JNJ Admits M&A Appetite in Medtech Space

While pharmaceuticals and biotech get much of the attention in the life sciences field, investors in medical device manufacturers got confirmation last week that the high growth projections in sales is on track. Of added interest to those invested in smaller companies in the medtech space, large key players are looking to increase market share through mergers and acquisitions (M&A). This was emphasized in Johnson and Johnson’s (JNJ) Q2 reporting released last week.

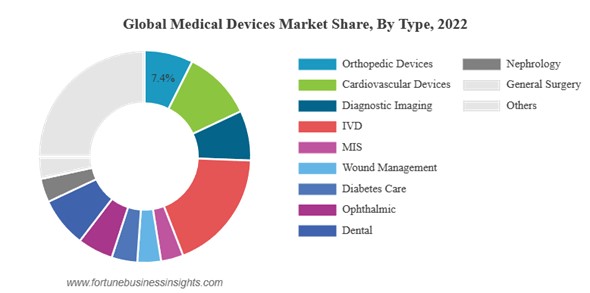

Consumer health giant Johnson & Johnson said it has a “pretty voracious” appetite for medical device M&A going forward, as it expects further rebounds in surgery volume, post-pandemic, to continue funneling cash into the company for the rest of the 2023. Projections for the global medical device market size, according to Fortune Business Insights, was valued at $512.29 billion in 2022 & is projected to grow from $536.12 billion in 2023 to $799.67 billion by 2030.

Even after the demand from patients who put off procedures, while labor shortages in hospitals became less of a problem, device sales that are helping fulfill delayed procedures have a much brighter future even after the pandemic-related surge in needs.

Driving demand is an aging and sedentary population, with a growing prevalence of chronic disorders like diabetes, cancer, heart disease, etc. There is also an increased demand for ophthalmic and orthopedic procedures as the population experiences more joint fractures and debilitating vision issues.

Johnson and Johnson’s admitted during its quarterly reporting that it will continue actively looking for situations to acquire medtech companies. The company’s medtech businesses produced $7.79 billion in global revenue during the second quarter, totaling 14.7% growth compared to the $6.90 billion brought in during the same three-month period in 2022.

Last year JNJ bought a miniature heart pump maker Abiomed, for $16.6 billion. Business from this acquisition accounted for 4.8%, or nearly a third of the Q2 gains, with $331 million in worldwide revenue for the quarter. JNJ’s acquiring Abiomed was one of the largest medtech deals of 2022; as of the end of the second quarter, it has added $655 million to J&J MedTech’s bottom line since the acquisition was closed last December.

“Everything is moving well and according to plan in Abiomed’s integration, and we are increasingly convinced that this is going to be a key component in our medtech strategy of becoming a leader in heart recovery,” J&J CEO Joaquin Duato said on the company’s investor call.

“When it comes to M&A, we continue to look for opportunities,” Duato said. “And when it comes to medtech … we look forward to growing in areas that are close to where we are today: vision, cardiovascular, surgery, and also high-growth segments in orthopedics.”

Abiomed wasn’t the only contributor in JNJ’s growing medtech businesses. Much of the growth was driven by a 25.9% year-over-year boost in electrophysiology sales, pushing the segment past the billion-dollar mark. The company also saw increases in trauma orthopedics, wound closure kits and biosurgery products, as well as in contact lenses.

Take Away

Medical device companies are helping to fulfill a need as the population ages and new technology, including AI and robotics, are able to provide new solutions to old problems. The announcement by JNJ that they are hungry for medtech companies that fit their criteria ought to cause life sciences investors to pay even more attention to the space.

Late in 2022 Channelchek asked our Med Device & Services analyst to discuss his “shopping list” in the medical device arena, the video is helpful for investors to discover more about this space.

Managing Editor, Channelchek