Research News and Market Data on HMENF

May 22, 2025 8:00 AM EDT

Vancouver, British Columbia–(Newsfile Corp. – May 22, 2025) – Hemisphere Energy Corporation (TSXV: HME) (OTCQX: HMENF) (“Hemisphere” or the “Company”) provides its financial and operating results for the first quarter ended March 31, 2025, declares a quarterly dividend payment to shareholders, renews credit facility, and provides operations update.

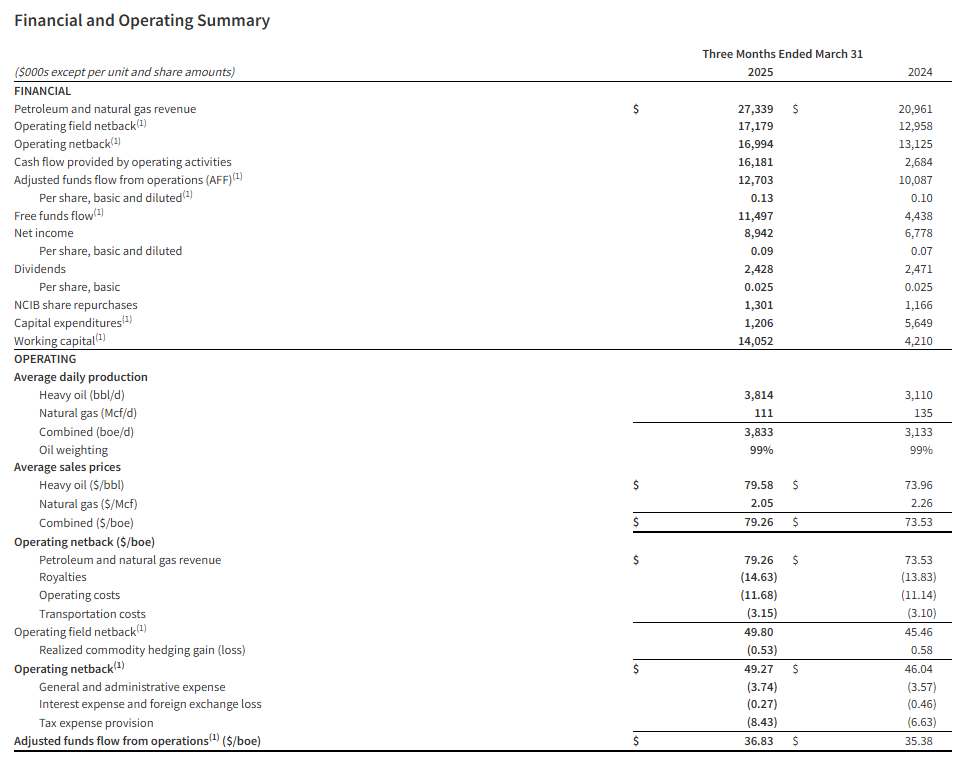

Q1 2025 Highlights

- Attained record quarterly production of 3,833 boe/d (99% heavy oil), a 21% increase over the same period of last year.

- Generated $27.3 million in revenue, a 30% increase over the first quarter of 2024.

- Achieved total operating and transportation costs of $14.63/boe.

- Delivered an operating netback1 of $17.0 million, or $49.27/boe.

- Realized quarterly adjusted funds flow from operations (“AFF”)1 of $12.7 million, or $36.83/boe, a 26% increase over the first quarter of 2024.

- Generated free funds flow1 of $11.5 million, or $0.12 per share.

- Distributed $2.4 million, or $0.025 per share, in dividends to shareholders during the quarter.

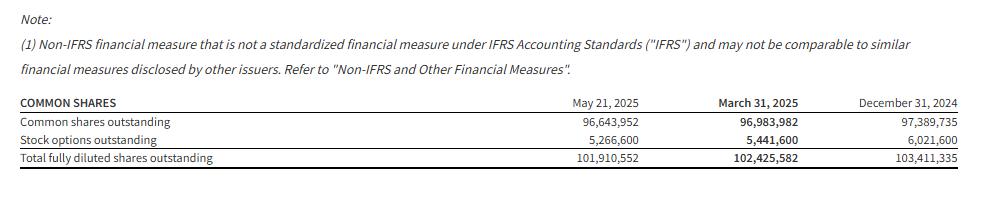

- Purchased and cancelled 709,700 shares for $1.3 million under the Company’s Normal Course Issuer Bid (“NCIB”).

- Exited the first quarter with positive working capital1 of $14.1 million, compared to $4.2 million at the end of March 2024.

(1) Operating netback, adjusted funds flow from operations (AFF), free funds flow, capital expenditure, and working capital are non-IFRS measures, or when expressed on a per share or boe basis, non-IFRS ratio, that do not have any standardized meaning under IFRS and therefore may not be comparable to similar measures presented by other entities. Non-IFRS financial measures and ratios are not standardized financial measures under IFRS and may not be comparable to similar financial measures disclosed by other issuers. Refer to the section “Non-IFRS and Other Specified Financial Measures”.

Selected financial and operational highlights should be read in conjunction with Hemisphere’s unaudited condensed interim consolidated financial statements and related notes, and the Management’s Discussion and Analysis for the three months ended March 31, 2025 which are available on SEDAR+ at www.sedarplus.ca and on Hemisphere’s website at www.hemisphereenergy.ca. All amounts are expressed in Canadian dollars unless otherwise noted.

Quarterly Dividend

Hemisphere is pleased to announce that its Board of Directors has approved a quarterly cash dividend of $0.025 per common share in accordance with the Company’s dividend policy. The dividend will be paid on June 30, 2025 to shareholders of record as of the close of business on June 19, 2025. The dividend is designated as an eligible dividend for income tax purposes.

Including Hemisphere’s special dividend of $0.03 per common share paid in April and base quarterly dividends of $0.025 per common share in February and June, Hemisphere will have paid its shareholders $0.08 per common share in dividends during the first half of 2025.

Credit Facility

The Company has completed its annual bank review and renewed its $35.0 million two-year extendible credit facility with the same key terms, and the next annual review date set for May 31, 2026.

Operations Update

With the majority of Hemisphere’s 2025 capital spending scheduled for the latter half of the year, the Company generated $11.5 million in free funds flow during the first quarter. Current second quarter production of approximately 3,800 boe/d (99% heavy oil, field estimates between April 1 – May 15, 2025) is consistent with that of the first quarter, and represents an increase of 13% over fourth quarter production of 3,359 boe/d (99% heavy oil), due both to downtime in November and continued injection support from Hemisphere’s polymer floods at its Atlee Buffalo projects in southeast Alberta.

At Hemisphere’s Marsden pilot polymer flood project, injection continues to repressure the reservoir. Management anticipates that polymer response could take until late 2025, at which time the Company will determine economics of further development.

Management continues to closely monitor the volatility of the oil market and will adjust capital spending accordingly. With over $14 million in working capital and an undrawn credit line, Hemisphere will prioritize shareholder returns, share buybacks, and potential acquisition activity over accelerated capital spending.

Annual General and Special Meeting of Shareholders

Hemisphere’s Annual General and Special Meeting of Shareholders will be held at 10:00 am (Pacific Daylight Time) on June 2, 2025 in the Walker Room of the Terminal City Club located at 837 West Hastings Street, Vancouver, British Columbia.

About Hemisphere Energy Corporation

Hemisphere is a dividend-paying Canadian oil company focused on maximizing value-per-share growth with the sustainable development of its high netback, ultra-low decline conventional heavy oil assets through polymer flood enhanced oil recovery methods. Hemisphere trades on the TSX Venture Exchange as a Tier 1 issuer under the symbol “HME” and on the OTCQX Venture Marketplace under the symbol “HMENF”.

For further information, please visit the Company’s website at www.hemisphereenergy.ca to view its corporate presentation or contact:

Don Simmons, President & Chief Executive Officer

Telephone: (604) 685-9255

Email: info@hemisphereenergy.ca

Website: www.hemisphereenergy.ca

SOURCE: Hemisphere Energy Corporation