The Mid-Year Sector Rotation is Benefitting Small-Cap Investors

“This time is different” is a saying often used in investing, usually just before the investor does something that they will soon regret. I say “regret” because, although the timing of patterns that have repeated themselves time and time again may change, well-entrenched investment rules very rarely change.

Over the past year, what I have perceived as undervalued stocks – coincidentally, all companies with a small market cap – have been prominently placed on my stocks watchlist. While last year was a bad year for most of the market, these underperformed during that down market. So, they became even cheaper. I fully expected the stocks to eventually get investor attention and begin to move upwaard – in fact, I have had reason to believe this for a while of the small-cap sector in general.

While these watchlist stocks, in my mind, became even better values, I never told myself the market may have fundamentally changed, which would mean small caps will no longer be the relied-upon outperformers over time, as they have been historically. I did not think that “this time it might be different.”

Based on the two major small-cap indexes stellar performance so far this June, and a couple of my watchlist stock’s movements, my long wait may have been worthwhile and may soon be replaced by action.

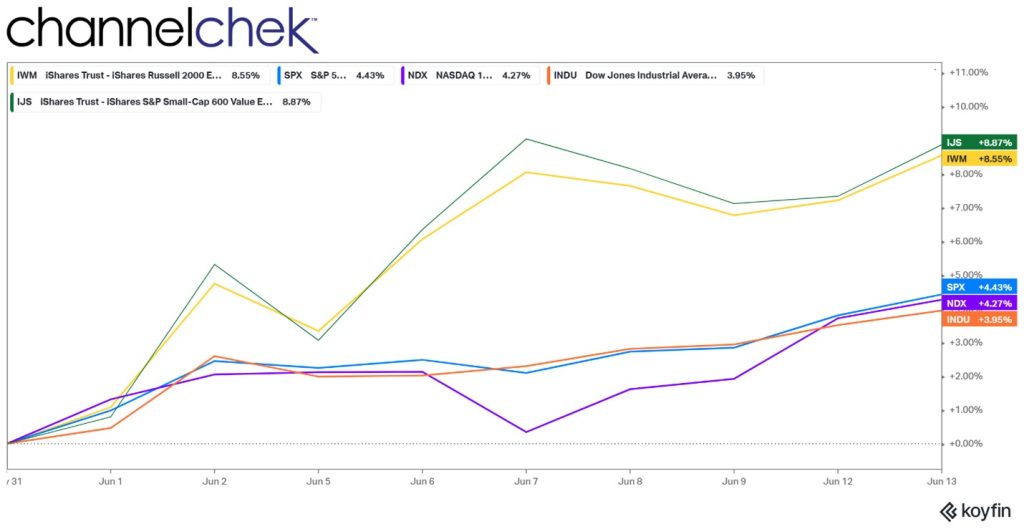

S&P 600 & Russell 2000 Indexes

Small-cap stocks have certainly turned up the heat so far in June. What’s more, is the larger indexes would seem to be losing steam as they have run so far for so long that, unless this time is different, they may be due for a retrenchment.

The renewed enthusiasm for the smaller and perhaps riskier stocks, over large caps, with businesses that tend to be more diversified, have deeper pockets, and more overall resources, is likely based on a number of normal factors. Smaller companies tend to operate leaner, so a higher percentage of revenue can flow to the bottom line in a growing economy. The two-week-old rally comes as many cyclical stocks, and industries that do best in a growing economy are springing to life, especially since the debt ceiling negotiations have been resolved, the banking system is seen as out of trouble, and the Fed has broken records in its tightening pace yet still unemployment is low.

The reduced clouds on the horizon and higher multiples of large-cap stocks seem to have given investors motivation to move to small cap stocks with lower multiples, and with less fear of the economy falling apart any time soon.

Investors are rotating into companies with lower market caps. Looking above at the two small-cap indexes, the S&P 600 (IJS as a proxy) is low in tech stocks that are heavily weighted in the worse-performing indexes. Financials and industrials make up 34% (tech is just 14%) of the S&P 600 Small-caps. The S&P 600 is up 8.87% so far in June compared to the large cap S&P 500 which only gained half as much. The Russell 2000 Small-cap Index is up 8.55% so far in June. This is also the month when investors watch the Russell Reconstitution, which is the rebalancing of the Russell 3000, Russell 1000, and Russell 2000 index based on remeasuring market-caps on the top 3000 stocks. There will be a great deal of attention to the reshuffling come the last Friday of the month.

Take Away

Is it different this time? Are small cap stocks going to play catch up as investors, hungry for value, and growing concerned that larger companies may be overvalued, and an overall increased comfort level that fewer dangers loom on the economic horizon, rotate some assets there? They have whetted their appetite, if the outperformance continues, I suspect they may go back for seconds, then others might join.

Managing Editor, Channelchek

Sources

https://www.economist.com/media/pdf/this-time-is-different-reinhart-e.pdf

https://www.barrons.com/articles/small-cap-stocks-apple-big-tech-9d3b5669