The Fed Doubles Down on Keeping Rates Down – Winners and Losers

“I guess I should warn you, if I turn out to be particularly clear, you’ve probably misunderstood what I said.” – Alan Greenspan

The announced move by the Federal Reserve last week to keep the interest rates it has control over steady was not a surprise to those that can translate today’s Fed-speak. In the past, two or more announcements Fed Chair Powell’s comments have been very consistent about being a long way from raising interest rates and they are wanting to see significant improvement in the labor market and inflation sustained above 2 percent before any tapering or tightening. In Fed-speak this means, well, it means exactly what he said. Fed Chair Powell has been abundantly clear and has not thrown the market any curveballs since being appointed. With this in mind, consider that by last measure inflation stood at 1.8%, unemployment at an unacceptable 6% and that is not including the 2 million fewer Americans in the labor force (relative to pre-covid).

What it Could Mean for You

As an investor, as someone that is an active producer and consumer in the economy, you may want to ask yourself, not what the Fed statement means, but “what does it mean to me?” How can I take advantage of their plan, how do I avoid being hurt, what investment sectors could continue to do well because of low rates, and even what should be the course of action if rates tick up? To be more direct, Fed Chair Jay Powell has said that highly accommodative monetary policy will continue for the foreseeable future. Ask, who wins and who loses, how can I benefit?

To better understand the complete Fed actions, remember the central bank has also taken steps to keep longer interest rates near its target range too. They’ve injected hundreds of billions of dollars into the system through securities repurchases. The Fed has had a seemingly unlimited pot to pull from to buy Treasuries and even mortgage-backed securities at more expensive levels than the market. Previously it announced that it held unlimited bond-buying abilities.

As there seems little doubt that the Fed will continues to sit tight on 0%-.25% overnight and other very low targets, here is who can be expected to benefit and who may lose from the ongoing promise by the Fed.

Bank Deposits

The Fed funds rate is what banks charge each other to borrow reserves from each other overnight. So a 0%-.25% Fed funds rate is what you are competing with on your savings and longer-term Certificates of Deposit (CDs). CD rates saw a substantial decline after the Fed lowered rates in early 2020.

CD owners locking in rates now will have to commit to earning those rates for the term of the CD. The Fed promised low rates through next year, those not beating the 1.8% inflation rate may be worse off.

Savings accounts are paying just above zero. It’s important to note that the return (within limits) is guaranteed by the FDIC. Other than U.S. Treasury securities, this kind of assurance is largely unavailable, so if you expect negative returns on alternatives, this is an easy safe harbor. If this level of security is important to the saver, shopping online for the best rate makes more sense than settling for the rate of the bank down the road. Remember the rate may only be slight;y more, but after compounding over the years the difference is more impactful.

Mortgages

The Fed funds rate doesn’t directly impact mortgage rates. But they do set the starting rate in the yield curve which measures risk-free (U.S. Treasury) rates through 30 years. Thirty-year mortgages are generally spread to 10-year U.S. Treasury notes. This is because their durations (average time to repayment) are similar. This has kept mortgage rates exceedingly low, as an added bonus the Fed remains a buyer of mortgage-backed securities, this demand helps keep mortgage rates low.

This low-rate environment makes winners of those getting a mortgage or able to refinance. Those with adjustable-rate mortgages also have benefitted from low rates. Demand for mortgages has surged over the past year as low rates have increased demand. Those owning mortgage securities have benefitted from the bond bull market.

Investors in Stocks

The Fed’s near-zero interest rate policy and open-ended buying of bonds provide both money for equity investors and few alternatives other than the stock market.

Low rates are likely to keep a floor under stocks. After the market drop in stocks following the novel coronavirus in the U.S., the government’s reaction has caused stocks to spring back and then some. The Standard & Poor’s 500 Index sits near all-time highs. More attractive alternative investments for all the money created are few.

The Federal Government

Those that borrow embrace low interest rates because their payments are based on a lower rate. There is no bigger borrower than the U.S Federal government. As the national debt passes $28 trillion, low rates allow higher rate debt rolling off to be refinanced at lower rates. This saves billions of dollars in interest. According to the Congressional Budget Office, the U.S. government increased the national debt by an additional $3.1 trillion in the last fiscal year (ended Sept. 30, 2020). Low rates mean the borrowing cost of spending more remains is less costly at this time.

Increased borrowing and lower return have hurt the value of the $US dollar. Exchange rates versus other large currencies and even many cryptocurrencies have weakened the greenback over the last year. Declining exchange rates tend to lower how much those savvy with their finances want to hold U.S. dollar-denominated securities.

Home Equity

Homeowners have mostly seen the price of their real estate rise. The cost of a home equity line of credit (HELOC) remains low since HELOCs adjust in synch to changes in short-term rates.

Since rates on HELOCs remain low, those with outstanding balances on their lines of credit will continue to have low-interest expenses and options.

Credit Card Debt

Many variable-rate credit cards change the rate they charge customers based on the prime rate, which is banks tend to adjust relative to the Fed funds rate. The Fed’s announced position to keep overnight rates low for an extended period means that interest on variable-rate cards is

Take-Away

The Fed is looking for fuller employment and a hot economy. They are adding money to the system, reducing the cost of spending, and creating few alternatives better than owning equity investments and real property. The US dollar weakening has the effect of lowering the buying power of any investment return, but liquidity is running high in both markets. For low return savings such as bank deposits, the erosion of US currency may exceed their return on the savings.

Suggested Reading:

|

|

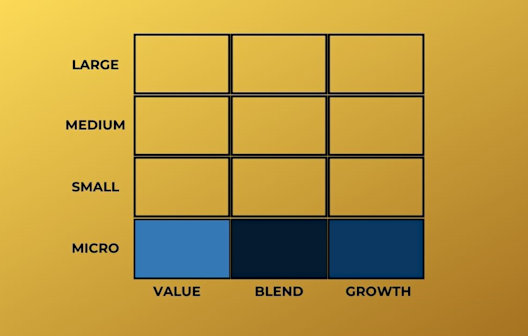

Do Microcap Stocks Provide Better Diversification?

|

Seeking Alpha Subscribers are Seeking Answers About Their New Paywall Policy

|

|

|

Will Janet Yellen be Good for Investors

|

Will the US Continue to Subsidize Alternative Energy?

|

Picture Credit: Robert Scoble, Credit Card of Future

Stay up to date. Follow us:

|

|

|

|

|

|

Stay up to date. Follow us:

|

|

|

|

|

|