|

|

|

|

Your Move – Three Investment Ideas to Consider Now

(Note: companies that

could be impacted by the content of this article are listed at the base of the

story [desktop version]. This article uses third-party references to provide a

bullish, bearish, and balanced point of view; sources are listed after the

Balanced section.)

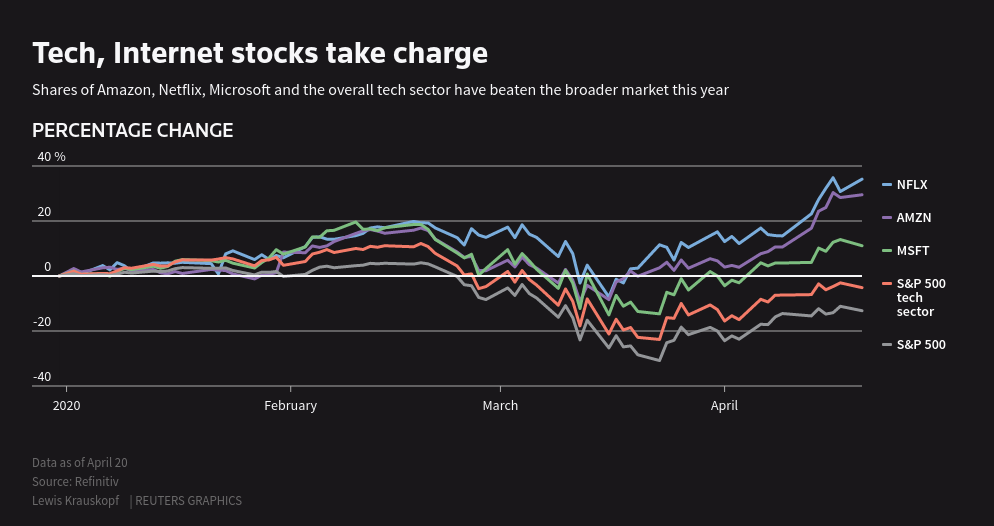

Stock market indices have gained a large portion of their value back after having been down as much as 34% over the past month. The major market averages are now off their high less than 20%. The unpredictable massive rally in these benchmarks included record moves that will surely be studied in history books – as will the selloff that took place the month earlier.

The magnitude of this upward index bounce is very misleading. Have you noticed that most sectors have not participated in any meaningful way? In fact, some of the more deflated stocks are still near their lows, others have fallen further. Here’s why.

Stocks With

the Most Pull

“The top five companies in the

S&P 500 have never occupied a greater share of the benchmark’s total market

capitalization.” – Mike Bird, WSJ, April 20, 2020

Companies that have added the most to the rise of the Nasdaq and S&P 500 over the past month are tech giants such as Amazon, Intel, and Microsoft. Today, just five stocks MSFT, AAPL, FB, GOOG, and GOOGL account for 20% of the market cap for the entire S&P 500. That exceeds their concentration during the dotcom bubble of 2000. The entire IT sector now accounts for a 25.4% weighting in the S&P 500 (a/o 4/17/20). None of the other ten major sectors even come close. While technology, which does not have a reputation of being defensive, has contributed most to index returns, some other individual companies have also held up well, especially in healthcare and consumer staples — two more traditional defensive sectors.

The performance of the entire S&P is in

large part because of participation by a few stocks.

Where Do We Go From Here

The market seems to be past the “blood in the streets” stage, where investors were tripping over themselves to unload stocks indiscriminately. The extreme rise in the tech sector looks to have been the standard kneejerk reaction by speculators trying to get in early and by those that followed the move and chased stocks behind them. The next move, if the worst is behind us, is typically more rational. That soberness may carry the overall market sideways to down as some participants wait for confirmation that indeed the economic road ahead will be positive.

While the overall indices may simmer, this will likely be because of cooling of the tech stocks while more traditional plays begin to heat up.

Strategies

for Low-Risk Exposure

The crisis fell upon us fast, but we learn fast. The follow-up in the investment markets is likely to be quick. In the same way, everyone quickly learned how to put on a mask, have Zoom meetings, and food shop for longer than a week at a time; investors are going to become more adept at crisis investing.

In the past, crisis investment strategies have always had three strong tenets:

1). Be very selective (not major market investing)

2). Be more defensive (base decisions on worst-case scenario)

3). Be among the first (don’t chase)

The best risk/return opportunities for investors will likely present themselves from long-term secular trends. The pandemic and the coinciding stay-at-home policies have accelerated many of these trends in tech usage. Look to capitalize on the old strong sectors that could experience a tailwind from the revised world we’re entering.

The old trends that had been worth watching in stocks, that will be enhanced once most of the economic lights are turned back on, include; a world that is more digital, a world that is more in debt and a world that values medical miracles.

Three

Investment Areas that Should get Warmer

1). Stable and

defensive stocks– This may seem obvious, but many people still get caught up in “sexy” stocks and chasing what is most highlighted on CNBC or Fox Business News. Invest in stocks that display earnings growth trends that are less likely to be negatively impacted by “sheltering in place.” Many people saw the TP shortage as an inconvenience; investors should have researched it as an opportunity. Consumer staples and healthcare products are always in demand without regard to economic conditions. This places them on stable ground for a defensive position. In many cases, the increased hours people stay at home has placed further demand on items such as soap, and paper products, while possibly lowering demand for items like hair gel and deodorant. This is why specific companies, rather than a consumer goods ETF, is preferable.

Many of these stocks pay dividends. This not only adds to return, it helps make the equities more attractive as yield investors are bumping up against sub 1% government bond rates. Dividends cause the stocks to be less volatile overall.

2). Cyclical stocks– Ahead of a firm-footed recovery, selective investing in cyclical companies that thrive as people open up their wallets, may look different than in the past. Discretionary spending will likely increase in areas that have pent-up demand. These could include household appliances, recreation, online dating, fitness, etc..

3). Long-term trends- We’ve already had a taste of the accelerated structural changes that could define this decade. There has been a digital transformation. This has set much deeper roots in the past month than it has in the past three years. The momentum is not likely to slow. Technological disruptors that improve work and home life seem to be in a position to maintain their above-average growth. Any dip in stock prices allows entry at a reasonable level as renewed activity should once again prove rewarding longer term. E-Commerce also got a boost from the lockdown’s effect on brick and mortar stores. The boost in popularity is likely to stick at a higher level than pre-crisis, thus providing a new base for these products.

Pharmaceutical and biotech companies with pipelines for drug and genetic therapies will continue to garner attention as the population has the pandemic fresh on their mind and now shows increased support for more rapid discovery, clinical trials, and FDA review.

Take-Away

The bounce that we have seen in the major indices is not representative of the movement in the various components of the underlying index. The split or bifurcation likely has sectors overbought while others that should get attention have been overshadowed by these “stars.” The coming recovery is likely to unfold slow but sure. Focusing on the surest beneficiaries of the eventual recovery is less speculative and more prudent. Chasing relatively high-flyers, or owning them by default because you have invested in an index fund may be less profitable. There is still much uncertainty moving forward. Picking your short, medium, and long term positions with more rationally will allow participation in moves upward with comfortable risk-adjusted returns in volatile times.

Suggested Reading:

Why

Index funds Could Be a Mistake in 2020

Stock

Index adjustments and Self-Directed Investing

Additional

Balance in 60/40 Asset Mixes

Sources: