Image Credit: Ketut Subiyanto

Two Things Happened to Real Estate Last Week, Both Could be Good for Stocks

The Real Estate market is an alternative and even competing investment to the stock market. They can be complementary investments, as historically there is a low correlation between the two. If one asset class enters a bear market, or perhaps shows potential for outsized gains, some investors will shift from one to the other.

Real Estate “Swing Traders”

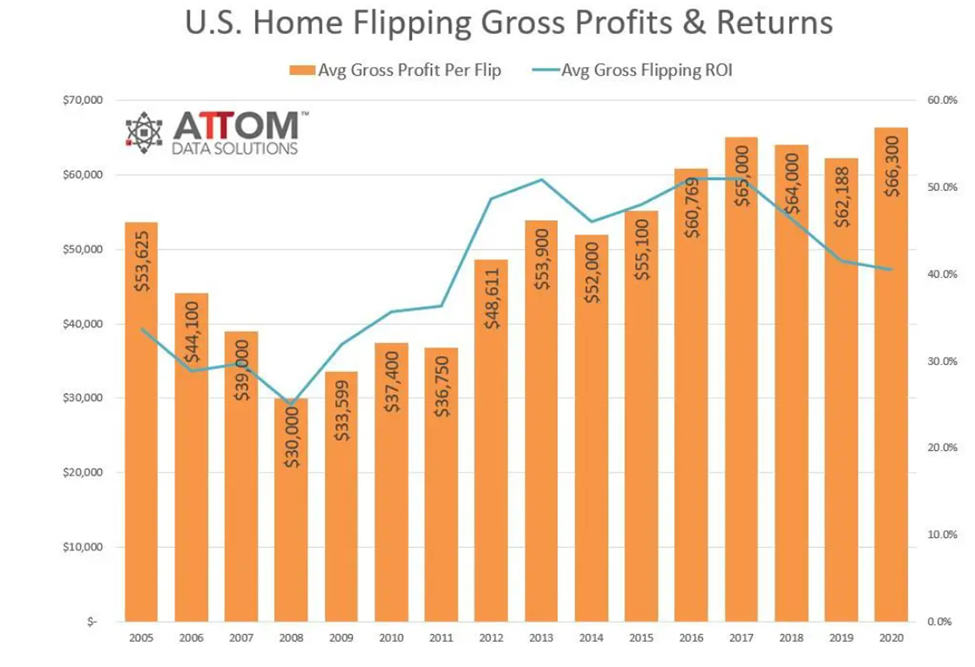

The low interest rate environment of the past few years had brought house flipping back as a profitable enterprise. A flip is defined as a home purchased and sold within a 12-month period. It’s been a good ride for those involved. During 2020, the average gross return on flipped homes reached record levels. According to ATTOM Data Solutions, the number of homes flipped in 2019 vs 2020 dropped 13%, even at that it was 5.9% of single-family home sales and 241,630 units. And, although it was the highest year for gross profit, the actual return on investment sunk to levels not seen since 2012.

The nature of any transaction in real estate is there has to be a wide margin for error. This is because transaction costs and carrying costs, including taxes, utilities, upkeep, and perhaps financing, can add up quickly. These costs all pull from the investment’s final return (ROI).

In terms of price growth, single-family homes and condos have outperformed the stock market over time so for some, they are considered less risky, and easier to understand than buying shares of a big company. But real properties are certainly not as liquid as securities that trade on an exchange. So, if the housing market begins to decline, finding someone to take the other side of your real estate sale may take time. As mentioned earlier, time is costly.

The chart shows net returns on real estate flipping have not increased since 2016 and have even trended lower. With more reduction in return, more investors may decide to place their investible cash someplace with a better risk/return profile.

Real Estate “Income Investors”

But not everyone invests in residential real estate with the idea of trading out of the property within 12 months. Some become landlords and benefit from an income stream. The difference between the two types of real estate investors is not unlike the difference between a (stock market) swing trader and another with a portfolio of dividend stocks. Over the past year, these landlord/investors have, as a group, captured the dramatic rise in real estate prices. Most have at the same time collected steady rents.

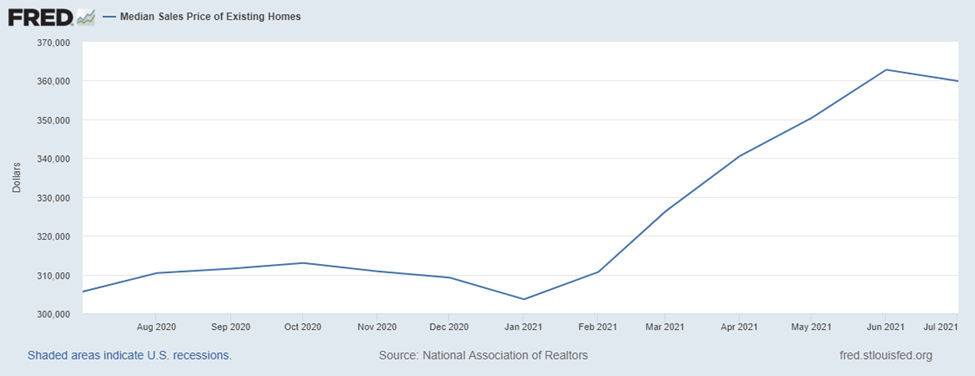

The Graph shows the national median sales price of existing homes over the last 12 months

Last week it was reported that home prices dipped in July from June. This interrupts housing’s price climb for the first time in a year. And the climb has been rapid; back in May and June, the median price for existing homes had reached a historical record when it grew 23% from a year earlier. But in July, the median price dipped (to $359,000), reducing the year-over-year gains to a still worthwhile 18.8%.

For both landlords that have had pandemic-related challenges that we’ll address later and the house flippers that are already seeing a decrease in their ROI, this may signal that it’s time to take their chips off the table. For the flippers, reduced inventory is already forcing fewer transactions. This speculative money will find itself trying to earn a return in other markets, perhaps stocks with high growth potential.

Rental property owners have their own set of concerns. For one, they’re faced with the proposed long-term capital gains tax increases (39.6% to 43.4% for high-income individuals) that would cut into any profit from a sale. Perhaps more concerning are the other government impositions since March 2020. Last March, an agency of the U.S. government (Center for Disease Control) imposed a temporary ban on evictions; this ban was extended twice, with the most recent deadline set as October 3, 2021. The reality that a property owner can have this level of outside meddling in their business increases their investment risk. For those that may have wanted to sell their property since March 2020 because of the changing regulatory landscape, a non-paying, non-evictable tenant hampered the option.

Real

Estate Investors (All Styles)

The U.S. Supreme Court on Thursday (Aug 26) effectively banned the temporary ban on evictions, originally imposed by the CDC. The Court said that the ban exceeded the CDC’s authority to combat communicable diseases and that it forced landlords to bear the costs of the pandemic. The court made clear in an unsigned opinion that the CDC did not have any standing in the case since they did not have authority. The Court paper did indicate Congress could still enact non-eviction laws.

|

“…the CDC has imposed a nationwide moratorium on evictions in reliance on a decades-old statute that authorizes it to implement measures like fumigation and pest extermination. It strains credulity to believe that this statute grants the CDC the sweeping authority that it asserts.” – U.S. Supreme Court, August 26, 2021 |

The decision was not unexpected. The current administration recently made $47 billion in funds available to landlords to benefit their tenants that had accrued overdue rent obligations. This money is to be distributed by state governments with the goal of making landlords whole and tenants current. The states have been slow to distribute this taxpayer money. Rules have recently been eased to help expedite the process. For example, landlords of multiple rentals had to apply for each individually; now they can put them all on one application. The $47 billion entering the economy is being put into the hands of landlords that are now able to evict. This could cause an increased supply of existing homes on the real estate market.

The Stock Market May Benefit

Home flipping is experiencing reduced returns and a much more difficult and risky environment. The nature of flipping is that it usually burns itself out in a cyclical nature. Low ROI and few available properties signal the top of the cycle. Signs of reduced activity in this area suggest investible cash is being sidelined.

As we saw with stimulus checks and the market reaction, large sums of money placed in people’s hands is either spent, invested, or used to reduce liabilities. Many landlords will receive their portion of the $47 billion reimbursements for uncollected rent and use it to pay overdue bills. Others that have been keeping up with their costs will see it as found money, money they can put to work (invested) or to treat themselves. Putting it to work, in light of current conditions, is not as likely to mean purchasing additional real estate, or even improving current properties. These owners had a hard lesson last year, and the Supreme Court has as much as told Congress, if you want eviction moratoriums, pass a law. Meanwhile, home prices dropped last month; interest rate increases could push prices down further. This opens the door for landlords who have been made whole to decide if it’s time to cash out on their properties that are now sitting near record highs in an environment fraught with negative pressures.

Simply put, money not being invested in flipping, money from the landlord reimbursements, money from landlords cashing out, all has to go someplace. The stock market has been breaking records, it’s liquid, not subject to moratoriums on earned income, and has few carrying costs. It is perhaps the natural alternative. This is not to say the stock market doesn’t have its own concerns. The implication is that although real estate has historically outperformed, at this time in history, investors may find stocks the preferred alternative.

Take-Away

Nothing happens in a vacuum. The bond market impacts the stock and real estate markets, both impact gold and other commodities; new stimulus checks will impact cryptocurrency, weather impacts farm prices, new regulations, etc. Everything is connected. Looking ahead to how one may impact the other is a way for investors to keep ahead. Real estate had gotten to the point where people were once again speaking as though it can only go up forever – popular TV shows encouraged home flipping. This era may be ending. As for rental properties, they had become a burden on many over the past 17 months. For those landlords that will be handed a check worth 17 months of rent, in what is still a very strong but possibly declining real estate market, the opportunity to get out of the business will be compelling.

Managing Editor, Channelchek

Suggested Reading:

A Look at Real Estate Risks to the Stock Market

|

Who benefits from America’s Jobs Plan?

|

Are Small Cap Stocks Smart Investments?

|

How Much is a Trillion?

|

Sources:

https://www.supremecourt.gov/opinions/20pdf/21a23_ap6c.pdf

https://www.cnbc.com/2020/12/17/home-flipping-profits-are-the-highest-in-20-years.html

https://www.nar.realtor/newsroom/existing-home-sales-climb-2-0-in-july

Stay up to date. Follow us:

|