Image Credit: Marc Tarlock (Flickr)

Investors Have Added Money to the Markets a Record 71.4% After Dips

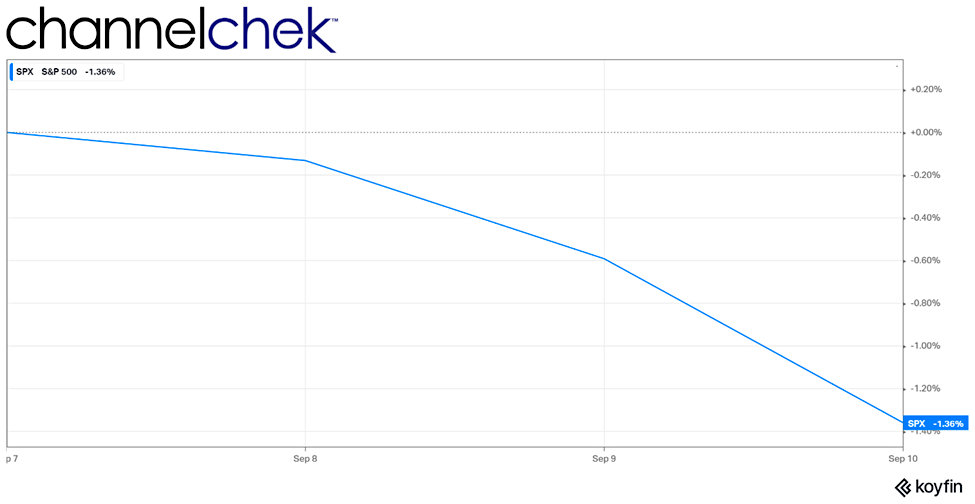

If there is one thing we have learned from the markets this year and last, it is there is still a lot to learn. Last week’s holiday-shortened trading saw stocks fall, with the S&P 500 declining 1.36%. This is the eighth such one-week dip in 2021; the last seven have proved to be buying opportunities. If 2021 maintains its current pattern, this decline will soon be replaced by higher price levels and new records.

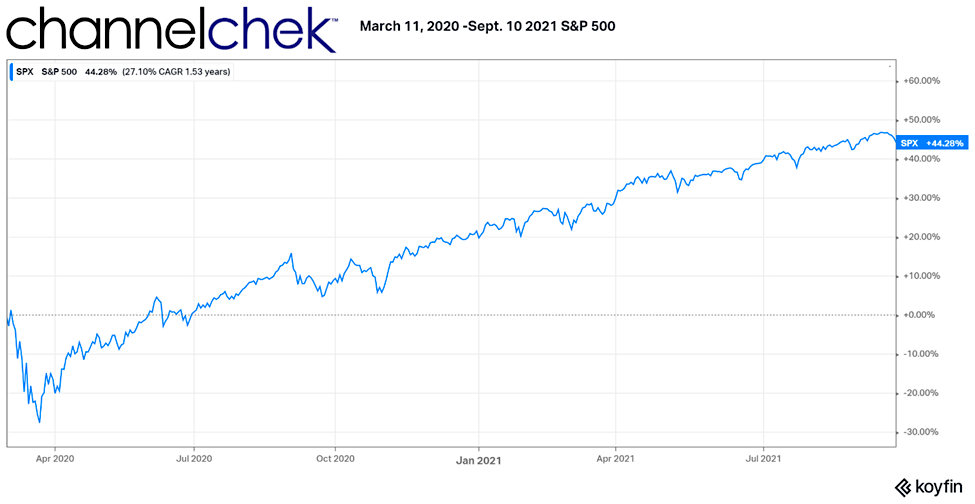

In the past, money flow from investors into markets often demonstrated a propensity to chase momentum – buying when stocks are rising, selling when falling. Cash would flow into stocks and equity funds, at times with a frenzy, at a market peak. Conversely, sell-offs were met with further selling until the move exhausted itself. The overall market behavior has been different over the past 12- 18 months and is worth understanding, especially that which has been happening since the beginning of this year.

In a research report put out by Alliance Bernstein last month, they demonstrated that the trend to “buy the dip” is double its seven-year average and at a record.

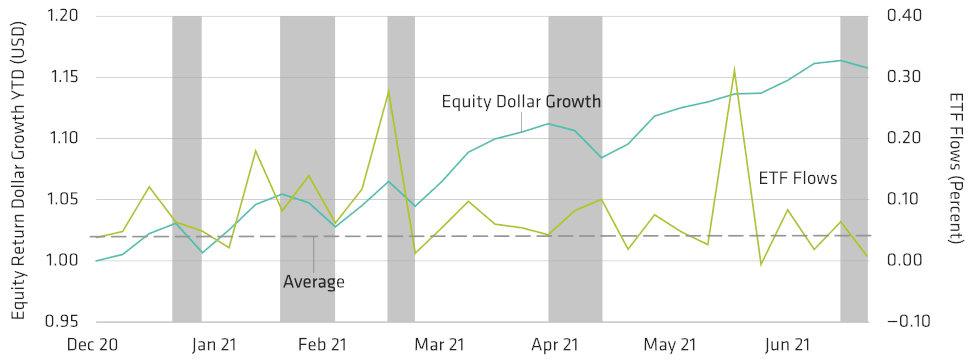

Of the seven one-week periods so far in 2021 during which equities closed in negative territory, investors then bought at above-average levels during five of them. This was calculated using flows into the 100 largest exchange-traded funds (ETF). The below chart is as of July 31, 2021, in addition to showing the pattern of dips and bounce-back, it shows the level of flows into the market via ETFs which coincide with those dips.

Flows for the 100 largest ETFs by Assets Under Management versus market return for the prior week.

Source: MSCI World Index and Alliance Bernstein

With 5 out of 7 dips or 71.4% experiencing higher than average ETF inflows, this year is running well ahead of last year’s 11% increase in flows during dips. The average since 2014 has been 35%. Investors are more comfortable than they were last year that the market would continue to rise, and they seem to have ample dry powder to put to work each time.

One Driving Force

In their report, Alliance Bernstein asked Why is “buy the dip” so prevalent…and why now? They suspect it is from a number of areas that all lead to an abundance of investible cash. One source of this cash is an unprecedented level of sidelined money. Savings since the start of the pandemic began changing behavior as it was at the fastest pace on record. By March 2021, the personal savings rate (after taxes and spending) was 27%, according to the Bureau of Economic Analysis. It is still well above average at 10%.

A few waves of stimulus money during the pandemic along with many paying down their more expensive debt, were contributors to the additional ability to save. The causes that created these high household cash positions may only be as long-lived as the current abnormal economy. And, the pace toward normalization will depend on how quickly work-life normalizes, and monetary and fiscal policies allow the economy to carry its own weight.

Until then, with aggressive amounts of cash in the system and employment levels increasing, consumer balance sheets should allow for the part of this trend that has been driven by cash on the sidelines to continue.

Take-Away

The “buy the dip” phenomenon has paid off this year. However, other factors that impact markets need to be minded as well. For now, investors have been paid by injecting more cash into their positions each time there is a one-week price drop. Interestingly, all of the openings have been at higher and higher averages. This could mean that investors are cautious in addition to their confidence.

The market, as measured by the S&P 500, dropped last week. We will soon know whether the trend continues and 6 out of 8 dips attract new money to flow in and the market rise, or if this will become a deviation from the trend.

Managing Editor, Channelchek

Suggested Reading:

Is it Wise to Buy on Dips?

|

Money Supply is Like Caffeine for Stocks

|

Four Inflation Growth Possibilities and Their Impact on Stocks

|

Yield Curve Control

|

Sources:

https://www.barrons.com/articles/2-reasons-to-buy-stocks-after-the-dip-51631202176

https://www.bea.gov/data/income-saving/personal-saving-rate

Stay up to date. Follow us:

|