kiewit Corporation, one of the top five contractors in the U.S. with vast experience in virtually every energy segment. This includes extensive work on energy-transition projects such as biofuel plants, geothermal plants, solar farms, and building the first offshore wind substation project in the U.S., as well as a wide range of projects for large oil-and-gas companies. Gevo expects Kiewit Energy Group Inc. will fulfill the engineering, procurement, and construction (EPC) role in the project once the FEED phase is complete.

“Kiewit’s comprehensive construction and engineering capabilities match its tremendous project experience in the energy sector, specifically the clean energy sector,” said Dr. Chris Ryan, President and Chief Operating Officer of Gevo, Inc. “Working with a firm like this, we expect to reduce execution risk on the Net-Zero 1 Project while increasing our capability to build out multiple net zero plants as the market demands—good news for our growing list of customers, shareholders, and folks who care about the environment.”

Kiewit is considered one of the leading construction and engineering firms in North America. Founded in 1884, the company has grown to more than 27,000 dedicated staff and skill craft workers. Active in markets across the industrial, mining, energy, building and transportation sectors, Kiewit had revenues of $12.5 billion in 2020 and has extensive experience delivering small-scale projects up to multi-billion-dollar programs.

”We’re very pleased that Gevo selected us to bring our design, engineering and construction expertise to support this innovative, important clean energy project,” said Ben Bentley, executive vice president, Kiewit Energy Group Inc. “We’ve seen firsthand Gevo’s strategic plans and commitment to help bring this and other net zero plants to market. We’re excited to deliver on this contract and expand our partnership in the coming years with a leader in this growing sector.”

Kiewit is a leader in safety and quality and committed to environmental stewardship. Kiewit is led by experienced managers at all levels, and its LEED®-accredited professionals are trained to achieve green objectives and support green designs. The firm has delivered more than 500 energy transition projects in virtually every energy market segment ranging from renewable and alternative fuels to energy storage and carbon capture, to chemical recycling and renewable power. With deep expertise in, and an understanding of, the technology necessary to build first-of-its-kind facilities, Kiewit is known for its leadership and ability to deliver complex projects. The company also has one of the largest and most modern, privately owned equipment fleets in North America.

“Kiewit’s ability to self-perform set them apart for us,” Dr. Ryan says. “And because the firm is large enough to take on multiple large projects, it will be capable of meeting our needs as we enter the expected next phase of our business.”

About Gevo

Gevo’s mission is to transform renewable energy and carbon into energy-dense liquid hydrocarbons. These liquid hydrocarbons can be used for drop-in transportation fuels such as gasoline, jet fuel and diesel fuel, that when burned have potential to yield net-zero greenhouse gas emissions when measured across the full life cycle of the products. Gevo uses low-carbon renewable resource-based carbohydrates as raw materials, and is in an advanced state of developing renewable electricity and renewable natural gas for use in production processes, resulting in low-carbon fuels with substantially reduced carbon intensity (the level of greenhouse gas emissions compared to standard petroleum fossil-based fuels across their life cycle). Gevo’s products perform as well or better than traditional fossil-based fuels in infrastructure and engines, but with substantially reduced greenhouse gas emissions. In addition to addressing the problems of fuels, Gevo’s technology also enables certain plastics, such as polyester, to be made with more sustainable ingredients. Gevo’s ability to penetrate the growing low-carbon fuels market depends on the price of oil and the value of abating carbon emissions that would otherwise increase greenhouse gas emissions. Gevo believes that its proven, patented technology enabling the use of a variety of low-carbon sustainable feedstocks to produce price-competitive low-carbon products such as gasoline components, jet fuel and diesel fuel yields the potential to generate project and corporate returns that justify the build-out of a multi-billion-dollar business.

Gevo believes that the Argonne National Laboratory GREET model is the best available standard of scientific-based measurement for life cycle inventory or LCI.

Learn more at Gevo’s website: www.gevo.com

About Kiewit

Kiewit is one of North America’s largest and most respected construction and engineering organizations. With its roots dating back to 1884, the employee-owned organization operates through a network of subsidiaries in the United States, Canada, and Mexico. Kiewit offers construction and engineering services in a variety of markets including transportation; oil, gas and chemical; power; building; water/wastewater; industrial; and mining. Kiewit had 2020 revenues of $12.5 billion and employs 27,000 staff and craft employees.

Learn more at Kiewit’s website: www.kiewit.com

Forward-Looking Statements

Certain statements in this press release may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements relate to a variety of matters, without limitation, including Kiewit engineering and construction for Net-Zero 1 FEED phase and beyond, the production of SAF, the attributes of Gevo’s products, and other statements that are not purely statements of historical fact. These forward-looking statements are made on the basis of the current beliefs, expectations and assumptions of the management of Gevo and are subject to significant risks and uncertainty. Investors are cautioned not to place undue reliance on any such forward-looking statements. All such forward-looking statements speak only as of the date they are made, and Gevo undertakes no obligation to update or revise these statements, whether as a result of new information, future events or otherwise. Although Gevo believes that the expectations reflected in these forward-looking statements are reasonable, these statements involve many risks and uncertainties that may cause actual results to differ materially from what may be expressed or implied in these forward-looking statements. For a further discussion of risks and uncertainties that could cause actual results to differ from those expressed in these forward-looking statements, as well as risks relating to the business of Gevo in general, see the risk disclosures in the Annual Report on Form 10-K of Gevo for the year ended December 31, 2020, and in subsequent reports on Forms 10-Q and 8-K and other filings made with the U.S. Securities and Exchange Commission by Gevo.

Investor and Media Contact

+1 720-647-9605

IR@gevo.com

Release – Capstone Green Energy Awarded Two Megawatt CCHP Order for Multi-State Industrial Grow Operator and Secures 20 Year Service Plan

Capstone Green Energy (NASDAQ:CGRN) Awarded Two Megawatt CCHP Order for Multi-State Industrial Grow Operator and Secures 20 Year Service Plan

SOURCE: Capstone Green Energy Corporation

Newrange Gold Corp. (NRGOF)(NRG:CA) – The Opportunity Set at Pamlico Could Expand Beyond Gold

Thursday, October 07, 2021

Newrange Gold Corp. (NRGOF)(NRG:CA)

The Opportunity Set at Pamlico Could Expand Beyond Gold

As of April 24, 2020, Noble Capital Markets research on Newrange Gold is published under ticker symbols (NRGOF and NRG:CA). The price target is in USD and based on ticker symbol NRGOF. Research reports dated prior to April 24, 2020 may not follow these guidelines and could account for a variance in the price target.

Newrange Gold Corp is an exploration stage company focused on acquiring and exploring exploration and evaluation assets in Colombia and the United States. The Company operates in a single reportable operating segment-the acquisition, exploration, and development of mineral properties. Some of the projects acquired by the company are Pamlico gold project in Nevada and Rocky mountain project in Colorado. The company also holds an interest in the Yarumalito property, El Dovio property and Anori property in Colombia.

Mark Reichman, Senior Research Analyst of Natural Resources, Noble Capital Markets, Inc.

Refer to the full report for the price target, fundamental analysis, and rating.

Assay results yield a few surprises. Assay results were released for four follow-up diamond core holes representing 800.6 meters of drilling around Hole P21-115, a reverse circulation hole that discovered shallow, high-grade oxide gold mineralization just east of the Merritt Zone and north of the historic Pamlico mine. Instead of gold mineralization resembling that observed in Hole P21-115, Holes P21-122 through P21-125 revealed concentric halos of zinc, lead, copper, arsenic, silver, and higher gold values near the center.

Looking through a broader lens. Information from geophysical work, mapping, and rock and soil sampling point to strong intrusive activity in the southern part of the property, with widespread copper, zinc, silver, and gold mineralization. Coupled with recent diamond drilling, the company appears to be outlining a large-scale polymetallic system …

This Company Sponsored Research is provided by Noble Capital Markets, Inc., a FINRA and S.E.C. registered broker-dealer (B/D).

*Analyst certification and important disclosures included in the full report. NOTE: investment decisions should not be based upon the content of this research summary. Proper due diligence is required before making any investment decision.