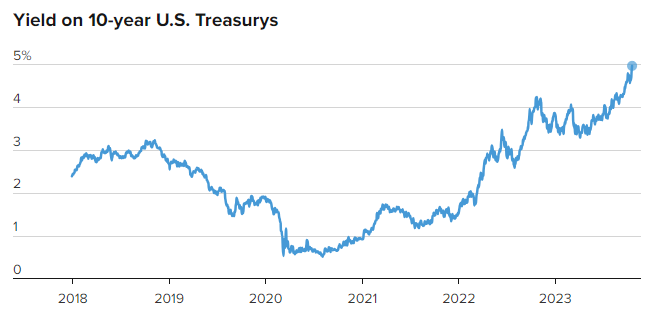

The yield on the 10-year Treasury note has once again crossed the 5% threshold. This benchmark yield has far-reaching implications for both the financial markets and the general public, serving as a barometer of economic conditions and influencing investment decisions, interest rates, and the cost of borrowing for governments, businesses, and individuals.

Data as of Oct. 20, 2023

Why Does the 10-Year Treasury Yield Matter?

The 10-year Treasury yield is a crucial indicator of the economy’s health and the state of the financial markets. It reflects the interest rate that the U.S. government pays on its debt with a 10-year maturity, which is considered a relatively safe investment. As such, it provides a reference point for other interest rates in the financial system.

Impact on Investors:

- Fixed-Income Investments: The 10-year Treasury yield directly impacts the pricing and performance of bonds and other fixed-income investments. When the yield rises, the value of existing bonds tends to decrease, which can lead to capital losses for bondholders.

- Stock Market: Higher Treasury yields can put pressure on stock prices. As bond yields increase, investors may shift from equities to bonds in search of better returns with lower risk. This shift can lead to stock market volatility and corrections.

- Cost of Capital: Rising Treasury yields can increase the cost of capital for businesses. This may result in higher borrowing costs for companies, which can impact their profitability and, subsequently, their stock prices.

Impact on the General Public:

- Mortgage Rates: Mortgage rates are closely tied to the 10-year Treasury yield. When yields rise, mortgage rates tend to follow suit. As a result, homebuyers may face higher borrowing costs, potentially limiting their ability to purchase homes or leading to higher monthly payments for existing homeowners with adjustable-rate mortgages.

- Consumer Loans: The yield on the 10-year Treasury note also influences interest rates for various consumer loans, including auto loans and personal loans. When yields rise, the cost of borrowing for individuals increases, affecting their spending capacity.

- Inflation Expectations: An increase in the 10-year Treasury yield can signal rising inflation expectations. In response, consumers may anticipate higher prices for goods and services, which can impact their spending and savings decisions.

- Retirement and Savings: For retirees and savers, rising Treasury yields can be a mixed bag. While it can translate into higher returns on savings accounts and CDs, it can also result in increased volatility in investment portfolios, which may be a concern for those relying on their investments for income.

Market Sentiment and Economic Outlook:

A sustained rise in the 10-year Treasury yield is often seen as an indication of a strengthening economy. However, if the yield surges too quickly, it can raise concerns about the pace of economic growth and the potential for the Federal Reserve to implement tighter monetary policy to combat inflation.

In conclusion, the 10-year Treasury yield is not just a number on a financial ticker; it’s a critical metric that touches the lives of investors, borrowers, and everyday consumers. Its movements provide valuable insights into the state of the economy and financial markets, making it a figure closely watched by experts and the public alike.