Image Credit: George Morina (Pexels)

The Final Trading Hours as the Russell Indexes Will Have Changed on Monday

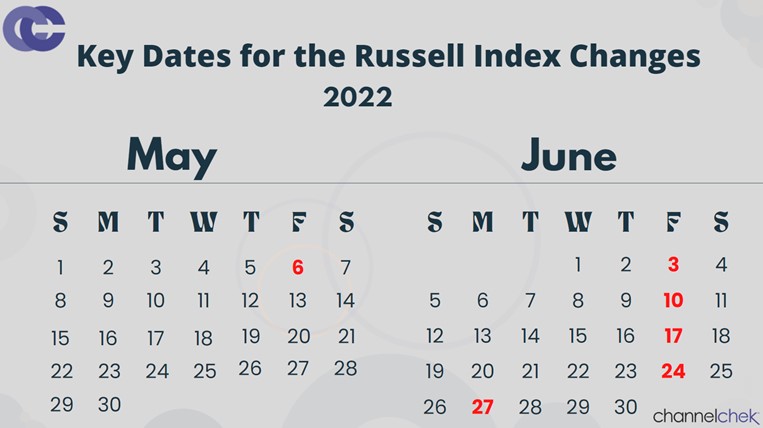

One of the most active trading days of the year is upon us. The last Friday in June is the day index funds totaling $12 trillion are realigning their portfolios. This is because the FTSE Russell

indexes reformulate after the close of business on the 24th and reset upon the opening bell on Monday, June 27th, with new components. This creates a challenge for those managing

Russell Indexed funds like the Russell 3000, Russell 2000, Russell 1000, and subdivisions, including value stocks. All will change their components which makes this a very busy day for managers of funds that mimic the various indexes.

Investors in a stock market which is substantially weaker than it was at the beginning of the year, and even much lower than at the beginning of May when the market-cap ranks by the FTSE Russell may find the last hour of trading to whipsaw both widely traded names and less followed companies.

The remix activity in the past has been toward the end of the Friday trading session, just prior to the reconstitution beginning which is at the start of the next trading day.

The resulting buying and selling just before the remix is final, may not only cause price swings but adds to very high volume. Total trading volume on the last Friday in 2021 topped 16 billion shares, putting it among last year’s busiest sessions.

The preliminary lists of Russell 3000 additions and deletions give investors a good idea of some of the stocks that will likely be on the move. Nearly 300 stocks will join the Russell 3000 index. The list of names moving into the Russell 3000 includes Airbnb (ABNB), Bumble (BMBL), Coinbase Global (COIN), and Harte Hanks (HHS). It is going to be more heavily weighted in energy and consumer discretionary companies as a result of their performance over the past year.

Roughly 300 stocks are also being removed from the Russell 3000, including Citizens (CIA), Genius Brands International (GNUS), Ideanomics (IDEX), and Kirkland’s (KIRK).

If you’re a participant or even a spectator to the activity, watching the company formerly known as Facebook, Meta (META.O) could provide a good lesson in what recategorizing can do. Meta will be moved to the Russell 1000 value index (.RLV), the index for investors to gauge how value stocks are trading. Facebook/Meta is perceived to be trading at a discount to its fundamentals. The Russell 1000 will experience a greater weighting in energy stocks (.RLG) as a result of strength in many of the related companies.

The Russell MidCap Growth index (.RMCCG) will move up to 5.1% of the index from 3.3% before the reconstitution.

The impact on $12 billion in portfolios creates a high duty of care for FTSE Russell. They are transparent in how they select stocks, they share the information they garner on “Rank Day,” Russell then gives itself weeks to sort through for errors, all the while market participants are aware of what to expect on the last Friday (and perhaps the beginning of trading on Monday).

Managing Editor, Channelchek

Suggested Content

Russell Reconstitution 2022, What Investors Should Know

|

Will Sell off Impact Russell Reconstitution Investor Strategies?

|

Investors Keeping Their Eye on Fridays in June

|

Powell Caught Between Competing Political Agendas and Economic Reality

|

Sources

https://www.forbes.com/advisor/investing/russell-index-rebalancing/

https://www.ftserussell.com/products/indices/russell-us

Stay up to date. Follow us:

|