Does the News Chatter Surrounding Cryptocurrencies Match the Interest in the Asset Class?

Over the 14 years since bitcoin sprung to life, expectations have ranged from overwhelming enthusiasm over its possibilities to fear of the risks inherent in an, as yet, not integrated payment method. A recent 50% run up in bitcoin has refired up the believers, but the most heard about crypto is still valued at less than half of its high point. Issues beyond volatility that cause some to disregard cryptocurrencies as a payment method are regulatory threats, the environmental cost of mining, and failed exchanges. During the week March 13-19, Pew Research Center conducted a survey measuring usage, confidence, and investment success. The survey is important for those paying attention to crypto as it cuts through our personal opinions and offers less biased statistics.

Survey Says…

Most Americans, 88% have heard of cryptocurrency. Almost 40% of those that are aware of crypto told surveyors they are not at all confident in the reliability and safety of crypto, with an additional 36% not very confident. Of the results for those that responded that they are extremely confident the result is 4%, and 2% as very confident. Of those that have heard of it, 18% say they are somewhat confident.

Digital technology is shown to be less embraced with age. Although the current concern for crypto is high, some age groups have a greater concern than others. This is reflected in that those 50 and older who know about cryptocurrency and are more inclined to say 85% they are not confident in its reliability and safety. Compare this to those adults 49 and younger, where the figure drops to 66%.

Does sex play a role in skepticism toward cryptocurrencies? 80% of women say they are not confident in it, compared with 71% of men out of the 88% that have heard of crypto.

Does experience lead to acceptance, or acceptance lead to experience? For those that invested in one or more digital currencies, 20% say they are extremely or very confident that it is safe and reliable. For those that have no experience investing in it, the slice drops to 2%. It is worth understanding that of the group that has had experience with crypto, 43% still responded that they are not very or not at all confident in it.

Cryptocurrency Usage in the U.S.

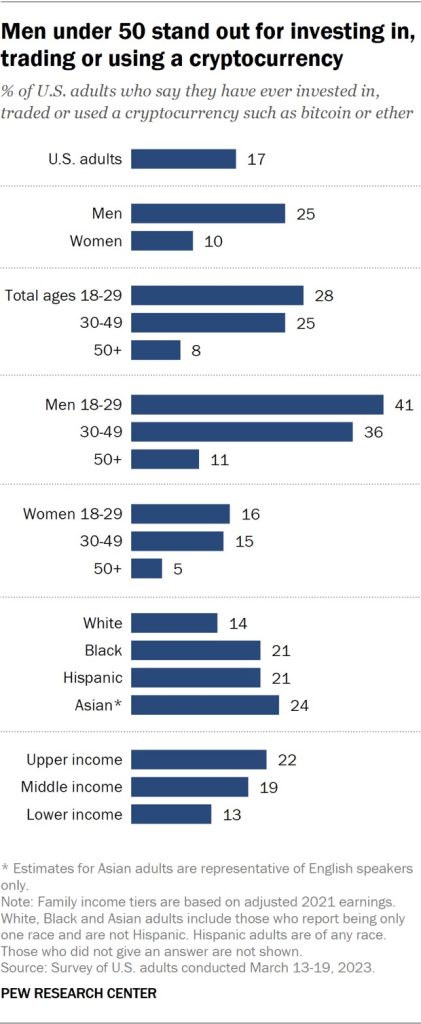

Younger males are more likely to use cryptocurrency compared with men 50 and older and women overall. The number of men 18-29 that have used crypto is more than double that of woman of the same age, 41% of men ages 18 to 29 compared with 16% of women in the same age range.

Adults with upper incomes that have used crypto totaled 22%, with middle incomes slightly less at 19%. Lower incomes that have ever invested in, traded or used cryptocurrency compared at 13%.

Few that have invested in or transacted using cryptocurrency used it for the first time within the past year. Pew Research asked when they first used cryptocurrency, 74% of those who have ever invested in, traded, or used cryptocurrency say they did for the first time one to five years ago. Only 16% say they first did this within the past year, and 10% more than five years ago.

For college graduates, 25% and those with some college experience, 20% showed they were more likely than those with just a high school education or less, 10% to answer that their cryptocurrency investments hurt their personal finances.

Results of Investment

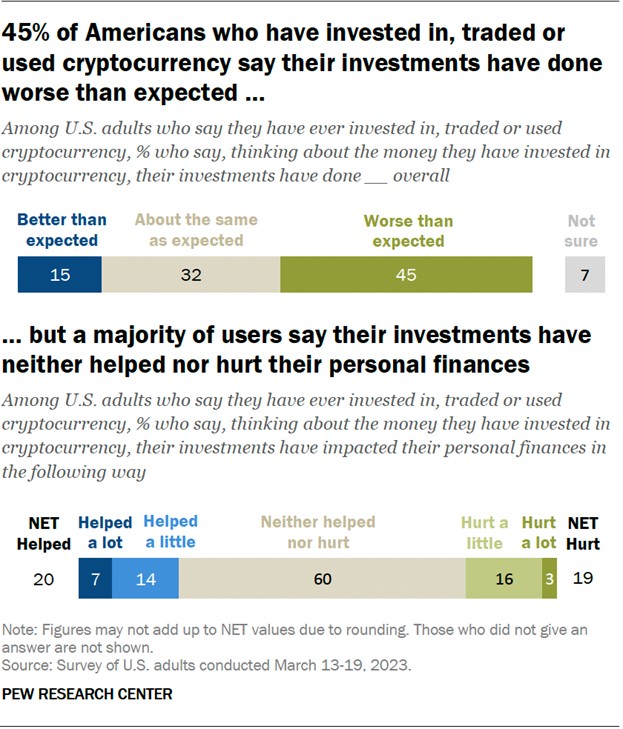

Of those that have invested in crypto, 15% say their investments have done better than expected, 32% say they have done about the same as expected and 7% are unsure. 19% of cryptocurrency users say the investments have hurt their personal finances at least a little.

Most users, 45% indicated their investments performed worse than expected.

Measuring the impact the speculation had on users’ personal finances, three-in-five users (60%) say that they have neither helped nor hurt. Roughly equal shares say that these investments have helped (20%) or hurt (19%) their finances. Just 7% say cryptocurrency has helped their finances a lot and 3% say it has hurt a lot.

Take Away

There seems to be far more noise reporting cryptocurrencies than activity or actual usage. This could mean a number of things. One could read into this that the asset’s potential when the fear lifts are high and the potential includes a large percentage of those that are now keeping away. The argument suggests that the ongoing dramatic headlines are warranted since once the potential is realized, there could be much greater movement than we have already seen. Bitcoin had once gone from pennies to $68,000 $USD. Another reason for so much news coverage for an asset class that is favored is it is still novel, so we are all evaluating the asset class as investors; since we’re showing interest or intrigue, news services will report on it to gain audience. If we turn our attention elsewhere, that is then what we will hear more about.

It is truly a speculative asset class with little history. While some are betting everything on crypto, far more are currently just spectators on the sidelines. The hype and attention it is currently receiving may not match actual investor interest.

Managing Editor, Channelchek

Source

https://www.pewresearch.org/wp-content/uploads/2023/04/sr_2023.4.10_crypto_topline.pdf