Image: ARK Funds

Cathie Wood is Unwinding One of Her Firm’s Nine Funds

On August 31, 2021, ARK Invest, run by Cathie Wood, filed with the SEC to create her company’s first indexed-based fund. Up until then, all ARK funds were managed by the founder and Chief Investment Officer. Yesterday it was announced the fund will close by the end of July 2022. The ETF, Transparency Global (CRTU), an ESG inspired fund based on The Transparency Index™ (TRANSPCY), will have opened, then closed in less than a year.

Fund Description

The ARK Transparency ETF held companies deemed to be the 100 most transparent companies globally by the index provider. The top five holdings included Teledoc (TDOC), Spotify (SPOT), Bill.com (BILL), Netflix (NFLX), and Acushnet (GOLF). Each of the top five represented about 1% of the fund. The ARK website explains the principle behind the fund in this way, “ARK believes that transparency enhances the performance of companies while benefiting the well-being of people. Transparency implies openness, communication, accountability, and trust.”

The ARK Transparency ETF, which was launched in December, will close later this month, according to a regulatory filing. ARK currently has nine ETFs, including the transparency fund. This is the only fund of ARK’s nine ETFs that is not managed but instead index based. The ARK Transparency ETF followed an index developed by Solactive, a German-based financial index provider, and tracked by Transparency Global.

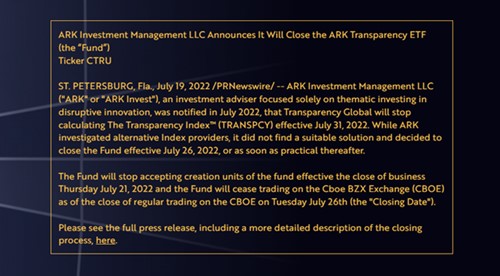

In early summer Transparency Global told ARK it would no longer calculate the ETF’s underlying benchmark after July.

Fund History

It was

reported when the fund was announced last year that Cathie Wood, the founder of ARK Invest, believes that while this carve-out index has many of the same attributes of popular ESG funds, the transparency screen could provide superior performance. The Ark application to register the then new fund came at a time when there was a massive appetite for ESG investing. At the time, ESG funds were on track for a record year of inflows after amassing $21 billion

The Transparency fund had accumulated $12 million in assets and had fallen nearly 36% since its inception, according to FactSet. Some of the fund’s largest holdings included Teladoc Health Inc. and Bill.com Holdings Inc., which are both down about 50% this year.

The transparency fund will no longer accept creation units after Thursday and will cease trading on the Cboe BZX Exchange after July 26, according to a statement from the firm.

Managing Editor, Channelchek

Suggested Content

Cathie Wood Talks About Being Wrong

|

Will Consumers Finally Adjust Spending Down?

|

The Proposed Ark Index-Based ETF is Appealing to ESG Investors (2021)

|

The Proposed Ark Index-Based ETF is Appealing to ESG Investors (2021)

|

Sources

https://www.sec.gov/Archives/edgar/data/1579982/000110465921111628/tm2126418d1_485apos.htm

https://transparency.global/transparency-index/

Stay up to date. Follow us:

|