Drivers Impacting Oil Now and in the Weeks Ahead

Oil prices are near flat on the month but have recently been rising. Meanwhile, the energy sector itself, relative to the overall market, is outperforming in a way that is getting attention as we move to September. Are the drivers of performance solidly in place to keep crude oil prices strong? Will the energy sector continue to benefit from factors impacting oil? We lay out factors impacting future price movements below.

What’s Impacting Oil

Credit for the recent strength in oil has been given in part to the Saudi Arabian production cuts that began in July when the Saudi’s voluntarily lowered production by one million barrels a day starting in July. This quickly strengthened prices, which then fell off as concerns over China’s weakening economy, and global economies in general, grew. China is the world’s second-largest consumer of crude oil.

The U.S. has seen strong economic reports recently. The market is still reacting poorly to “good” news. This reaction also played into the direction of stocks and commodity prices. U.S. economic activity readings raised expectations for further monetary policy tightening by the Federal Reserve. The idea of heightened activity lifted U.S. Treasury yields and, along with them, the U.S. dollar. During the last week in August, weaker U.S. labor data served to ease some of the rise in yields.

Adding to the strength, this week, the Energy Information Administration (EIA) on Wednesday reported that U.S. commercial crude inventories fell by 10.6 million barrels for the week ending Aug. 25. That was the third straight weekly decline reported by the agency and the largest since the week ended July 28. U.S. commercial crude inventories have fallen by almost 34 million barrels over the past five weeks.

Inventories are now only 1.1% higher than the same week last year, even with over 100 million barrels having been released from the U.S. Strategic Petroleum Reserve during the 12 months.

A reversal to the upside after crude fell last week below support at $78 a barrel also coincided with the formation of what technicians refer to as a golden cross, this is when the 50-day moving average crosses above the 200-day moving average from below. This got the attention of commodity traders.

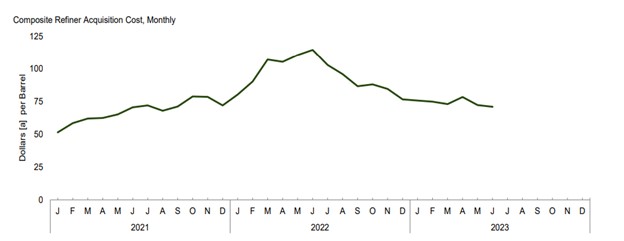

Overall, the price paid per barrel of oil has been range-bound through 2023. The extended production cuts by Saudi Arabia and Russia were largely offset by fears about China’s economy flailing; it had been expected it would rebound strongly after pandemic lockdowns were lifted. Oil consumption did not rise as expected.

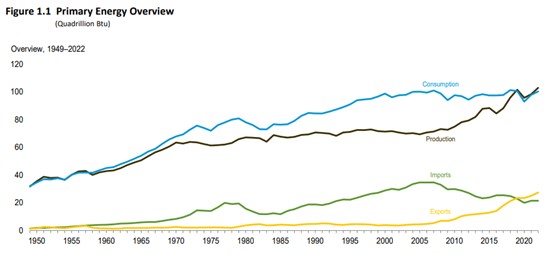

There is also increasing indications the United States is relaxing sanctions on crude exports from Iran and Venezuela to keep prices from rising too much and in exchange for diplomatic objectives. The U.S. is the number one oil consumer.

Given still low inventories and a need to replenish the U.S. Strategic Oil Reserves there are market participants that remain bullish on oil prices and the energy sector. There are others that are more cautious, despite Saudi production cuts, as the chart above indicates, consumption recently fell below the level of production.

Take Away

Oil prices have been in a tight range all year. Better stock market performance from energy producers has in part been because of easing of rules concerning fossil fuels, and headway made on green energy projects. Consumption will increase and fall based on economic activity. Where the U.S. economy and global economy are headed is faced with more cross-currents than usual. Added supply to the U.S. may come from countries we don’t currently trade with. Those spigots can not be turned on quickly. This leaves oil and energy with a current trend upward but challenges down the road.

Managing Editor, Channelchek

Sources