Well Productivity Improvements – Good for Producers, Bad for Energy Prices

Oil well production and improved drilling efficiency could keep the price per barrel low, even as demand picks up. Although today’s lower oil price range is largely demand-related, the result of pandemic related slowdowns, technology has been improving well output, this is also a culprit. The trend is also impacting natural gas. Technology is not likely to reverse itself and reduce the capacity to bring oil to the surface. From a supply standpoint, oil prices could be stuck in a lower range, even in a booming economy.

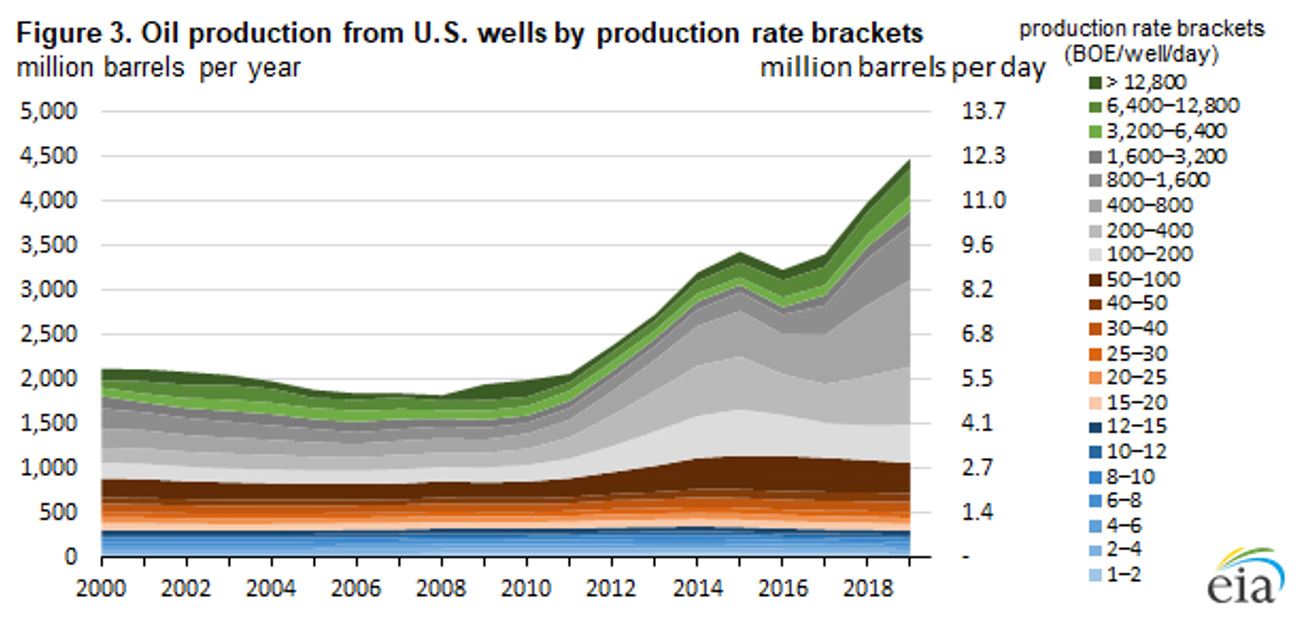

Where the Growth in Oil Production is Greatest

A recent study by the U.S. Energy Information Administration shows that technology improvements in the last decade have not only increased the overall production of oil and gas in the United States they have also dramatically increased production rates per well. To show this graphically, the EIA separated production into categories based on the size of the well. The graph below shows that the growth in oil production has occurred primarily from wells producing 100-1600 barrels of oil equivalent (BOE) per day. Interestingly, there has not been much growth in the number of production of large wells producing more than 3,200 BOE/day. The limited growth from “mega wells” reflects a decreased emphasis on drilling in the Gulf of Mexico and searching for giant discoveries. It is also worth noting that there has been little growth among smaller wells. These largely represent existing wells that have been in production for many years at steady rates.

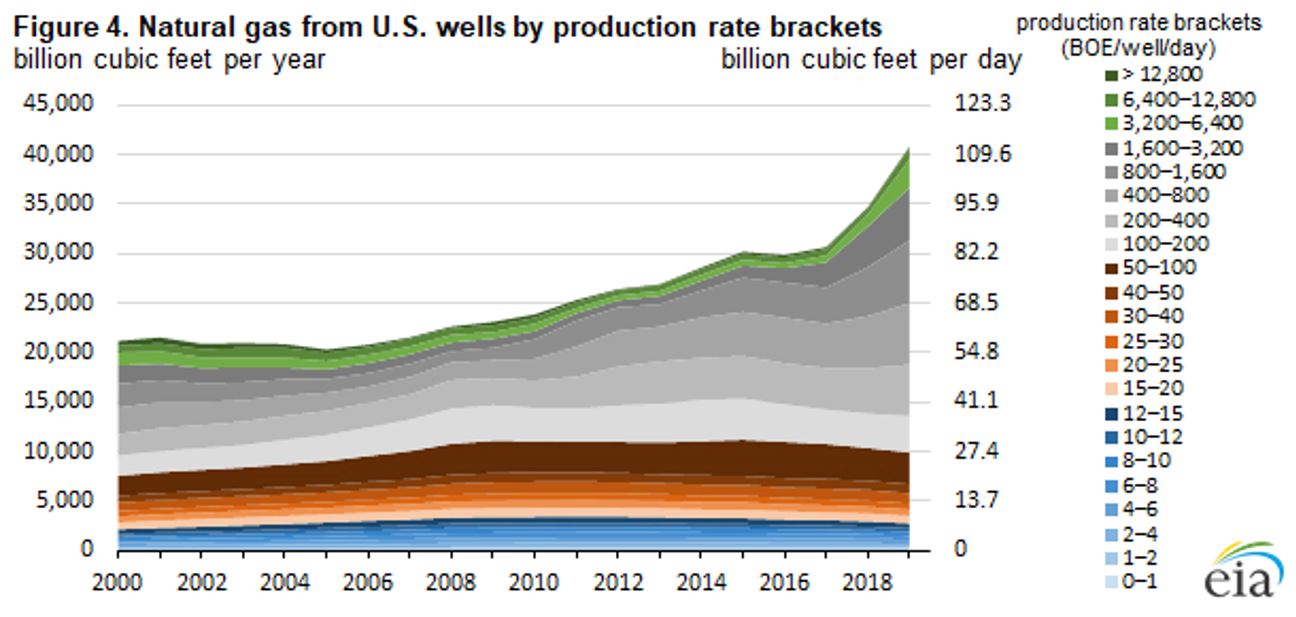

Where the Growth in Natural Gas Production is Greatest

A similar story can be told by looking at natural gas well production. The growth has come from the middle size wells and not the largest or smallest producing wells. Notably, the production growth has come during a period of low natural gas prices and does not yet reflect the impact of a rebound in natural gas prices in the second half of 2020.

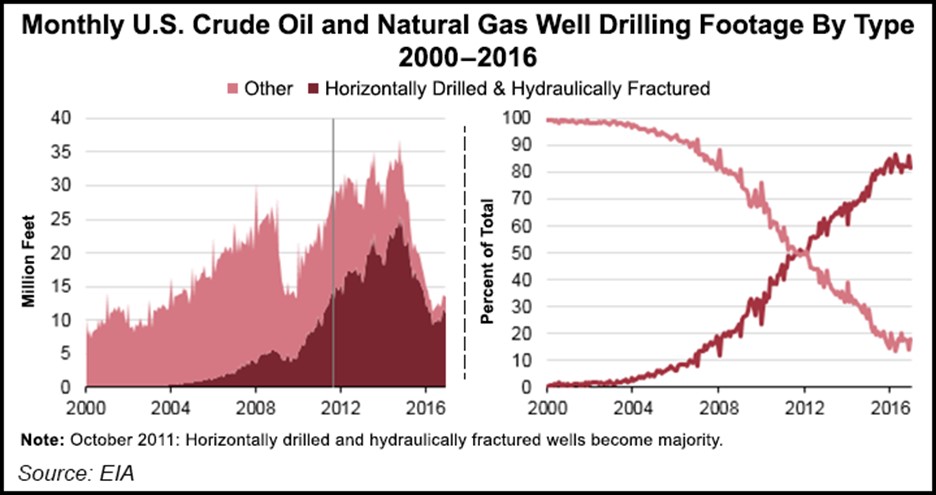

Improved Drilling Methods

The growth in oil and natural gas production should come as no surprise. Horizontal drilling and fracking have improved initial productivity rates of middle-size wells. What is perhaps a surprise is the fact that improvements seem to be accelerating in recent years. Horizontal drilling began in the ‘70s, and fracking has been done for over 150 years, but it wasn’t until ten years ago that the use of horizontal drilling and fracking surged in the United States. Importantly, drillers continue to improve well production rates by finetuning the number and spacing of fracks per well, and the amount of pressure and viscosity used to frack a well. To complicate matters, the ideal drilling formula in one land formation may not work in another land formation. This has lead to a growth of producers that specialize in specific drilling locations.

It is a common theme among producers to report well production that surpasses expected “type curves”. At the same time, managements report a reduction in the number of days it takes to drill a well and thus its overall drilling cost. The result of reduced well cost and higher production has meant a higher return on investment. Higher returns have helped offset lower energy prices in 2019 and the first half of 2020.

Take-Away

Improved profitability is clearly positive for individual energy companies. As a whole, however, it means lower energy prices. Drilling can continue at lower energy prices than before, and drilling will increase sooner when prices rise. If the natural trading range of oil was previously $40-$70 per barrel, perhaps the new range is now $30-$60 per barrel. And, for natural gas, perhaps the range has shifted from $2.50-$3.50 per mcf to $2.00-$3.00 per mcf. If true, current prices of $48 for oil and $2.40 for natural gas do not represent depressed levels but levels in the middle of the new trading ranges. And technology continues to improve. Ten years from now, we may be talking about even lower trading ranges. Technology is not going to reverse itself and cause trading ranges to rise.

Suggested Reading:

Small-Cap Energy Underperformance During the Drop in Oil is Unwinding

Are we headed to Another Oil Collapse?

Sources:

https://www.hartenergy.com/news/history-horizontal-directional-drilling-52314., Hart Energy, September 1, 2005

https://www.nrdc.org/stories/fracking-101#history, NRDC, April 19, 2019