Research News and Market Data on ORN

Oct 25, 2023

HOUSTON, Oct. 25, 2023 (GLOBE NEWSWIRE) — Orion Group Holdings, Inc. (NYSE: ORN) (the “Company”), a leading specialty construction company, today reported its financial results for the third quarter ended September 30, 2023.

Highlights for the quarter ended September 30, 2023:

- Contract revenues of $168.5 million

- GAAP net loss was $0.7 million or $0.02 per diluted share

- Adjusted net income was $0.8 million or $0.02 per diluted share

- Adjusted EBITDA was $9.4 million

- Signed contract valued over $100 million with Grand Bahama Shipyard Limited (GBSL) for the turnkey design-build of the Grand Bahama Shipyard Dry Dock Replacement Project

- Other recently awarded new contracts in both the Concrete and Marine segments for a combined total of approximately $121 million

- Backlog and contracts awarded subsequent to quarter end totaled $920 million

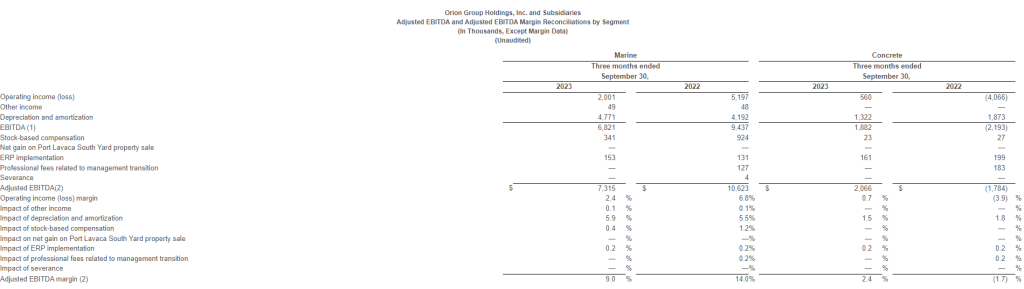

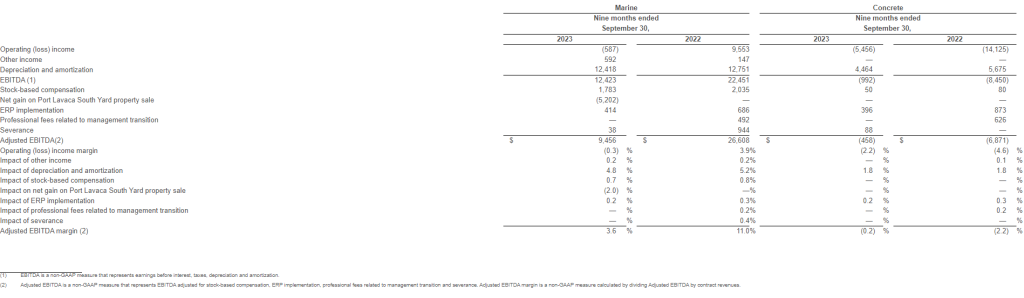

See definitions and reconciliation of non-GAAP measures elsewhere in this release.

Management Commentary

“As CFO Scott Thanisch and I marked our first anniversary with Orion, we are incredibly proud of how our people have worked collaboratively to embrace change and deliver positive results,” said Travis Boone, Chief Executive Officer of Orion Group Holdings. “Backlog is a key metric and indicator of the health of the business. As of September 30, backlog stood at $878 million compared with backlog of $549 million in the prior year period. We have won several prestigious projects including the $435 million contract to build a dry dock at Pearl Harbor for the US Navy and a contract valued over $100 million with the Grand Bahama Shipyard Limited (GBSL) for the turnkey design-build of the Grand Bahama Shipyard Dry Dock Replacement Project.”

“Last quarter we told you that we expected continued improvement in profitability through the back half of the year, and we are delivering on that promise. Third-quarter Adjusted EBITDA was $9.4 million versus $3.7 million in the second quarter of 2023. While our third quarter revenue of $169 million is down year-over-year due to our exit from the Central Texas concrete business, the higher quality of our revenue is delivering improved profitability.”

“Since March, our Concrete business has been profitable and improving on an Adjusted EBITDA basis. Adjusted EBITDA margin increased from negative 1.7% to positive 2.4% year-over-year. In addition, the Concrete business was operating income positive on an unconsolidated basis in the third quarter. In Marine, we have a lot of momentum with projects won and potential future projects. There’s a tremendous amount of pent-up demand that we think will be a significant tailwind for us well into 2024 and 2025.”

“As we look ahead to the fourth quarter and beyond, we are optimistic. Our investments in business development are paying off, and we have sufficient capacity and a more disciplined approach to optimize our people and assets. We will see continued improvement in our margins and benefit from operating leverage as we grow the top line. We are excited to build on our success this year and continue growing profitably in 2024,” concluded Boone.

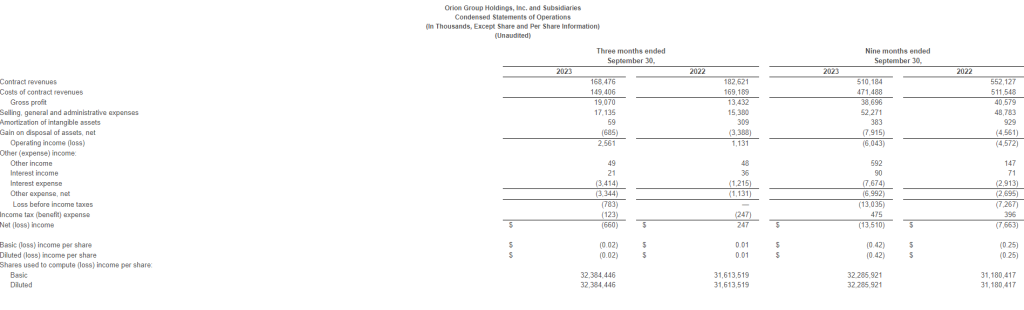

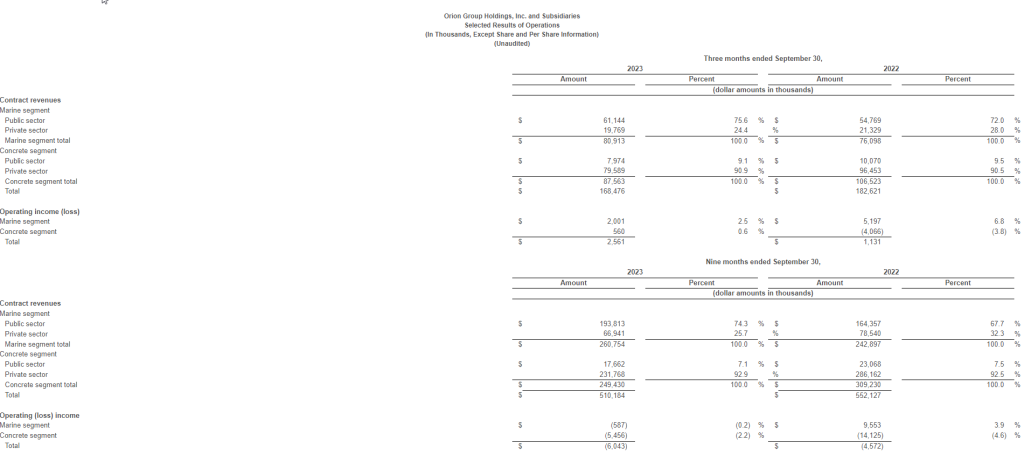

Third Quarter 2023 Results

Contract revenues of $168.5 million decreased 7.7% from $182.6 million in the third quarter last year, primarily due to our decision to exit the unprofitable concrete business in central Texas, partially offset by an increase in marine segment revenue related to the Pearl Harbor, Hawaii drydock project (the “Pearl Harbor Project”).

Gross profit was $19.1 million or 11.3% of revenue up from $13.4 million or 7.4% of revenue in the third quarter of 2022. The increase in gross profit dollars and margin was primarily driven by margin improvements in both segments stemming from higher quality projects and improved execution, partially offset by lower equipment and labor utilization in our dredging business.

Selling, general and administrative (“SG&A”) expenses were $17.1 million, up 11.4% from $15.4 million in the third quarter of 2022. As a percentage of total contract revenues, SG&A expenses increased to 10.2% from 8.5%, primarily due to lower revenues and an increase in SG&A in the third quarter. The increase in SG&A dollars reflected an increase in IT and business development spending and higher legal costs related to customer claims.

Net loss for the third quarter was $0.7 million or $0.02 per diluted share compared to net income of $0.2 million or $0.01 per diluted share in the third quarter of 2022.

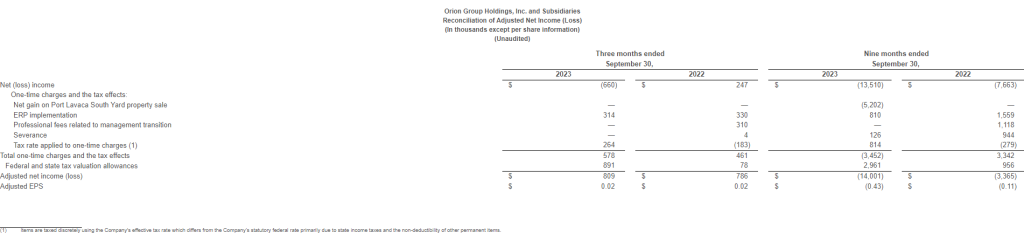

The third quarter 2023 net loss included $1.5 million ($0.04 diluted income per share) of non-recurring items. Third quarter 2023 adjusted net income was $0.8 million ($0.02 diluted income per share).

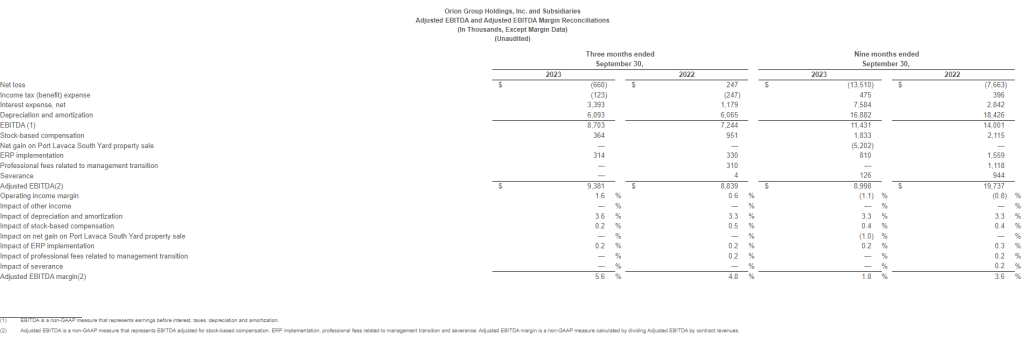

EBITDA for the third quarter of 2023 was $8.7 million, representing a 5.2% EBITDA margin, as compared to EBITDA of $7.2 million, or a 4.0% EBITDA margin in the third quarter last year. Adjusted for non-recurring items, EBITDA for the third quarter of 2023 was $9.4 million, representing a 5.6% adjusted EBITDA margin, as compared to adjusted EBITDA for the third quarter of 2022 of $8.8 million, representing a 4.8% adjusted EBITDA margin.

Backlog

Total backlog at September 30, 2023 was $877.5 million, compared to $818.7 million at June 30, 2023 and $548.6 million at September 30, 2022. Backlog for the Marine segment was $699.9 million, compared to $614.9 million at June 30, 2023 and $280.2 million at September 30, 2022. Backlog for the Concrete segment was $177.6 million, compared to $203.8 million at June 30, 2023 and $268.4 million at September 30, 2022. In addition, the Company has been awarded $43 million in new project work subsequent to the end of the quarter ended September 30, 2022 that is not included in backlog at the end of the quarter.

Recent Wins

On September 22, the Company entered into a design-build contract valued over $100 million for its Marine and Engineering business. The contract was awarded by Grand Bahama Shipyard Limited (GBSL) for the turnkey design-build of the Grand Bahama Shipyard Dry Dock Replacement Project, situated in Grand Bahama, Bahamas. In addition, the Company was recently awarded other new contracts in both its concrete and marine segments for a combined total of approximately $121 million.

Safety Award

Orion Group Holdings, Inc. was presented with the Company Award for Leadership in Safety from the Council of Dredging and Marine Construction Safety (CDMCS). The award, presented at the 2023 CDMCS Annual Awards Dinner in Washington, D.C. on September 28, recognizes outstanding safety leadership in the dredging and marine construction industry.

Orion Group Holdings was recognized for advancing a safety-first culture through safety-conscious policies and procedures in the workplace, mentoring others in safety, training on identifying and properly controlling hazards, and placing high personal value on collaborative and proactive work toward improving safety.

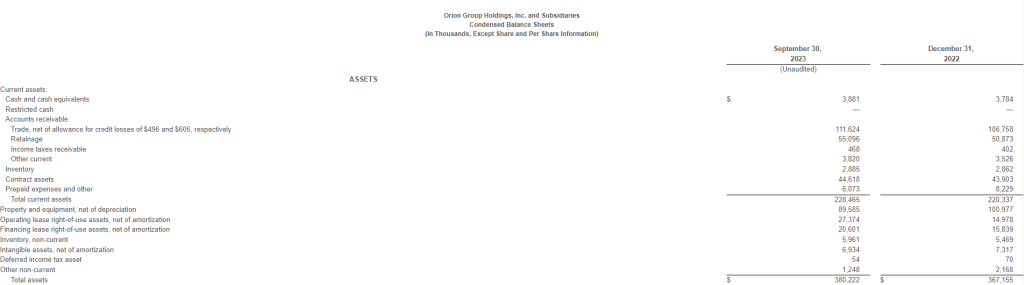

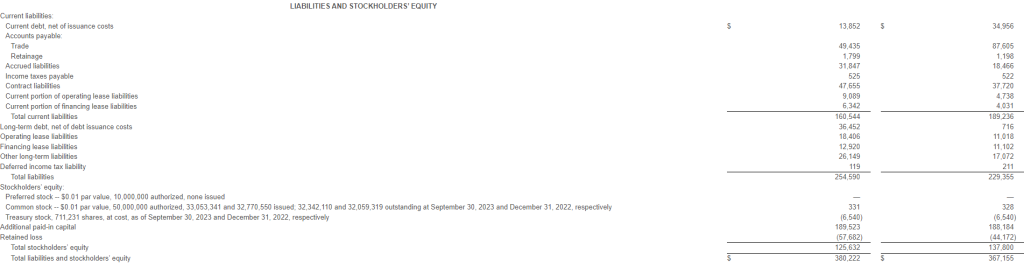

Balance Sheet Update

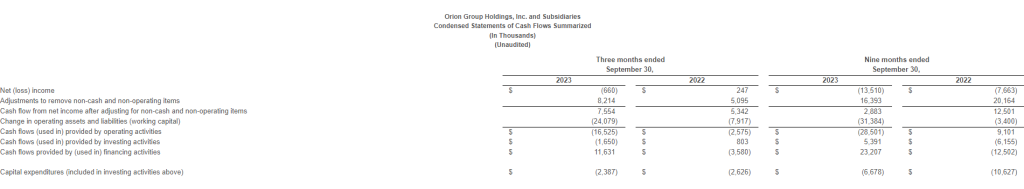

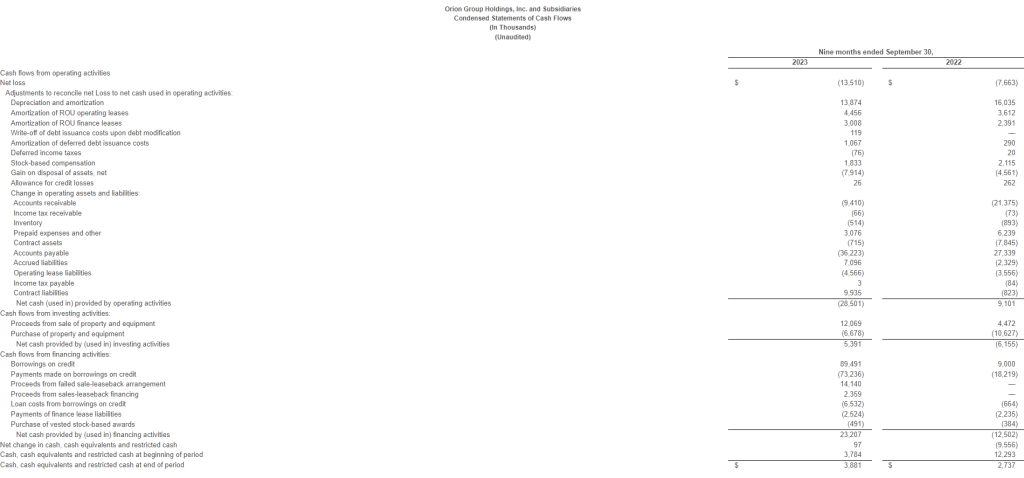

As of September 30, 2023, current assets were $228.5 million, including unrestricted cash and cash equivalents of $3.9 million. Total debt outstanding as of September 30, 2023 was $50.3 million. At the end of the quarter, the Company had $13.5 million in outstanding borrowings under its revolving credit facility.

Conference Call Details

Orion Group Holdings will host a conference call to discuss results for the third quarter 2023 at 9:00 a.m. Eastern Time/8:00 a.m. Central Time on Thursday, October 26, 2023. To participate, please dial (800) 715-9871 and ask for the Orion Group Holdings Conference Call. A live audio webcast of the call will also be available on the Investor Relations section of Orion’s website at https://www.oriongroupholdingsinc.com/investor/ and will be archived for replay.

About Orion Group Holdings

Orion Group Holdings, Inc., a leading specialty construction company serving the infrastructure, industrial and building sectors, provides services both on and off the water in the continental United States, Alaska, Hawaii, Canada and the Caribbean Basin through its marine segment and its concrete segment. The Company’s marine segment provides construction and dredging services relating to marine transportation facility construction, marine pipeline construction, marine environmental structures, dredging of waterways, channels and ports, environmental dredging, design and specialty services. Its concrete segment provides turnkey concrete construction services including place and finish, site prep, layout, forming, and rebar placement for large commercial, structural and other associated business areas. The Company is headquartered in Houston, Texas with regional offices throughout its operating areas. The Company’s website is located at: https://www.oriongroupholdingsinc.com.

Backlog Definition

Backlog consists of projects under contract that have either (a) not been started, or (b) are in progress but are not yet complete. The Company cannot guarantee that the revenue implied by its backlog will be realized, or, if realized, will result in earnings. Backlog can fluctuate from period to period due to the timing and execution of contracts. The typical duration of the Company’s projects ranges from three to nine months on shorter projects to multiple years on larger projects. The Company’s backlog at any point in time includes both revenue it expects to realize during the next twelve-month period as well as revenue it expects to realize in future years.

Non-GAAP Financial Measures

This press release includes the financial measures “adjusted net income/loss,” “adjusted earnings/loss per share,” “EBITDA,” “Adjusted EBITDA” and “Adjusted EBITDA margin.” These measurements are “non-GAAP financial measures” under rules of the Securities and Exchange Commission, including Regulation G. The non-GAAP financial information may be determined or calculated differently by other companies. By reporting such non-GAAP financial information, the Company does not intend to give such information greater prominence than comparable GAAP financial information. Investors are urged to consider these non-GAAP measures in addition to and not in substitute for measures prepared in accordance with GAAP.

Adjusted net income/loss and adjusted earnings/loss per share should not be viewed as an equivalent financial measure to net income/loss or earnings/loss per share. Adjusted net income/loss and adjusted earnings/loss per share exclude certain items that management believes impairs a meaningful evaluation of the Company’s financial performance. The Company believes these adjusted financial measures are a useful supplement to earnings/loss calculated in accordance with GAAP because they better inform our common stockholders as to the Company’s operational trends and performance relative to other companies. Generally, items excluded are one-time items or items whose timing or amount cannot be reasonably estimated. Accordingly, any guidance provided by the Company generally excludes information regarding these types of items.

Orion Group Holdings defines EBITDA as net income/loss before net interest expense, income taxes, depreciation and amortization. Adjusted EBITDA is calculated by adjusting EBITDA for certain items that management believes impairs a meaningful comparison of operating results. Adjusted EBITDA margin is calculated by dividing Adjusted EBITDA for the period by contract revenues for the period. The GAAP financial measure that is most directly comparable to EBITDA and Adjusted EBITDA is net income, while the GAAP financial measure that is most directly comparable to Adjusted EBITDA margin is operating margin, which represents operating income divided by contract revenues. EBITDA, Adjusted EBITDA and Adjusted EBITDA margin are used internally to evaluate current operating expense, operating efficiency, and operating profitability on a variable cost basis, by excluding the depreciation and amortization expenses, primarily related to capital expenditures and acquisitions, and net interest and tax expenses. Additionally, EBITDA, Adjusted EBITDA and Adjusted EBITDA margin provide useful information regarding the Company’s ability to meet future debt service and working capital requirements while providing an overall evaluation of the Company’s financial condition. In addition, EBITDA is used internally for incentive compensation purposes. The Company includes EBITDA, Adjusted EBITDA and Adjusted EBITDA margin to provide transparency to investors as they are commonly used by investors and others in assessing performance. EBITDA, Adjusted EBITDA and Adjusted EBITDA margin have certain limitations as analytical tools and should not be used as a substitute for operating margin, net income, cash flows, or other data prepared in accordance with GAAP, or as a measure of the Company’s profitability or liquidity.

Forward-Looking Statements

The matters discussed in this press release may constitute or include projections or other forward-looking statements within the meaning of the “safe harbor” provisions of Section 27A of the Securities Exchange Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, of which provisions the Company is availing itself. Certain forward-looking statements can be identified by the use of forward-looking terminology, such as ‘believes’, ‘expects’, ‘may’, ‘will’, ‘could’, ‘should’, ‘seeks’, ‘approximately’, ‘intends’, ‘plans’, ‘estimates’, or ‘anticipates’, or the negative thereof or other comparable terminology, or by discussions of strategy, plans, objectives, intentions, estimates, forecasts, outlook, assumptions, or goals. In particular, statements regarding future operations or results, including those set forth in this press release, and any other statement, express or implied, concerning future operating results or the future generation of or ability to generate revenues, income, net income, gross profit, EBITDA, Adjusted EBITDA, Adjusted EBITDA margin, or cash flow, including to service debt, and including any estimates, forecasts or assumptions regarding future revenues or revenue growth, are forward-looking statements. Forward-looking statements also include project award announcements, estimated project start dates, anticipated revenues, and contract options which may or may not be awarded in the future. Forward-looking statements involve risks, including those associated with the Company’s fixed price contracts that impacts profits, unforeseen productivity delays that may alter the final profitability of the contract, cancellation of the contract by the customer for unforeseen reasons, delays or decreases in funding by the customer, levels and predictability of government funding or other governmental budgetary constraints, and any potential contract options which may or may not be awarded in the future, and are at the sole discretion of award by the customer. Past performance is not necessarily an indicator of future results. In light of these and other uncertainties, the inclusion of forward-looking statements in this press release should not be regarded as a representation by the Company that the Company’s plans, estimates, forecasts, goals, intentions, or objectives will be achieved or realized. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. The Company assumes no obligation to update information contained in this press release whether as a result of new developments or otherwise, except as required by law.

Please refer to the Company’s 2022 Annual Report on Form 10-K, filed on March 16, 2023, which is available on its website at www.oriongroupholdingsinc.com or at the SEC’s website at www.sec.gov, for additional and more detailed discussion of risk factors that could cause actual results to differ materially from our current expectations, estimates or forecasts.

Contacts:

Financial Profiles, Inc.

Margaret Boyce 310-622-8247

orn@finprofiles.com