Utilities Currently Provide Attractive Return For The Risks Investors Incur

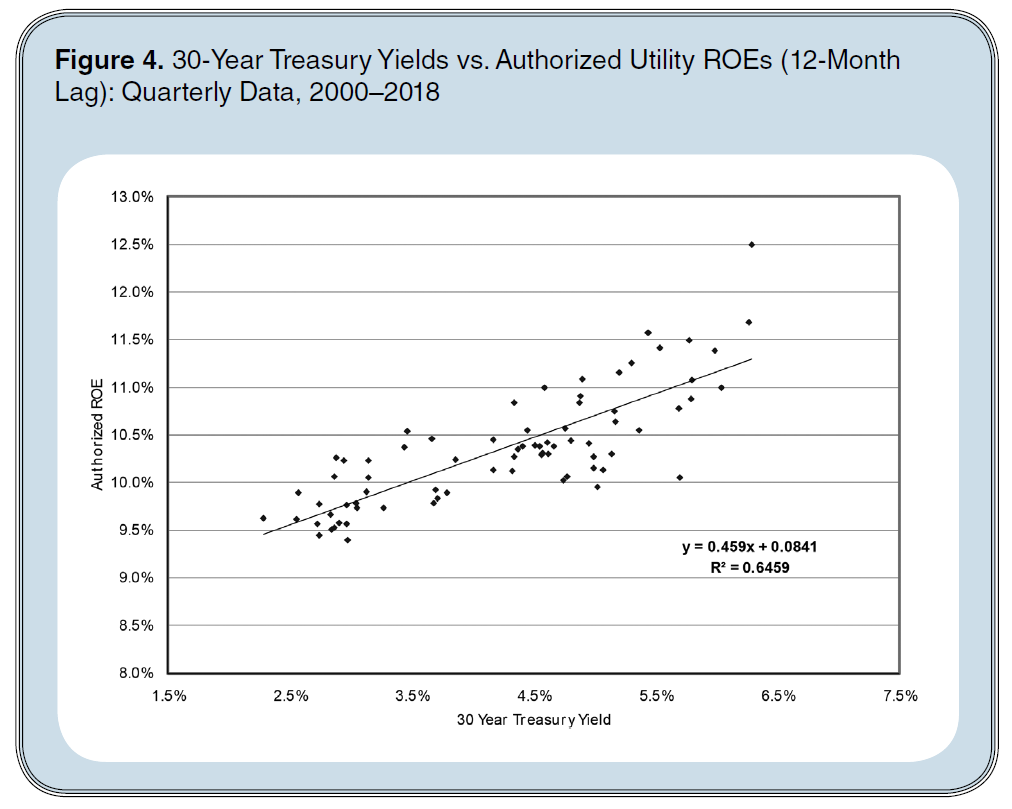

Electric, gas, and water utilities are called natural monopolies. Since it is more cost-efficient to have only one utility providing service to a neighborhood, regulators give a utility monopoly rights in exchange for regulating the price they charge customers. Rate setting is a complicated process, but the basic concept is to set prices so that utilities get the chance to recover all their costs and be left with a residual amount to compensate investors for the risks taken. The residual amount is referred to as the allowed return on equity, and it is one of the most contested components of any rate case. Typically, the allowed ROE is set at a level above the risk-free interest rate. Long-term government bond yields are a good proxy for risk-free interest rates. The figure below shows that there is a strong correlation between 30-year Treasury Yields and the allowed returns granted one year later.

Source Valuescope

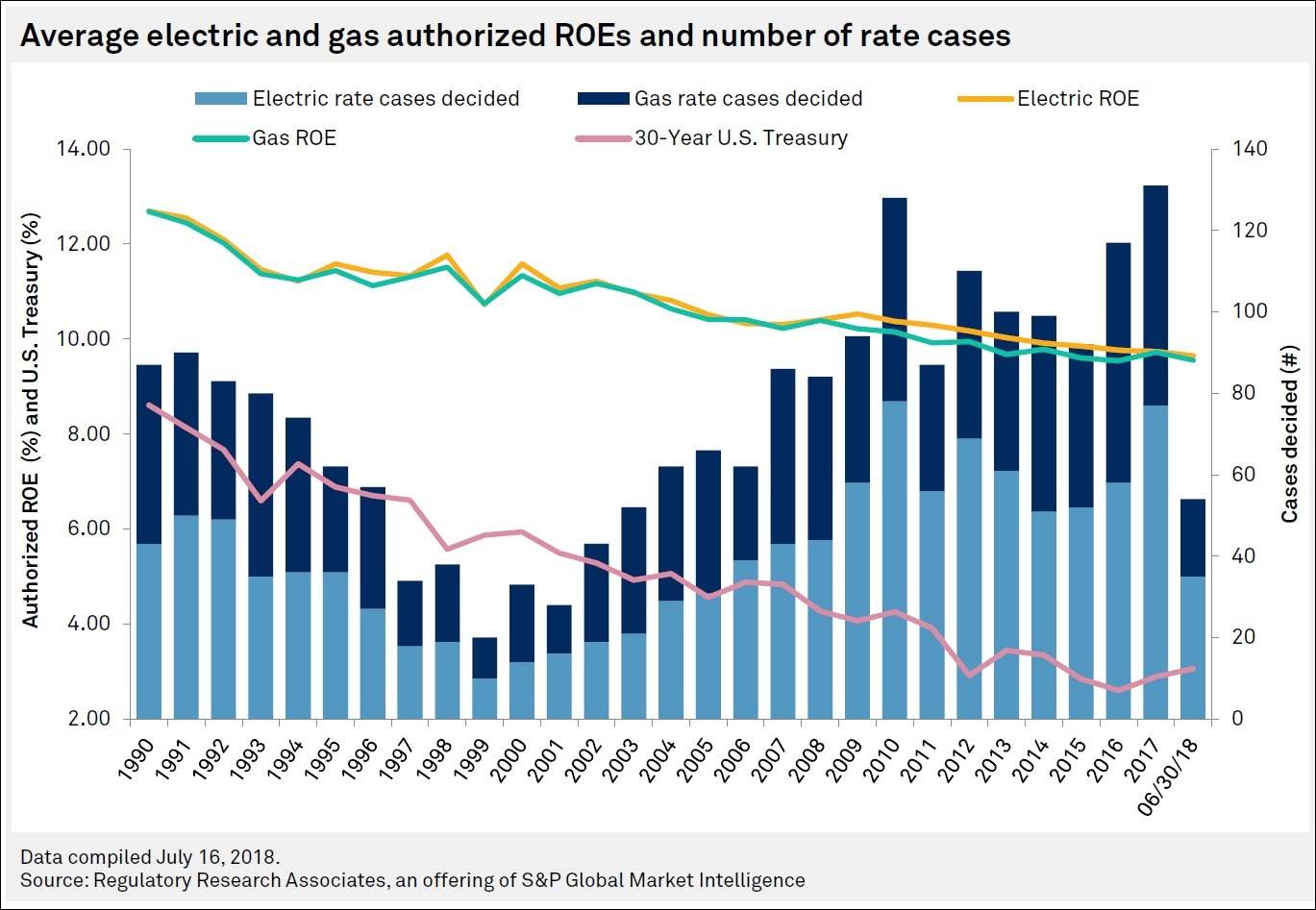

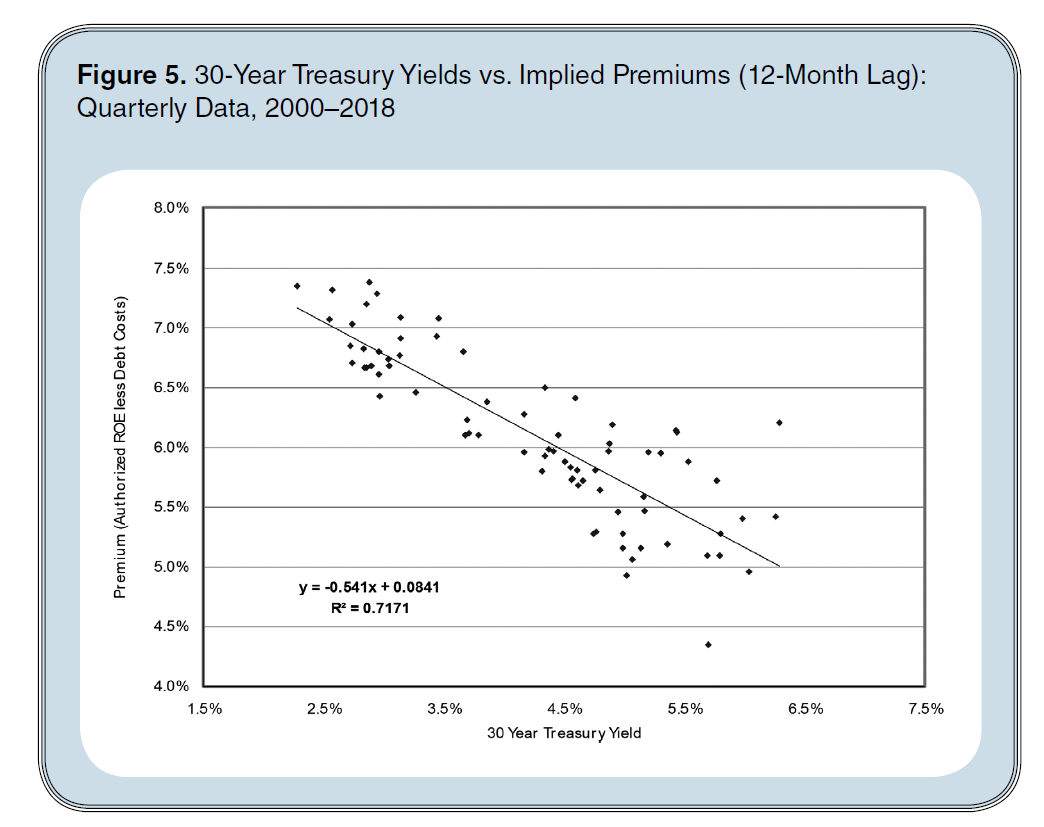

The graph shows that the allowed ROE premium over long-term government bond yields has traditionally been 500-700 basis points. However, allowed returns do not automatically change when interest rates change. There is some stickiness that prevents returns from rising when bond yields rise or fall when bond yields fall. Note in the graph below that as yields have fallen in recent years, the spread between allowed returns and bond yields has grown.

If we plot the allowed return premium against the 30-year US Treasury yield, we see a negative regression line. The figure below shows that when bond yields are near 6%, the allowed return premium has only been 500 basis points but when rates fall to 2%, the premium rises to 700 basis points.

This is an important fact to consider now that 30-year US Treasury bond yields have fallen to 1.2%. Allowed returns can be expected to fall from their current level of 9-10%, but will they go as low as 8% (700 basis point premium)? Or, will they stick at a level near 9% (800 basis point premium) as the regression formula in the chart above would seem to indicate.

The implications of rapidly declining bond yields and authorized returns are many. First, many utilities may attempt to stay out of rate cases. Remember that actual return and allowed returns are not the same thing. Once a utility’s rates are set, it may earn above or below its allowed return depending on customer usage, operating costs. Typically, earned returns will slip as operating costs rise with inflation until earned returns get so low that the utility files for a rate increase. Occasionally, earned returns are above the earned returns and regulators call the utility in for a rate decrease. However, rate decreases are rare. In the case of falling allowed returns, a utility may accept earning below its allowed return because it knows it would not get a rate increase anyways when its rates are set based on a lower allowed return.

A second implication of a sudden drop in interest rates is that utilities may be earning higher returns than needed for several years. As mentioned earlier, regulators are slow to request utility rate decreases. Utility investors may reap the benefits of higher return if they are able to hold the line on operating costs. This could make utility stocks an attractive investment until regulators catch up with the drop in interest rates.

Suggested Reading:

Nuclear Energy Expectations Through 2050

COVID-19 May Be Killing the US LNG Market

Virtual Investment Conference, August 2020

Each event in our popular Virtual Road Shows Series has maximum capacity of 100 investors online. To take part, listen to and perhaps get your questions answered, see which virtual investor meeting intrigues you here.

Source:

https://www.valuescopeinc.com/energy-roe/, Valuescope, August 26, 2019

https://marketrealist.com/2016/11/look-us-utilities-return-equity/, Vineet Kulkarni, Market Realist, 11/1/2016

https://www.spglobal.com/marketintelligence/en/news-insights/research/average-u-s-electric-gas-roe-authorizations-in-h1-18-down-from-2017, S&P Global Market Intelligence, 8/2/2018