Home Buying Versus Home Selling Conditions

The underlying dynamics of the housing market are not what one might expect. Especially with home prices still near its peak after mortgage rates more than doubled over the past year and a half. One of the unique nuances of today’s housing market is what some are calling the “golden handcuffs” that may apply to anyone who has a home with a mortgage of 3.5% or lower. These owners are slow to sell; this is keeping a supply of homes off the market. The lack of homes for sale is keeping prices up despite the higher cost of borrowing. As witnessed in a monthly survey conducted by Fannie Mae, the attitudes of adults in the U.S., as it relates to buying, or selling, are fairly extreme, with many of the survey responses hit all-time highs and lows in terms of expectations.

Fannie Mae’s National Housing Survey

The National Housing Survey (NHS) is a monthly temperature check of attitudes among the general population related to home-owning, renting, household finances, and confidence in the economy. Each respondent is asked more than 100 questions; this makes the survey far more detailed than other measures of housing attitudes or expectations. Six of the questions are used to derive the Home Purchasing Sentiment Index (HPSI).

The overall economy typically benefits from housing turnover, as new buyers decorate and make a house, or condo, a home.

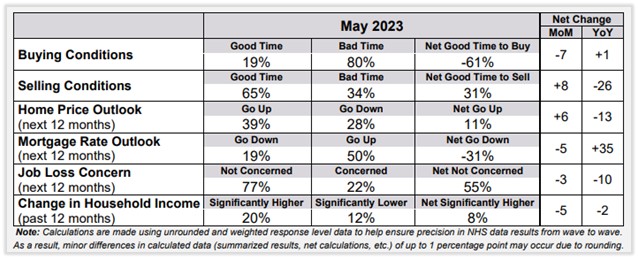

Below is the noteworthy response data from the six questions Fannie Mae uses for its index.

Home Purchase Sentiment Index (HPSI)

Fannie Mae’s Home Purchase Sentiment Index (HPSI) decreased in May by 1.2 points to 65.6. The HPSI is down 2.6 points compared to the same time last year.

Below are the May statistics on some of the most relevant questions.

Good/Bad Time to Buy:

The percentage of respondents who say it is a good time to buy a home decreased from 23% to 19%, while the percentage who say it is a bad time to buy increased from 77% to 80%. As a result, the net share of those who say it is a good time to buy decreased by 7 percentage points month over month.

Good/Bad Time to Sell:

The percentage of respondents who say it is a good time to sell a home increased from 62% to 65%, while the percentage who say it’s a bad time to sell decreased from 38% to 34%. As a result, the net share of those who say it is a good time to sell increased 8 percentage points month over month.

Home Price Expectations:

The percentage of respondents who say home prices will go up in the next 12 months increased from 37% to 39%, while the percentage who say home prices will go down decreased from 32% to 28%. The share who think home prices will stay the same increased from 31% to 33%. As a result, the net share of those who say home prices will go up increased 6 percentage points month over month.

Mortgage Rate Expectations:

The percentage of respondents who say mortgage rates will go down in the next 12 months decreased from 22% to 19%, while the percentage who expect mortgage rates to go up increased from 47% to 50%. The share who think mortgage rates will stay the same remained unchanged at 31%. As a result, the net share of those who say mortgage rates will go down over the next 12 months decreased five percentage points month over month.

Job Loss Concern:

The percentage of respondents who say they are not concerned about losing their job in the next 12 months decreased from 79% to 77%, while the percentage who say they are concerned increased from 21% to 22%. As a result, the net share of those who say they are not concerned about losing their job decreased three percentage points month over month.

Household Income:

The percentage of respondents who say their household income is significantly higher than it was 12 months ago decreased from 24% to 20%, while the percentage who say their household income is significantly lower increased from 11% to 12%. The percentage who say their household income is about the same increased from 64% to 67%. As a result, the net share of those who say their household income is significantly higher than it was 12 months ago decreased five percentage points month over month.

Spring is typically a time when people look to buy homes. With summer less than two weeks away, many who might have purchased a new home opted to wait, or could not find what they were looking for. “As we near the end of the spring homebuying season, the latest HPSI results indicate that affordability hurdles, including high home prices and mortgage rates, remain top of mind for consumers, most of whom continue to tell us that it’s a bad time to buy a home but a good time to sell one,” said Mark Palim, Fannie Mae Vice President and Deputy Chief Economist.

“Consumers also indicated that they don’t expect these affordability constraints to improve in the near future, with significant majorities thinking that both home prices and mortgage rates will either increase or remain the same over the next year. Notably, the same factors impacting affordability may also be affecting the perceived ease of getting a mortgage. This was particularly true among renters: 81% believe it would be difficult to get a mortgage today, matching a survey high,” according to Palim.

Take Away

Consumers don’t expect housing affordability to improve anytime soon. At the same time, and for related reasons, rents have increased. As with most markets, one would expect if the buyers step back, prices might come down in response. An odd dynamic at play now, though, is that many people that are in a home, are staying put because moving might mean saying goodbye to a mortgage rate near 3% and then having to secure one that is nearly five percentage points higher.

Managing Editor, Channelchek