Looking Back on March Markets and Forward to the Second Quarter

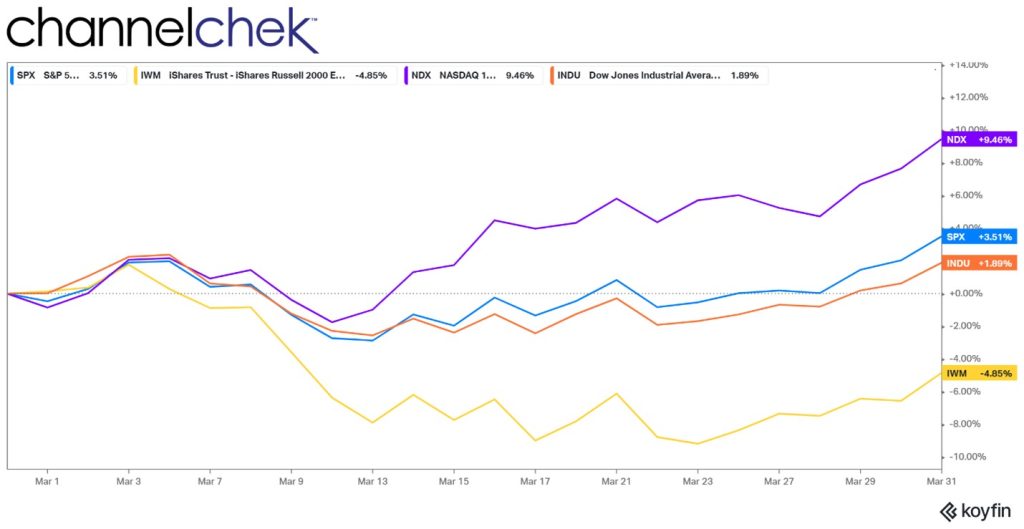

Looking in the rearview mirror at March, the month distinguished itself in two ways. First, attention was drawn to the unexpected banking sector as problems with Silicon Valley Bank and Credit Suisse shook investor confidence. The fear of any additional financial sector bank problems bubbling up are at rest for now. Second, after the FOMC meeting concluded with a 25bp tightening on March 22, all major indices breathed a sigh of relief and trended upward in the final week of March. Looking forward into the month of April, the Nasdaq 100 just broke 20% above its October low. This has investors cautiously optimistic that large-cap tech has entered a new bull market, with hopes that the other indices will also continue to climb higher.

Looking Back

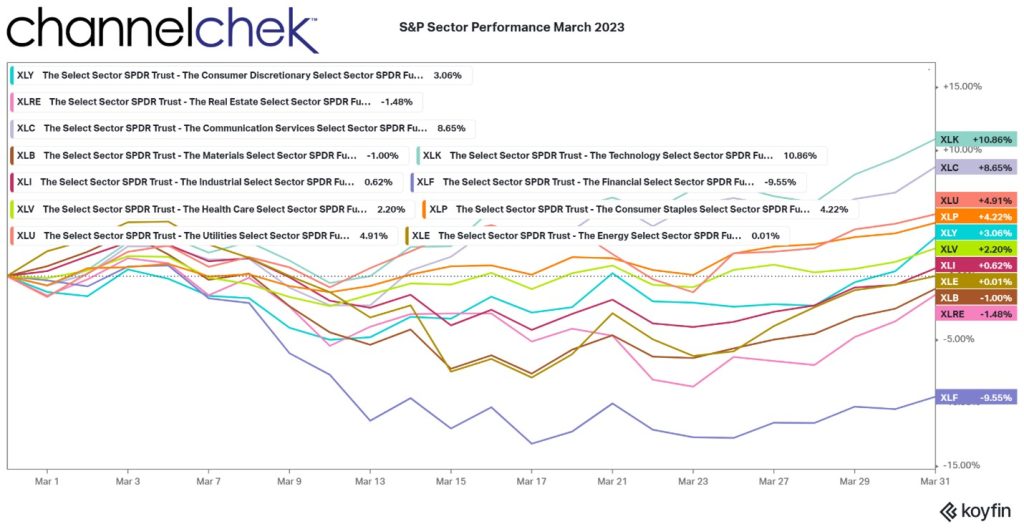

Of the 11 S&P market sectors (SPDRs), seven finished March in positive territory, energy was break-even on the month, and three sectors were negative. The best performing three were led by Technology (XLK), up 10.86%, followed by Consumer Discretionary (XLC), which increased 8.65%, and Utilities (XLU), rose 4.91% during March, reacting to lower fuel costs and lower yields.

Energy, which closed out the month essentially where it began, now indicates that April will kick-off with a strong tailwind as OPEC+ decided to cut production, driving oil futures higher.

Of the worst-performing sectors, Financials (XLF) which includes banks, was down 9.55%. Real Estate (XLRE) was lower by 1.48%, and Basic Materials (XLB), reacting to the increased threat of recession as the bank crisis unfolded, was down 1%.

All sectors began moving higher after the March 22nd interest rate decision by the Federal Reserve.

Looking Forward

Moving past the March banking crisis, three key factors are likely to continue to be front and center in April. These are inflation and interest rates. Fuel prices, to a lesser degree, may also become impactful as rising fuel prices could serve to push headline inflation higher.

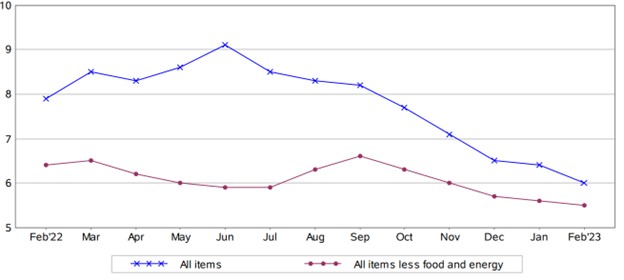

The Consumer Price Index (CPI) gained 6% year-over year in February (reported in March). The inflation gauge is still coming off a peak of 9.1% in June last year, but still well above the Federal Reserve’s 2% long-term target.

12-Month Percent Change in CPI for All Urban Consumers (CPI-U), Not Seasonally Adjusted, Feb. 2022 – Feb. 2023

At the Fed meeting, the Federal Open Markets Committee (FOMC) voted to raise interest rates by one-quarter of a percentage point. This followed a quarter-point move at the prior meeting, following more aggressive hikes going back to March 2022.

Federal Reserve Chairman Powell noted that “financial conditions seem to have tightened” since the banking crisis began. The Fed released fresh long-term economic projections at the meeting, including an outlook that foresees just one more rate hike before the FOMC is seen as pausing any moves on overnight lending rates.

The availability of jobs and very low unemployment rate in the face of massive rate hikes from March 2022-March 2023, makes this tightening cycle unique,and perhaps more difficult for the Fed to manage. That said, recession risks remain elevated as the Fed moves work through the economy over time.

Traders now forecast near a 49% chance that the Fed will raise rates by an additional quarter point at the meeting ended May 3 —and a 51% chance it could do nothing.

Recession Watch

The Fed is reaching a critical point in its battle against inflation, the next couple of months will determine whether or not it can navigate a soft landing for the U.S. economy without tipping it into a recession.

In recent months, the U.S. housing market has softened significantly, and manufacturing activity has dropped. In addition, the U.S. Treasury yield curve has been inverted since mid-2022, something that’s historically been seen as a strong recession indicator.

In fact, the New York Fed’s recession model predicts a 54.5% chance of a U.S. recession sometime in the next 12 months.

So far, the most convincing argument a soft landing may still be possible has been the resilience of the U.S. labor market. The Labor Department reported the U.S. economy added 311,000 jobs in February, widely exceeding economists’ expectations. The unemployment rate rose a bit to 3.6%, but that’s still down from 3.8% a year ago.

Take-Away

The market became fearful early in March as participants reevaluated to determine if the bank failures were isolated cases or part of a broader problem. Once confidence set back in with the feeling the problem was isolated, there were relief rallies that pushed all indices and sectors northward the last third of the month.

With the Nasdaq 100 having risen 20% from its low last October, there is an expectation that it is in a bull market and hope that it will lead the other market cap sectors to break into bull territory as well.

The next FOMC meeting is scheduled for May 2-3.

Managing Editor, Channelchek

Sources

https://www.federalreserve.gov/monetarypolicy/fomccalendars.htm

https://www.bls.gov/news.release/pdf/cpi.pdf