The New Russell Indexes Unconfirmed Versions – How Investors Use Them

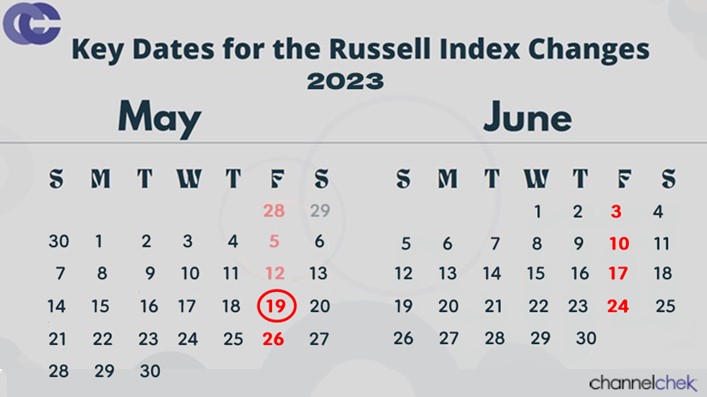

The preliminary list of stocks to be included in the Russell Reconstitution, and also which Russell Index, is a huge day for many stock investors and the impacted companies as well. This year, it occurs on Friday, May 19. The list, although preliminary and subject to refinements each Friday through June, includes the stocks that are believed to meet the requirements based on valuations taken on April 28. This is the first official file from the popular index provider, in addition to informing the investor public what to expect when the indexes are reconstituted. The reconstitution can be expected to impact prices as index fund managers readjust holdings. The event also, for many, redefines market-cap levels that are considered small-cap, mid-cap, and large-cap.

Background

The Russell Reconstitution is an annual event that reconfigures the membership of the Russell indexes by defining the top 3000 stocks based on market-cap (Russell 3000), then the top 1000 stocks (Russell 1000), and reclassifying the smaller 2000 stocks to form the Russell 2000 Small Cap Index. These serve as a benchmark for many institutional investors, as the indexes reflect the performance of the U.S. equity market across different market-cap classifications. The reconstitution process adds, removes, and weights stocks to ensure the indexes accurately represent the market.

The Preliminary List which will be published after the market closes on May 19, 2023, is a crucial step in the market cap reclassification process. It provides market participants with an initial glimpse into potential additions and deletions from the indexes. The stocks listed on this preliminary roster may experience increased attention from investors, as it hints at potential buying or selling pressure once the final reconstitution is completed.

The newly reconstituted indexes become live after the market close on June 23.

Implications for Investors

The release of the Russell Preliminary List on May 19 could provide opportunities for investors, including:

Enhanced Market Visibility – Companies listed on the Preliminary List may experience increased trading volumes and heightened market popularity, or even scrutiny, as investors evaluate their potential inclusion in the Russell indexes.

Potential Price Movements – Stocks slated for addition or deletion from the indexes can experience price volatility as market participants adjust their positions to align with the anticipated reconstitution changes.

Portfolio Adjustments – Active managers who track the Russell indexes may need to realign their portfolios to reflect the new index constituents, potentially triggering buying or selling activity in affected stocks.

Investor Considerations

Stock market participants should consider the following factors when analyzing the Preliminary List and its potential impact:

Final Reconstitution – The Preliminary List is subject to changes in the final reconstitution, which is typically announced in late June. Investors should monitor subsequent updates to confirm the actual index membership changes. These updates may occur as the result of faulty data or dramatic changes to the company such as a merger since the April 28 market cap snapshot.

Fundamental Analysis – As always, the fundamentals and financial health of the companies should be among the most important factors for non-index investors to consider. In the past, potential additions often presented attractive investment opportunities, while potential deletions may mean the stock gets less attention from investors.

Take Away

The release of the Preliminary List on May 19, 2023, marks a significant milestone in the Russell Reconstitution process. Investors should pay close attention to the stocks listed, as they may experience increased market visibility and potential price movements. However, it is important to remember that the Preliminary List is subject to changes. Thorough fundamental analysis, including earnings, potential growth, and liquidity assessment, is prudent for most stock investments. For information to evaluate small-cap names, look to Channelchek as a source of data on over 6,000 small cap companies.

Managing Editor, Channelchek

Sources

https://research.ftserussell.com/products/downloads/FTSE_FAQ_Document_Russell_US_Equity_2023.pdf