Are There Long-Lived Changes in Oil Markets that Hold it Above $50/bbl?

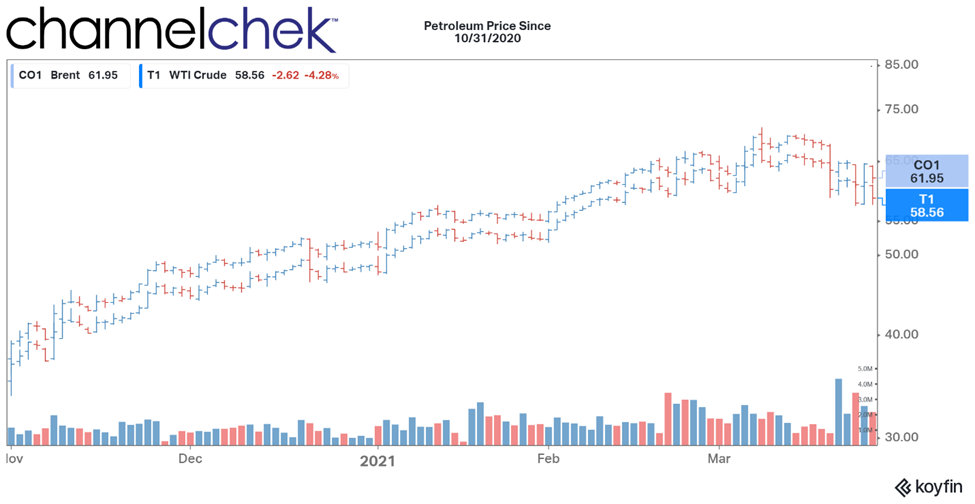

Oil prices have risen dramatically in recent months. The upward trend took root in November of 2020 and seems firmly in place. Oil’s current strength reflects increasing optimism for a global economic recovery as fewer cases of Covid19 lead to more petroleum-consuming activities. While prices have gone up, producers have been slow to respond to the increase, as evidenced by continued low rig count numbers. These factors provide investors hope that there has been a fundamental change to the supply and demand of oil that could lead to oil prices staying above $50/bbl. The below graph shows the recent rise in WTI and Brent oil prices.

Is Backwardation a Concern?

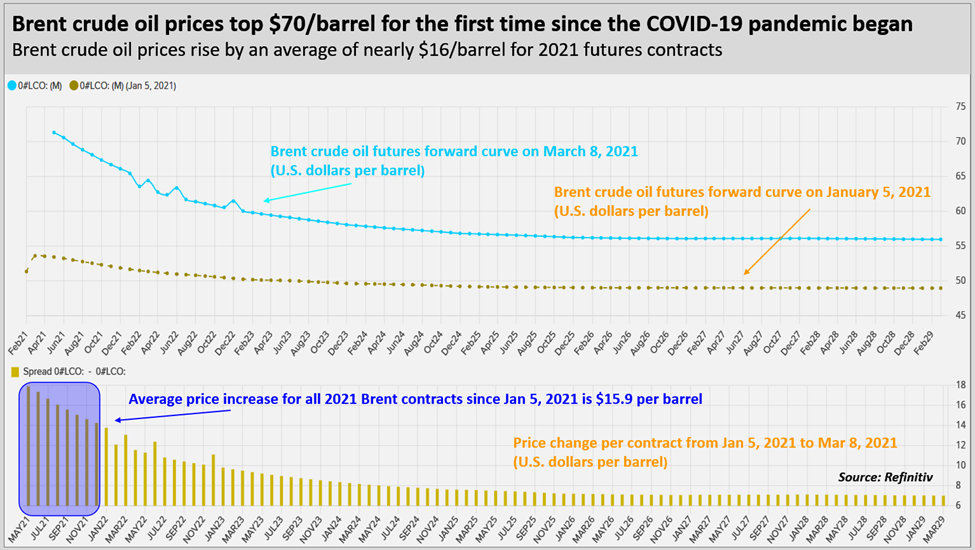

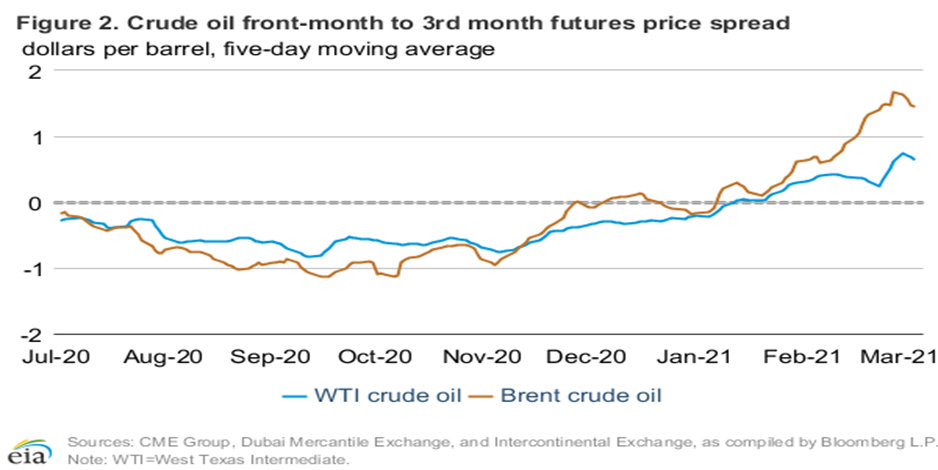

The upward trend in oil prices accelerated in March as OPEC unexpectedly held supply reduction levels despite growing demand. Spot prices have jumped again in recent days with the news that a container ship was blocking the Suez Canal and could take weeks to free. These two events have moved spot and futures prices higher, but not evenly. At current levels, spot prices are higher than future prices, a situation referred to as backwardation (see chart below). When near-term prices are below long-term prices, that situation is referred to as contango.

Higher spot prices relative to longer-term contracts is often a sign that prices are expected to fall. This is often the case when spot prices have risen due to events that are seen as temporary (OPEC decisions and Suez Canal Blockage) as opposed to events that may be longer-term in nature (Increased drilling, changing economic conditions, technological breakthroughs, etc.) Futures curve backwardation is not unusual. However, the current spread between near-term and longer-term prices is unusually large. The chart below shows how the spread has been growing over the last twelve months.

Take-Away

A futures curve is by no means a perfect predictor of the direction of oil prices. However, it can give investors insight into other investor expectations. And, of course, the futures curve tells us something about what price might be received by energy producers seeking to hedge production. Investors should make sure to monitor all oil pricing when deciding whether to buy an energy stock and not just the spot price.

Suggested Reading:

|

|

| Uranium is an ESG Energy Source Getting More Attention | Private Energy Companies Role in Energy Cycle |

|

|

| Ruling Out Nuclear Energy Now Could be a Mistake | Energy 2020-4Q Review and Outlook |

C-Suite Series: enCore Energy (ENCUF)(EU.V) CEO Paul Goranson

& Exec. Chairman William Sheriff

- Outlook for uranium pricing; how enCore’s production capabilities position them well for the next big move

- Supply and demand outlook for uranium; value of building a strategic reserve

- Steps they’ve taken to restart the processing plants acquired in 2020

- Long term plans for existing assets in New Mexico; addressing environmental & community standards in restarting activities

- Current cash position; plans to finance future growth

Sources:

https://finance.yahoo.com/news/low-tide-slows-clear-suez-033034022.html, Yusri Modamed, Gavin Maguire and Florence Tan, Reuters, March 24, 2021

https://www.eia.gov/outlooks/steo/marketreview/crude.php, EIA, March 9, 2021

https://www.reuters.com/article/uk-global-oil-idUSKBN2B001L, Laura Sanicola, Reuters, March 7, 2021