Research, News, and Market Data on LBNKF

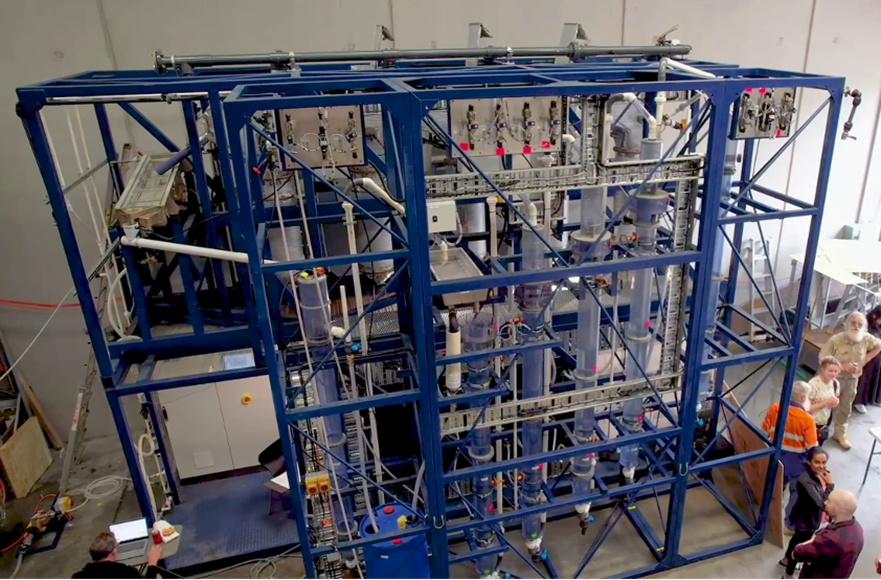

Calgary, Alberta. December 11, 2023 – LithiumBank Resources Corp. (TSX-V: LBNK) (OTCQX: LBNKF) (“LithiumBank” or the “Company”) is pleased to announce that the G2L Greenview Resources Inc. (“G2L”) Direct Lithium Extraction (DLE) pilot plant is now in transit to LithiumBank’s Calgary facility. Once completed, the facility will have capacity to process up to 10,000 L/d of brine and yield up to 3 kg/d LCE. Commencing in early 2024, several piloting campaigns are planned as the Boardwalk Project advances into its feasibility studies phase of development. The Company also anticipates that the facility will accelerate the development of the Company’s Park Place, Estevan, South, and Kindersley properties.

The pilot plant has been constructed in Australia by Clean TeQ Water on the behalf of G2L and is based on G2L’s Continuous Direct Lithium Extraction (cDLE®) technology. As seen in recent testwork results (Reported Nov. 22, 2023), the cDLE® process utilizes an ion exchange material (sorbent) designed to selectively extract lithium from the brine while rejecting most contaminants. In the context of the Boardwalk Project, the configuration of the pilot adsorption and elution stages has been purposefully designed to maximize extraction of lithium from the brine. Similarly, the selectivity of the sorbent and elution chemistry allows strong rejection of typical impurities in the brine such as sodium, calcium and chloride. This results in a clean, lithium-rich concentrate suitable for further refining.

At the facility in Calgary, the cDLE® process will demonstrate the cost and process advantages of using common industrial reagents such as quicklime and sulfuric acid. The operating cost benefits of this change in reagent suite will be quantified in an updated Boardwalk Project Preliminary Economic Assessment. Senior process engineers from G2L will head up the installation of the pilot and the first 100 hours of processing. G2L will continue to lend support throughout the entire piloting program which is intended to last up to 18 months following the first 100 hours of operation.

With a processing capacity of up to 10,000 L/d of brine, the Calgary facility will represent one of the largest DLE pilot plants in North America. The pilot plant represents an approximate 1:5,000 scale to the future, commercial production modules which is consistent with scale-up factors used in other hydrometallurgical processes. Within the pilot plant, sufficiently large ion exchange equipment has been installed to permit direct scale-up of these process steps to the commercial plant, accelerating the Boardwalk Project development.

During operation, the pilot plant will be targeting one of the industry’s highest lithium recoveries. This is seen as achievable for the Boardwalk project given the project’s careful staging of adsorption and elution contactors, along with the characteristics of the sorbent. Specifically, experiences from industrial ion exchange processes used for the recovery of precious (gold) and energy (uranium) metals have been leveraged in formulating the Boardwalk DLE flowsheet. This formulation included a trade-off assessment of lithium recovery and capital cost which was undertaken for the purposes of the upcoming updated PEA. As a result, the pilot plant will assess the performance of five contactor stages with results to follow in the PEA.

Furthermore, G2L’s experience in pilot testing of continuous ion exchange for recovery of other metals, including nickel and cobalt, at a similar scale in similar pilot equipment, provides confidence that recovery using counter-current adsorption contactors can be predicted from laboratory scale test work.

The cDLE® pilot plant in transit is a variation of a pilot plant that was designed and constructed by the Clean TeQ Water technical team to extract nickel and cobalt by ion exchange from acid leached lateritic ore in the Sunrise Energy Metals project. The plant was run over several campaigns and the data were subsequently used for a Bankable Feasibility Study (BFS) on the production of battery-grade nickel and cobalt sulfates. The Boardwalk Project cDLE® plant uses the same basic configuration, with critical design changes incorporated to ensure maximum lithium extraction from the brine, and the production of a high purity eluate containing a high lithium concentration.

A video showing the cDLE® pilot plant prior to shipping to Calgary can be viewed below:

About LithiumBank Resources Corp.

LithiumBank Resources Corp. (TSX-V: LBNK) (OTCQX: LBNKF), is a publicly traded lithium company that is focused on developing its two flagship projects, Boardwalk and Park Place, in Western Canada. The Company holds 2,480,196 acres of brownfield & exploration lithium brine permits, across 3 districts in Alberta and Saskatchewan. In May 2023, LithiumBank completed an initial robust preliminary economic assessment of its Boardwalk project that targets a 31,350 TPA operation with a pre-tax USD $2.7B NPV and a 21.6% IRR with the potential for a number of near term enhancements. The Company will continue to de- risk its assets through detailed geological modelling and advanced engineering.

For more information see the Company’s Boardwalk Lithium Brine Project Preliminary Economic Assessment Technical report entitled “Preliminary Economic Assessment (PEA) for LithiumBank Resources Boardwalk Lithium-Brine Project in West- Central Alberta, Canada” effectively dated June 16, 2023 filed on SEDAR+ (www.sedarplus.ca) on June 23, 2023 and on the Company’s website (www.lithiumbank.ca).

Mineral resources are not mineral reserves and do not have demonstrated economic viability. There is no guarantee that all or any part of the mineral resource will be converted into a mineral reserve. The estimate of mineral resources may be materially affected by geology, environment, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues. A preliminary economic assessment is preliminary in nature as it includes a portion of inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the preliminary economic assessment will be realized.

About G2L Greenview Resources Inc.

Go2Lithium Inc. was formed in early 2023 as a 50/50 joint venture with Computational Geosciences Inc (CGI), a subsidiary of the Robert Friedland-chaired Ivanhoe Electric Inc. (NYSE:IE) and Clean TeQ Water (ASX:CNQ). Please see Clean TeQ’s case studies for additional information on their suite of water treatment and metal extraction technologies.

The scientific and technical disclosure in this news release has been reviewed and approved by Mr. Kevin Piepgrass (Chief Operations Officer, LithiumBank Resources Corp.), who is a Member of the Association of Professional Engineers and Geoscientists of Alberta (APEGA) and the Association of Professional Engineers and Geoscientists of the Province of British Columbia (APEGBC) and is a Qualified Person (QP) for the purposes of National Instrument 43-101. Mr. Piepgrass consents to the inclusion of the data in the form and context in which it appears.

Contact:

LithiumBank

Rob Shewchuk

CEO & Director

rob@lithiumbank.ca

(778) 987-9767

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding Forward Looking Statements

This press release includes certain statements and information that may constitute forward-looking information within the meaning of applicable Canadian securities laws. All statements in this news release, other than statements of historical facts, including statements regarding future estimates, plans, objectives, timing, assumptions or expectations of future performance, including without limitation, statements regarding the completion of the Offering and the timing thereof, and the anticipated use of proceeds of the Offering are forward-looking statements and contain forward-looking information. Generally, forward-looking statements and information can be identified by the use of forward-looking terminology such as “intends” or “anticipates”, or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “should” or “would” or occur. Forward-looking statements are based on certain material assumptions and analyses made by the Company and the opinions and estimates of management as of the date of this press release, including, but not limited to, that the Company will complete the Offering on the terms disclosed, that the Company will receive all necessary regulatory approvals for the Offering, that the Company will use the proceeds of the Offering as currently anticipated; and assumptions relating to the state of the financial markets for the Company’s securities. These forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking statements or forward-looking information. Important factors that may cause actual results to vary, include, without limitation, market volatility, unanticipated costs, changes in applicable regulations, and changes in the Company’s business plans. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. Readers are cautioned that reliance on such information may not be appropriate for other purposes. The Company does not undertake to update any forward-looking statement, forward-looking information or financial out-look that are incorporated by reference herein, except in accordance with applicable securities laws.