Research News and Market Data on HHS

Company Expects Continued Revenue and EBITDA Growth in 2023

CHELMSFORD, MA / ACCESSWIRE / March 7, 2023 / Harte Hanks, Inc. (NASDAQ:HHS), a leading global customer experience company focused on bringing companies closer to customers for 100 years, today announced financial results for the fourth quarter and full-year period ended December 31, 2022. The results include one month of contribution from the acquisition of InsideOut Solutions in 2022, with no contribution in 2021. In addition, the results reflect the impact of the repurchase of all the Company’s outstanding Series A Convertible Preferred Shares (the “Preferred Shares”) from Wipro, LLC, the sole holder of the Preferred Shares, for a cash payment of $9.9 million, equal to the liquidation value, and 100,000 shares of Harte Hanks common stock.

Harte Hanks CEO, Brian Linscott, commented: “This was an important year for Harte Hanks, with results that reflect the successful culmination of our restructuring and the emergence of sustainable, profitable growth based on a differentiated offering and solid relationships with our top-tier customers. Our improved financial results have enabled us to materially strengthen our balance sheet. We have streamlined our capital structure by eliminating our debt and redeeming our preferred shares, thereby eliminating the dilutive effect of preferred shares going forward. Simultaneously, our pension liability was reduced by nearly $15 million, positioning us to commence the process to transfer one of our qualified pensions to a third party.”

“We have proven our operating leverage and earnings power with continued growth. Our 6% full-year revenue growth translated to a near doubling of operating income and a 75% increase in EBITDA,” concluded Linscott. “Demand for our solutions continues to grow, offsetting headwinds from the culmination of pandemic-related projects. We anticipate continued revenue and EBITDA growth for the full year of 2023, even though our first quarter results will include modest revenue growth and lower EBITDA on a year-over-year basis as result of an abnormally strong comparison period in 2022 driven by revenue mix.”

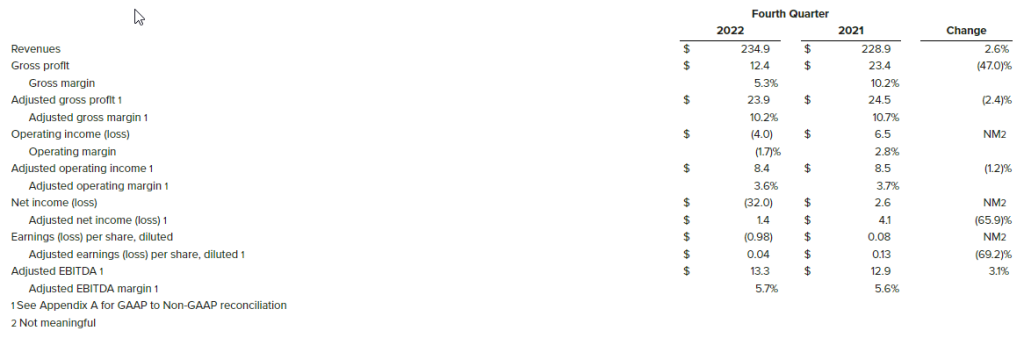

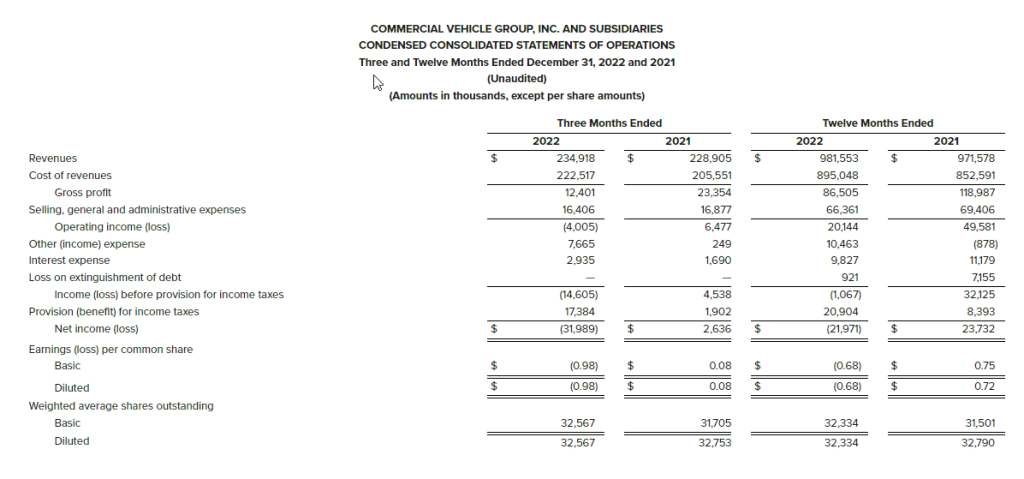

Fourth Quarter Financial Highlights

- Revenues increased by 5.4% to $54.8 million, compared to $52.0 million in the same period in the prior year. Revenue for the fourth quarter of 2022 included approximately $1 million in revenue from InsideOut Solutions, acquired on December 1, 2022, with no contribution in the prior-year.

- Fulfillment & Logistics Services grew 34.4%, offsetting decreases of 6.8% in Marketing Services and 12.9% in Customer Care. Customer Care decreases were largely related to the completion of pandemic-related projects.

- Operating income of $3.4 million, compared to operating income of $2.9 million in the same period in the prior year, an increase of 19.8%.

- Net income of $21.8 million, inclusive of a one-time $19.8 million tax benefit due to release of valuation allowance due to the expectation of sustained profitability, and $1.4 million in other expenses mainly related to pension expense and foreign currency loss. This compared to net income of $1.8 million in the same period in the prior year, which included income tax expense of $271,000.

- Diluted EPS was $2.70 for the fourth quarter of 2022 vs. $0.20 for the same period in the prior year. The tax benefit accounted for approximately $2.62 of the current-period earnings per share.

- EBITDA was $4.4 million compared to $3.5 million in the same period in the prior year.[1]

[1] EBITDA is a non-GAAP financial measure. See “Supplemental Non-GAAP Financial Measures” below. EBITDA is also the Company’s measure of segment profitability.

Full-Year Financial Highlights

- Revenues increased by 6.0% to $206.3 million, compared to $194.6 million in the prior year.

- Fulfillment & Logistics Services grew 35.6%, offsetting declines in Marketing Services of 6.1% and Customer Care of 10.0%.

- Operating income of $15.1 million, compared to operating income of $7.6 million last year, an increase of 97.8%.

- Net income of $36.8 million, compared to net income of $15.0 million, last year. The 2022 results included a $19.8 million tax benefit due to release of valuation allowance due to the expectation of sustained profitability, while the 2021 results included a one-time gain of $10.0 million related to the extinguishment of the Company’s PPP loan.

- Earnings per diluted share of $4.75 compared to $1.76 per diluted share last year.

- EBITDA 1was $17.8 million compared to $10.2 million last year.1

Segment Highlights

- Customer Care, $16.7 million in revenue, 30% of total – Revenue decreased by 12.9%, or $2.5 million, from the prior year quarter, and year-over-year EBITDA increased by 24.4% to $3.2 million from $2.6 million. Decrease in revenue was driven by sunsetting of pandemic-related projects, but continuous improvement in retention and reduction in labor costs drove the EBITDA increase. New business wins for the quarter included:

- A community-based health plan company selected Harte Hanks to support its members with plan related customer support. The company selected Harte Hanks to provide extended support hours for its members while maintaining its CMS 5-star rating. Harte Hanks has consistently delivered high CMS ratings for its clients through its rigorous training and certification process for employees and systems.

- A global beverage company expanded services with Harte Hanks by extending its Customer Care solution to additional markets. The expansion allows our client to benefit from our lower cost facilities in the Philippines, while improving its customer experience with faster and easier access for support.

- Fulfillment & Logistics Services, $24.5 million in revenue, 45% of total – Revenue increased by 34.4%, or $6.3 million, compared to the prior year quarter; and year-over-year EBITDA improved 5.9% to $2.3 million from $2.1 million. New business wins for the quarter included:

- A growing international investment firm with approximately $30 billion of assets under management selected Harte Hanks to provide digital print and premium item fulfillment services to its brokers. Our financial services sector experience and streamlined onboarding to support a rapid pivot from a competitor were key differentiators in the selection process.

- A leading branding company selected Harte Hanks Fulfillment to manage the production, kitting, and distribution of 250,000 makeup kits for a Fortune 200 retail partner. This partnership continues to lead to new value-added product fulfillment opportunities, unlocked by our investment in flexible, automated production lines.

- Marketing Services, $13.6 million in revenue, 25% of total – Revenue decreased by 6.8% compared to the prior year quarterand year-over-year EBITDA decreased 18.4% to $2.1 million from $2.6 million. Decrease in revenue was driven by a reduction of Direct Mail work for clients. New business wins for the quarter included:

- A leading premium brand retailer of Kitchen, Bath and Outdoor products selected Harte Hanks to design and execute a series of lead generation programs. Harte Hanks was chosen based on our extensive experience in retail strategy and ability to deliver a full suite of creative, data, analytics and campaign execution.

- A leading global technology manufacturer expanded our successful B2B demand generation program into South America by utilizing Harte Hanks Audience Finder product to identify buyers with intent.

Consolidated Fourth Quarter 2022 Results

Fourth quarter revenues were $54.8 million, up 5.4% from $52.0 million in the fourth quarter of 2021. The Company’s Fulfillment & Logistics Services segment grew, more than offsetting declines in Marketing Services and Customer Care.

Fourth quarter operating income was $3.4 million, compared to operating income of $2.9 million in the fourth quarter of 2021. The improvement resulted from the elimination of restructuring expense and higher revenues.

Net income for the quarter was $21.8 million inclusive of $19.8 million tax benefit and $1.4 million in expenses related to pension and currency loss on intercompany receivables, compared to net income of $1.8 million in the fourth quarter last year. The Company recorded an income tax benefit of $19.8 million, or approximately $2.62 per diluted share, in the fourth quarter of 2022, compared to an expense of $271,000 in the fourth quarter of 2021. The tax benefit in the fourth quarter of 2022 was mainly related to the release of the majority of valuation allowances due to the improved profitability of the company. Income attributable to common stockholders for the fourth quarter was $20.4 million, or $2.81 per basic and $2.70 per diluted share (based on 7.6 million weighted average diluted shares outstanding), compared to net income attributable to common shareholders of $1.4 million, or $0.20 per basic and diluted share (based on 7.3 million weighted average diluted shares outstanding) during the prior year fourth quarter. Income attributable to common stockholders was reduced by a $1.4 million one-time loss on redemption of Preferred Stock.

Full-Year 2022 Results

Revenues for 2022 were $206.3 million, up 6.0% from $194.6 million last year. Operating income was $15.1 million, compared to operating income of $7.6 million last year. Net income for the year was $36.8 million (inclusive of a $19.8 million tax benefit due to release of valuation allowance due to the expectation of sustained profitability), compared to net income of $15.0 million (inclusive of a $10.0 million gain related to the forgiveness of the Company’s PPP loan), last year. Income attributable to common stockholders for the year was $35.4 million, or $4.98 per basic share and $4.75 per fully diluted share, compared to net income attributable to common shareholders of $12.6 million, or $1.85 per basic share and $1.76 per fully diluted share.

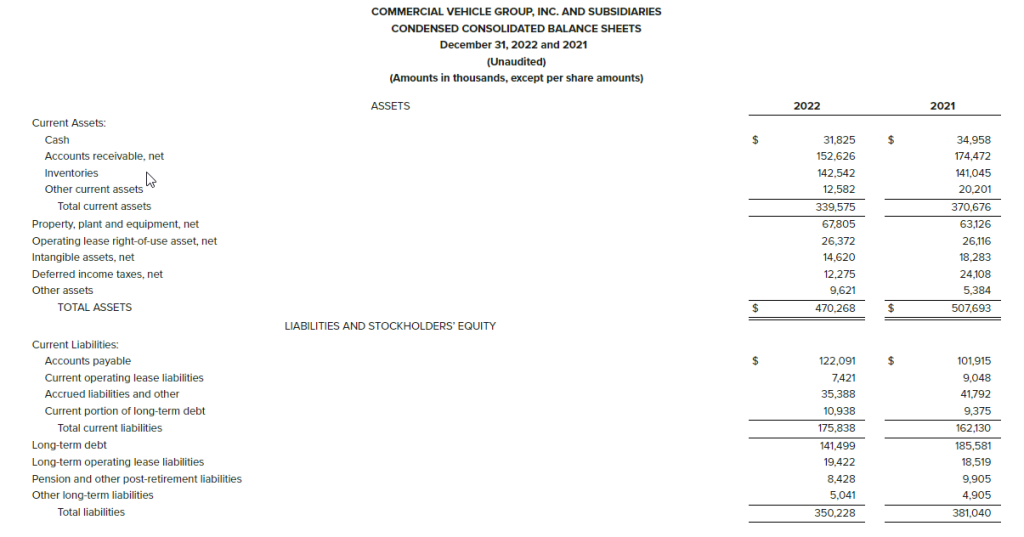

Balance Sheet and Liquidity

Harte Hanks ended the year with $10.4 million in cash, cash equivalents and restricted cash, compared to $15.1 million at December 31, 2021. At December 31, 2022, the Company had nothing drawn on its line of credit, and $37.8 million in outstanding long-term pension liability. On December 31, 2021, the Company had no short-term debt, $5 million in long-term debt and $52.5 million in outstanding long-term pension liability.

During 2022, Harte Hanks has decreased outstanding debt by $5 million and redeemed its preferred shares for $9.9 million.

The company anticipates receiving a Federal income tax refund related to a net operating loss (NOL) carryback claim of $5.3 million which will further enhance liquidity.

Conference Call Information

The Company will host a conference call and live webcast to discuss these results on Tuesday, March 7, 2023 at 4:30 p.m. EST. Interested parties may access the webcast at https://investors.hartehanks.com/events or may access the conference call by dialing (877) 545-0523 in the United States or (973) 528-0016 from outside the U.S. and using access code 471821.

A replay of the call can also be accessed via phone through March 21, 2023 by dialing (877) 481-4010 from the U.S., or (919) 882-2331 from outside the U.S. The conference call replay passcode is 47696.

About Harte Hanks:

Harte Hanks (NASDAQ:HHS) is a leading global customer experience company whose mission is to partner with clients to provide them with CX strategy, data-driven analytics and actionable insights combined with seamless program execution to better understand, attract and engage their customers.

Using its unparalleled resources and award-winning talent in the areas of Customer Care, Fulfillment and Logistics, and Marketing Services, Harte Hanks has a proven track record of driving results for some of the world’s premier brands, including Bank of America, GlaxoSmithKline, Unilever, Pfizer, HBOMax, Volvo, Ford, FedEx, Midea, Sony and IBM among others. Headquartered in Chelmsford, Massachusetts, Harte Hanks has over 2,500 employees in offices across the Americas, Europe, and Asia Pacific.

For more information, visit hartehanks.com

As used herein, “Harte Hanks” or “the Company” refers to Harte Hanks, Inc. and/or its applicable operating subsidiaries, as the context may require. Harte Hanks’ logo and name are trademarks of Harte Hanks.

Cautionary Note Regarding Forward-Looking Statements:

Our press release and related earnings conference call contain “forward-looking statements” within the meaning of U.S. federal securities laws. All such statements are qualified by this cautionary note, provided pursuant to the safe harbor provisions of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Statements other than historical facts are forward-looking and may be identified by words such as “may,” “will,” “expects,” “believes,” “anticipates,” “plans,” “estimates,” “seeks,” “could,” “intends,” or words of similar meaning. These forward-looking statements are based on current information, expectations and estimates and involve risks, uncertainties, assumptions and other factors that are difficult to predict and that could cause actual results to vary materially from what is expressed in or indicated by the forward-looking statements. In that event, our business, financial condition, results of operations or liquidity could be materially adversely affected and investors in our securities could lose part or all of their investments. These risks, uncertainties, assumptions and other factors include: (a) local, national and international economic and business conditions, including (i) the outbreak of diseases, such as the COVID-19 coronavirus, which has curtailed travel to and from certain countries and geographic regions, created supply chain disruption and shortages, disrupted business operations and reduced consumer spending, (ii) market conditions that may adversely impact marketing expenditures, (iii) the impact of the Russia/Ukraine conflict on the global economy and our business, including impacts from related sanctions and export controls and (iv) the impact of economic environments and competitive pressures on the financial condition, marketing expenditures and activities of our clients and prospects; (b) the demand for our products and services by clients and prospective clients, including (i) the willingness of existing clients to maintain or increase their spending on products and services that are or remain profitable for us, and (ii) our ability to predict changes in client needs and preferences; (c) economic and other business factors that impact the industry verticals we serve, including competition and consolidation of current and prospective clients, vendors and partners in these verticals; (d) our ability to manage and timely adjust our facilities, capacity, workforce and cost structure to effectively serve our clients; (e) our ability to improve our processes and to provide new products and services in a timely and cost-effective manner though development, license, partnership or acquisition; (f) our ability to protect our facilities against security breaches and other interruptions and to protect sensitive personal information of our clients and their customers; (g) our ability to respond to increasing concern, regulation and legal action over consumer privacy issues, including changing requirements for collection, processing and use of information; (h) the impact of privacy and other regulations, including restrictions on unsolicited marketing communications and other consumer protection laws; (i) fluctuations in fuel prices, paper prices, postal rates and postal delivery schedules; (j) the number of shares, if any, that we may repurchase in connection with our repurchase program; (k) unanticipated developments regarding litigation or other contingent liabilities; (l) our ability to complete anticipated divestitures and reorganizations, including cost-saving initiatives; (m) our ability to realize the expected tax refunds; and (n) other factors discussed from time to time in our filings with the Securities and Exchange Commission, including under “Item 1A. Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2021 which was filed on March 21, 2022. The forward-looking statements in this press release and our related earnings conference call are made only as of the date hereof, and we undertake no obligation to update publicly any forward-looking statement, even if new information becomes available or other events occur in the future.

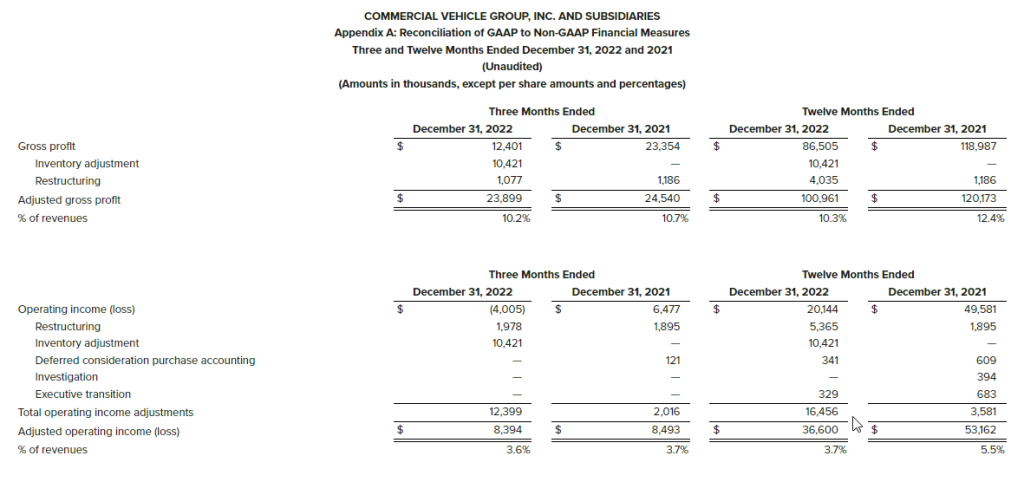

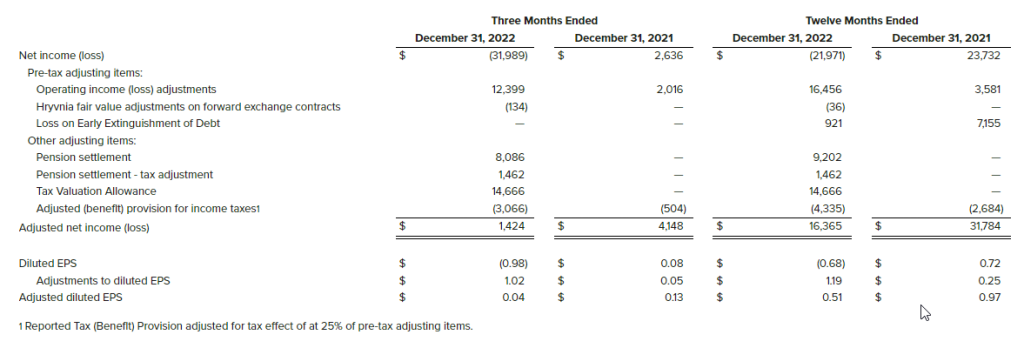

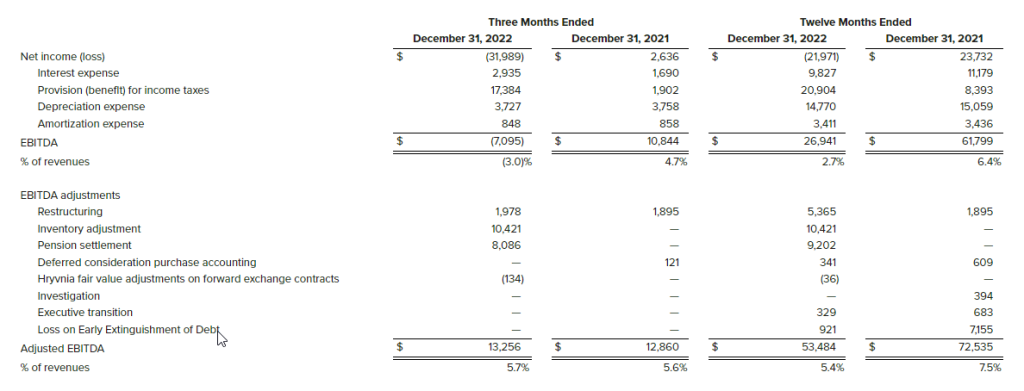

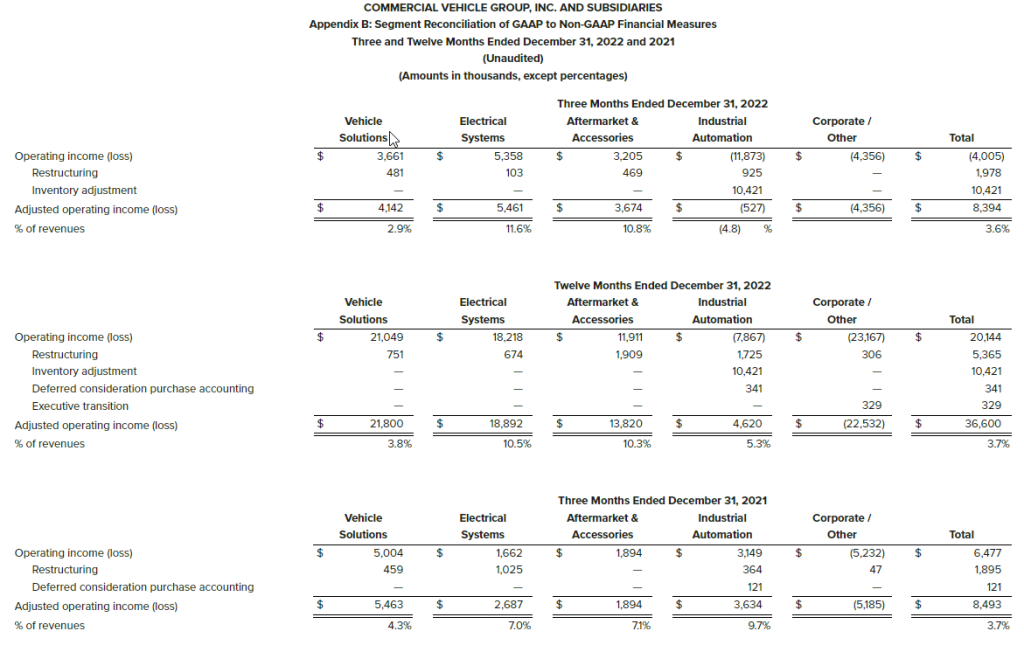

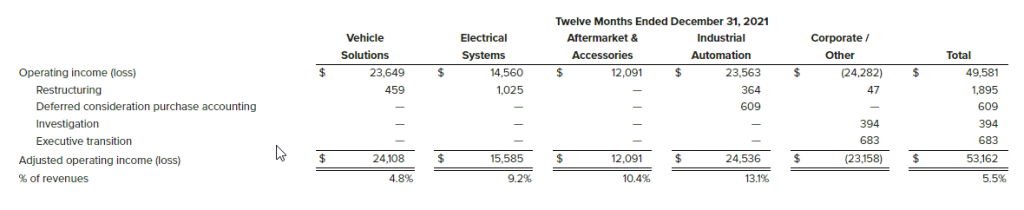

Supplemental Non-GAAP Financial Measures:

The Company reports its financial results in accordance with generally accepted accounting principles (“GAAP”). However, the Company may use certain non-GAAP measures of financial performance in order to provide investors with a better understanding of operating results and underlying trends to assess the Company’s performance and liquidity in this press release and our related earnings conference call. We have presented herein a reconciliation of these measures to the most directly comparable GAAP financial measure.

The Company presents the non-GAAP financial measure “Adjusted Operating Income (Loss)” as a measure useful to both management and investors in their analysis of the Company’s financial results because it facilitates a period-to-period comparison of Operating Revenue and Operating Income (Loss) by excluding restructuring expense, impairment expense and stock-based compensation. The most directly comparable measure for this non-GAAP financial measure is Operating Income (Loss).

The Company presents the non-GAAP financial measure “EBITDA” as a supplemental measure of operating performance in order to provide an improved understanding of underlying performance trends. The Company defines “Adjusted EBITDA” as earnings before interest expense net, income tax expense (benefit) and depreciation expense. The most directly comparable measure for EBITDA is Net Income (Loss). We believe EBITDA is an important performance metric because it facilitates the analysis of our results, exclusive of certain non-cash items, including items which do not directly correlate to our business operations; however, we urge investors to review the reconciliation of non-GAAP EBITDA to the comparable GAAP Net Income (Loss), which is included in this press release, and not to rely on any single financial measure to evaluate the Company’s financial performance.

The use of non-GAAP measures do not serve as a substitute and should not be construed as a substitute for GAAP performance but should provide supplemental information concerning our performance that our investors and we find useful. The Company evaluates its operating performance based on several measures, including this non-GAAP financial measures. The Company believes that the presentation of this non-GAAP financial measures in this press release and earnings conference call presentations are useful supplemental financial measures of operating performance for investors because they facilitate investors’ ability to evaluate the operational strength of the Company’s business. However, there are limitations to the use of this non-GAAP measures, including that they may not be calculated the same by other companies in our industry limiting their use as a tool to compare results. Any supplemental non-GAAP financial measures referred to herein are not calculated in accordance with GAAP and they should not be considered in isolation or as substitutes for the most comparable GAAP financial measures.

EBITDA is the Company’s measure of segment profitability.

Investor Relations Contact:

Rob Fink or Tom Baumann

646.809.4048 / 646.349.6641

FNK IR

HHS@fnkir.com

Source: Harte Hanks, Inc.

View source version on accesswire.com:

https://www.accesswire.com/742474/Harte-Hanks-Grows-Annual-Revenue-Increases-Profitability-and-Ends-2022-with-Strengthened-Balance-Sheet