Why are Precious Metals Spiking?

The better-than-expected inflation numbers are having a positive impact on precious metals (PM) prices. And, depending on how one is invested to provide exposure to gold or silver, the performance varied by a wide margin. Gold commodity prices jumped by 1.3% and silver by 4.5% after the CPI report on Wednesday July 12. With even better performance were mining stocks. What is causing the leap in prices, and is there a preferred category of investment taking preference over the others?

Why the Spike in Precious Metals?

A slowing inflation trend is reviving talk of the Federal Reserve pausing or completely halting rate hikes. The market had already built two rate hikes into prices. At about the same time the U.S. CPI report was released, The Bank of Canada raised its interest rates by 25bp. The EU raised its rates on June 15, meanwhile the U.S. central bank opted not to raise rates in June.

In reaction to a difference in rates available in the U.S. compared to outside in other currencies, the $U.S. dollar tumbled 1% to a low not seen in more than a year against major peers. This made PMs, including gold and silver, a more attractive asset to preserve wealth outside the U.S. And rates have dropped, the 10-year U.S. Treasury that had been trading at 3.94% before the print, and 4.08% as recently as last week, was yielding 3.86% by mid-afternoon.

Performance of PM Related Assets

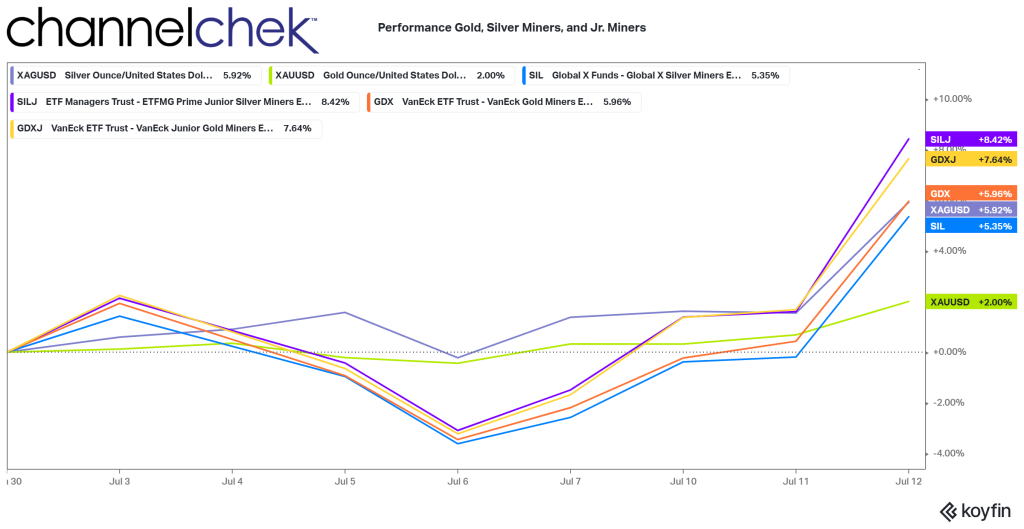

Looking out since the beginning of July, we find that both gold and silver dipped to their lows last Friday. Additionally, gold mining stocks and silver mining stocks, using GDX and SIL ETFs as proxies, had the most dramatic dip, while gold and silver (expressed in $US dollars) barely went negative on the month.

What we also see is that when gold and silver rise, or fall, there has been an amplification of the move among the mining stocks. On the upside, the magnification of the trend was even more pronounced among junior mining stocks.

While silver junior miners are the top performers MTD at 8.42%, they are closely followed by the gold junior mining stocks at 8.42%. Larger gold mining company stocks returned 5.96%, while gold itself, only returned 2%. Silver edged out the major mining stocks returning 5.92% compared to 5.35% over the 12 day period.

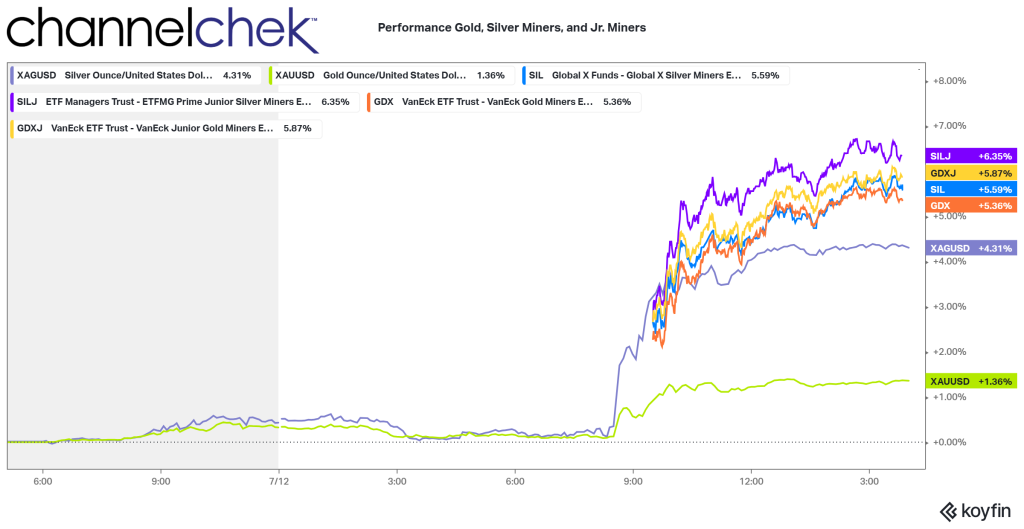

The patten of performance held during the one-day of trading that CPI was released with the gold majors swapping places with silver. And gold, the commodity, up significantly in one trading day but trailing the others by a wide margin.

Choosing PM Investments

Investing in the commodities gold or silver is fairly straightforward and can be done with most brokerage accounts today. ETFs are also as easy to trade as a stock. However, the owner receives the weighted average of all the ETFs holdings, less fees.

While individual stock pickers run the risk of reduced diversification among miners, with some understanding of the differences in companies, they may also be able to perform above the average of a broad swath of companies within an ETF for gold, silver, or both.

There are places to look for information on mining companies, the more challenging information to acquire is of the smaller junior miners – the group that have been outperforming. Channelchek can help you discover these companies and provide data, research, and videos, to help build a better understanding before committing to an investment.

Or, to really jump-start your understanding of a host of mining companies, along with those in other exciting but more difficult-to-assess industries, consider coming to Florida in early December for NobleCon19, an investment conference where you can immerse yourself in the information provided directly from Sr. management of many junior miners and along with companies of other exciting industries.

Learn more about NobleCon19 and presenters here.

Managing Editor, Channelchek.com

Sources

https://www.channelchek.com/c-suite-interviews

https://app.koyfin.com/share/eecfbd6ad8

https://www.bankofcanada.ca/2023/07/fad-press-release-2023-07-12/

https://www.bankofcanada.ca/2023/07/fad-press-release-2023-07-12/