|

|

|

|

Is the Repeated Outperformance in June of the Russell 2000 Random?

“Sell in May and Go Away” is an investment axiom that suggests investors would do better to lighten their positions in stocks during the summer months. Is this good advice? It doesn’t tell us when in May that we should take our chips off the table. Is it May 1, Memorial Day weekend, May 31? And, is one sector or index more impacted than others? This May, the Nasdaq hit its low for the month on May 3, right before its 800 point climb. The S&P 500 bottomed later on May 14 before shooting up close to 10%. Overall, May 2020 was an excellent month for the major market indexes. If you didn’t sell, there’s a good chance it gave a boost to your portfolio.

What will June and the summer bring? I don’t know of any market sayings for June. I guess you were supposed to have already reduced your positions in May. I do know, from my years on Wall Street, that the trading desks during the summer months are often controlled by the rookies and interns. They’re often trying to demonstrate their abilities while the veterans are out playing golf or lying on a beach in South Hampton. Could this be the root of the “sell in may…” advice?

Serious investors don’t care about sayings; they care about company data, economic numbers, trends, and probabilities. I decided to look back at the trends over the past 20 Junes to see if history provided a verifiable pattern across the most followed market benchmarks.

June

Results Since 2000

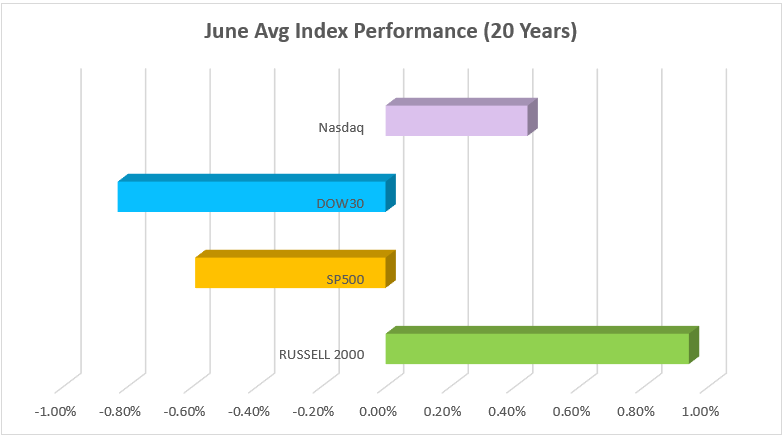

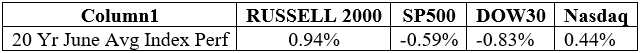

Out of the past 20 years, the Russell 2000 has returned positive results 13 times (65%). This doesn’t sound overly impressive until you compare it to the Dow 30 which had been up in June for only 7 of the years (35%), the S&P 500 was up 11 of the 20 (55%), or the Nasdaq that was up 9 Junes (45%) over the past 20 years. So, over the period, only two indexes were up during June more than half the time. I should point out here that this 20-year period was not “cherry-picked” to compare performance history. A quick review of the data for the ten years prior to this, and the ten years prior to that only reinforced this June “trend” with the small-cap index exceeding the others. Here is a link for the Underlying Data.

Data Source: investing.com

In terms of performance, the track record for the Russell 2000 is even more compelling. With a one-month return average of almost 1% (0.94%) in June since 2000, the Russell has returned more than double the next closest index which is Nasdaq.

There May Be a Reason

Rather than caution that past history is not an indication of future performance, I’ll instead make sure readers know that during this period, the best year was 6.89% (June 2019), and the worst June was negative 8.60% (June 2008). So any particular year has its own circumstances. But there is something at play during June with this index. The Russell Indexes are being reworked and this creates activity that could be providing a predictable tailwind. The added companies typically have a good amount of new interest surrounding them. This added interest causes fresh institutional buyers of the new stocks being included and often a rise in their value leading up to and for a short time after their inclusion.

Take Away

Channelchek wrote two informative articles on the impact on investors of index reconstitution. They are Opportunity When Stock Market Indices

are Reshuffled and The Russell Index Reconstitution. These two articles, coupled with the above data, make clear that investors should be aware of how the calendar impacts the index, which measures the lower 2000 stocks of the 3000 largest capitalized companies.

As far as selling everything else now that it’s the last day in May, normal market probabilities may not apply this year. The one thing certain in 2020 is that there are cross-currents that will continue to move markets dramatically. The normal drivers of stock price based largely on recent company performance, for now, are on hiatus.

Paul Hoffman

Managing Editor

Suggested

Reading:

Why Index funds Could be a Mistake in

2020

Can the Market Continue to Defy Gravity?

Lower Multiple are a Good Case for Investing in Utilities

Enjoy Premium Channelchek Content at No Cost