Image Credit: Pixabay (Pexels)

Global Strength in the US Dollar Is Positively Correlated to Strength in Many Stock Sectors

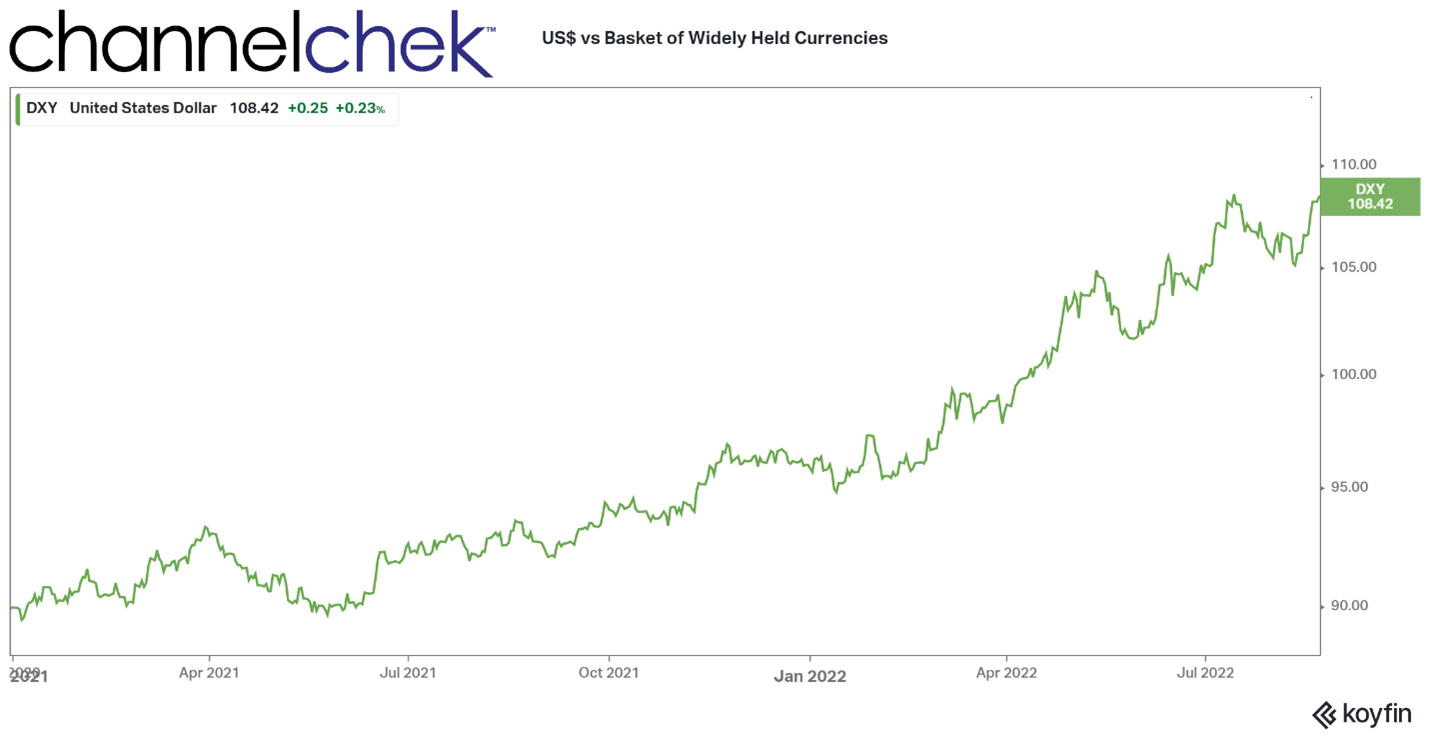

The last time the U.S. Dollar was this strong against other currencies was October 2002. It reached a new high today (August 22) as the expectations surrounding the annual Jackson Hole Economic Symposium become more hawkish. Higher U.S. interest rates tend to place upward pressure on the dollar’s value measured against other currencies that have lower real rates (inflation less native interest rate). There are other global economic factors at play as well.

Why is the Dollar at a High

The Euro lost relative value to the U.S. currency over the past month after Russia announced a three-day halt to European gas supplies flowing through the Nord Stream 1 pipeline. Europe is already experiencing an energy crisis that is inflating all related costs. Higher inflation weakens a currency against those with lower or no inflation.

Away from Europe, the world’s second-largest economy, China saw its Yuan sink to its lowest level in almost two years after the Chinese central bank cut key lending rates. China has been easing policy to shore up its weakened state related to its response to Covid-19 and crashing real estate values.

Source: Koyfin

US Stocks and a Strong Dollar

What does a rising dollar mean for stocks? The short answer is, as the value of the U.S. dollar rises in relationship to global currencies, the U.S. stock indexes statistically have risen along with it.

Over the last 20 years, the S&P 500 index has shown a positive correlation to the dollar about 40% of the time. While this may not seem huge, in stock market indicator terms, it is better than most and would be better if some sectors were excluded or given less weight.

As with most everything else, the value of something will tend to rise with increasing scarcity or increased demand. The demand for the dollar has been increasing as the U.S. is perceived to have one of the stronger, safer economies relative to our trading partners. Additionally, as real rates are expected to continue to rise in the U.S., overseas investors will flock to dollars which they may then store in dollar-denominated assets, which adds to demand.

What sectors have the highest propensity for positive returns? One obvious answer is companies that rely on imports. This is because they have an advantage when the U.S. dollar is strong. One caveat, many retailers that import their goods have been under a lot of strain because of built-up or mistimed

inventories. Manufacturing businesses that rely heavily on raw materials or commodities and get these products from overseas (steal, semi-precious metals, minerals, etc.) will benefit from paying in or exchanging from the stronger currency. This has the impact of reducing relative costs and helping the bottom line. Stocks do better with a growing bottom line.

Investors should be more cautious with companies that sell their products internationally. If there are alternative suppliers available to them that transact in non-dollars, these companies’ sales could suffer.

Companies that buy and sell only in dollars will not have the price advantage that importers do, but they avoid exchange rate factors altogether. Utilities and regional banks are on this list. A word of caution as interest rates are moving upward, utility stocks known for their dividends may begin to compete less effectively with bonds. Also, banks will generally earn more with a steep yield curve; this has been elusive so far in this tightening cycle.

Some investors increase the number of small companies on their watch list. This is because, as a rule, their sales are domestic, while they may or may not import. Large companies tend to transact internationally. Small-cap stocks are not typically at the multinational stage yet. Use the data available on Channelchek to better understand whether the small company stock you are interested in imports or exports internationally.

Take Away

There are many factors that move the market up or down. And there are factors that impact specific industries and individual stocks. Statistically, a stronger U.S. dollar is positive for US stocks. Companies that import could fair even better. Stocks least affected by currency shifts include utilities, regional banks, and small-caps in almost all industries. Each company should be vetted separately, but minimizing headwinds is a good step toward successful investing.

Managing Editor, Channelchek

Suggested Content

Michael Burry Tweets About the Weak Dollar While Mainstream News Discusses Dollar Strength

|

Using Current Dollar Strength to Refine Your Watch List

|

Will Gold’s Direction Continue to Point South?

|

What Quality Equity Research and Dating Apps Have in Common

|

Sources

https://www.investopedia.com/ask/answers/06/usdollarcorrelation.asp

https://www.bbc.com/news/business-62629144

Stay up to date. Follow us:

|