EIA Reports the Largest Weekly U.S. Crude Decline

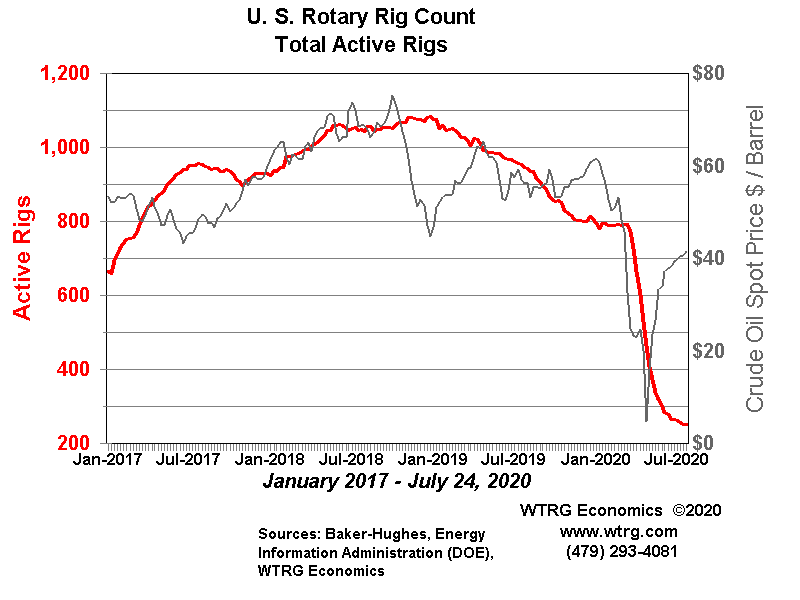

The Energy Information Administration reported that inventories for the week ended July 24 fell 10.6 million barrels, the largest decline in seven months. The decline reflects increased demand associated with a reopening of the economy as well as decreased supply associated with a drop in active drilling rigs. Figure #1 below shows the sharp decline in active U.S. oil rigs that occurred when oil prices sank below $20 per barrel in early April. Interestingly, the number of active rigs has not yet rebounded despite oil prices rising back above $40 per barrel.

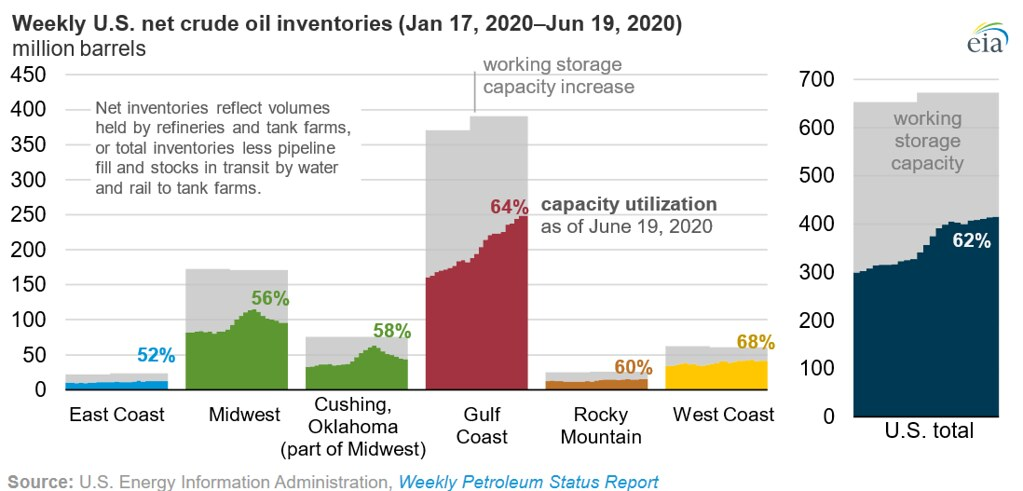

Rising oil inventories have largely been concentrated in the middle of the country. The chart below shows inventory trends by region through the month of June, showing that storage levels had been rising several months before the pandemic crisis began. It also shows that the rise in inventory has been largely concentrated in the Midwest, Cushing-Oklahoma, and Gulf Coast regions. It also shows that the Midwest and Cushing-Oklahoma regions are starting to see a decrease in inventories in response to decreased drilling while the Gulf Coast has not. This is not surprising given that higher well costs in the Gulf make the region less flexible to making short-term drilling adjustments to price changes.

Figure #2

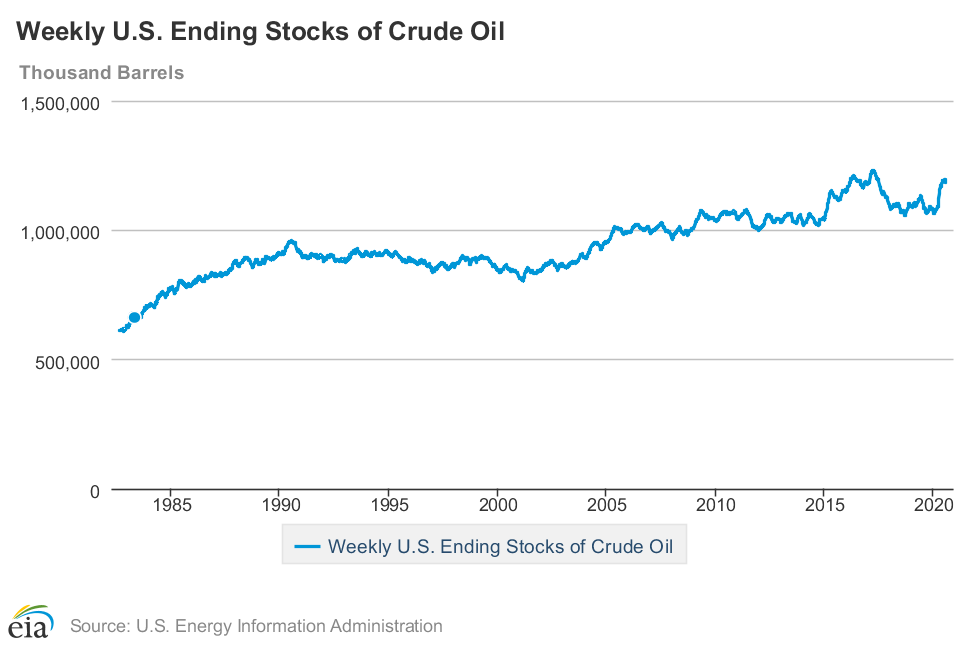

The decline in inventories was a much-needed relief from a long steady rise of U.S. Crude inventories, as shown in figure #3. It’s too early to make the claim that we are now seeing a reduction in supply arising from decreased drilling. One week of data does not make a trend; however, it does warrant increased attention to future inventory reports.

Suggested Reading:

Is M&A Picking up in Energy Sector

Exploration and Production Second Quarter Review and Outlook

Virtual Power Plants and Tesla Car Batteries

Each event in our popular Virtual Road Shows Series has maximum capacity of 100 investors online. To take part, listen to and perhaps get your questions answered, see which virtual investor meeting intrigues you here.

Sources:

https://finance.yahoo.com/m/885423dd-6248-3267-8c4d-de7148e60f0b/oil-prices-get-a-lift-as-eia.html, Myra P. Saefong, Marketwatch, July 29, 2020

https://tradingeconomics.com/united-states/crude-oil-rigs, Trading Economics, July 24, 2020

https://www.eia.gov/outlooks/steo/report/us_oil.php, EIA, July 7, 2020