For the Third Time This Year, Investors Get to Peak Behind the “Smart Money” Curtain

What’s smart money doing?

If retail investors weren’t always eager to know what hedge fund managers, corporate insiders, and others building positions in a stock have been doing, shows like CNBC’s Closing Bell, news sources like Investors Business Daily, and communities like Seeking Alpha would get far less attention. Next week, the most followed institutional investors are expected to make their quarter-end holdings public. This will usher in a lot of buzz around the surprise changes in holdings and even short positions in celebrity investor portfolios.

Popular SEC Filings

The most popular SEC filings from the supposed “smart money” that small investors look to for ideas are:

Form 13D – This is a filing that is required to be made by any person or group that acquires 5% or more of a company’s voting securities. The filing must disclose the person’s or group’s intentions with respect to the company, such as whether they plan to take control of the company or simply invest in it.

Investors may recall Elon Musk’s accumulation of Twitter shares was incorrectly filed on form 13-G which is for passive investors. He later had to amend his filing on 13D as his accumulation of shares was discovered to be predatory.

Form 4 – This is a filing that is required to be made by any officer, director, or 10% shareholder of a company when they buy or sell shares of the company’s stock. The filing must disclose the number of shares bought or sold, the price per share, and the date of the transaction.

This is the filing that the public used to discover that in 2021, Mark Zuckerberg sold Meta (META) shares (Facebook) almost daily for a total of $4.1 billion. The same year Jeff Bezos sold $8.8 billion worth of Amazon (AMZN) stock, mostly during the month of November.

Both of the filing types mentioned above are as needed, they don’t have a recurring season. However, another popular filing is form 13-F, these much anticipated filings occur four times each year.

Form 13F – This is a quarterly report that is required to be filed by institutional investment managers with at least $100 million in assets under management. The report discloses the manager’s equity and other public securities, including the number of shares held, the CUSIP number, and the market value.

Investors will pour over the quarter-end snapshot of the account and measure changes from the prior quarter, especially from investors like Warren Buffett, Bill Ackman, and Cathie Wood for insights. When Michael Burry filed his 13-F in mid May 2022, he had a position showing that he was short Apple (AAPL). Headlines erupted across news sources, and this certainly had an impact on the tech company’s stock price as other investors questioned its high valuation against any positions they may have had.

The Consistency of the 13-F

The SEC 13-F is a regular filing for large funds. Interested investors can generally mark their calendars for when a funds 13-F will be released. The SEC requires a quarterly report filed no later than 45 days from the calendar quarter’s ends. Most popular managers wait until the last minute, as they may not be so eager to share their funds positions any sooner than needed. This means that most 13-F filings are on February 15 (or before), May 15 (or before), August 15 (or before), and November 15 (or before). In 2023, August 15th is next Tuesday. During the second quarter of 2023 there seemed to have been significant sector rotation, and a reduction in short positions among large funds. This will make for above average interest.

Famous Investors that file a Form 13F

The legendary investor Warren Buffett is the CEO of Berkshire Hathaway. His company’s Form 13F filings are closely watched by investors around the world.

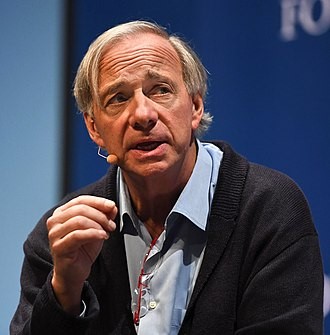

Ray Dalio is the founder of Bridgewater Associates, one of the world’s largest hedge funds. His company’s Form 13F filings are also very popular with investors.

Michael Burry is the investor who famously bet against the housing market in the lead-up to the 2008 financial crisis. His company’s Form 13F filings are often seen as positions of a highly regarded contrarian.

Cathie Wood is the CEO of ARK Invest, a firm that invests in disruptive technologies. Her company’s Form 13F filings are often seen as a bellwether for the future of technology. Wood is always open and transparent about her funds holdings. This may explain why she is among the earliest filers after each quarter-end.

Drawbacks to Using Form 13F

While Form 13F filings can be a valuable source of information for investors, it isn’t magic. And if it is going to weigh heavily as part of an investor’s selection process, some drawbacks should be considered.

The information is delayed: Form 13F filings are not real-time information. They are usually filed 45 days after the end of the quarter, so the information is already outdated by the time it is available to the public.

The information is not complete: Form 13F filings only disclose the top 10 holdings of each fund. This means that investors do not have a complete picture of the fund’s portfolio.

It is not always clear if a position is based on expectations for the one holding, or should be viewed in light of the full portfolio, balancing risk and potential reward. For example, an investment manager may be bullish on tech and long a tech megacap with a lower than average P/E ratio and as of the same filing, short a similar amount of a tech megacap with a higher P/E ratio. The fund manager may be bullish on both, and the nature of the positions may indicate an expectation that the P/E ratios are likely to move toward a similar ratio. If there is just a focus on one side (long or short), the investor may read the intentions or expectations wrong.

Take Away

As earnings season fades, the third week in August will provide a mountain of information on what institutional investors were doing during the second quarter. This is a great place to find ideas and understand any changes in flows.

Investors should be cautioned that this is only a June 30th snap shot, and these holdings may have changed days later.’

Managing Editor, Channelchek

Sources

https://fintel.io/search?search=ray+dalio+13-f

https://fintel.io/i13fs/ark-investment-management

https://whalewisdom.com/filer/scion-asset-management-llc

https://www.vrresearch.com/blog/learn-about-hedge-funds-from-13f-filings

https://www.sec.gov/Archives/edgar/data/1418091/000110465922045641/tm2212748d1_sc13da.htm