Research News and Market Data on DLHC

August 2, 2023

Quarterly Revenue Over $100 Million; Active Pipeline of Opportunities to Accelerate Growth in Fiscal 2024

ATLANTA, Aug. 02, 2023 (GLOBE NEWSWIRE) — DLH Holdings Corp. (NASDAQ: DLHC) (“DLH” or the “Company”), a leading provider of research and development, systems engineering and integration, and digital transformation solutions to federal agencies, today announced financial results for its fiscal third quarter ended June 30, 2023.

Highlights

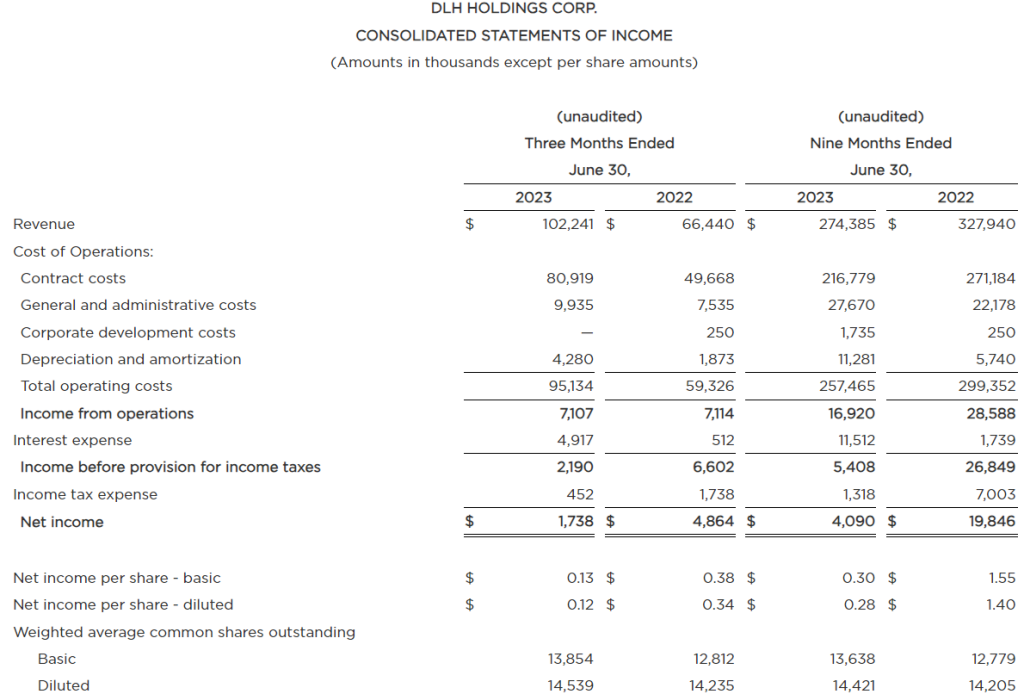

- Third quarter revenue was $102.2 million in fiscal 2023 versus $66.4 million in fiscal 2022; the prior-year period included an adjustment of $(5.1) million related to the short-term FEMA task orders in Alaska, without which revenue was $71.6 million.

- Operating and net income for the third quarter were $7.1 million and $1.7 million, respectively, as compared to $7.1 million and $4.9 million in the prior-year period. Operating income for the fiscal 2022 quarter included $0.6 million from the FEMA task orders.

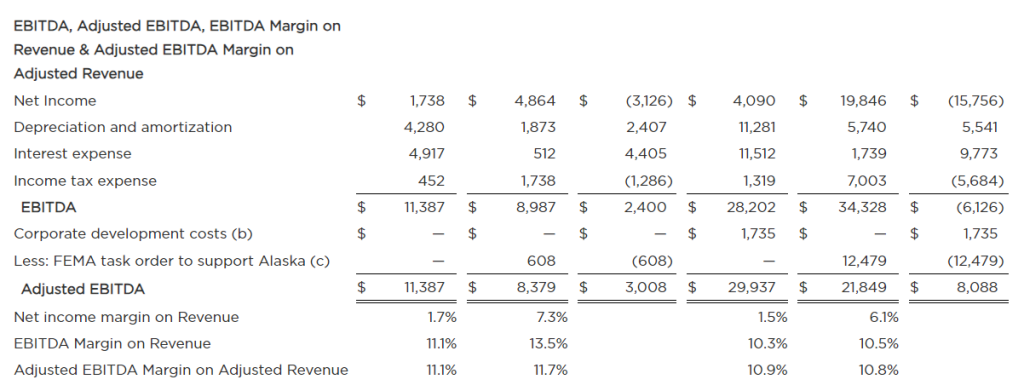

- Earnings before interest, taxes, depreciation and amortization (“EBITDA”) was $11.4 million for the third quarter as compared to $9.0 million in fiscal 2022. The prior-year period included $0.6 million of EBITDA from the FEMA task orders.

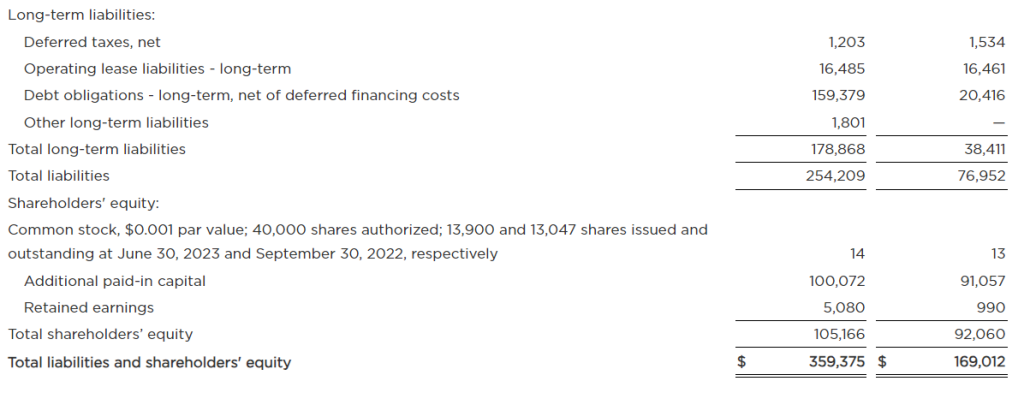

- Total debt at the end of the third quarter was $195.8 million compared to $204.2 million as of March 31, 2023.

- Contract backlog was $817.8 million as of June 30, 2023 versus $940.6 million at the end of the fiscal second quarter.

Management Discussion

“Third quarter performance once again highlighted the Company’s ability to produce strong underlying results,” said Zach Parker, DLH President and Chief Executive Officer. “We passed the $100 million revenue run rate, improved margins sequentially from the second quarter, used cash flow to continue paying down debt and successfully accomplished several milestones in the GRSi integration. The contract award environment continues to experience some headwinds, reflecting certain contract protests and extensive procurement cycles. The Company remains in excellent position to capitalize on current market dynamics and execute on new business development initiatives, resulting in an active bid environment. Our expanded health IT suite of solutions — leveraging unique applications and our highly-credentialed staff — provides us access to penetrate new programs within the key government agencies we serve. At the same time, with our ability to generate healthy cash from operations, we remain on track to de-lever the balance sheet in the coming quarters, which we expect will result in increased returns to our shareholders.

“In addition, we recently announced that DLH had been awarded a contract to expand our role at the National Heart, Lung and Blood Institute within the National Institutes of Health. The multiple-award contract has a total ceiling value of up to $85 million over five years, and we’ll be responsible for driving key digital transformation goals for the agency. Overall, we continue to see numerous opportunities to accelerate growth going forward, leveraging our expanded set of technology solutions, and are well prepared for further improved performance.”

Results for the Three Months Ended June 30, 2023

Revenue for the third quarter of fiscal 2023 was $102.2 million versus $66.4 million in fiscal 2022, with the prior-year period including an adjustment of $(5.1) million related to the Company’s short-term FEMA contracts in Alaska. Comparing this quarter’s revenue performance to the same period in the prior fiscal year, excluding the impact from the FEMA contracts, revenue increased $30.6 million, including contributions of $34.4 million from GRSi.

Income from operations was $7.1 million for the quarter versus $7.1 million in the prior-year period, which included $0.6 million from the FEMA task orders. Comparing this quarter’s operating income performance to the same period in the prior fiscal year, excluding the impact from the FEMA contracts, operating income increased $0.6 million. As a percentage of revenue, the Company reported an operating margin of 7.0% in the fiscal 2023 third quarter versus 10.7% in fiscal 2022, with the year-over-year decline primarily due to higher non-cash amortization expense as a result of the GRSi acquisition.

Interest expense was $4.9 million in the fiscal third quarter of 2023 versus $0.5 million in the prior-year period, reflecting higher debt outstanding due to the acquisition of GRSi and increased interest rates. Income before income taxes was $2.2 million this year versus $6.6 million in fiscal 2022, representing 2.1% and 9.9% of revenue, respectively, for each period.

For the three months ended June 30, 2023 and 2022, respectively, DLH recorded a $0.5 million and $1.7 million of income tax expense. The Company reported net income of approximately $1.7 million, or $0.12 per diluted share, for the third quarter of fiscal 2023 versus $4.9 million or $0.34 per diluted share, for the third quarter of fiscal 2022. As a percentage of revenue, net income was 1.7% for the third quarter of fiscal 2023 versus 7.3% for the prior-year period.

On a non-GAAP basis, EBITDA for the three months ended June 30, 2023 was approximately $11.4 million versus $9.0 million in the prior-year period, or 11.1% and 13.5% of revenue, respectively. Adjusted EBITDA1 was $11.4 million versus $8.4 million for the prior-year period, or 11.1% and 11.7% of adjusted revenue, respectively.

Key Financial Indicators

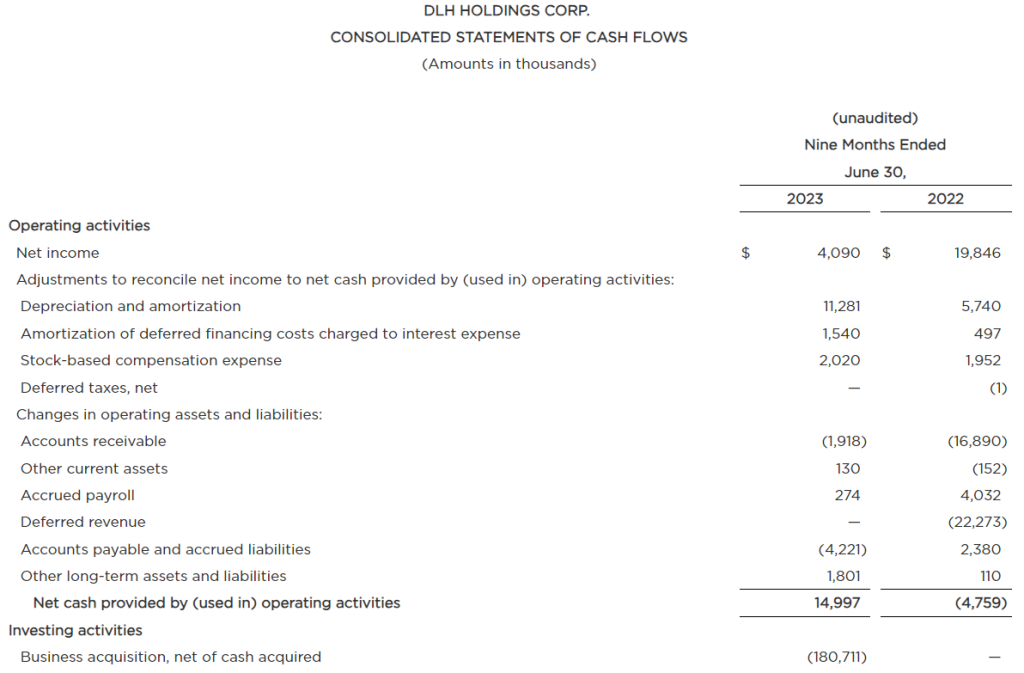

For fiscal 2023, DLH has produced $15.0 million in operating cash. As of June 30, 2023, the Company had cash of $0.5 million and debt outstanding under its credit facilities of $195.8 million versus cash of $1.1 million and debt outstanding of $22.0 million as of September 30, 2022. The Company is on pace to reduce its total debt balance to between $185.0 million and $187.0 million by the end of this fiscal year.

At June 30, 2023, total backlog was approximately $817.8 million, including funded backlog of approximately $147.3 million and unfunded backlog of $670.5 million.

Conference Call and Webcast Details

DLH management will discuss third quarter results and provide a general business update, including current competitive conditions and strategies, during a conference call beginning at 10:00 AM Eastern Time tomorrow, August 3, 2023. Interested parties may listen to the conference call by dialing 888-347-5290 or 412-317-5256. Presentation materials will also be posted on the Investor Relations section of the DLH website prior to the commencement of the conference call.

A digital recording of the conference call will be available for replay two hours after the completion of the call and can be accessed on the DLH Investor Relations website or by dialing 877-344-7529 and entering the conference ID 5343381.

About DLH

DLH (NASDAQ:DLHC) enhances public health and national security readiness missions through science, technology, cyber, and engineering solutions and services. Our experts solve some of the most complex and critical missions faced by federal customers, leveraging digital transformation, artificial intelligence, advanced analytics, cloud-based applications, telehealth systems, and more. With over 3,200 employees dedicated to the idea that “Your Mission is Our Passion,” DLH brings a unique combination of government sector experience, proven methodology, and unwavering commitment to innovative solutions to improve the lives of millions. For more information, visit www.DLHcorp.com.

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995:

This press release may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements relate to future events or DLH`s future financial performance. Any statements that refer to expectations, projections or other characterizations of future events or circumstances or that are not statements of historical fact (including without limitation statements to the effect that the Company or its management “believes”, “expects”, “anticipates”, “plans”, “intends” and similar expressions) should be considered forward looking statements that involve risks and uncertainties which could cause actual events or DLH’s actual results to differ materially from those indicated by the forward-looking statements. Forward-looking statements in this release include, among others, statements regarding estimates of future revenues, operating income, earnings and cash flow. These statements reflect our belief and assumptions as to future events that may not prove to be accurate. Our actual results may differ materially from such forward-looking statements made in this release due to a variety of factors, including: the risk that we will not realize the anticipated benefits of our acquisition of GRSi or any other acquisitions (including anticipated future financial performance and results); the diversion of management’s attention from normal daily operations of the business and the challenges of managing larger and more widespread operations resulting from our recent acquisition; the inability to retain employees and customers; contract awards in connection with re-competes for present business and/or competition for new business; our ability to manage our increased debt obligations; compliance with bank financial and other covenants; changes in client budgetary priorities; government contract procurement (such as bid and award protests, small business set asides, loss of work due to organizational conflicts of interest, etc.) and termination risks; the ability to successfully integrate the operations of GRSi or any future acquisitions; the impact of inflation and higher interest rates; and other risks described in our SEC filings. For a discussion of such risks and uncertainties which could cause actual results to differ from those contained in the forward-looking statements, see “Risk Factors” in the Company’s periodic reports filed with the SEC, including our Annual Report on Form 10-K for the fiscal year ended September 30, 2022, as well as subsequent reports filed thereafter. The forward-looking statements contained herein are not historical facts, but rather are based on current expectations, estimates, assumptions and projections about our industry and business.

Such forward-looking statements are made as of the date hereof and may become outdated over time. The Company does not assume any responsibility for updating forward-looking statements, except as may be required by law.

CONTACTS:

| INVESTOR RELATIONS |

| Contact: Chris Witty |

| Phone: 646-438-9385 |

| Email: cwitty@darrowir.com |

Non-GAAP Financial Measures

The Company uses EBITDA and EBITDA Margin on Revenue as supplemental non-GAAP measures of performance. We define EBITDA as net income excluding (i) interest expense, (ii) provision for or benefit from income taxes and (iii) depreciation and amortization. EBITDA Margin on Revenue is EBITDA for the measurement period divided by revenue for the same period.

The Company is presenting additional non-GAAP measures regarding its financial performance for the three and nine months ended June 30, 2023. The measures presented are Adjusted Revenue, Adjusted Operating Income, Adjusted EBITDA, and Adjusted EBITDA Margin on Adjusted Revenue. In calculating these measures, we have added the corporate development costs associated with completing the GRSi acquisition to our results for fiscal year 2023 and we have removed the contribution from the FEMA task orders from the results for fiscal year 2022. These resulting measures present the quarterly financial performance compared to results delivered in the prior year period. Definitions of these additional non-GAAP measures are set forth below.

We have prepared these additional non-GAAP measures to eliminate the impact of items that we do not consider indicative of ongoing operating performance due to their inherent unusual or extraordinary nature. These non-GAAP measures of performance are used by management to conduct and evaluate its business during its review of operating results for the periods presented. Management and the Company’s Board utilize these non-GAAP measures to make decisions about the use of the Company’s resources, analyze performance between periods, develop internal projections and measure management performance. We believe that these non-GAAP measures are useful to investors in evaluating the Company’s ongoing operating and financial results and understanding how such results compare with the Company’s historical performance.

These supplemental performance measurements may vary from and may not be comparable to similarly titled measures by other companies in our industry. Adjusted Revenue, Adjusted Operating Income, EBITDA, Adjusted EBITDA, EBITDA Margin on Revenue, and Adjusted EBITDA Margin on Adjusted Revenue are not recognized measurements under accounting principles generally accepted in the United States, or GAAP, and when analyzing our performance investors should (i) evaluate each adjustment in our reconciliation to the nearest GAAP financial measures and (ii) use the aforementioned non-GAAP measures in addition to, and not as an alternative to, revenue, operating income, net income or diluted EPS, as measures of operating results, each as defined under GAAP. We have defined these non-GAAP measures as follows:

“Adjusted Revenue” represents revenue less the contribution to revenue from the short-term FEMA task orders

“Adjusted Operating Income” represents operating income plus the corporate development costs associated with completing the GRSi acquisition incurred in fiscal 2023 less the contribution from the FEMA task orders, which occurred in fiscal 2022.

“Adjusted EBITDA” represents net income before income taxes, interest, depreciation and amortization and the corporate costs associated with completing the acquisition, less the contribution from FEMA task orders. “Adjusted EBITDA Margin on Adjusted Revenue” is calculated as Adjusted EBITDA divided by Adjusted Revenue.

Below is a reconciliation of Adjusted Revenue, Adjusted Operating Income, EBITDA, Adjusted EBITDA, EBITDA Margin on Revenue and Adjusted EBITDA Margin on Adjusted Revenue reported for the three and six months ended June 30, 2023 and 2022 compared to the most directly comparable financial measure calculated and presented in accordance with GAAP (in thousands except for per share amounts):

(a): Represents revenue adjusted to exclude revenue from the short-term FEMA task orders during the three and nine months ended June 30, 2022.

(b): Represents corporate development costs we incurred to complete the GRSi transaction. These costs primarily include legal counsel, financial due diligence, customer market analysis and representation and warranty insurance premiums.

(c): Adjusted operating income represents the Company’s consolidated operating income, determined in accordance with GAAP, adjusted to add the corporate development costs associated with the GRSi acquisition for fiscal year 2023 and adjusted to exclude the operating income derived from the FEMA task orders. Operating income for the FEMA task orders is derived by subtracting contract costs of ($5.7) million from the revenue attributable to such task orders during the three months ended June 30, 2022 of ($5.1) million. Similarly, for the nine months ended June 30, 2022 operating income for the FEMA task orders is derived by subtracting from the revenue attributable to the tasks orders of $125.8 million the following amounts associated with such task orders: contract costs $112.1 million and general & administrative costs of $1.2 million.

_______________________________

1 Adjusted Operating Income, EBITDA, Adjusted EBITDA, EBITDA Margin on Revenue, and Adjusted EBITDA Margin on Adjusted Revenue are non-GAAP financial measures. See “Non-GAAP Financial Measures” below for additional detail.