Tax Date Will Provide Timing on Critical Debt Ceiling Breach

While both stock and bond investors are focused on the Federal Reserve and how it will orchestrate lower inflation without crashing the economy, the debt limit time bomb hasn’t gotten much attention yet, this could quickly change. The U.S. mathematically hit its allowed debt ceiling on January 18, 2023. Treasury Secretary Janet Yellen has since been taking measures to avoid a U.S. default on the national debt. But she can only do this dance for so long. How long will become much clearer quite soon. April 18, 2023 is tax date; the U.S. Treasury will then have more precise revenue numbers. This will give the department a much better understanding of when the U.S. would default on its debt if Congress doesn’t allow a higher borrowing limit.

Congress tends to let these issues come down to the eleventh hour before acting. All parties involved know a default would be catastrophic, so the down-to-the-wire drama frustrates markets but tends to allow Congressional representatives to carve out deals on what is important to them. Some expect the actual deadline will be as early as mid-June, others forecast it to be just after summer. The answer will come into clearer focus as tax receipts are taken in over the coming week. Once the time-frame is more certain, the markets are likely to begin to then react as concern amps up.

The Treasury’s $31.4 trillion borrowing cap plus tax receipts will give a clearer idea of how much cash it will have available, which it can weigh against its spending rate. In a note to clients, Bank of America’s analysts, Mark Cabana and Katie Craig wrote “we maintain our current base case for a mid-August X-date but see risks skewed toward earlier.” This four-month or earlier period would end near the scheduled recess for both the House and Senate.

In the analysts view, an influx from taxes of more than $200 billion following tax day would be a relief, while a figure of less than $150 billion would be concerning. Meanwhile, U.S. House Speaker Kevin McCarthy is preparing to roll out his proposal this week for a one-year debt ceiling suspension, according to sources reported by Bloomberg. Republicans have long sought to make any deal contingent on spending cuts, while President Biden has insisted that budgetary needs and debt ceiling should be viewed separately.

Over the coming months markets and US Treasury officials culd encounter:

T-Bill Yield Increases

Investors could expect higher yields on securities maturing in the very short end of the curve. The fear driving the rate increases is the knowledge that should the U.S. runs out of borrowing capacity, it may not be able to borrow to pay the maturing debt.

This could begin to create an unusual one-year and shorter yield curve as investors either want maturities well ahead of any possible default or well after to give the Congress time to act.

Insuring Against Default

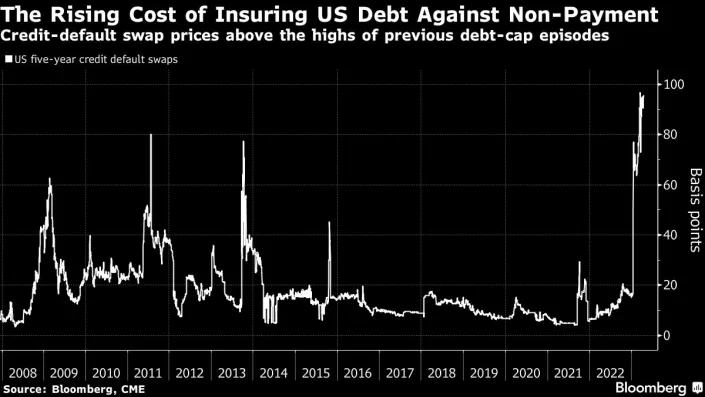

A key market to watch is what happens in credit default swaps for U.S.-issued debt. There has been an increase in activity in recent months as pricing has moved past levels seen in previous debt-cap crunches; this is viewed as the market’s increased expectation of a higher probability of default.

Treasury Cash On-Hand

The measures Treasury Secretary Yellen deployed in late January to address the debt limit issue involve in part, spending cash it doesn’t need to borrow. Last week this cash dropped to $87 billion. This is the lowest level since December 2021 during the debt ceiling battle. However, with the tax payment infusion and other tax revenue, this amount is viewed as a safe cushion for the time being.

The amount of revenue received in taxes this week is critical in that market participants can gauge how far off the debt ceiling debate will be. The concern that the negotiations can cause short-term shifts in interest rates and impact the U.S. dollar and other markets generally has investors on edge.

The situation is not likely to be resolved until the eleventh hour with the current split Congress – when the peak period of drama occurs will be better known very soon.

Managing Editor, Channelchek

Sources

https://www.nab.org/documents/advocacy/2023CongressionalCalendar.pdf