Image Credit: Pratkxox (Flickr)

Using Current Dollar Strength to Refine Your Watch List

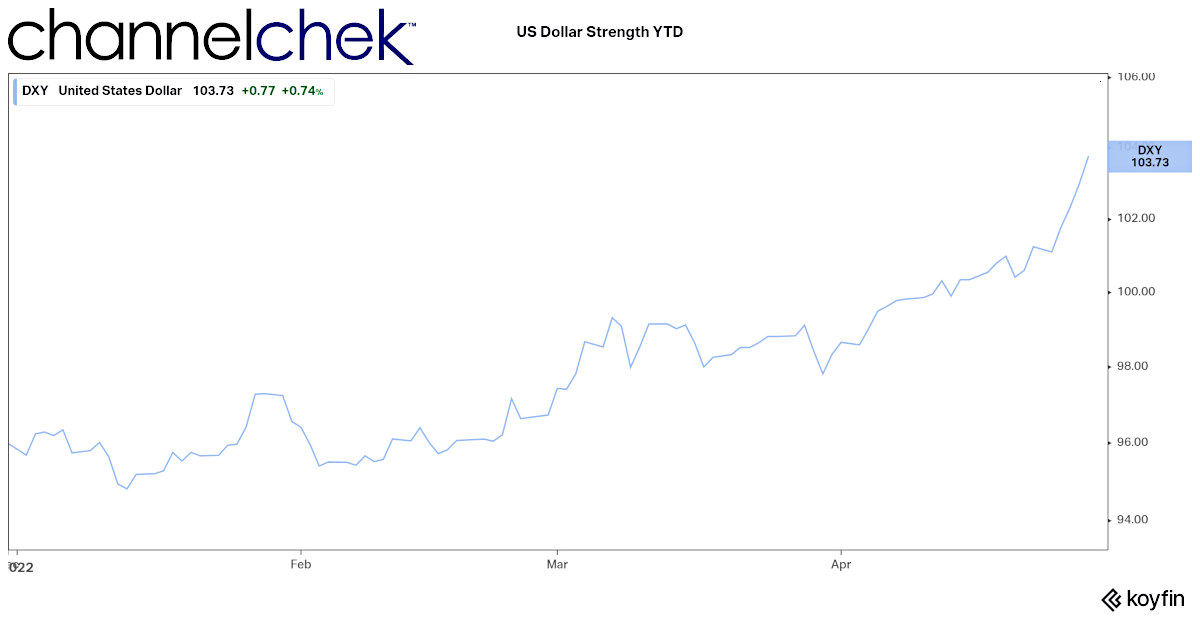

The U.S. dollar is up 8.1% vs. its trading partners (DXY) thus far in 2022 (April 28). Over the past 20 years, when the U.S. dollar rose, U.S. stock indexes have shown a positive correlation. To date, this has not happened in 2022. As measured by the S&P 500, stocks are down about 12% this year. A reversion to a more statistical correlation could bring stocks up, the dollar down, or possibly both.

Of course, within the universe of stocks, there will be some investments that are much more positively correlated to the dollar and those that have demonstrated themselves to have a negative correlation. When the currency has a strong and clear direction, it may make sense to look into stocks in the sectors that have a higher probability of taking their cue from the dollar.

Dollar Value Moves Some Stock Prices

Any country’s currency can gain in value relative to other currencies. This happens when there is increased global demand for the currency, or when there is a reduction in the supply of currency available.

There is a high propensity that an increase in the dollar’s value will coincide with a rise in U.S. market indices since U.S. stocks are denominated in dollars. At a minimum, they should outperform foreign markets.

Source: Koyfin

As mentioned above, a way to magnify any effect is to understand the sectors that benefit from a weak or strong native currency and then research stocks within that industry for selection. Often the smaller more concentrated companies provide an even greater effect.

Manufacturing businesses that rely heavily on raw materials, or commodities and get these products from overseas (steal, semi-precious metals, minerals, etc.) will benefit from paying in or exchanging from the stronger currency. This has the impact of reducing relative costs and helping the bottom line. Stocks do better with a growing bottom line.

Importers also do well in a strong and rising dollar scenario. The reason is if the cost of goods is paid for in stronger dollars they are lower in price because they are manufactured and sold based on a depreciated currency.

Take-Away

The values of American stocks tend to increase along with the demand for U.S. dollars; they have a positive correlation.

One explanation for this relationship is foreign investment. As more investors place their money in U.S. equities, they are required to first buy U.S. dollars to purchase American stocks, causing the indexes to increase in value. So the stocks are actually causing the increased demand for the dollars. The inverse could be true as well. Continued dollar strength may cause more people to convert to dollars and they then keep the currency invested in U.S. markets, thus driving up equity prices.

Suggested Reading

Money Supply is Like Caffeine for Stocks

|

Financial Protection Bureau Has New Supervisory Powers

|

Why Good Economic Numbers Can Cause a Selloff

|

How PPI Impacts CPI Numbers

|

Sources

Stay up to date. Follow us:

|