Another Sign Conditions are Improving for Biotech Stocks

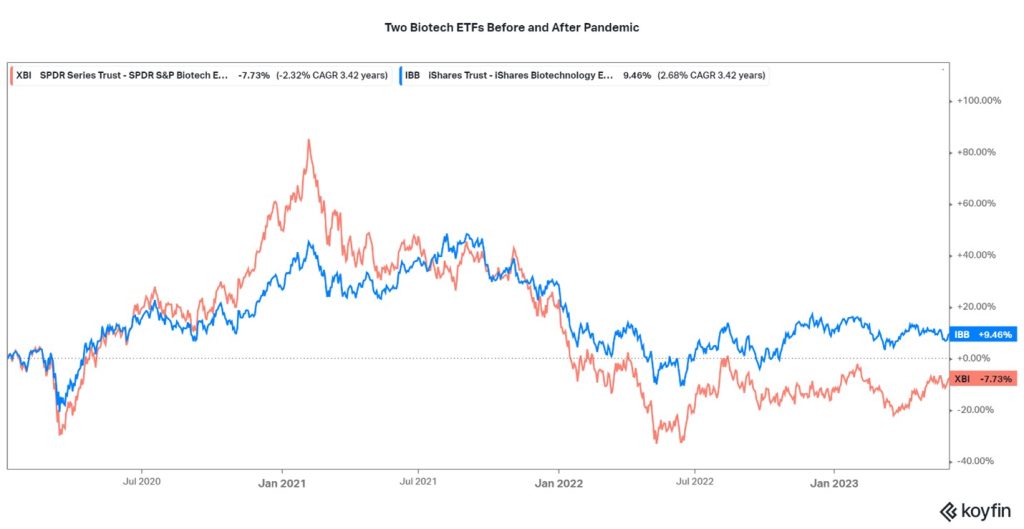

Biotech stocks seem to be exhibiting unusual value for any stock segment. A subset of the healthcare sector, biotechnology includes companies researching, and developing what may be the next-generation medical preventatives and treatments. There had been a huge decline in interest in the segment that coincided with FDA approval of the first Covid19 vaccine in late Summer 2021. Since then, the average price has been more than cut in half (see XBI/IBB chart) for biotechs.

The chart below is the S&P SPDR Biotech ETF and iShares Biotech ETF. They represent 280 stocks. According to an article in Barron’s dated June 4, 2023, of these, 23 (almost 10%) are trading below enterprise value (EV). Many more are on the cusp of trading right at the value of their net assets. For example, the article mentioned Atea Pharmaceuticals (AVIR), a biotech developing antiviral therapeutics for Hep-C and Covid. “If you bought all Atea’s shares and paid off all of its debt, the cash and other liquid assets remaining on its balance sheet would be worth more than what you spent,” wrote Barron’s.

Of the 280 stocks, nearly 60 have enterprise values below $100 million – the current conditions are not sustainable. At some point, the “invisible hand” of the market is will work to correct it. Last week, Atea, which had been trading near $3.70 recently, was offered $5.75 per share. Concentra Biosciences, which is controlled by the investment fund Tang Capital Partners, made the offer with some contingencies tied to licenses or sales of Atea’s products.

The peculiar condition of the market valuing biotech companies below EV or even cash came to my attention at a RoadShow that was arranged by Noble Capital Markets that featured Cocrystal Pharma (COCP). Cocrystal has several products advancing toward clinical milestones. It was presented by a member of Cocrystals executive management team in South Florida. While the myself and the other investors became familiar with COCP’s development pipeline, and data like the rate of cash usage, the amount of cash on hand, and the market value, it became quite apparent the company had far more cash than the amount the stock market had priced the entire company. And at its cash burn rate (amount of cash used to cover expenses each month), that there might be a significant valuation disconnect.

Many believe disconnects like this will be resolved as the markets always are seeking value and seemingly mispriced companies. There are already many examples this in 2023 as big pharma either has partnered with, or outright acquired companies. This, of course, can cause the stock prices to skyrocket. In fact, while the news was focused on Silicon Valley Bank last March, Provention Bio (PRVB) shot up 258% after a deal was announced.

Smaller biotechs need money to spend on developing drugs, and can’t rely on product sales. Even with what might seem like a huge war-chest of cash, low market values have stifled the ability to raise new money. The road to the next wonder drug is long and requires management to take comfort that they can secure funds when needed.

The extent of this challenge is unique to each company. For many, since the biotech segment valuations came down from the pandemic-inspired dizzying heights, they might have cash, but not enough to go an extended period until funding conditions improve. The offer last week by Concentra is a sign that conditions are changing. It isn’t just pharmaceutical companies shopping now for biotech bargains to own, it seems investment partnerships are also recognizing the extreme value in some companies.

For data and current information on almost 250 biotech companies, visit the biotech industry section here, on Channelchek.

Managing Editor, Channelchek

Sources

https://www.barrons.com/articles/biotechs-negative-enterprise-values-5e289e8e?mod=Searchresults