The Election May be the Reason Smaller Stocks are Doing Better

The stock market is forward-looking. It trades on expectations of future values based on a world of information and investors all trying to maximize return. We’re approaching the end of October, the beginning of the holiday season, and soon the beginning of a new year. All of these have their own impact on market behavior. We will also be experiencing a U.S. Presidential election next week; this has its own set of probabilities and behavior that traders need to be aware of.

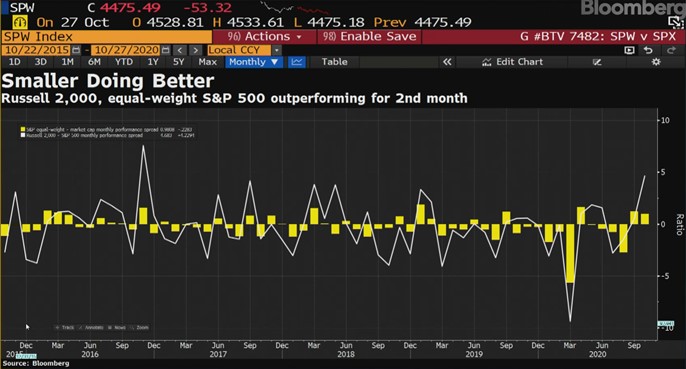

The nature of the stock market to be forward-looking may explain the winning and losing sectors month-to-date. The NASDAQ, despite all of its resilience this year, is down 1.6%. The Dow Industrials and the S&P 500 are also down for the month. The Dow by 4.8% and the S&P 500 by 2.5%. The one major index which is up is the Russell 2000. So far, in October, this small-cap index has gained 1.2%. The strength of small-cap stocks may have a lot to do with market participants looking forward to history repeating after election day.

The Data

The average return for small-cap stocks, the year following a presidential election, for the past 40 years, is 17.48%. Looking back, the least the Russell 2000 returned during these years was 2.03% (1981), the most 38.82% (2017). The major large-cap indexes don’t have this level of consistency; they also fall short in performance by a few full percentage points. This begs the questions: Why would smaller companies outperform after a presidential election and more relevant, are they likely to outperform again next year?

Why the Outperformance?

After voters decide on who will be their President, there is a renewed focus on domestic issues that had a reduced priority during the Presidential race. The noise and distraction of political gamesmanship become severely reduced after the contest(s). Elected officials get back to their To-Do list. These lists usually include providing a positive environment for businesses and workers. For example: In 2021, we’re likely to see work on tax and trade policies, health care reform, hearings on big tech oversight, and overall creating an environment where jobs are created.

Large multinational companies don’t benefit as directly as smaller companies in the U.S. are more likely to feel an immediate positive impact that is focusing on domestic issues has since they have a much higher percentage of their business conducted in North America.

|

But now there’s a growing chorus on Wall Street calling for a leadership change. Earnings drive stock prices long term, and small-cap earnings estimates are improving faster than those for large-caps. Add cheaper valuations and the relative reward for small-caps looks even better. – Barron, August 14, 2020 |

S&P 500 vs. Russell 2000 10/22/15-10/27/20

Will the Streak Continue in 2021?

Market cap weighted indexes like the S&P 500 and tech heavy indexes like the NASDAQ 100 are heavily influenced by FAANG stocks. These stocks have had an amazing ride in 2020 because of lockdowns. Their strength and their increased weighting created a strong updraft for the NASDAQ and S&P 500 indexes, which are positive on the year. By contrast, the popular index of America’s small-cap companies, the Russell 2000, is down 6.3% YTD. So, in addition to four decades of market history placing odds on the side of small domestic companies with less overseas exposure, small-cap stocks are also less than one week until the election and are more attractively priced after falling out of favor.

The run-up we’ve had in big tech and other large-caps is part of a cycle and won’t last forever. Any possible rotation into small-caps was derailed with COVID’s impact and the distractions of an election year which included impeaching a U.S. President. The potential for outperformance on those facts is strong, add to it a weakening dollar (vs. Euro) and companies with a high percentage of their business dealings done domestically also face a tailwind.

|

Some strategists think 2021 might finally be the time for the Davids of the market to start outperforming the massive Goliaths of tech. – CNN Business, September |

In addition to the post-election year probabilities of this group outperforming, the odds are also in their favor as GDP just posted a strong positive performance. This record growth signals an end to the recession. In an interview Michael Binger, President of Gradient Investments, had on CNBC’s

Trading Nation said: “When you look historically, as the economy comes out of a recession — and we’re certainly going to be in a recession after the second quarter — small-caps have outperformed large caps in nine out of the last 10 economic downturns after the economy came out of the downturns. So, I think you have history on your side.”

Take-Away

Is outperformance by small-cap stocks a slam-dunk next year? The investment markets never provide a future slam-dunk possibility without caveats. There are a lot of other moving parts to consider. Analysis of the markets do, however, provide higher and lower probability of outcomes. Armed with the history of this sector in post-election years, post-recession years, with a weakening dollar, and after large-caps ran so far, I’d place this scenario in the perfect storm category for small-caps to recover relative lost performance ground in the coming year. And, possibly much more than just lost ground.

Suggested Reading:

U.S. Debt as a

Percentage of GDP

Small-cap Stocks are Looking Better for Investors

Investment Barriers Once Seen as Insurmountable are Falling Fast

Enjoy Premium Channelchek Content at No Cost

Each event in our popular Virtual Road Shows Series has maximum capacity of 100 investors online. To take part, listen to and perhaps get your questions answered, see which virtual investor meeting intrigues you here.

Each event in our popular Virtual Road Shows Series has maximum capacity of 100 investors online. To take part, listen to and perhaps get your questions answered, see which virtual investor meeting intrigues you here.

Sources:

Investing in

Small-Caps after an Election Year, CNN

Pick up Some Values in Small-Cap Stocks, Kiplinger

Small-Cap Stocks Could Keep Rising

Small-caps Historically Outperform After Recessions

Small-cap and Emerging Market Favored in Post COVID Era

The Most Popular Small-cap Index Isn’t the Best, Morningstar