Michael Burry Has a Huge Bet According to His Just Filed SEC 13-F Report

It looks like Michael Burry has changed his mind, again. At the beginning of 2023, Burry, the founder of Scion Asset Management, was not positive at all on the stock market. The market then moved up in an epic rally. By late March, he announced in a tweet, “I was wrong to say sell.” Over the coming months stocks that had been beaten down the prior year, moved up significantly.

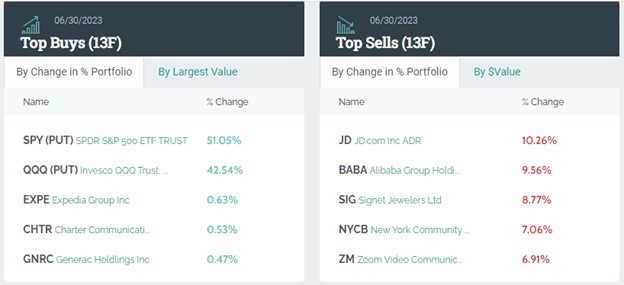

In his quarterly SEC 13-F filing today, the hedge fund manager that was portrayed in the movie “The Big Short” reported that he is more than just short the S&P 500 and Nasdaq 100. Burry held a huge leveraged short position as of June 30th. The position represents 84% of Scion’s assets under management (AUM), and is in the form of an all-or-nothing marketable options trade.

Source: Koyfin

About His Position

Burry recognized losses during the second quarter. The long positions he had put on earlier were underwater when he sold. The only conclusion is that he must have switched again from bullish to bearish – at least on these specific stocks. He then, with a broad brush, shorted large-cap stocks using stock options on ETFs. As of quarter-end 51.05% of his portfolio held puts on SPY and 42.54% held puts on QQQ.

Burry manages $1.7 billion. The puts used to short the S&P 500 ETF (SPY) and Nasdaq 100 (QQQ) is a broad brush that shows a great deal of confidence that large-cap stocks are headed lower before the options expire. It is a huge bet, while a short using puts has less downside than a straight short that, if unmanaged, can move against the owner an infinite amount, options have a window when they can be sold or exercised. If the position doesn’t work out, losses can be 100%.

Take Away

A lot can be learned from celebrity investors and fund managers. The lesson that investors may glean from Michael Burry’s first six months of 2023 is that you don’t sit in a bad position. Or, changing your mind is okay. The new positions indicate a high degree of confidence that large-cap stocks will fall apart over the coming months. It is just two positions, but they speak volumes in terms of his market call.

Managing Editor, Channelchek

https://whalewisdom.com/filer/scion-asset-management-llc

https://www.channelchek.com/news-channel/michael-burry-suggests-he-is-now-bullish