Will ESG Investing be Able to Recycle Itself in 2023?

Investment trends run in cycles. As a new trend is recognized, it attracts new money, which drives up prices, until there isn’t as much additional money left to keep the trend going strong. At some point, investors may feel there is a more profitable use for their capital, and the old trend then falls out of favor. Over the decades, sustainable and social investing have had several up cycles, followed by a hiatus and then a new incarnation. Where is ESG investing in its cycle in 2023?

Background

Environmental, social, and governance (ESG) holds as an underlying promise that companies and those that invest in them can do well by doing good. Just a couple of years back, investors trillions of dollars into ESG strategies. This had the effect of causing many businesses to alter their business model in ways that would conform to an unofficial ESG designation(s).

Investment companies aimed to fill the demand by creating new ESG funds, at the same time the business of creating ESG profile rankings also grew. Professionally managed assets with ESG mandates surged to an astronomical $46 trillion globally in 2021. According to Deloitte’s Center for Financial Services, assets, ESG funds represented nearly 40% of all assets under management.

The first couple of years this decade were riddled with black swan events, investment assets swelled on many fronts. Investors in ESG have recently stepped back and moved the most money out of U.S. sustainable funds in more than five years (4Q). The fund industry experienced nearly $6.2 billion pulled from professionally managed funds catering to environmental, social, and governance strategies. As compared to the trillions in the funds, this is not overly significant. What is significant is the reversal of what had been a strong trend of inflows.

Sustainable funds overall netted more than $3 billion in positive flows for all of 2022 – traditional U.S. funds experienced more than $370 billion in withdrawals during the year. A lower percentage but still significant as it was the first calendar year of net outflows since Morningstar began tracking data in 1983.

According to a new report from Morningstar, flows of money into U.S. sustainable mutual funds and ETFs has declined since its record high in the first quarter of 2021. The withdrawal of money comes as many companies are improving their ESG scores. The decline in 4Q 2022 came as a myriad of factors soured investors on many market sectors.

Political Winds Changing

But stock market sentiment may only be part of the story. There are louder and louder voices that are questioning the purity of this newer incarnation of social investing. They ask if it provide for what is good and best overall? There is even some confusion by investors that remember the older versions of social and environmental investing that specifically excluded things like nuclear power. Today many ESG scores view carbonless nuclear generation as clean.

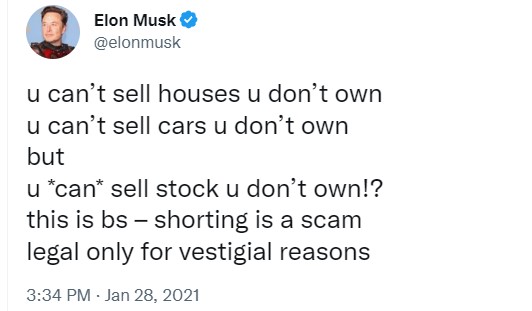

Where there is money, there is also politics. This is part of what originally helped the trend pick up steam. Now opposing political voices are causing some second looks at the overall benefits. The most recent examples include the person who moved the electric vehicle (EV) movement out so far into the spotlight that the car company he founded is the most valuable in the world (market cap). Elon Musk made one of his negative ESG comments as a tweet responding to self-described “Hero of the Environment” and author, Michael Shellenberger.

Less political, but perhaps more important, Federal Reserve Chair Jerome Powell made his official position clear during a conference titled Central Bank Independence and the Mandate—Evolving Views. Standing before an international audience in Stockholm, Sweden, Powell said, “we resist the temptation to broaden our scope to address other important social issues of the day. Taking on new goals, however worthy, without a clear statutory mandate would undermine the case for our independence.”

The New York Times ran the following headline:

Performance

Sustainable funds lagged behind the broader market in performance. Remember, there was an increasing supply of names that were attaining ESG status. Also their lack of exposure to the top-performing oil and gas sector and its 66% gain during the year hurt performance.

The drag in the last quarter of 2022 was even more pronounced as it was the first period in more than three years that U.S. sustainable funds had a lower organic growth rate than the total U.S. fund market. During the fourth quarter, sustainable funds shrank by 2.2% compared with an 0.8% shrinkage in the overall U.S. landscape.

Morningstar’s sustainable fund universe encompasses mutual funds and ETFs “that, by prospectus or other regulatory filings, claim to focus on sustainability; impact; or environmental, social, and governance factors.”

Take Away

Last year while the overall markets were gloomier, ESG investors slowed and then reversed their piling into ESG funds. These funds had attracted 40% of fund assets, so it is no surprise they paused. However last quarter was the first decline since 1983. Part of the issue is the normal cyclicality of investment trends. Make no mistake; sustainable investing is not dying, but it suffers from a lack of clarity as to how companies are scored, and who is doing the scoring.

Investors that wish to keep the entire universe of opportunities open to their portfolios can still invest in stocks that suit their appetite for many factors, including environmental, social, or corporate governance. A little digging through analyst research reports ought to provide enough information to steer one clear of companies individuals would rather not be part of, and those they feel especially good about owning.

Managing Editor, Channelchek

Sources

https://www.morningstar.com/products/esg-investing

https://www.yahoo.com/now/musk-rips-satanic-esg-world-233742968.html

https://www.barrons.com/articles/esg-investing-big-test-reckoning-51650041442

https://www.barrons.com/articles/us-esg-sustainable-funds-outflows-51674767507?mod=hp_LEAD_5