The FOMC Member’s Change in Sentiment is a Big Focus

Whether the Fed moves rates up after the June FOMC or not could mean little to whether there is additional drag on the economy. The short end of the yield curve, where savers benefit, has risen each time the Fed has raised rates. Out further, the 10-year T-Note, which is the benchmark for 30-year mortgages and from which corporate 10-year notes are spread, has been remarkably steady. Nine months ago, when Fed Funds were 3.00%- 3.25%, the 10-Year Treasury yielded 3.76%. Today the Fed Funds target rate is 5.00-5.25%, the 10-Year is still at 3.76%. This may be why the Fed has had a difficult time reeling in inflation, longer interest rates, where they impact the economy most, had reached 4.25% last October, the Fed has since tightened 200bp, and 10-year rates have traded around 50 bp lower since the October high, despite the tightening. And for the same reason, mortgage rates are lower now than they were last October.

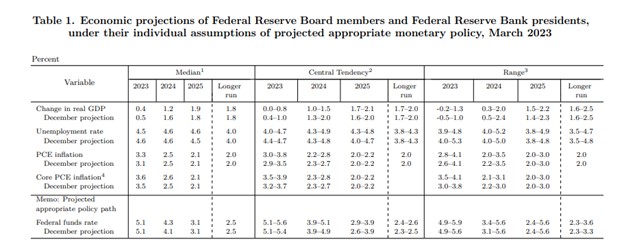

Summary Of Economic Projections

More meaningful for market participants might be the Summary of Economiuc Projections (SEP). Outside of a normal knee-jerk reaction after Wednesday’s policy announcement, or a quick trade that can be had off Powell’s press conference remarks, what the Fed members now expect by year-end is a better indication of any new mindset on monetary policy.

The Summary of Economic Projections includes estimates from the FOMC members showing where they see rates at the end of 2023 (and beyond). At the March meeting (see below), most of the Fed policymakers saw rates staying at current levels, with a few signaling additional hikes may be coming. While Powell will answer questions at the press conference that may be indicative of what they are thinking, the change in the SEP numbers (released in the statement after the meeting) is a better indicator of whether the Fed is now more hawkish or dovish.

A big shift toward expectations of higher rates would indicate a more hawkish stance. It will be useful to note how projections have evolved compared to March – Chair Powell will, of course, provide further color through his press conference.

Pause, Pivot, or Push Higher

Has the view changed with recent economic data? Was the view in March skewed by what could have turned into a banking crisis? We’ll see in hard numbers, without reading between any lines. We can see in black and white what the aggregate thinking is of the members when behind closed doors, where the important discussions happen – inside the FOMC meeting room.

After the announcement, Channelchek subscribers will receive a summary in their email of the announcement, changes in language from previous meetings, and the new SEP to compare any change in sentiment (subscribe at no cost).

While the actual impact on the overall economy of a 25bp move compared to a Fed pause may have little impact on the economy, company earnings, or even Treasury Bonds, each time the Fed raises overnight rates, there are investors that are more comfortable with a larger allocation of cash. Depending on where “uninvested” assets are held, they may be earning near 5%. This is a risk to stock prices as some investors may find be comfortable with money market returns for a larger portion of their portfolios. Fewer assets in the stock market have a depressing effect on prices.

Take Away

While pre and post-Fed meeting investor conversations tend to swirl around words like, “pause”, “pivot”, and “tighten”, the Fed’s overall change in rate expectations, which they have the most control over, is more telling than any polished statement or press briefing. These numbers are on the SEP report.

Managing Editor, Channelchek

Sources