Brain Tumors are Cognitive Parasites – How Brain Cancer Hijacks Neural Circuits and Causes Cognitive Decline

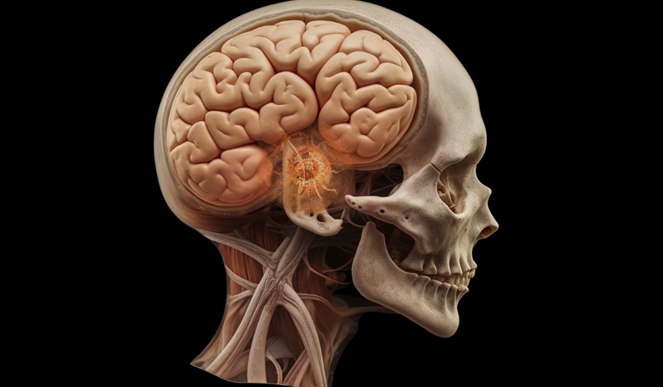

Researchers have long known that brain tumors, specifically a type of tumor called a glioma, can affect a person’s cognitive and physical function. Patients with glioblastoma, the most fatal type of brain tumor in adults, experience an especially drastic decline in quality of life. Glioblastomas are thought to impair normal brain functions by compressing and causing healthy tissue to swell, or competing with them for blood supply.

What exactly causes cognitive decline in brain tumor patients is still unknown. In our recently published research, we found that tumors can not only remodel neural circuits, but that brain activity itself can fuel tumor growth.

This article was republished with permission from The Conversation, a news site dedicated to sharing ideas from academic experts. It represents the research-based findings and thoughts of, Saritha Krishna, Postdoctoral Fellow in Neurological Surgery, University of California, San Francisco, and Shawn Hervey-Jumper, Associate Professor of Neurological Surgery, University of California, San Francisco.

We are a neuroscientist and neurosurgeon team at the University of California, San Francisco. Our work focuses on understanding how brain tumors remodel neuronal circuits and how these changes affect language, motor and cognitive function. We discovered a previously unknown mechanism brain tumors use to hijack and modify brain circuitry that causes cognitive decline in patients with glioma.

Brain Tumors in Dialogue with Surrounding Cells

When we started this study, scientists had recently found that a self-perpetuating positive feedback loop powers brain tumors. The cycle begins when cancer cells produce substances that can act as neurotransmitters, proteins that help neurons communicate with each other. This surplus of neurotransmitters triggers neurons to become hyperactive and secrete chemicals that stimulate and accelerate the proliferation and growth of the cancer cells.

We wondered how this feedback loop affects the behavior and cognition of people with brain cancer. To study how glioblastomas engage with neuronal circuits in the human brain, we recorded the real-time brain activity of patients with gliomas as they were shown pictures of common objects or animals and asked to name what they depicted while they were undergoing brain surgery to remove the tumor.

While the patients engaged in these tasks, the language networks in their brains were activated as expected. However, we found that the brain regions the tumors had infiltrated quite remote from known language zones of the brain were also activated during these tasks. This unexpected finding shows that tumors can hijack and restructure connections in the brain tissue surrounding them and increase their activity.

This may account for the cognitive decline frequently associated with the progression of gliomas. However, by directly recording the electrical activity of the brain using electrocorticography, we showed that despite being hyperactive, these remote brain regions had significantly reduced computational power. This was especially the case for processing more complex, less commonly used words, such as “rooster,” in comparison with simple, more commonly used words, such as “car.” This meant that brain cells entangled in the tumor are so compromised that they need to recruit additional cells to carry out tasks previously controlled by a smaller defined area.

We make an analogy to an orchestra. The musicians need to play in synchrony for the music to work. When you lose the cellos and the woodwinds, the remaining musicians can’t deliver the piece as effectively as when all players are present. Similarly, when brain tumors hijack the areas surrounding it, the brain is less able to effectively function.

Gabapentin as a Promising Drug for Glioblastoma

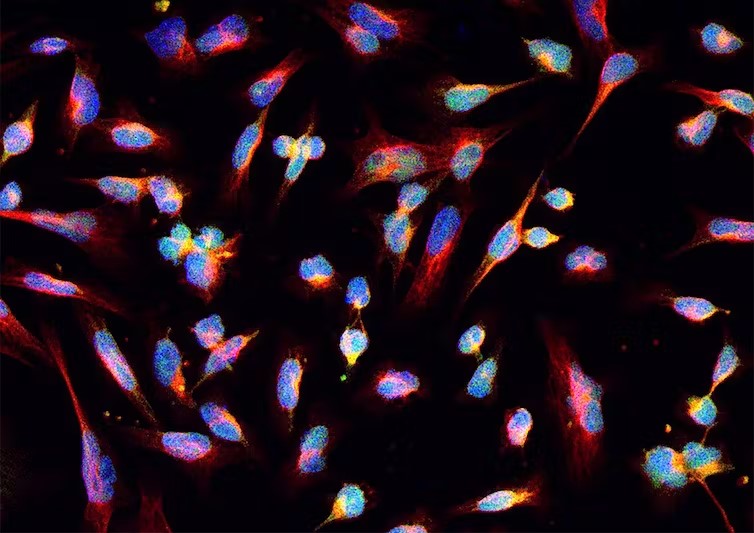

Now we understood that tumors can impair cognition by affecting neural connections. Next, we further examined their connections with each other and with healthy neurons using mouse models and brain organoids, which are clusters of brain cells grown in a Petri dish.

These experiments, led by one of us, Saritha Krishna, found that tumor cells secrete a protein called thrombospondin-1 that plays a key role in promoting the hyperactivity of brain cells. We wondered whether blocking this protein, which normally helps neurons form synapses, would halt tumor growth and extend the survival of mice with glioblastoma.

To test this hypothesis, we treated mice with a common anti-seizure drug called gabapentin that blocks thrombospondin-1. We found that gabapentin was able to keep the brain tumors from expanding for several months. These findings highlight the potential of repurposing this existing drug to control brain tumor growth.

Our study suggests that targeting the communication between healthy brain cells and cancer cells could offer another way to treat brain cancer. Combining gabapentin with other conventional therapies could complement existing treatments, helping mitigate cognitive decline and potentially improving survival. We are now exploring new ways to take advantage of this drug’s potential to halt tumor growth. Our goal is to ultimately translate the findings of our study to clinical trials in people.