|

|

|

|

Has Warren Buffett Already Shown His Hand?

Market participants, of all levels, have been wondering aloud about Warren Buffett’s low profile. Shortly after other wealth destroying market events, the “Oracle of Omaha” tended to step-up and calm fears early in the financial turmoil. The orchestrated economic stoppage of today’s lockdown has left investors wondering. They’re wondering if and when they’ll get a glimpse into the thinking of the highly respected Chairman of Berkshire Hathaway. Well, they don’t have to wonder much longer. His “silence” will end Saturday (May 2) at the Berkshire Hathaway shareholder meeting (held virtually). The discussions from that meeting have the potential to set the market tone in a number of industries and even the overall mood.

Has He

Already Shown His Hand?

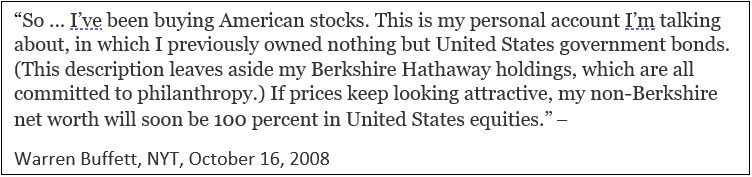

Reviewing his actions and experience after the financial bubble burst late Summer 2008 may lend clues into his current focus. There was an excellent op-ed article written by Buffett for The New York Times just one month after the recognized start of the 2008 financial crisis. The piece was titled “Buy American – I Am” and contains one of his most famous quotes; “A simple rule dictates my buying: Be fearful when others are greedy, and be greedy when others are fearful.” The article uses market history to make compelling arguments for ignoring fear and to confidently move cash from the sidelines and into the market. The only problem with the article, at least according to the author himself; is, he was wrong.

The Oracle of Omaha used the op-ed to “cheerlead” for the country and the markets. He wrote about taking his personal account from 100% U.S. Treasuries to making significant investments in U.S. Companies. The piece helped calm fears and served to inspire others to be comfortable investing while the extent of trouble was not fully clear.

Berkshire Hathaway, in 2008/2009, for its part, took large positions in beaten-up companies with excellent brands and excellent histories. The investments back then included Harley Davidson, General Electric, Tiffany & Co, and construction materials giant USG, among others. When discussing the crisis many months later, Buffett had lamented his timing and said he wished he had written his op-ed later than he did. He had spoken too soon.

This (jumping in early) by itself could easily explain his now shying away from making any bold statements. He is famous for confidently investing when others are fearful, but it is difficult to know when fear is near its peak. In 2008 he expressed extreme optimism only one month after the start of the market crisis. He was reminded that one month is too short to assess a new and highly unusual situation.

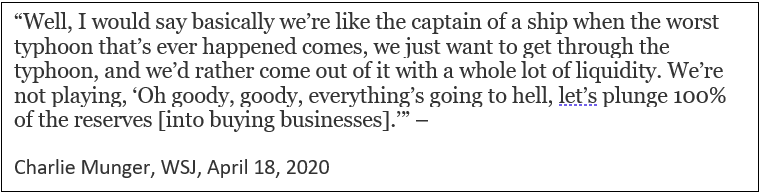

Charlie Munger, Warren Buffett’s business partner and Vice-Chairman of Berkshire Hathaway, spoke with The Wall Street Journal a week ago. He was very clear as to what was going on in the Berkshire Hathaway investment mindset and the deals coming their way. In short, he made clear, “The Phone Is Not Ringing Off the Hook.”

The Vice Chairman also said, “Warren wants to keep Berkshire safe for people who have 90% of their net worth invested here. We’re always going to be on the safe side. That doesn’t mean we couldn’t do something pretty aggressive or seize some opportunity. But basically, we will be fairly conservative. And we’ll emerge on the other side very strong.”

Munger also noted that they generally don’t go out searching for deals with companies. In the past, corporations looking to discuss their situation came to them. He said large corporations are most likely having those conversations with the U.S. government. Certainly, the U.S. has deeper pockets and greater ability to help than Berkshire Hathaway.

What Others are

Saying

The speculation and consensus among investors is that he is quietly deploying capital and selectively buying shares of companies that are the backbone of America. In a podcast for The Knowledge Project titled “Getting Back Up,” Bill Ackman, CEO of Pershing Square Capital Management, discussed what he thinks Berkshire Hathaway may be doing and should be doing. In the podcast, Ackman is heard saying: “I’m surprised they haven’t done anything yet that’s visible, but my guess is they’ve been buying stocks a lot…” The hedge fund manager added, “The big opportunity for Berkshire is Berkshire itself.” He explained it was a “cheap stock” before the market route and now is a “real bargain.” Class B shares of BRK (BRK-B) closed Wednesday at $189.61.

Rest Assured He Will Be Comforting

If history offers any indication, Warren Buffett believes markets always come back. As an “oracle” his projections usually have a soothing mood of confidence. This is not to suggest that anyone should believe the markets have seen their worst, or that everything will perform equally. Instead it would suggest there are many bargains within the equity markets, but the strength of the overall market may have gotten a bit ahead of itself.

As far as thoughts he shares on sectors and industries within the market, the investors will be listening for tips relative to performance spreads between stock classifications, which industries he sees value within, and if he is more likely to be looking offshore this time.

The normally lavish Berkshire Hathaway Annual meeting will be held virtually for the first time. It has been announced that Charlie Munger, who is 96, will not be attending. You can “attend” yourself on Saturday with this live stream this link.

Suggested Reading:

“The Big Short” Dr.

Michael Burry’s Views on the Shutdown

Why Index Funds Could be

a Mistake in 2020

What Now? Post Pandemic

Stock Market Investing

Register for Channelchek Premium Content and Tools at No Cost!

Sources:

Berkshire Hathaway 2020 Meeting Press

Release

“Buy American – I Am” NYT, 10/16/08